Why Undo a Check Correction?

Users may utilize this function if you've already made check corrections such as a void, or void and reverse and wish to undo that action. Keep in mind that undoing check corrections that weren't made the same day can cause unbalances in your general ledger and reporting. Always consult your team before undoing a check correction.

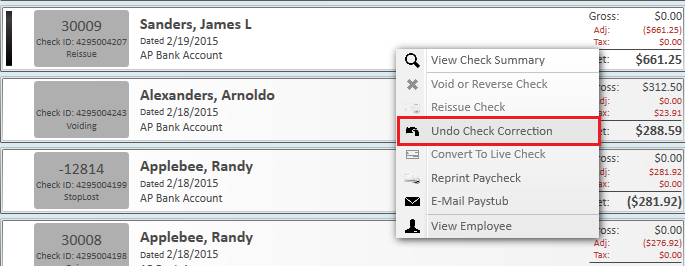

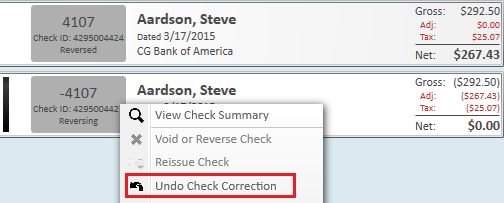

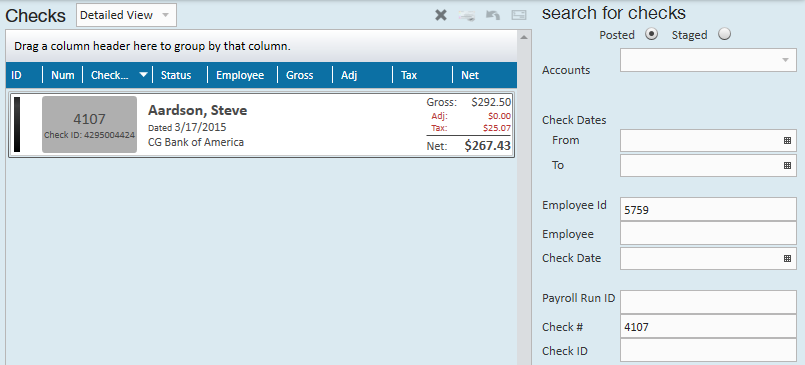

Step 1: Find checks within the check register with the status of reversing, voiding, or reissue.

Step 2: Select the check you wish to undo the correction and right-click to choose undo check correction.

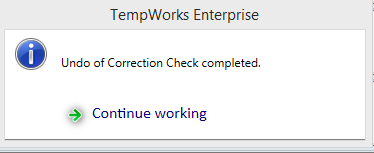

A window will appear alerting you that the undo check correction is complete.

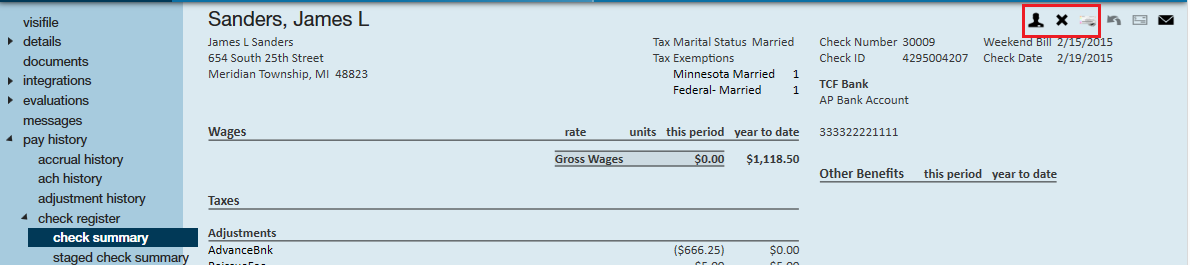

Step 3: Navigate into the check summary detail and notice that you now have the option to make the correct changes to the check if needed. Users may go back and select what actions they wish to take for correcting the check information such as void, reverse, or reissue.

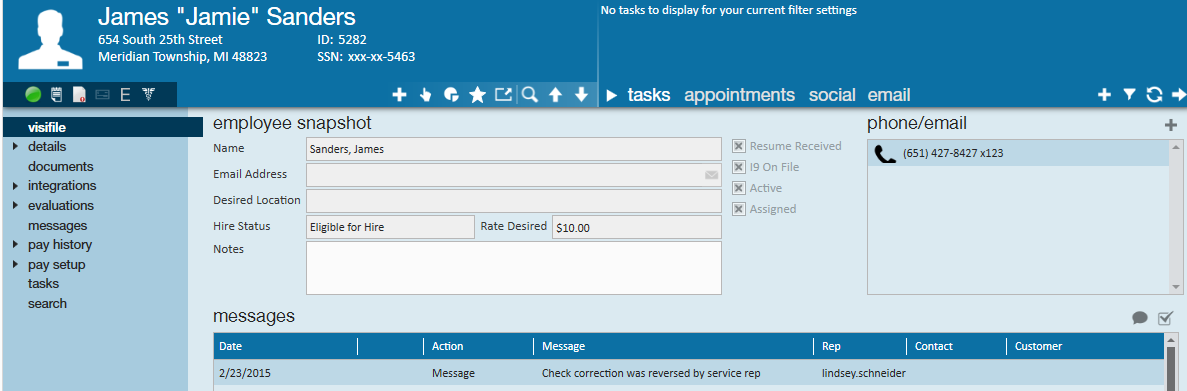

A message will be logged on the employee record as to what was done with the check:

Double-click the message to open a more detailed layout of check number and check id information and what actions were selected to fix the check:

Example:

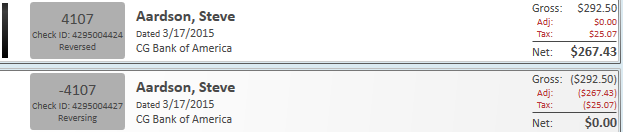

Before undo check correction is applied for a void and reverse:

An advance bank adjustment has already been created in this situation.

Select the undo check correction option.

When selecting a check that is in the reversing stage this functionality creates a voiding check to cancel out the reversing transaction. The original check goes back to its original status. As seen below.

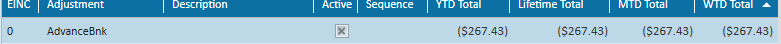

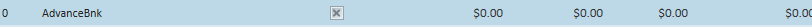

The advance bank is set back to zero. If the advance bank has already been recouped and you undo the reversing check, you will need to reimburse the employee manually. *Note- It is recommended to enter the reimbursement as a one-time adjustment on their next timesheet:

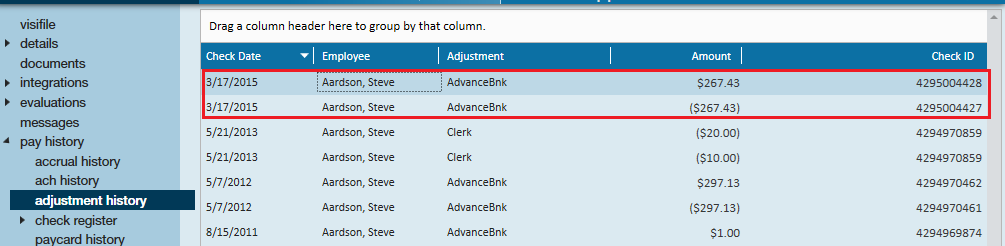

Within the adjustment history section of the employee record you may view the advance bank creation and canceling transaction: