Overview

The purpose of the Tax Collection Detail report is to help you see how much tax is going to be collected in your tax wire.

This report differs from the Wire Summary and the Tax Deposit reports in that it auto excludes jurises that TempWorks doesn't collect for tax processing (e.g. TempWorks doesn't collect/pay/file for NYMCTMT tax, so it’s auto excluded from the Tax Collection Detail Report).

Security

To access this report, you will need to be a member of the "Tax Administration" report security group.

*Note* For more information on security within Beyond and Enterprise, please see the following articles:

Running the Report

Once you have access, select the "Tax Collection Detail" report from the list:

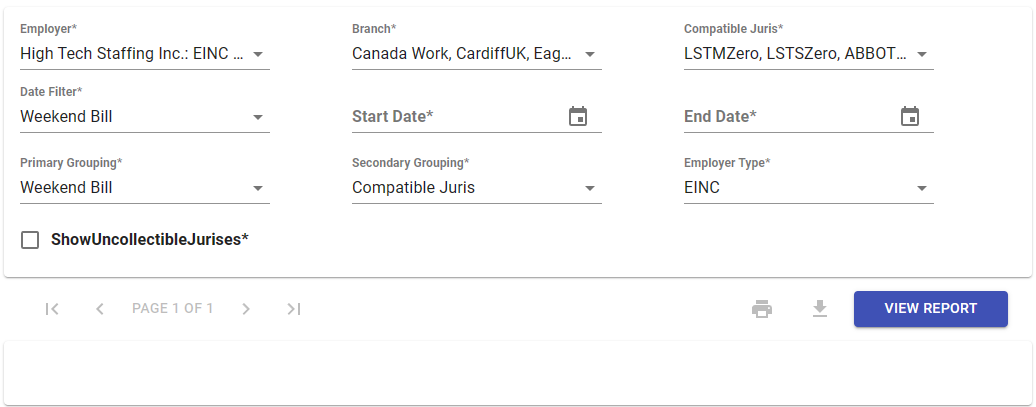

The report will open and show the following filters:

- Employer: The Employer (EINC).

- Branch: A list of Branch records associated with the selected EINC(s).

- Compatible Juris: A list of tax jurisdictions that are included within the calculations.

- Date Filter: Choose whether the information is displayed by Weekend Bill or Check Date.

- Start Date: The date in which calculations begin.

- End Date: The date in which calculations end.

- Primary Grouping: The first grouping on how the information is displayed within the report:

- Check Date Quarter

- Check Date Month

- Weekend Bill

- Juris Status

- Secondary Grouping: The second grouping on how the information is displayed within the report:

- Compatible Juris

- Parent Juris

- Tax State

- Employer Type: Leave this as "EINC" by default.

- Show Uncollectible Jurises: Selecting this allows you will see tax jurisdictions that are not being collected in tax processing.

