Do you ever find yourself in a situation where the rates have been updated for a worker comp code and previous transactions need to be recalculated, or the wrong worker comp code has been added to an order?

Enterprise has added the recalculate worker comp tool within the order and pay/bill sections to help with these pain points you may have as a staffing company.

How to Recalculate Worker Comp

Utilize this option from the order if you had the wrong code on the order and you wish to have this apply a different code to the historical data (previous transactions) associated with the order itself.

For example, you have 80 people on an order with the wrong worker comp code and have processed their transactions for a certain amount of time under the wrong code. This will allow historical data on checks to update with the correct code and cost associated with said worker comp code. Doing this will also help balance your worker comp reporting.

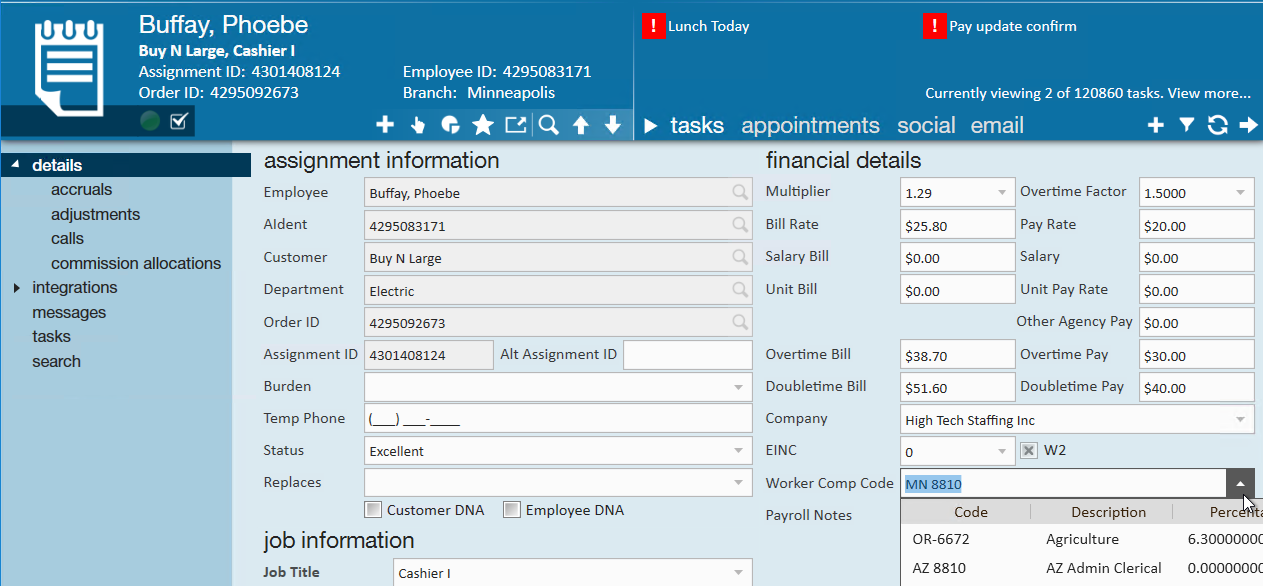

*Note* If you have wish to update current order details as well as timecards associated in the future, you may simply update the worker comp code within the assignment and follow the prompts to update.

Step 1: Update the Worker Comp Codes for the Assignment(s)

Before the system can recalculate worker comp transactions, you need to first update the assignment records with the correct worker comp codes.

If it is just one or two assignments that have the incorrect code, you can change the code on their assignment record:

If you need to update all assignments related to an order:

- Navigate to the order record

- Change the Worker Comp Code under Details

- Select Save

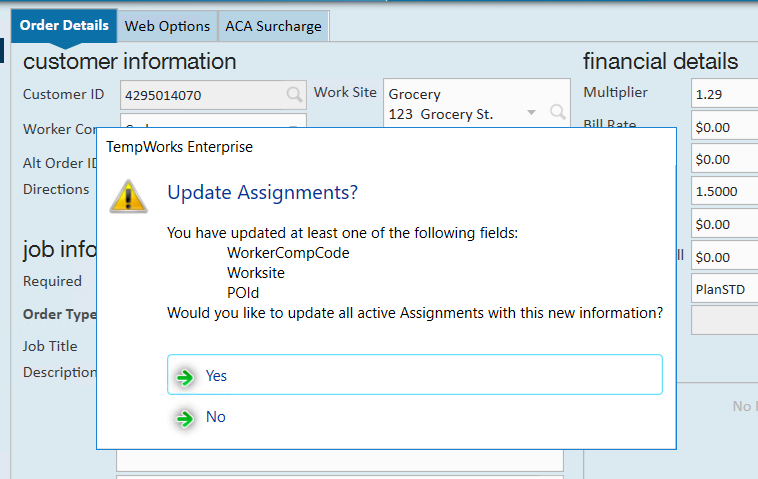

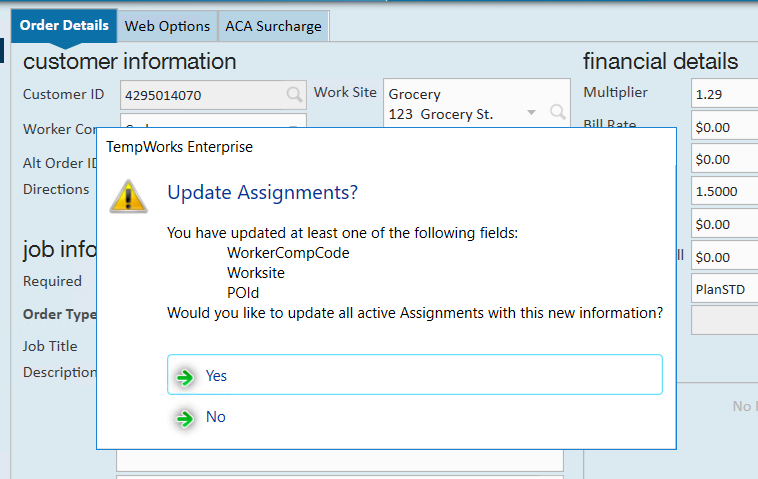

- You will be prompted to update the worker comp codes for the associated assignments:

- Select Yes

Step 2: Recalculate Worker Comp

Navigate to an order, select the (1.) 'Actions' menu , then select (2.) 'Recalculate Worker Comp' (3.):

Once this is selected, the recalculate worker comp window will open. Select the date filter and choose whether you wish to use the weekend bill or check date based on your companies personal preference and business operations. Once all necessary information is inputted, simply select 'Save'.

How to Modify Worker Comp Cost

Utilize this option to simply recalculate the cost of a worker comp code for a given date range.

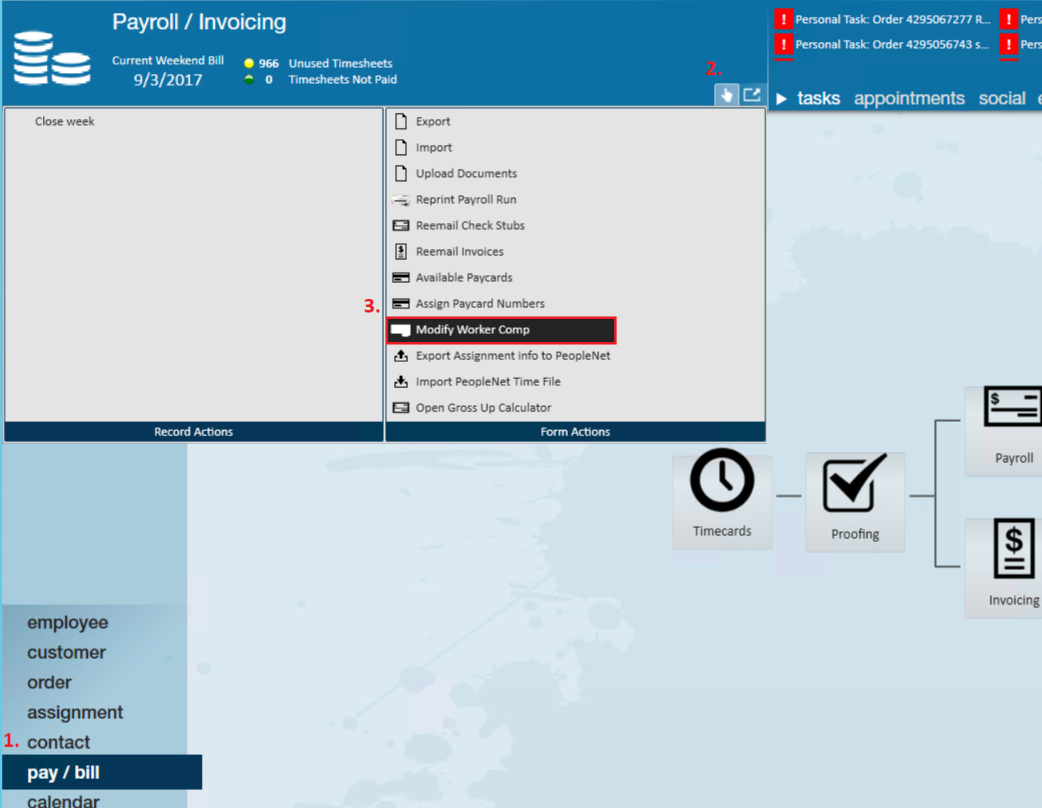

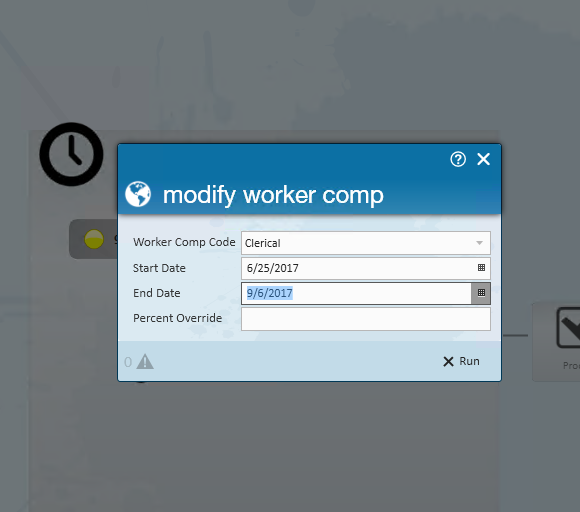

Navigate to the 'pay/bill' area, then select the (1.) 'Actions' menu, select (2.) 'Modify Worker Comp' (3.):

Scenario One:

If your worker comp has been updated correctly you may use this option to reapply that worker comp code with the correct rate within a given date range. In this example you would not use a percentage override.

Scenario Two:

In this scenario , a worker comp code was incorrect two years ago, the current worker comp code is correct and has been the correct rate but you need to go back to a previous year and make changes. You may enter a percent override and this will not affect the current worker comp code rate.

For example, currently the rate is 1%, you want to go back to last year and change 2016 from 5% to 3%. Instead of changing it in administration, you use the percentage override of 3% with date range 1/1/16-12/31/16.

Within the modify worker comp window select the worker comp code you wish to update, enter check date range, and enter the percent override. Once information is entered, select "Run".