Overview

The Report Manual for Enterprise Infinity, which can be accessed here: ReportManualEnterpriseInfinity.pdf, provides a screen shot, report purpose explanation, and parameters information for every standard report in Enterprise Infinity. The manual is broken out into the following categories:

- Affordable Care Act

- Customer

- Employee Info

- Employee Reporting

- Exports

- Financial

- Forecast

- Log Information

- Order & Assignment

- Productivity

- Sales & Invoicing

- Tasks

- Tax Administration

- Time & Pay

- User Security Setup

*Note* This article is NOT the complete report manual. The article includes only Tax Administration reports.

For the full reports manual please click on the link above.

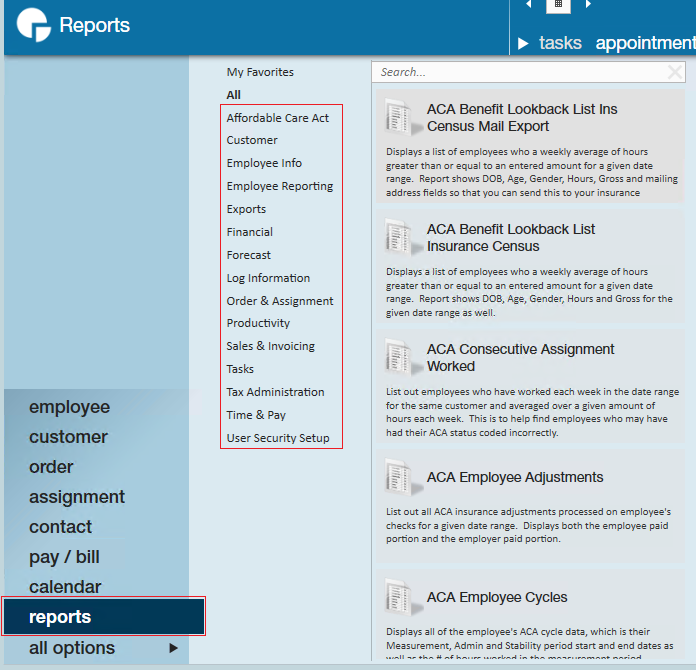

Users can access the reports section of Enterprise by selecting "reports" in the navigation tree. All categories available to you will be listed in the main report's dashboard:

*Note* The reports available to users are based on their individual security roles. You may not see/have access to all reports included in this manual. Please see your manager if you have questions or need access to a report.

Tax Administration

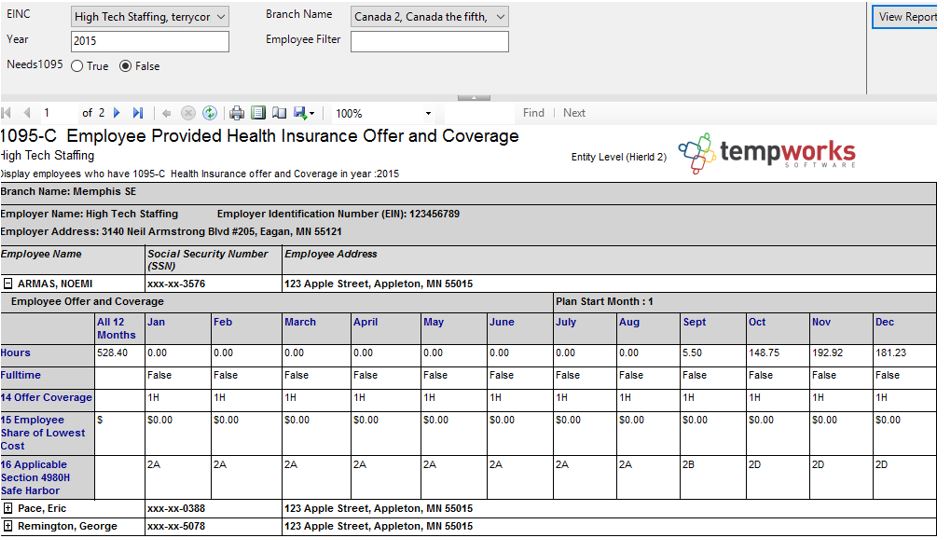

1095 Verification

Purpose:

- This report was designed to verify the 1095 data printed matches the data in Enterprise. The report will show the total breakdown per month per the 1095 standards.

Parameters:

- EINC: A drop-down list of all EINC's in the user's current hierarchy. This is a multi-value parameter so all EINC's can be selected, or just one specific EINC or any combination of different EINC's in the list.

- Branch Name: A dropdown list of all branches in the current hierarchy. This is a multi-value parameter so all Branches can be selected, just one specific Branch can be selected or any combination of different Branches on the list.

- Year: This is the calendar year.

- Employee Filter: Allows the filtering of a specific employee name.

- Needs 1095: Allows the selection of True or False of a 1095 is needed for the year entered.

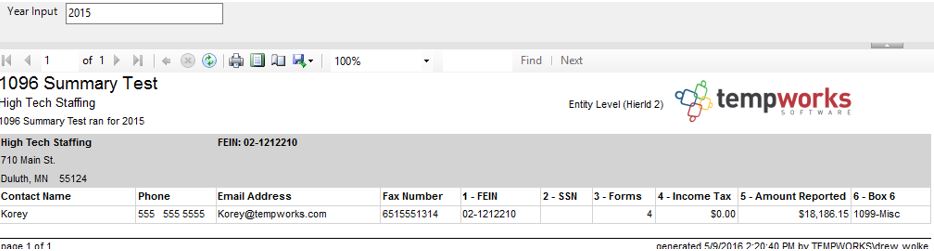

1096 Summary

Purpose:

- This report is designed to display data which will appear on the 1096 forms.

Parameters:

