How to Help Your Employees

While we are getting ready for this change there are a couple things you can do to make sure there is a smooth transition.

- Review the W-4 form and Tax Withholding Estimator.

*Note* If you use HRCenter™, are your workflows using the default form? If so, this change will be seamless for you. If not, you will need to create a ticket with support for a new, custom 2020 W-4.

How Does This Affect Our Products?

HRCenter

The TempWorks team has enabled the updated Federal W-4 form as of 1/1/2020 (with subsequent year updates as needed). As long as you have been utilizing the default W-4 form in one of your workflows, this has been flipped to use the updated version of the default W-4 form.

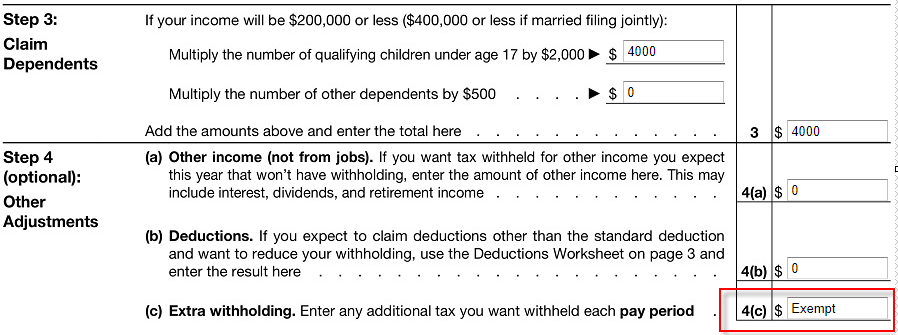

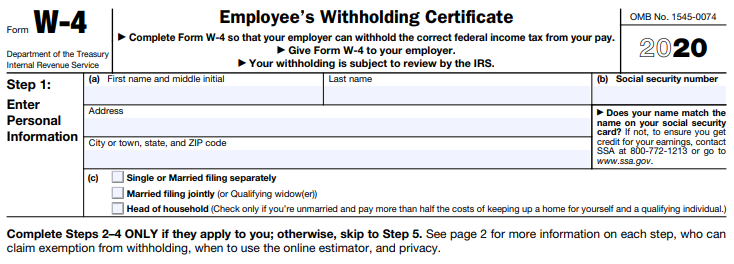

*Note* On the updated form featured below, to mark exempt, the applicant should write "Exempt" in the 4(c) field instead of a dollar amount. This will fill "99" to Federal Exemptions on the employee record.

Further instructions can be found within Page 2 of the W-4 form.

