Checklist |

| Item | Important Dates & Deadlines | ✔ |

| Schedule a Data Integrity Check Call | - Calls begin the first Monday of November

- Hot day rates for Data Integrity Check support begin the third week of December 🔥

| ☐ |

| Run your Data Integrity Check | - Best practice is to run this quarterly

- For year end prep, run in early November

| ☐ |

| Review your tax logins and confirm you have all of your Employer IDs Note: If you are Lone Oak Payroll Processing or Tax Processing client, LOP handles this on your behalf. | - Before the end of November

| ☐

|

Manage your new SUTA rates in Enterprise Administration

- New rates are published between November and January most often. You can add them as soon as you receive them by entering the proper start date, which might be in the future.

Note: If you are a Lone Oak Payroll Processing or Tax Processing client, LOP handles this on your behalf. | - Between November and January

| ☐

|

| Obtain Benefit Admin File from your provider | - Communicate to your Ben Admin exactly what you will need from them in November.

- Obtain the file from Ben Admin and have it in the correct format by the time of your TempWorks 1094/5 processing call (~as early as third week of January)

| ☐

|

Ensure you are enrolled for year end services (W2 processing, 1094/5 processing)- Contact your Account Manager if you have questions related to your enrollment in year end services.

Note: Lone Oak Payroll clients are automatically enrolled in W2 processing, but they do need to enroll/opt in for 1094/5 processing. Note: If you were enrolled in year end services last year, you are automatically enrolled for future years. | - Enrollment is due by the first Monday of December

| ☐ |

| Resolve data integrity check blue errors Note: All blue errors must be resolved before the year can be closed. | - Before your year close call

| ☐ |

| Review data integrity check purple errors | - Before your year close call

| ☐ |

Resolve data integrity red errors- Red errors are specifically covered during your data integrity call with the TempWorks year end team.

| - During your TempWorks Data Integrity Call, and before your year close call

| ☐ |

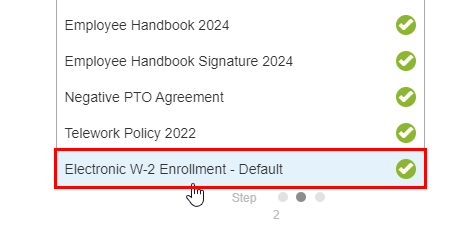

Ensure the "Electronic W-2 Enrollment - Default" survey is added to your HRC Workflow

| - This can be done at anytime, today is the perfect day to confirm you have this added.

| ☐ |

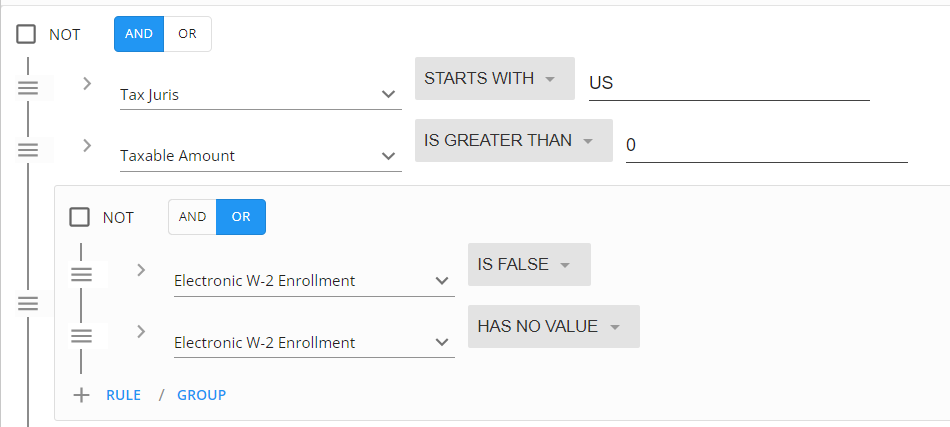

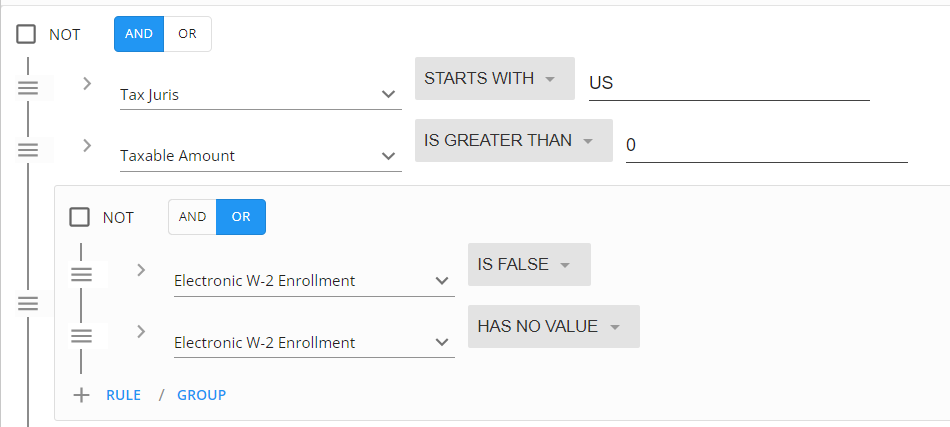

Assign the "Electronic W-2 Enrollment - Default" survey to un-enrolled employees- Run a Beyond employee advanced search to see which employees are not enrolled in electronic w-2's and assign them the enrollment survey

| - We recommend this be a December push when W-2s are on employee's minds

| ☐ |

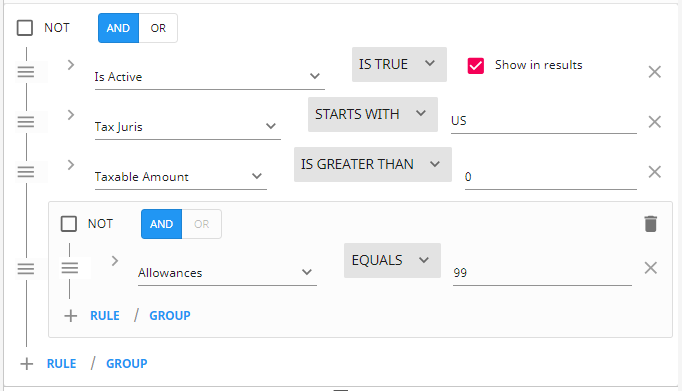

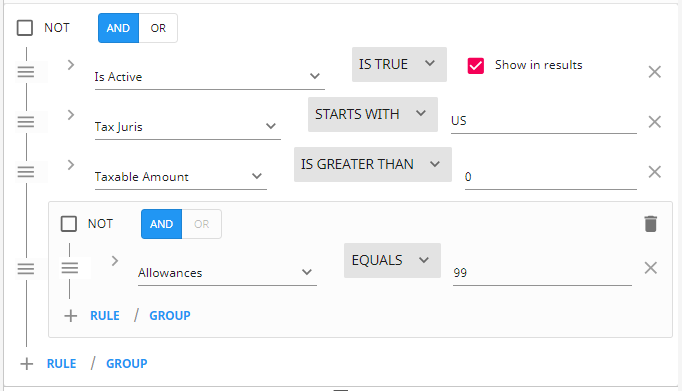

Assign new W-4s for exempt from withholding (99) employees- Run a Beyond employee advanced search to see which employees have claimed to be exempt from withholding and assign them a new W-4 for the new year

| - Updated W-4's are due by February 15th

| ☐ |

| Schedule a Year Close call Note: TempWorks closes the year on behalf of some Lone Oak Payroll clients and software only clients. If you are not sure if you are responsible for closing your year, contact Support or your Account Manager. | - Year close calls begin the first Monday in January

- Year end hot rate support begins the third week of January 🔥

| ☐ |

Update minimum wage pay rates by state to reflect rates for the new year- Run a Beyond assignment advanced search and include the impacted state and previous minimum wage rate in your search. Then, select all results and choose to "mass update rates" to the new rate:

| - Due before your first payroll of the new year, and can be setup in advance by using the "create a new assignment" feature within Beyond

| ☐ |

Tax rates updated for the new year- No action required as TempWorks applies updates on your behalf

| | ☑ |

Re-Run Data Integrity Check in the new year- Resolve any new blue errors (if applicable), and scan for any new errors.

| - First week in January to catch any new errors

- Resolve prior to year close call

| ☐ |

Import Employer Benefits not tracked in TempWorks- Fill out the S125 tracking spreadsheet included in our KB article and import from Enterprise Pay/Bill.

- This tool allows employer paid benefits that were tracked in TempWorks to display on the W-2. For example, employer paid health insurance benefits that need to display in box 12 code DD.

| - Before the year is closed

| ☐

|

Close the year | - Lone Oak Payroll Clients: By the first Friday in January

- Software Only Clients: Before the third Thursday in January (~1/16-1/19)

- Year end hot rate support begins the third week of January 🔥

| ☐ |

| Schedule your 1095-C processing call | - Appointments begin the third Friday in January (~1/17-1/20)

| ☐ |

Ensure inactive employees have the ability to access W-2s from WebCenter- Contact Support and confirm you have the configuration/WebCenter role for this type of access (for inactive employees) activated

| - W-2s must be available by January 31st 🔥

| ☐

|

Post W-2s to WebCenter- This is done from Step 4 of the year end worksheet within Enterprise

| - W-2s must be posted to WebCenter by January 31st 🔥

| ☐ |

W-2's printed and postmarked- No action required when you are enrolled in TempWorks year end services

Note: While we cannot provide an exact date that W-2s will be postmarked, we can guarantee they will postmarked by January 31st when you are processing with us. | - Printed and postmarked by January 31st 🔥

| ☑ |

| Electronic W-2s submitted to SSA Note: TempWorks submits electronic files for all Lone Oak Payroll clients, as well as all Tax Processing clients. If this is a service you are interested in, please contact your Account Manager. | | ☐ |

| Electronic W-2s submitted to states Note: TempWorks submits electronic files for all Lone Oak Payroll clients, as well as all Tax Processing clients. If this is a service you are interested in, please contact your Account Manager. | - N/A to states without income tax

- January 31st 🔥 (for most)

- February 15th

- February 28th 🔥

| ☐

|

1095-Cs generated, distributed and postmarked- No action required when you are enrolled in TempWorks year end services

Note: While we cannot provide an exact date that 1095-Cs will be postmarked, we can guarantee they will postmarked by February 1st when you are processing with us.

| - Postmarked by March 1st 🔥

| ☑

|

| File electronic 1094-Cs | | ☐

|