- Year Input: Calendar Year

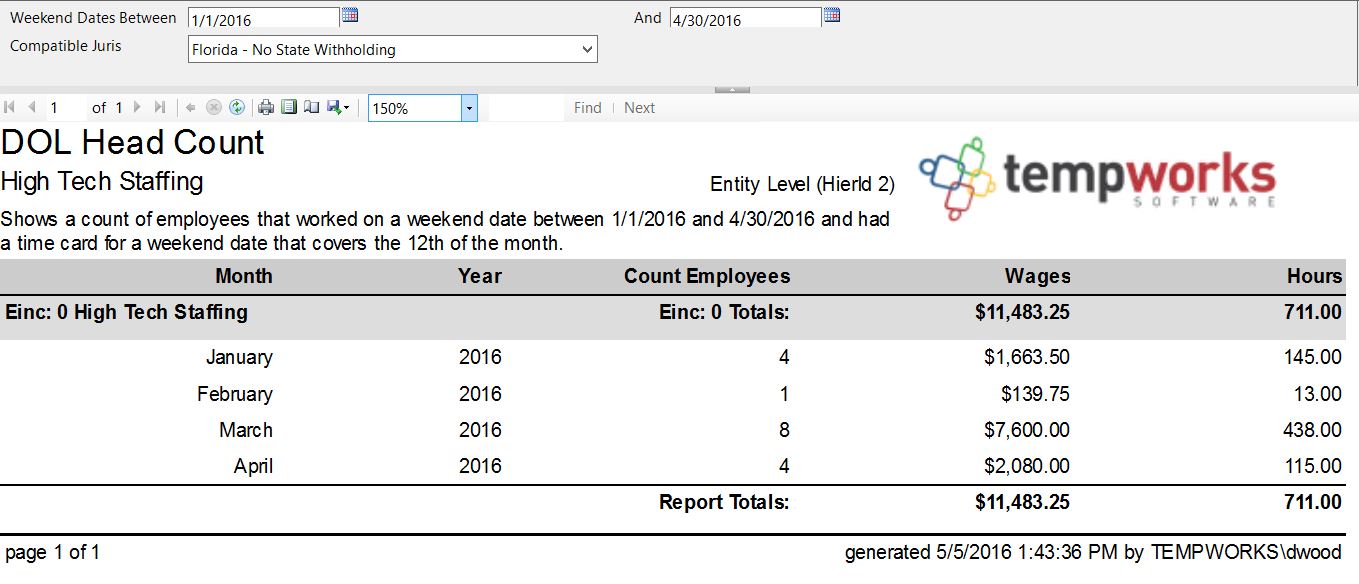

DOL Head Count

Purpose:

- This report is used to fill out reports for the Department of Labor. This report displays a count of employees that had federal income tax withheld from their check that had a timecard covering the 12th day of the month. It splits out each month and each year. It also shows the Federal Gross wages.

Parameters:

- Weekend Dates Between:

- Starting Weekend date for the desired date range

- Ending Weekend date for desired date range

- Compatible Juris: Select the juris for which the report should be run

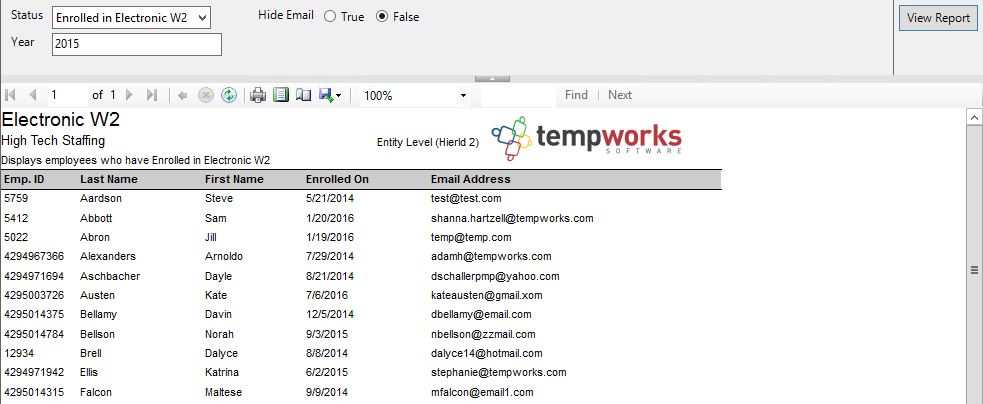

Electronic W2

Purpose:

- Displays a list of employees who have opted in for the electronic W2's, who have opted out of electronic W2's or who have not taken any action.

Parameters:

- Status: Choose which W2 election to be diplayed

- Hide Email: Choose whether or not to display the employee email on the result list

- Year: Calendar Year

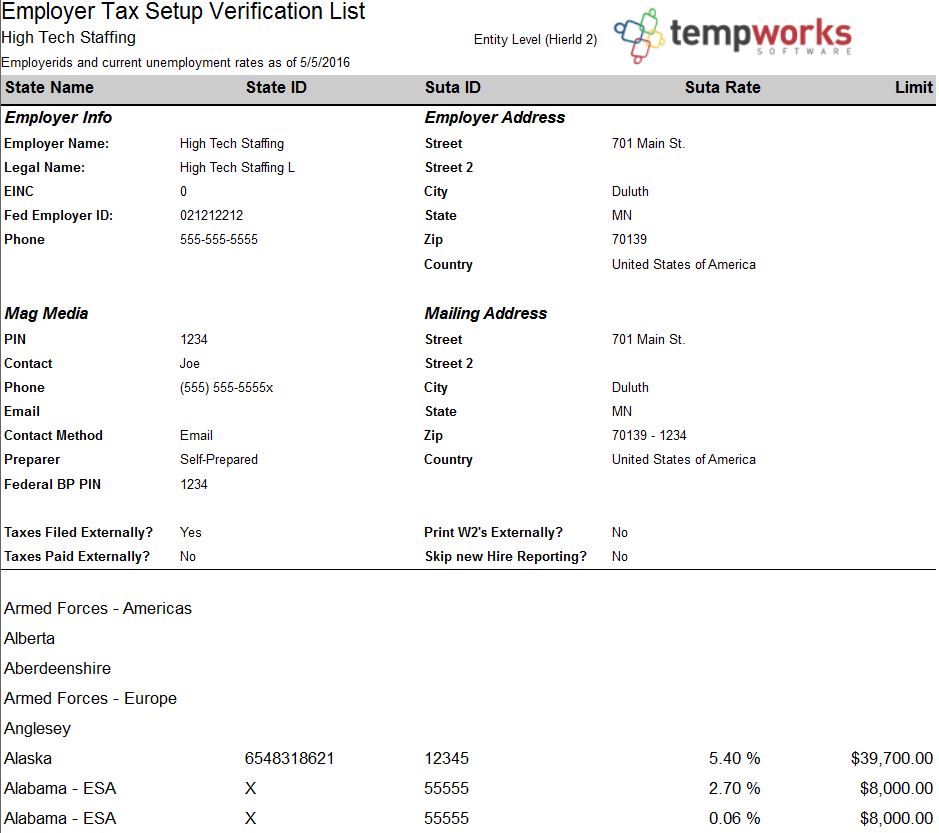

Employer Tax Setup Verification List

Purpose:

- This report is designed to allow you to verify the company specific tax rates, id and mailing addresses. It lists out all of your state unemployment and income tax employer ids that are listed in the TempWorks system along with your unemployment rates and limits, which are active as of the date the report was created

- This is a great report to use for auditing your unemployment rates and limits each year to ensure that they are set correctly. This report does not show employee portions of unemployment.

Parameters:

- Employer: A dropdown list of all employers in the user's current hierarchy. This is a multi-value parameter so all employers, just one specific employer or any combination of different employers in the list can be selected.

