When creating a new order it is important that we set up the order correctly to function with a desired pay schedule. Whether it be a daily, weekly, bi-weekly, semi-monthly, or monthly pay schedule, knowing the proper set up is needed to guarantee that payroll goes smoothly. The set up of the order can affect when payroll can be ran for an employee and how their adjustments and taxes are calculated.

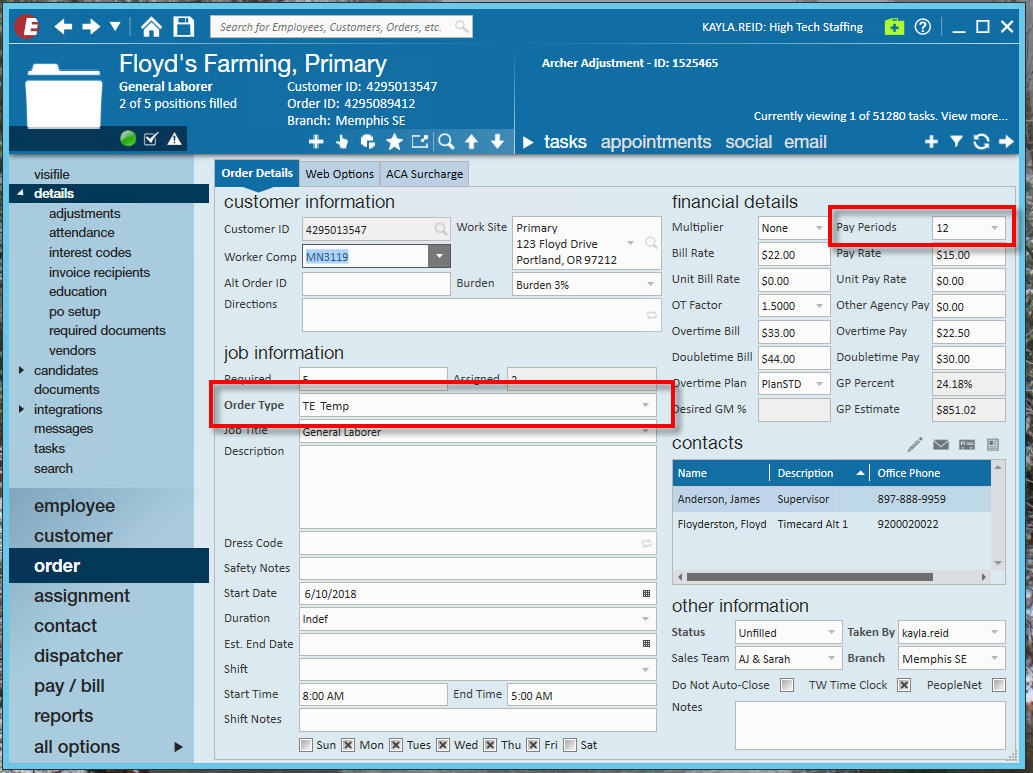

In this article, we will be going over the proper set up for each pay schedule as well as identifying the benefits of each set up and the importance behind having the correct information in the order for payroll. The key fields we will be focusing on are Order Type, Pay Periods, and Duration.

This Article Review the Following:

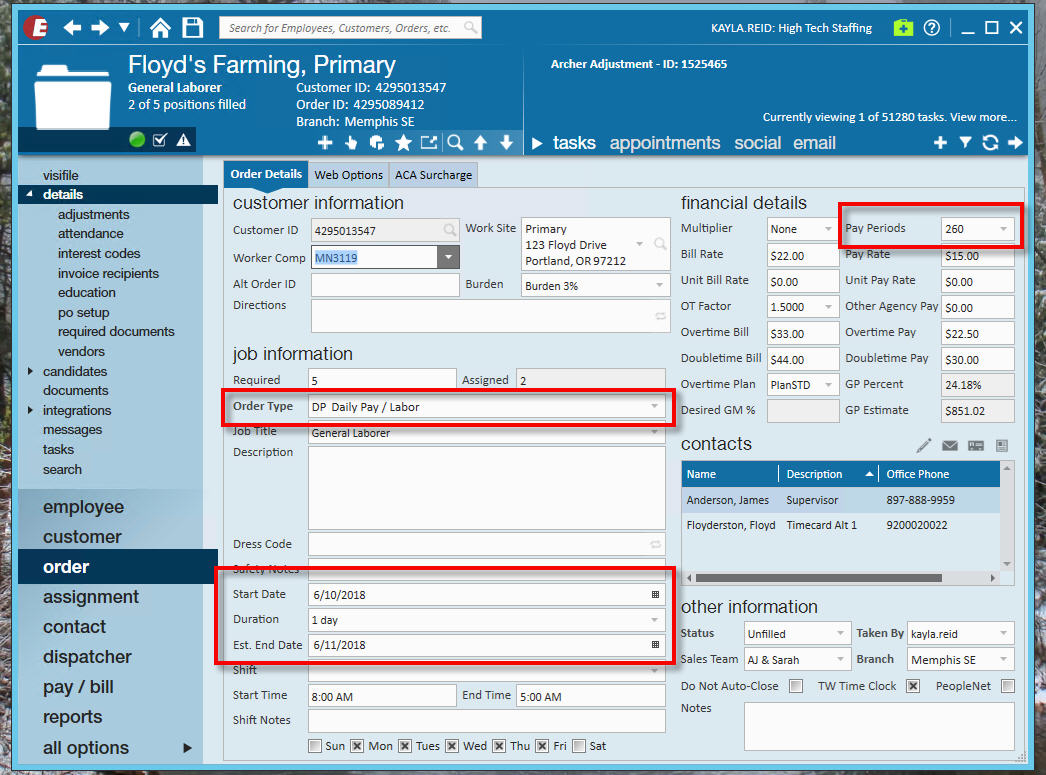

Daily Pay

When to Use:

- Employees assigned to the order are only working one day, and are getting paid for their one day of pay, commonly the same day.

How to Set Up the Order:

- Order Type must be set to "DP Daily Pay / Labor"

- Pay Periods will be 260

- Duration will be 1 day

What Behavior to Expect:

- When utilizing Daily Orders, each assignment will only be open for one given day.

- Using Daily Orders allows you to pay the employee for their time in the same week (or even the same day) that they submit their hours instead of paying them for their hours this week in the following week.

Benefits:

- Shows up in Dispatcher

- Can be paid using Instant Pay Runs in Dispatcher

- Quick and easy payroll for employees who need/want their money quickly

How this Affects the Paycheck:

- The employee's taxes will be calculated based on the estimated gross pay. In this case, it will be total gross on check x 260 days. This will determine the employee's tax bracket to base tax calculations off of.

- If you use instant pay, the employee would receive a check for each order worked that day.

- Otherwise, if the employee works multiple orders in a day, you will have separate timecards for each order, but can pull them together on one check in Pay/Bill. Can pay them for all of their daily orders throughout the week in one day, however, each day should still be a separate order and a separate timecard. Otherwise, you will more than likely need to set the employee up on a weekly order.

- Daily orders must be paid out and invoiced in the current open week. If you need invoicing to take place the following week, please reach out to TempWorks Support to determine the best way to set up your system.

*Note* Daily is the only pay schedule that allows for same week pay.