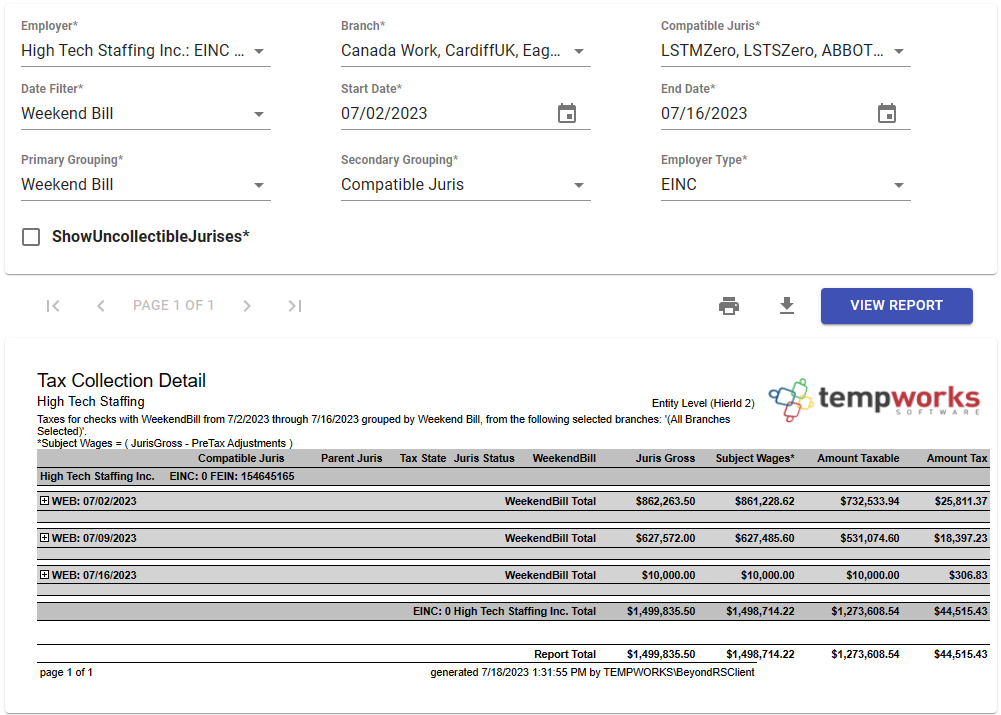

*Primary Example* The following is the primary method in which the report should be run to show you how much tax is going to be collected within your tax wire:

- Employer: "Select All"

- Branch: "Select All"

- Compatible Juris: "Select All"

- Date Filter: "Weekend Bill"

- Start Date: Select an appropriate Start Date.

- End Date: Select an appropriate End Date.

- Primary Grouping: "Weekend Bill"

- Secondary Grouping: "Compatible Juris"

- Optionally, you can select "Parent Juris" or "Tax State" if you so choose.

- Optionally, you can select "Parent Juris" or "Tax State" if you so choose.

- Employer Type: Leave this as "EINC" by default.

- Show Uncollectible Jurises: Make sure this is not selected.

The following are additional examples on how this report can be run depending on the information you want to see:

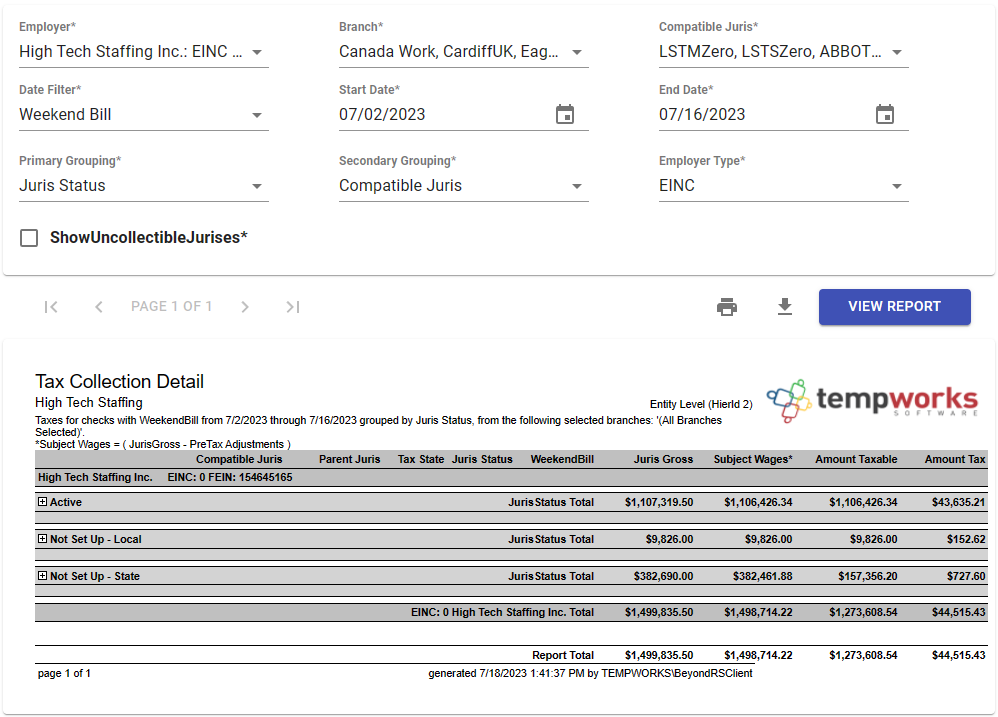

Example 1 - Primary/Secondary Grouping

By setting the Primary Grouping to "Juris Status" and the Secondary Grouping to "Compatible Juris", you are able see which jurisdictions are active/set up on the admin side, and which ones are not:

Example 2 - Uncollectible Jurises

By selecting the "Show Uncollectible Jurises" checkbox, this will also show you jurises that TempWorks is not collecting funds for, in case you want to see all your tax jurisdictions from a particular weekend bill.

Related Articles

- None