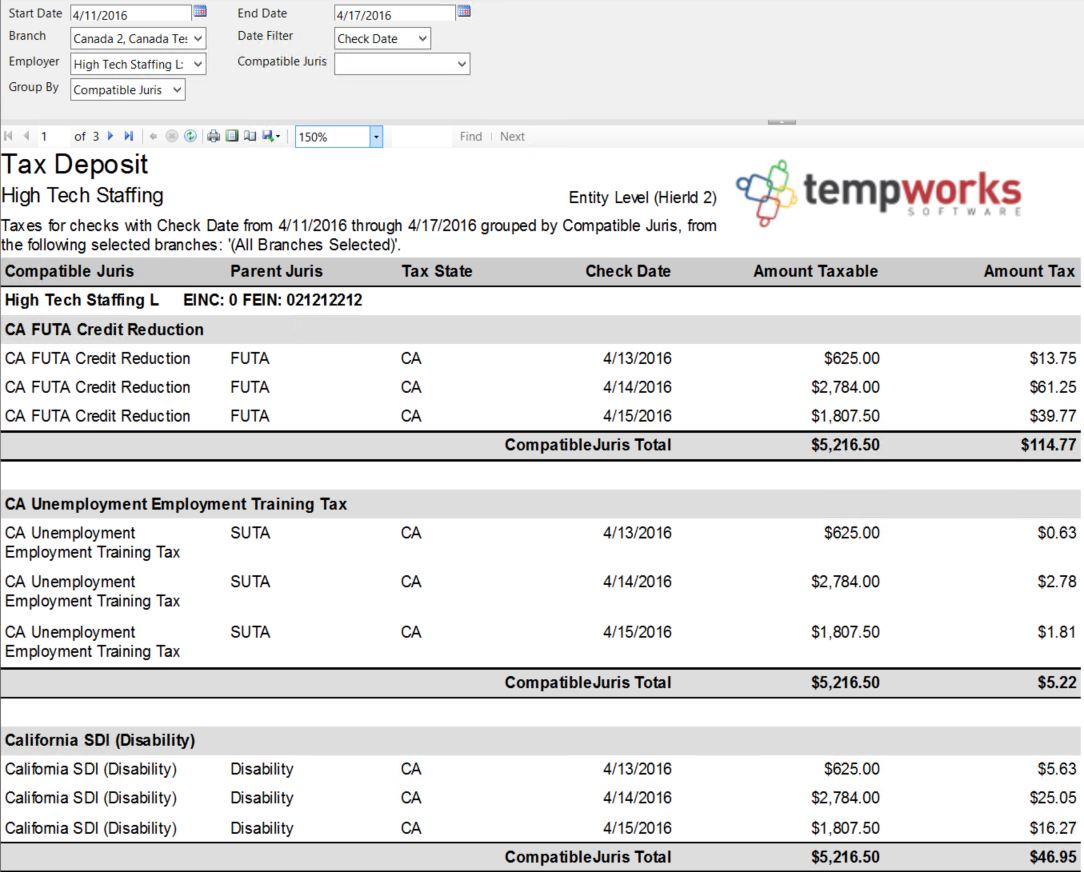

Purpose

This is an overarching tax deposit report that shows every tax withheld from an employee's check as well as all employer paid taxes. It is grouped by employer then grouped by the specified group by parameter. If this report is being used to file taxes it should always be run by Check Date.

How to Run This Report

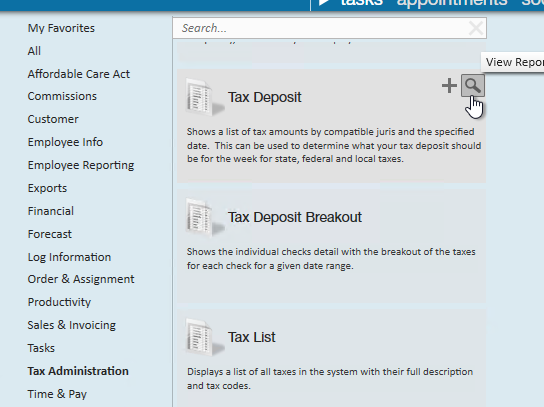

This report can be run in Enterprise under All Options > Reports. Select the Tax Administration category on the left.

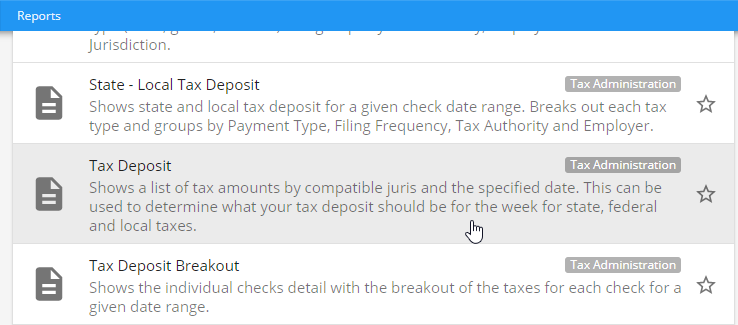

You can also run this report in Beyond under the B menu > Reports. Select All Reports and search by the report name or select the Tax Administration report group.

Parameters

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Filter: A drop down determining what field your date range filters on.

- Check Date: Date written on check

- Weekend Bill: The processing weekend date (always a Sunday) See Time Entry Part 1: The Basics for more information

- Branch: A drop down list of all branches in your current hierarchy. This is a multi-value parameter so all branches can be selected, just one branch can be selected or any combination of multiple branches can be selected from the list.

- Employer: A drop down list of all employers in your current hierarchy. This is a multi-value parameter so you can select all employers, specify just one employer or select any combination of multiple employers from the list.

- Compatible Juris: This is a drop down list of all compatible jurises. It is a multi-value parameter so you can select all compatible jurises, select just one specific juris or select any combination of multiple jurises from the list.

- Group By: This is a list of different fields by which the data can be grouped on the report. The group by can be by:

- Compatible Juris

- Parent Juris

- Tax State

Related Articles

- None