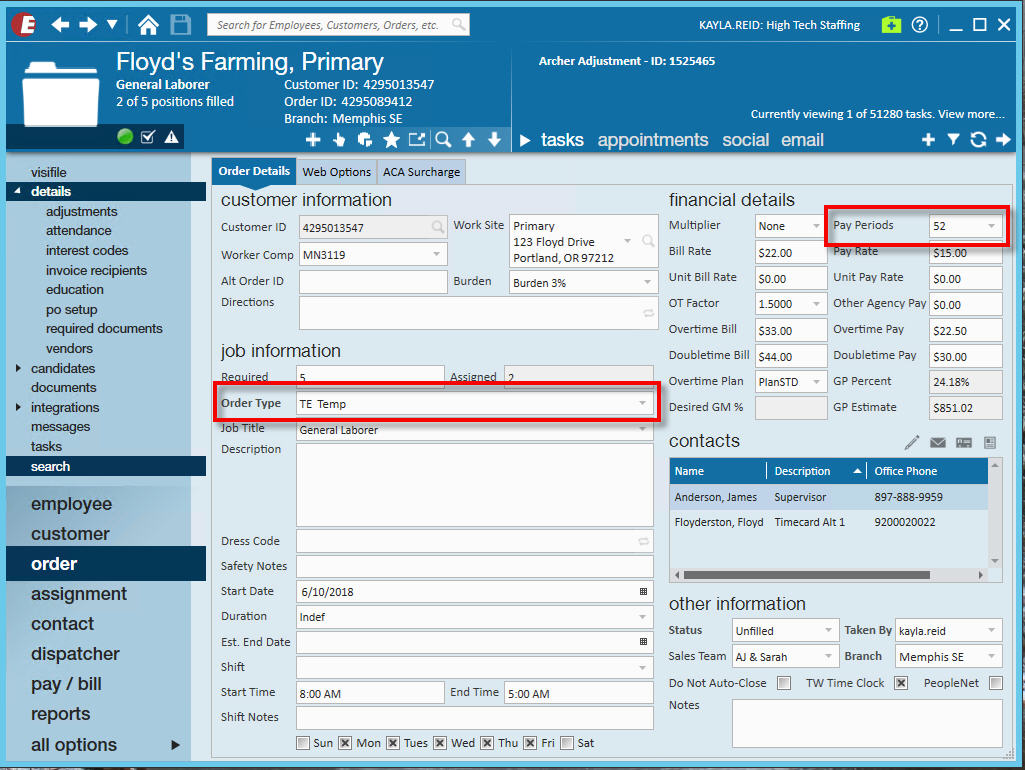

Weekly

When to use:

- Employees are getting paid every week, for the hours they worked the previous week.

How to Set Up the Order:

- Order Type is generally set to "TE Temp"

- Pay Periods will be 52

- Duration does not affect the behavior for a Weekly order

What Behavior to Expect:

- When utilizing Weekly Orders, each assignment will be open until the end date and the status is manually updated.

- Using Weekly Orders allows you to pay the employees weekly for their hours from the previous week.

Benefits:

- Can record and pay the employee for a whole week's worth of work on one timecard.

- Able to record time for the previous week in the current open week.

- Order/assignment can be open indefinitely, if desired.

How this Affects the Paycheck:

- Payroll done in the current week is for timecards from the previous week.

- Employee's tax bracket will be determined by their gross wages this week x 52 weeks and then take out taxes based on the estimated gross income for the employee.

- If an employee is being paid for every week of work and work full time, they would be receiving a paycheck for 40 hours of work.

Below is an example of what a 40 hour check could look like if calculated when the timecard(s) is set up for a Weekly order versus a Daily order.

- Minnesota state withholding

- 0 Federal Exemptions

- 0 State Exemptions

- 40 hours of work

- $15.00 per hour

| Weekly | Daily | |

| Gross | $600.00 | $600.00 |

| Federal Withholding | $59.80 | $118.62 |

| Social Security | $37.20 | $37.20 |

| Medicare | $8.70 | $8.70 |

| Minnesota State | $31.00 | $42.00 |

| Tax Total | $136.70 | $206.52 |

| Net | $463.30 | $393.48 |

Notice that if your order is set up as a Daily order even though you are paying the employee for one whole week of work, their taxes will be a lot higher. If your employee's pay schedule is to pay for one full week (or more than one day on the same order) on one given check for one weekend bill date, then it is best practice to set up your order to follow the Weekly set up above.

