Sometimes it is not always easy to understand everything you may be viewing on your paystub and you may wonder why certain items are being deducted. Have no fear! This quick guide will help you grasp the basics of your paycheck/paystub.

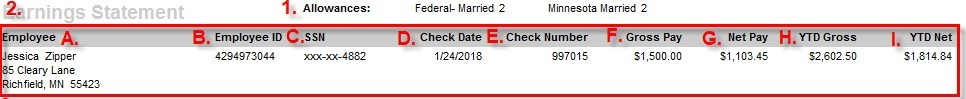

1. Allowances- This breakout of deductions is reflective of what you have claimed on your W-4 for both state and federal.

2. Employee and Check Details- Here you will find your personal information as well as check details.

A. Employee- Your employee name and address details are displayed here. If a temporary address was in place, this would be visible.

B. Employee Id- A unique identifier utilized within the software program.

C. SSN- The last four of your SSN.

D. Check Date- The date the funds were released to you.

E. Check Number- The numbering mechanism used to track checks processed by your staffing company.

F. Gross Pay- All money made while working on this specific job before any personal, federal, and state deductions are taken.

G. Net pay- Money you receive from this specific job after deductions and taxes have been withheld from your paycheck during a given time period.

H. YTD Gross- A running total of earnings before deductions are taken from the check.

I. YTD Net- A running total of earnings after deductions have been taken from the check.

A. Customer- The customer you went to work for.

B. Asg #- A unique number utilized within the software to track the job you worked on.

C. Date Worked- Gives you the Start and End date details of the duration of your job.

D. T Hrs- Reg, OT, and DT hours combined on your timecard to give total hours worked during that pay period.

E. Type- The paycode utilized on your timecard. This can include a bonus, commission, retro pay, etc.

F. Rate- The payrate you've agreed to work for on this specific job.

G. Hrs- Hours worked, typically reported by you and approved by your supervisor.

H. OT Rate- The rate of pay you would receive if working overtime.

I. O Hrs- Hours of overtime worked.

J. DT Rate- Typically used for any hours over a specific amount of overtime depending upon the staffing companies policy.

K. DT Hrs- The amount of doubletime hours.

L. Salary- If you are a paid salary, the salary amount would display here.

M. Units- Units are utilized when getting paid bonus, commissions, tips, etc. For example, if you were participating in a referral bonus program and brought three people in to the company to work, you would see '3.00' within the Units column.

N. U Rate- The rate at which they are paying in correlation to number of units.

O. TotalPay- The final (gross amount) of your timecard transaction before taxes/deductions.

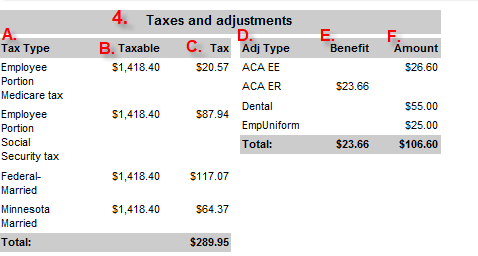

4. Taxes and Adjustments- Here you will find taxes (state and federal) as well as personal adjustments that were deducted from your paycheck.

A. Tax Type- This will show the type of taxes taken for both federal and state. Here, you will see medicare commonly seen as EMed (this funds hospital medicare insurance program) and social security tax commonly seen as EFica. If you wish to change these amounts, please work with your staffing specialist.

B. Taxable- Gives you the amount of pre-tax or wage limit amount of your check that can be taxed.

C. Tax- The amount taken from your personal check to cover these programs and account for your claimed filings from your W-4.

D. Adj Type- Any additional adjustments that you have been taken out of your check are labeled here: child support, dental, HSA accounts, uniform fees, badge fees, etc.

E. Benefit- Lists the benefit amount that was contributed from the employer.

F. Amount- The amount and final total that was deducted from your check to allot for these adjustments. Typically, these are either recurring deductions or one time situations based on the staffing companies policies.

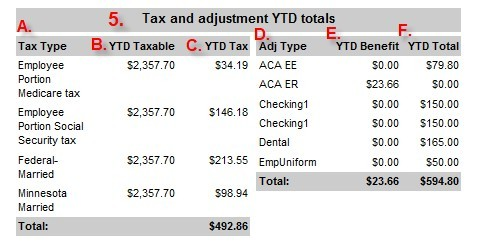

5. Tax and Adjustment YTD Totals- Here you will find your year to date totals of taxes and adjustment amounts taken out.

A. Tax Type- This will show the type of taxes and year to date totals taken for both federal and state. Here, you will see medicare commonly seen as EMed (this funds hospital medicare insurance program) and social security tax commonly seen as EFica. If you wish to change these amounts, please work with your staffing specialist.

A. Tax Type- This will show the type of taxes and year to date totals taken for both federal and state. Here, you will see medicare commonly seen as EMed (this funds hospital medicare insurance program) and social security tax commonly seen as EFica. If you wish to change these amounts, please work with your staffing specialist.

B. YTD Taxable- This gives you the amount of pre-tax or wage limit amount of your check that can be taxed for the year so far.

C. YTD Tax- The amount taken from your personal check to cover these programs and account for your claimed filings from your W-4 for the year so far.

D. Adj Type- Any additional adjustments that you have taken out of your check labeled here: child support, dental, HSA accounts, uniform fees, badge fees, etc.

E. YTD Benefit- This lists the total benefit amount that was contributed from the employer for the year so far.

F. YTD Total- The total that was deducted from your check to allot for these adjustments. Typically, these are either recurring deductions or one time situations based on the staffing companies policies for the year so far.

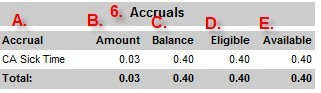

6. Accruals- Here, you will find your accrual package information, whether you are enrolled in a PTO plan, sick time, etc. If you are unsure if this is something you are participating in, please work with your staffing specialist.

A. Accrual type- The label of the accrual itself, whether this is a PTO plan, sick time, vacation, etc.

B. Amount- The rate at which the accrual calculates by.

C. Balance- The balance of the accrual.

D. Eligible- Dependent on your staffing company policies there may be a delay days before you can start using this amount. For example, if this is a PTO package and the staffing company states that you must be there 90 days before being able to use this amount, this distinguishes the amount you're starting to accrue and will eventually be able to take.

E. Available- This will be the amount that you have you accrued and can eventually take based on the staffing companies policy.