Beyond

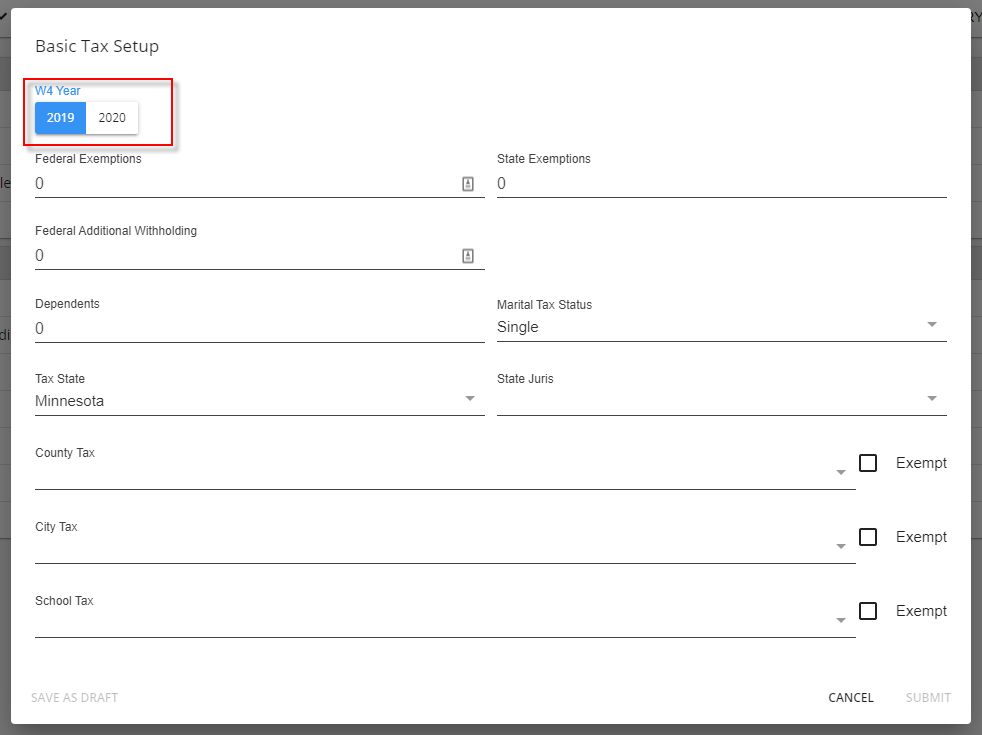

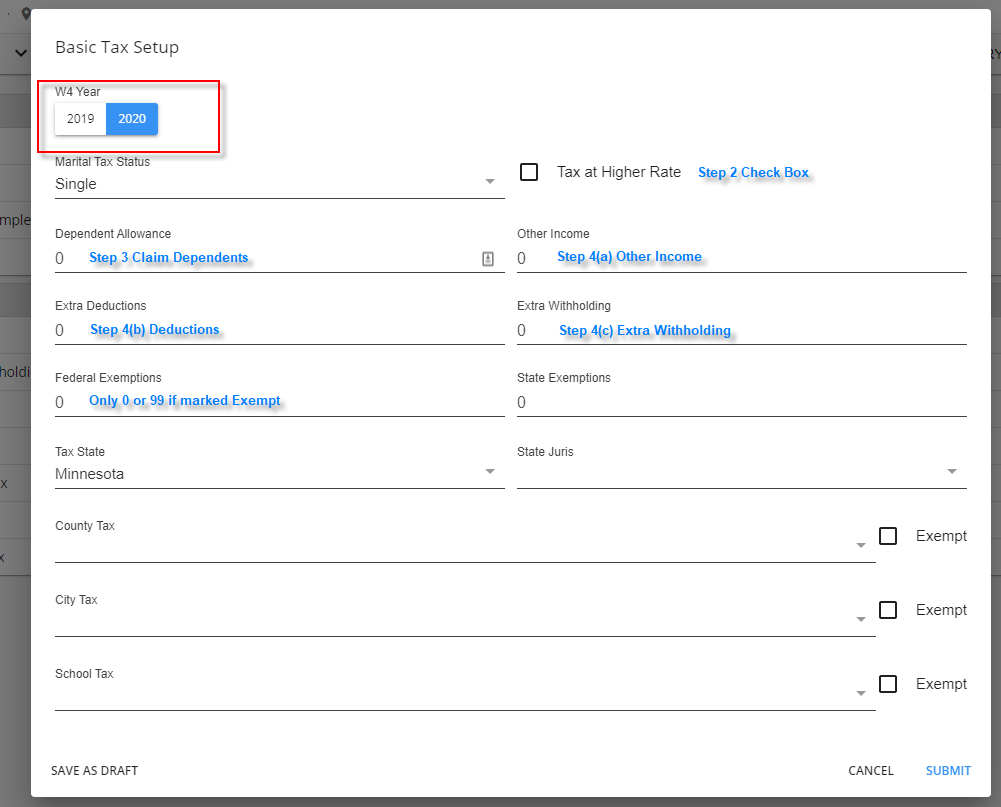

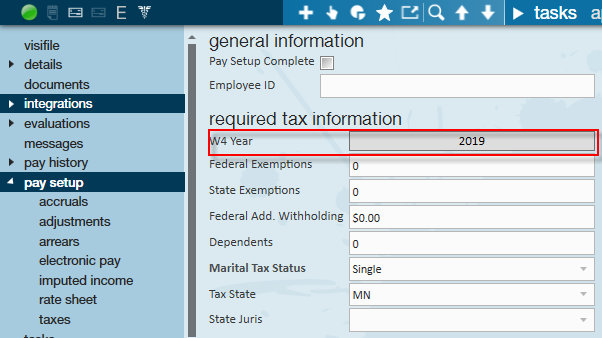

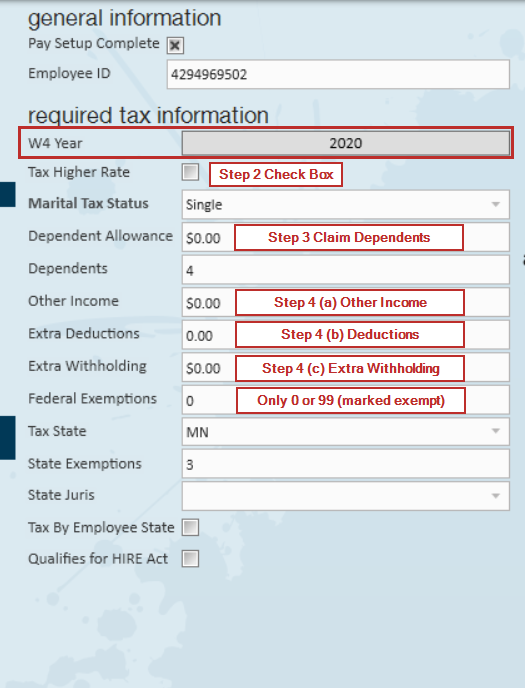

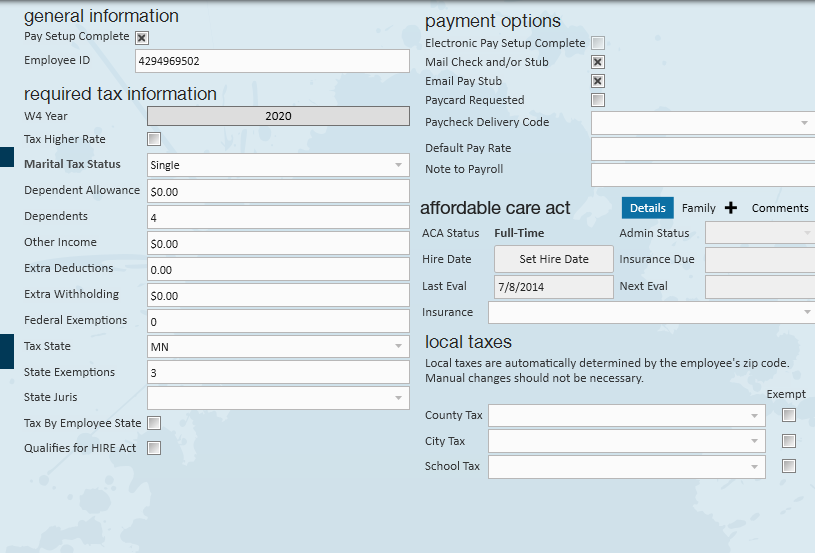

For an existing employee:

All existing employees will default to a 2019 W4 Year processing status. If you flip the W4 Year to 2020 (or later), new fields will appear that are relevant to the 2020 (and subsequent years) W-4 form. We have outlined how each new field maps to the 2020 (or later) W-4 below.

For a new employee on or after 1/1/2020:

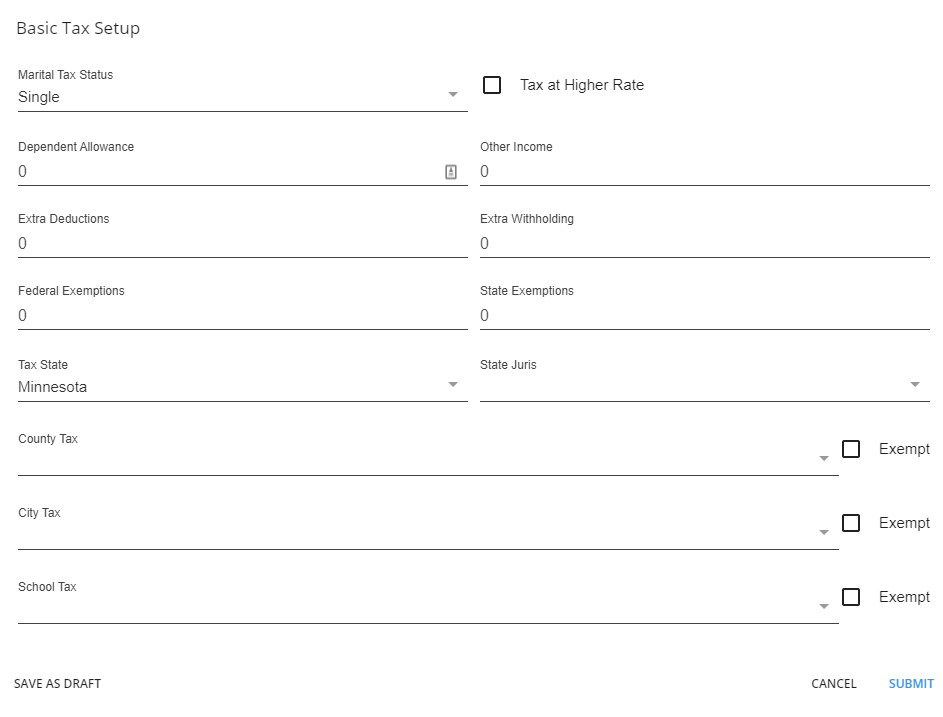

All new employees after 1/1/2020 will default to a 2020 (or later) W4 Year processing status. This will not be displayed anywhere in the UI. Below is what they will see, with no option of reverting back to 2019.

Enterprise

For an existing employee:

All existing employees will default to a 2019 W4 Year processing status. If you flip the W4 Year to 2020 (or later), new fields will appear that are relevant to the 2020 (and subsequent years) W-4 form. We have outlined how each new field maps to the 2020 (or later) W-4 below.

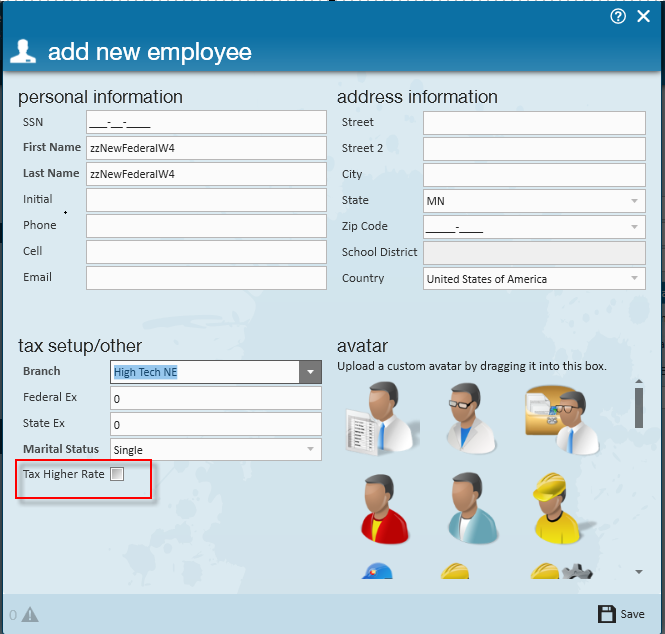

For a new employee on or after 1/1/2020:

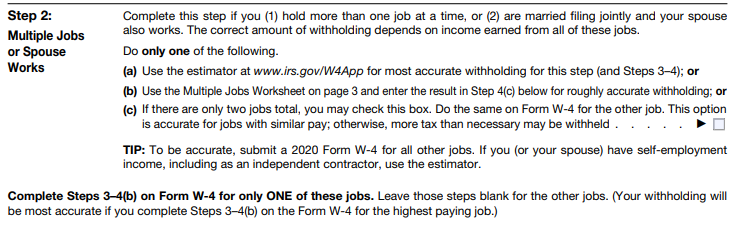

When you quick add an employee, you will now be prompted for the "Tax Higher Rate", so the correct tax juris will be applied to the employee. You should check "Tax Higher Rate" only if the employee checked the 2(c) box on the 2020 (or later) W-4. On their Pay Setup screen, you will not see the W4 Year toggle because you cannot revert back to 2019.

Breakdown of the W-4 form

Step 1: Enter Personal Information

- This section of the form resembles the prior form.

Step 2: Multiple Jobs or Spouse Works

- Select this new box to be taxed at a higher rate for this job.

Step 3: Claim Dependents

- Use this to enter any child tax and/or dependent credits.

Step 4: Other Adjustments

- This step likely requires the employee to use the Tax Withholding Estimator made available in August of 2019.

- Step 4(b) informs employees that if the employee skips this line, withholding will be based on the standard deduction.

- Employees that are exempt from withholding can select the appropriate checkbox at the bottom of Step 4.

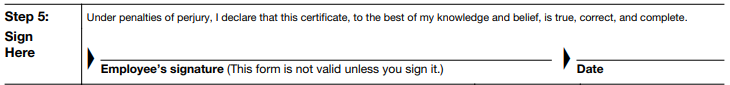

Step 5: Sign the form

- The last step is easy!