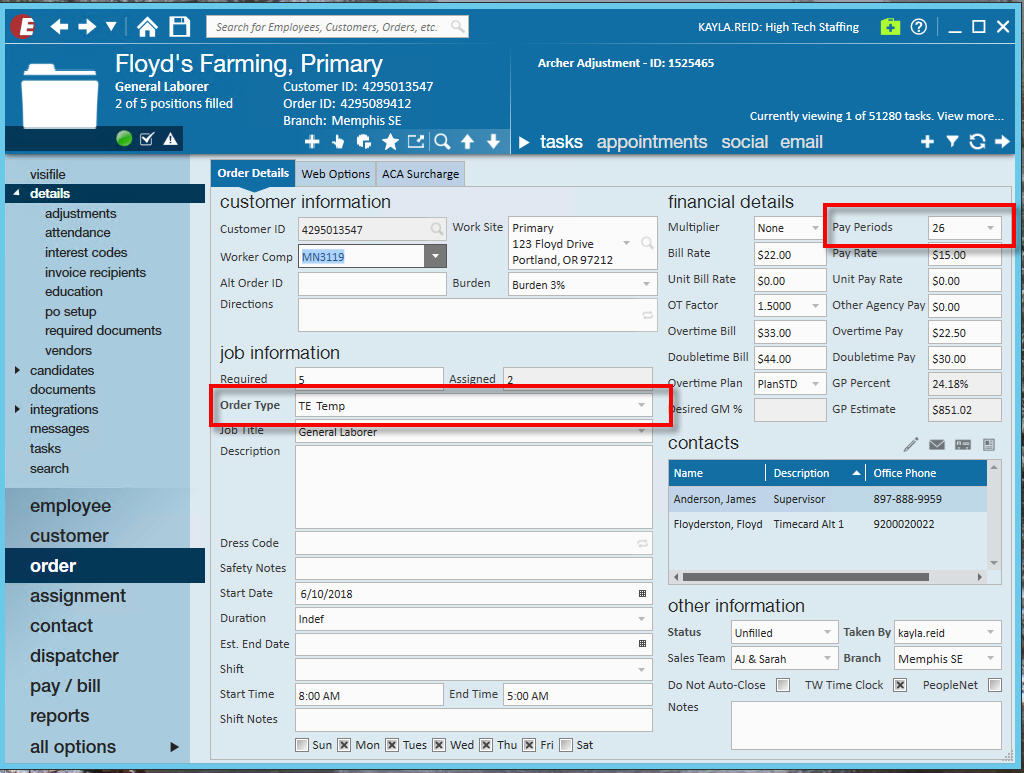

Bi-Weekly

When to Use:

- Employees are going to be paid every other week for the hours they worked the previous two weeks.

- This is often used for salaried employees as well as hourly employees. View this article for the full salary set up.

How to Set Up the Order:

- Order Type is generally set to "TE Temp" or "Payrolled"

- Pay Periods will be 26

- Duration does not affect the behavior for a Bi-Weekly order

What Behavior to Expect:

- When utilizing Bi-Weekly Orders, each assignment will be open until the end date and the status is manually updated.

- Using Bi-Weekly Orders allows you to pay the employees bi-weekly for their hours from the previous two weeks.

Benefits:

- Bi-Weekly orders can be used to pay your salary employees when you have pay periods for every other week.

How this Affects the Paycheck:

- If an employee is being paid for every two weeks of work and work full time, they would be receiving a paycheck for 80 hours of work.

- Employee's tax bracket will be determined by their gross wages this week x 26 weeks and then take out taxes based on the estimated gross income for the employee.

Below is an example of what an 80 hour check could look like if calculated when the timecard(s) is set up for a Bi-Weekly order versus a Weekly order.

- Minnesota state withholding

- 0 Federal Exemptions

- 0 State Exemptions

- 80 hours of work

- $15.00 per hour

| Bi-Weekly | Weekly | |

| Gross | $1,200.00 | $1,200.00 |

| Federal Withholding | $119.60 | $170.26 |

| Social Security | $74.40 | $74.40 |

| Medicare | $17.40 | $17.40 |

| Minnesota State | $61.00 | $73.00 |

| Tax Total | $272.40 | $335.06 |

| Net | $927.60 | $864.94 |

Notice that if your order is set up as a Weekly order even though you are paying the employee for two weeks of work, their taxes will be a lot higher. If your employee's pay schedule is to pay for two weeks on one given check for one weekend bill date, then it is best practice to set up your order to follow the Bi-Weekly set up above.

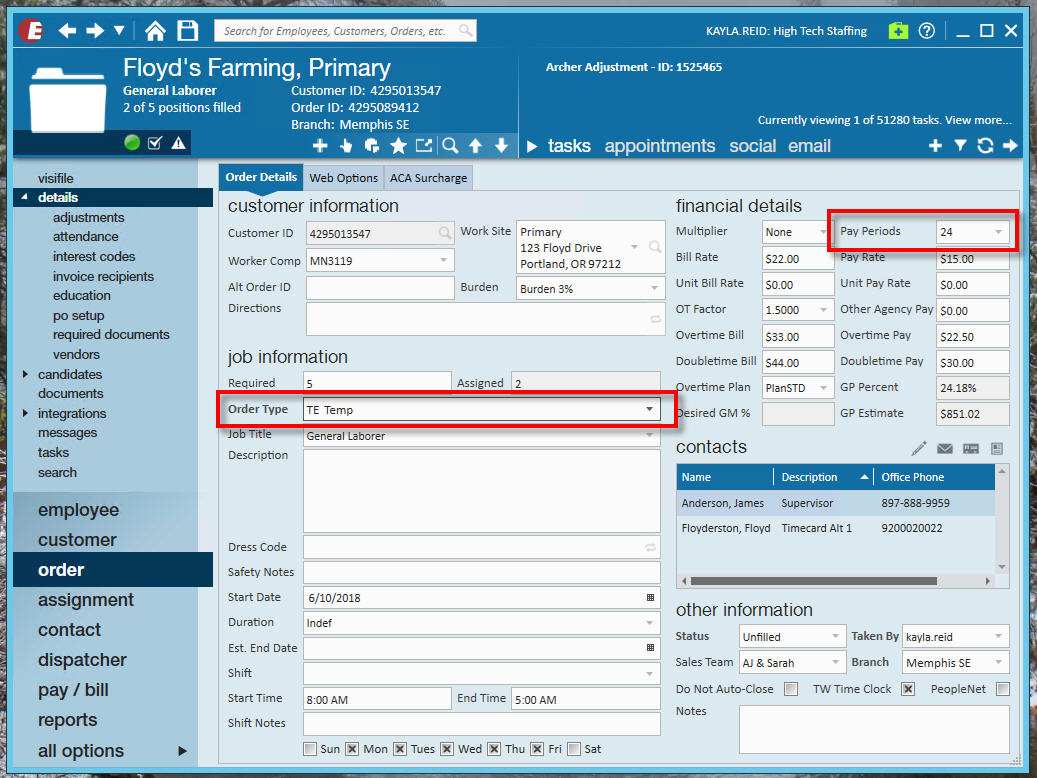

Semi-Monthly

When to Use:

- Employees are going to be paid twice a month, generally the 1st and the 15th.

- This will typically be for salaried employees. View this article for the full salary set up.

How to Set Up the Order:

- Order Type is generally set to "TE Temp" or "Payrolled"

- Pay Periods will be 24

- Duration does not affect the behavior for a Semi-Monthly order

What Behavior to Expect:

- When utilizing Semi-Monthly Orders, each assignment will be open until the end date and the status is manually updated.

- Using Semi-Monthly Orders allows you to pay the employees twice a month for their hours they worked.

Benefits:

- Semi-monthly orders can be used when you have worked out an agreement to pay your employee's semi monthly.

How this Affects the Paycheck:

If an employee is being paid for every two weeks of work and work full time, they would be receiving a paycheck for 80 hours of work.

Note that if your order is set up as a Bi-Weekly order even though you are paying the employee for two weeks or more of work, their taxes will be a lot higher. If your employee's pay schedule is to pay for half a month's hours on one given check for one weekend bill date, then it is best practice to set up your order to follow the Semi-monthly set up above.

Monthly

When to Use:

- Employees are going to be paid once a month.

- This will typically be for salaried employees. View this article for the full salary set up.

How to Set Up the Order:

- Order Type is generally set to "TE Temp" or "Payrolled"

- Pay Periods will be 12

- Duration does not affect the behavior for a Monthly order

What Behavior to Expect:

- When utilizing Monthly Orders, each assignment will be open until the end date and the status is manually updated.

- Using Monthly Orders allows you to pay the employees once a month for the hours they worked.

Benefits:

- Monthly orders can be used for the salaried employees you pay only once a month.

How this Affects the Paycheck:

- If an employee is being paid once a month and work full time, they would be receiving a paycheck for around 160 hours of work.

- Their tax amount will be determined by their gross pay x 12 pay periods which will give the system the correct tax brackets to pull calculations for.

Note that if your order is set up as a Semi-Monthly order even though you are paying the employee for an entire month of work, their taxes will be a lot higher. If your employee's pay schedule is to pay for one month's hours on one given check for one weekend bill date, then it is best practice to set up your order to follow the Monthly set up above.