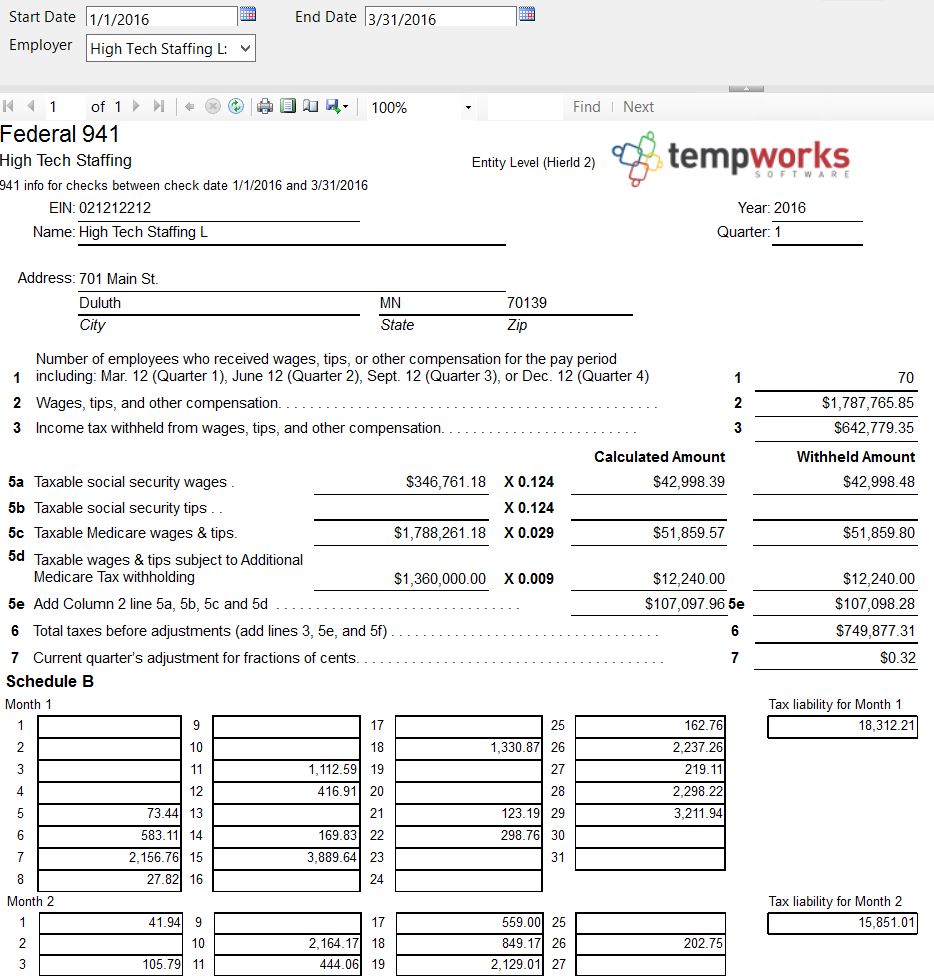

Federal 941

Purpose:

- This report is designed to help you fill out your federal 941 returns. It cannot be printed and filed directly with the IRS since it is not in an acceptable format.

Parameters:

- Start Date: Starting check date of your desired date range

- End Date: Ending check date of your desired date range

- Employer: A drop-down list of all employers in the user's current hierarchy. This is a multi-value parameter so all employers, just one specific employer or any combination of different employers in the list can be selected.

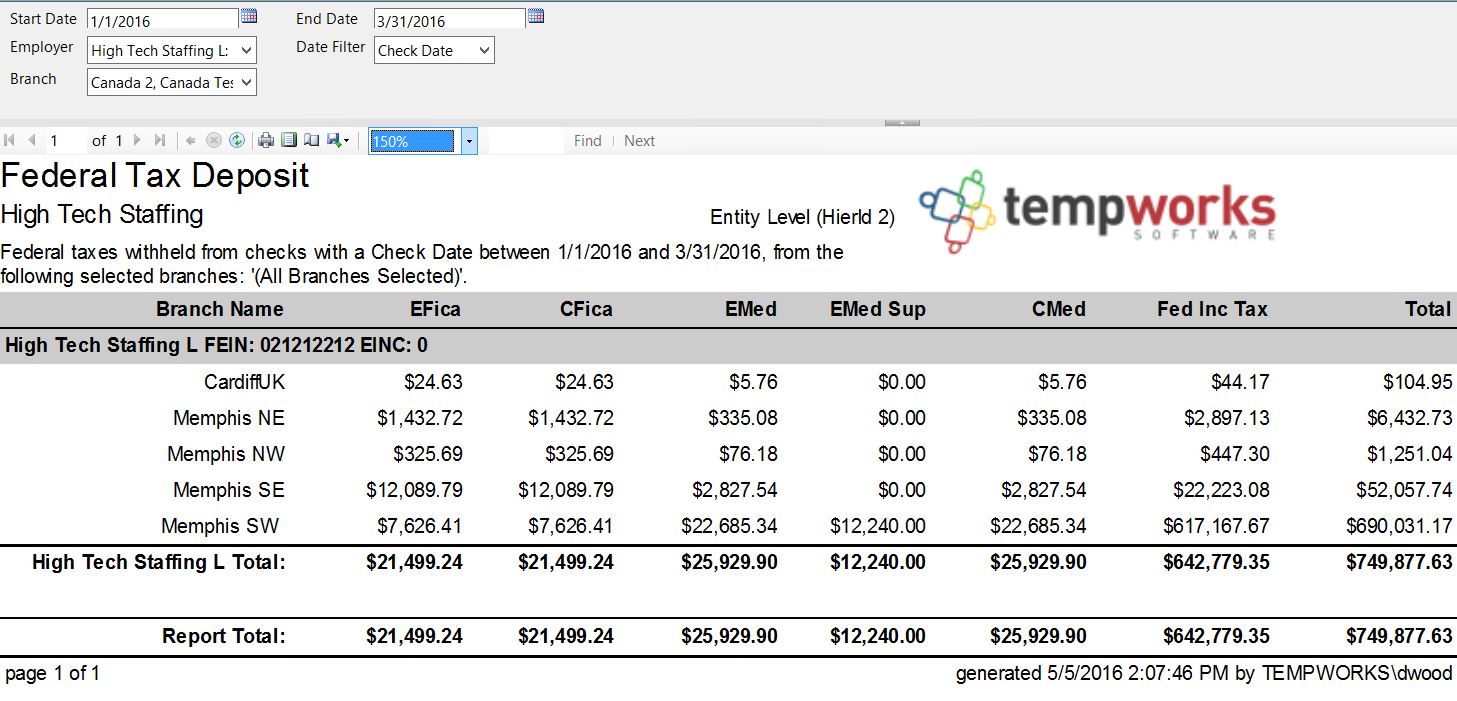

Federal Tax Deposit

Purpose:

- This report shows you a breakdown of your federal deposit amount. This report should always be run by the check date when you are making your deposit to the IRS. The Weekend Bill date filter is to allow you to balance with your other reports such as the Management report.

Parameters:

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Filter: A drop down determining what field your date range filters on

- Weekend Bill of the check

- Check date of the check

- Branch: A drop down list of all branches in the user's current hierarchy. This is a multi-value parameter so all branches, just one specific branch or any combination of different branches in the list can be selected.

- Employer: A drop-down list of all employers in the user's current hierarchy. This is a multi-value parameter so all employers, just one specific employer or any combination of different employers in the list can be selected.

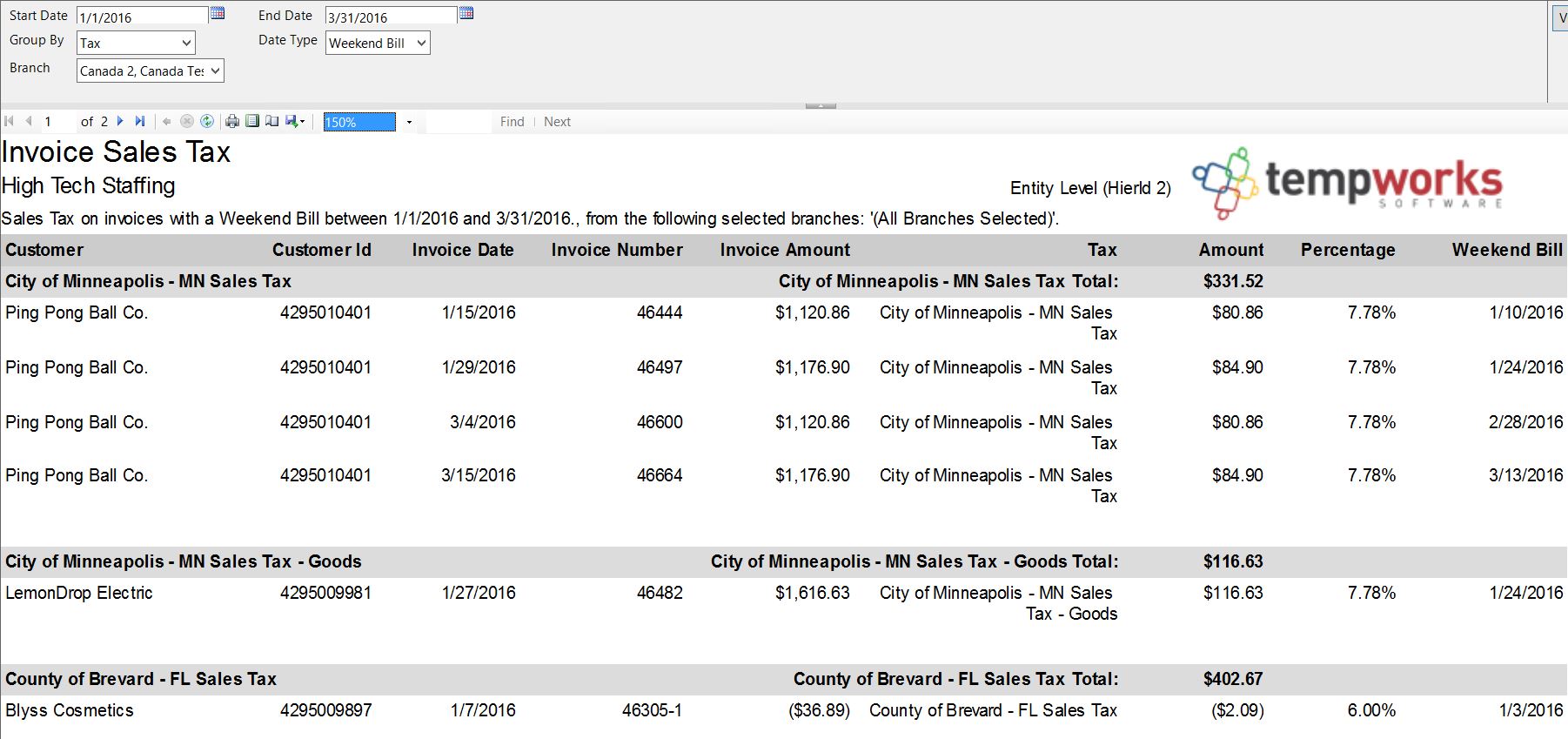

Invoice Sales Tax

Purpose:

- This report shows you the breakdown of the sales tax calculated on your invoices. It is designed to be the detail report to the Sales Tax Deposit report.

Parameters:

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Type: A drop down determining what field your date range filters on.

- Weekend Bill of the invoice

- Invoice Date of the invoice

- Branch: A drop down list of all branches in the user's current hierarchy. This is a multi-value parameter so all branches, just one specific branch or any combination of different branches in the list can be selected.

- Group By: A list of the different fields to group the data into on the report. Has the following options:

- Branch

- Customer

- Tax

- Invoice Date

- Weekend Bill

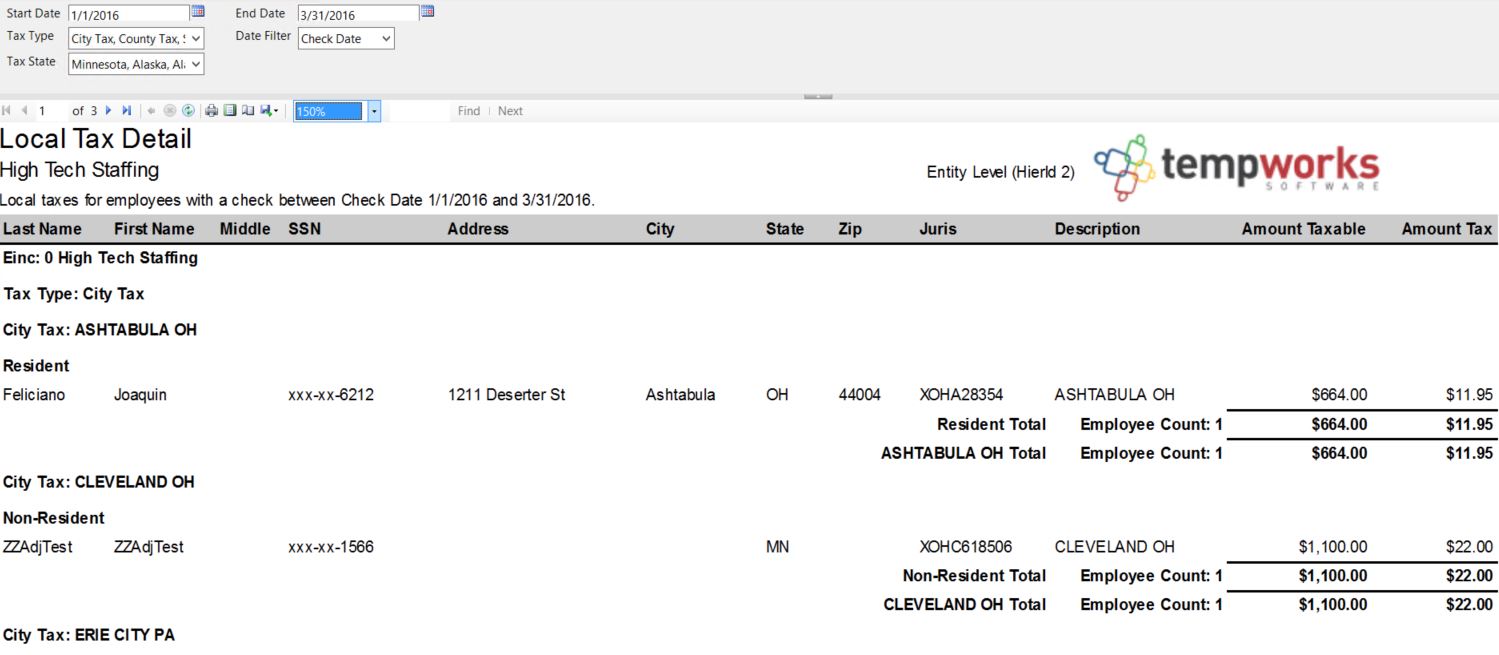

Local Tax Detail

Purpose:

- This report shows you the detail of the local taxes withheld from employee's checks. It is designed to be the detail of the State - Local Tax Deposit for the local taxes.

Parameters:

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Filter: A drop down determining what field your date range filters on

- Check Date of the check

- Weekend Bill of the check

- Tax Type: A list of different local tax types. You can select one or multiple types. The report has the following options:

- City Tax

- County Tax

- School Tax

- Tax State: This is a list of all the states in your TempWorks system. This field allows you to select which state(s) you would like to view. This is a multi-value parameter so all states, just one specific state or any combination of different states in the list can be selected.

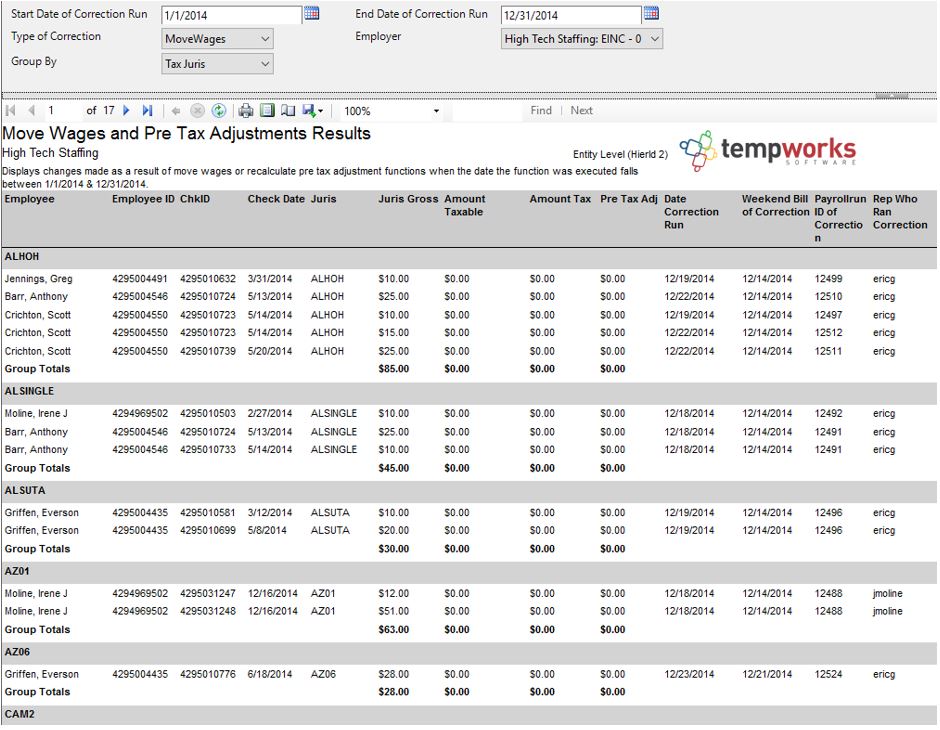

Move Wages and Recalc Pre Tax Adj Results

Purpose:

- Displays changes made as a result of moving wages or recalculating pre-tax adjustment functions when the date the function was executed falls between the start and end date selected.

Parameters:

- Start Date of Correction Run: Starting date of the desired date range. This will filter on the actual date the payroll run was processed.

- End Date of Correction Run: Ending date of the desired date range. This will filter on the actual date the payroll run was processed.

- Type of Correction: Select which type of moved wage runs to be displayed.

- Employer: This is a drop down list of all employers in the currently hierarchy level. This is a multi-value parameter so all employers can be selected, just one employer may be selected or any combination of different employers may be selected.

- Group By: This list will display different fields by which to group the data on the report.

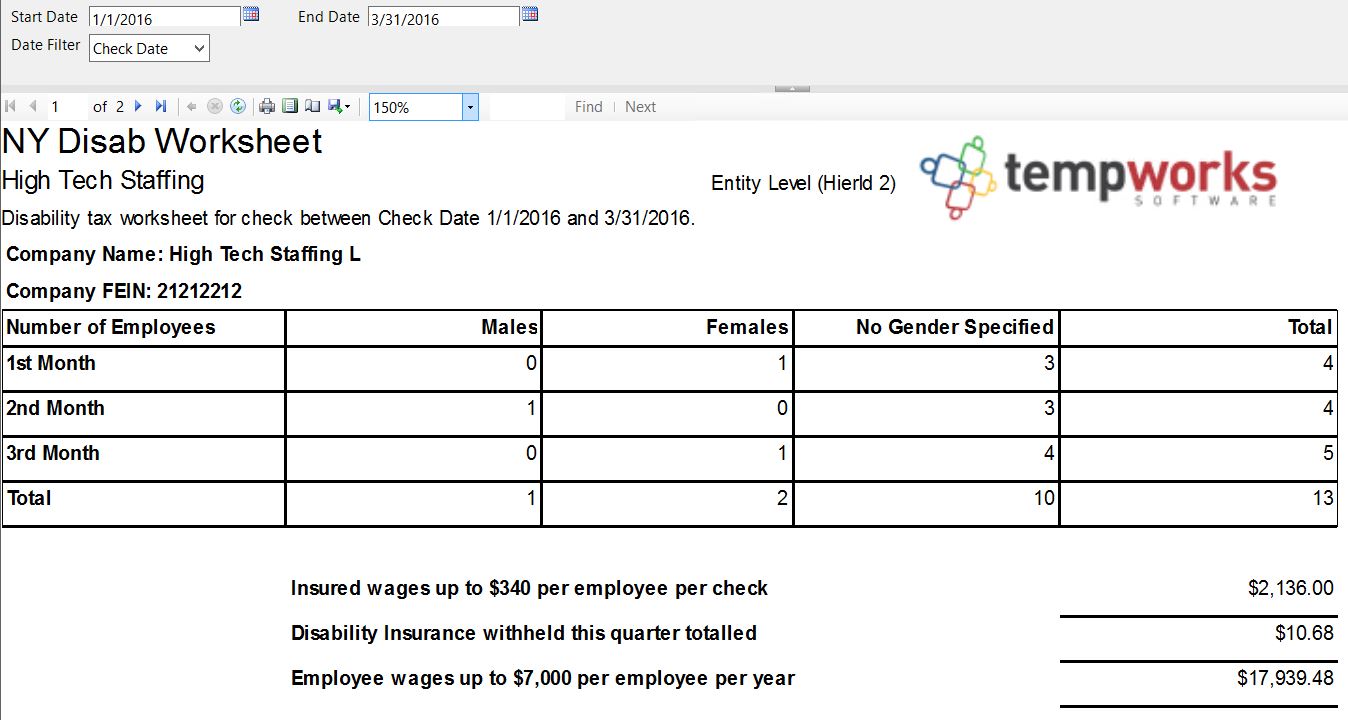

NY Disab Worksheet

Purpose:

- This report is used for private insurance plans outside of the one provided by the state of New York. It should be run only for 3 month periods.

- This report groups data by EIN and shows a total for all EINs.

Parameters:

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Filter: A drop down determining what field your date range filters on

- Check Date of the check

- Weekend Bill of the check

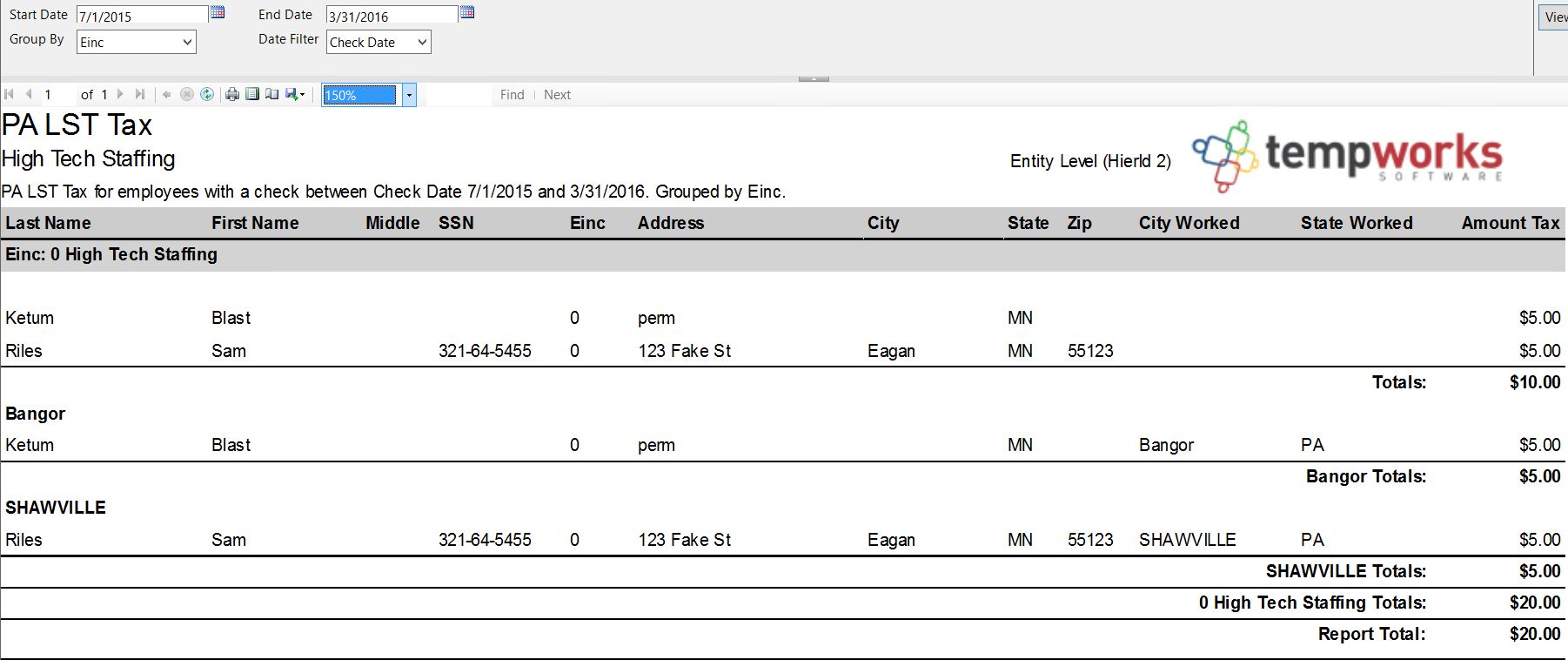

PA LST Tax

Purpose:

- This report is to be used for your PA LST Taxes. It displays the employee residency as well as the city and state in which they worked and where tax was withheld.

Parameters:

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Filter: A drop down determining what field your date range filters on

- Check Date of the check

- Weekend Bill of the check

- Group By: A list of different fields by which the report can be grouped. It has the following options:

- No grouping

- EINC

- Employee

- Employee State

- City Worked

Pre-Tax Adjustments

Purpose:

- This report displays a list of pre-tax adjustments and the jurisdictions from which they are exempt.

Parameters:

- There are no parameters that must be set for this report

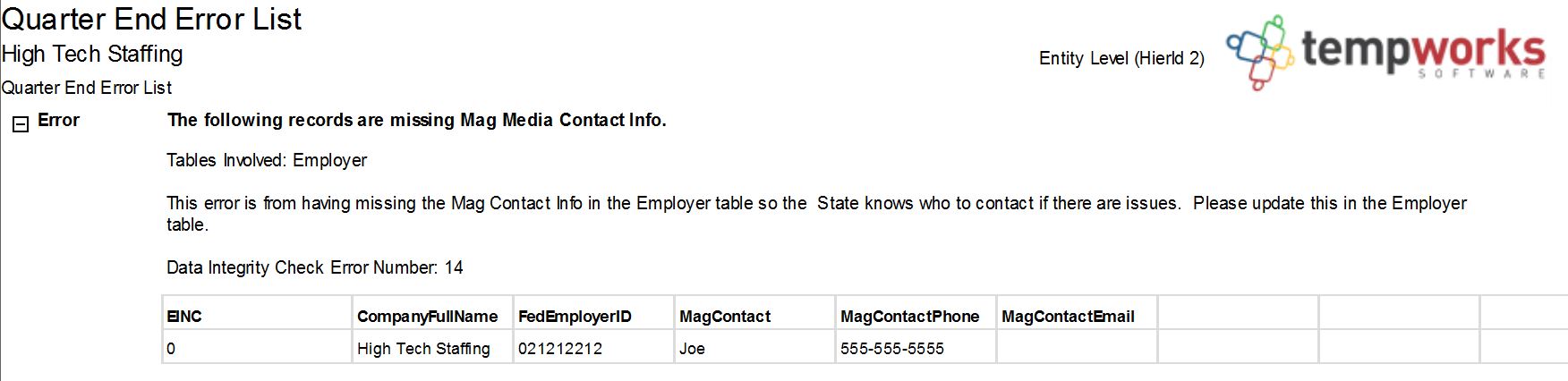

Quarter End Error List

Purpose:

- This report is designed to show you a list of errors that were created when running your mag media file export and allows you to see all of the errors for all states and companies. This will enable you to clear them up all at once then re-run your export to get your files.

Parameters:

- There are no parameters that must be set for this report

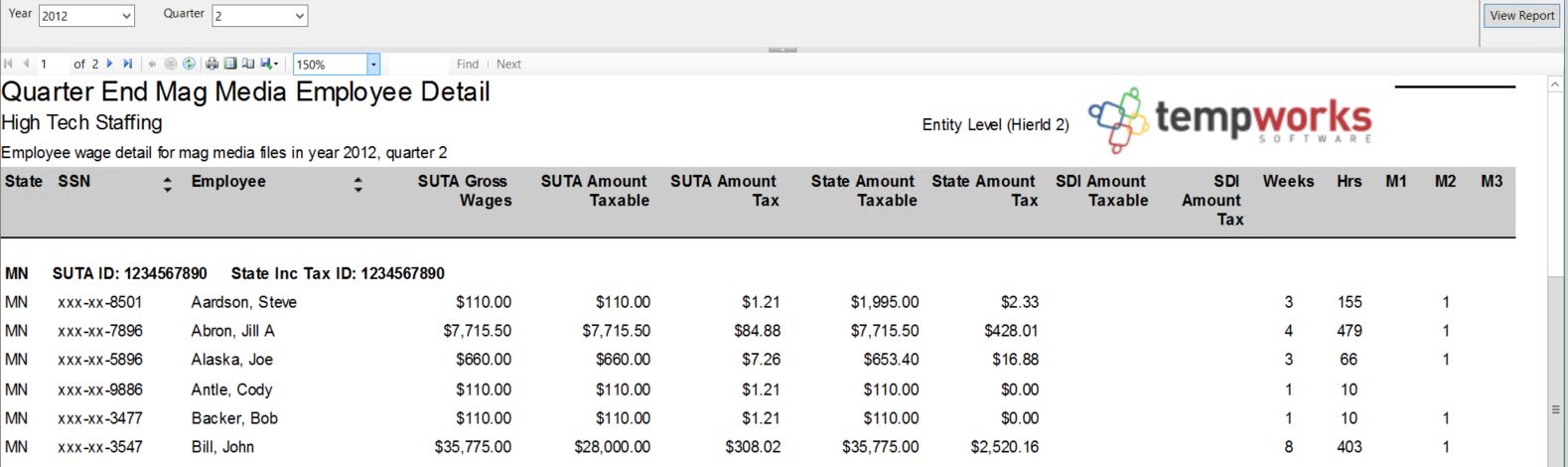

Quarter End Mag Media Employee Detail

Purpose:

- This report is designed to show you, in a layout format, the information included in your quarterly mag media files that are sent into the state unemployment agencies on a quarterly basis.

- To export the actual files which you upload/send to the state unemployment agencies, go to the Pay/Bill area of TempWorks Enterprise and use the Export action menu item. Select the "Taxes" category, then choose the "Quarterly Mag Media Files" procedure.

- This is a good report to balance against the Unemployment Wage Detail or the Tax Deposit reports.

Parameters:

- Year: Calendar year

- Quarter: The given Quarter within the selected year

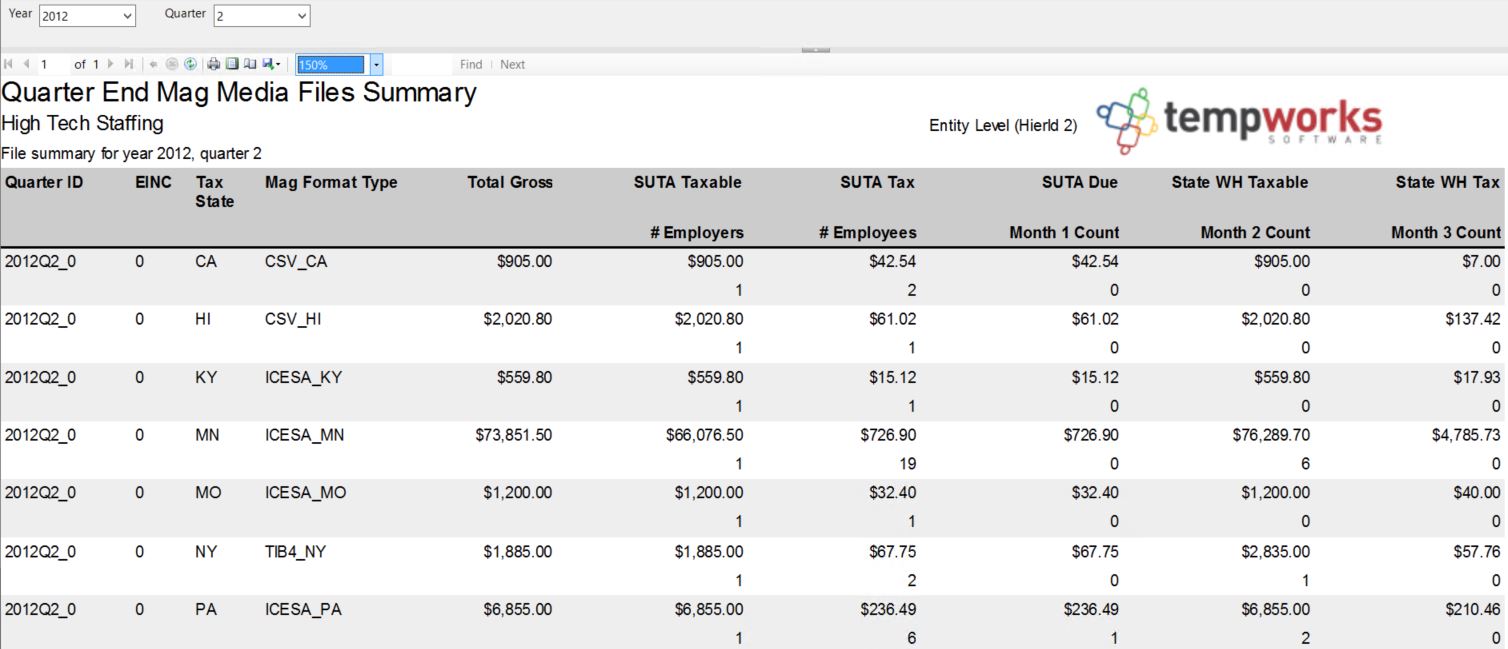

Quarter End Mag Media Files Summary

Purpose:

- This report is designed to show you, in a report layout, the information included in your quarterly mag media files that are sent to the state unemployment agencies on a quarterly basis. To export the actual files which you upload/send to the state unemployment agencies, go to the Pay/Bill area and use the Export action menu item. Select the "Taxes" category, then choose the "Quarterly Mag Media Files" procedure.

- This is a good report to balance against the Unemployment Wage Detail or the Tax Deposit reports.

Parameters:

- Year: Calendar year

- Quarter: The given Quarter within the selected year

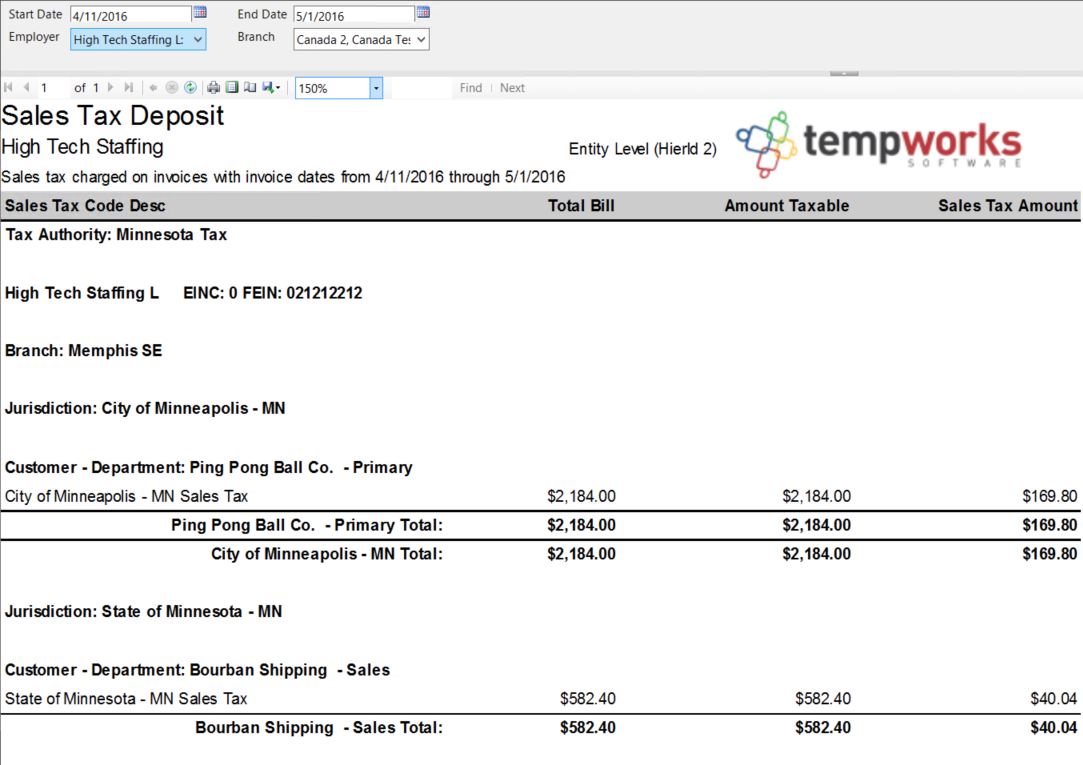

Sales Tax Deposit

Purpose:

- This report is designed for you to make your sales tax deposits to their respective tax authorities. The report can be grouped by Tax Authority, EINC, and Jurisdiction.

Parameters:

- Start Date: Starting Invoice date of your desired date range

- End Date: Ending Invoice date of your desired date range

- Employer: A drop-down list of all employers

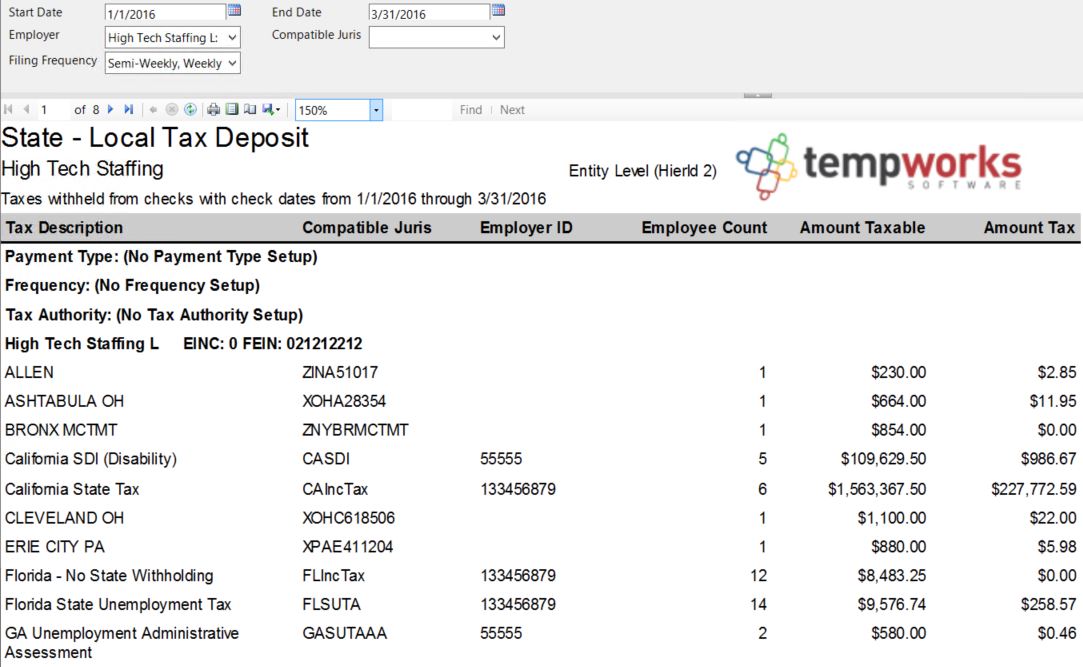

State - Local Tax Deposit

Purpose:

- This report is designed to be used to make your state and local tax deposits. It pulls the payment type, filing frequency, and tax authority from the tax management/tax pay area. If you are not using this, these will not be set up.

- The report groups data by Payment Type, Frequency, Tax Authority and EINC.

Parameters:

- Start Date: Starting Invoice date of your desired date range

- End Date: Ending Invoice date of your desired date range

- Employer: A drop down list of all employers in the user's current hierarchy. This is a multi-value parameter, you can select all employers, any one specific employer or any combination of multiple employers in the list.

- Compatible Juris: This is a drop down list of all compatable jurises. This is a multi-value parameter therefore, you can select all jurises, just one specific juris or any combination of multiple jurises from the list.

- Filing Frequency: This is a drop down list of all filing frequencies. This is a multi-value parameter therefore, you can select all filing frequencies, just one specific filing frequency or any combination of multiple filing frequencies from the list.

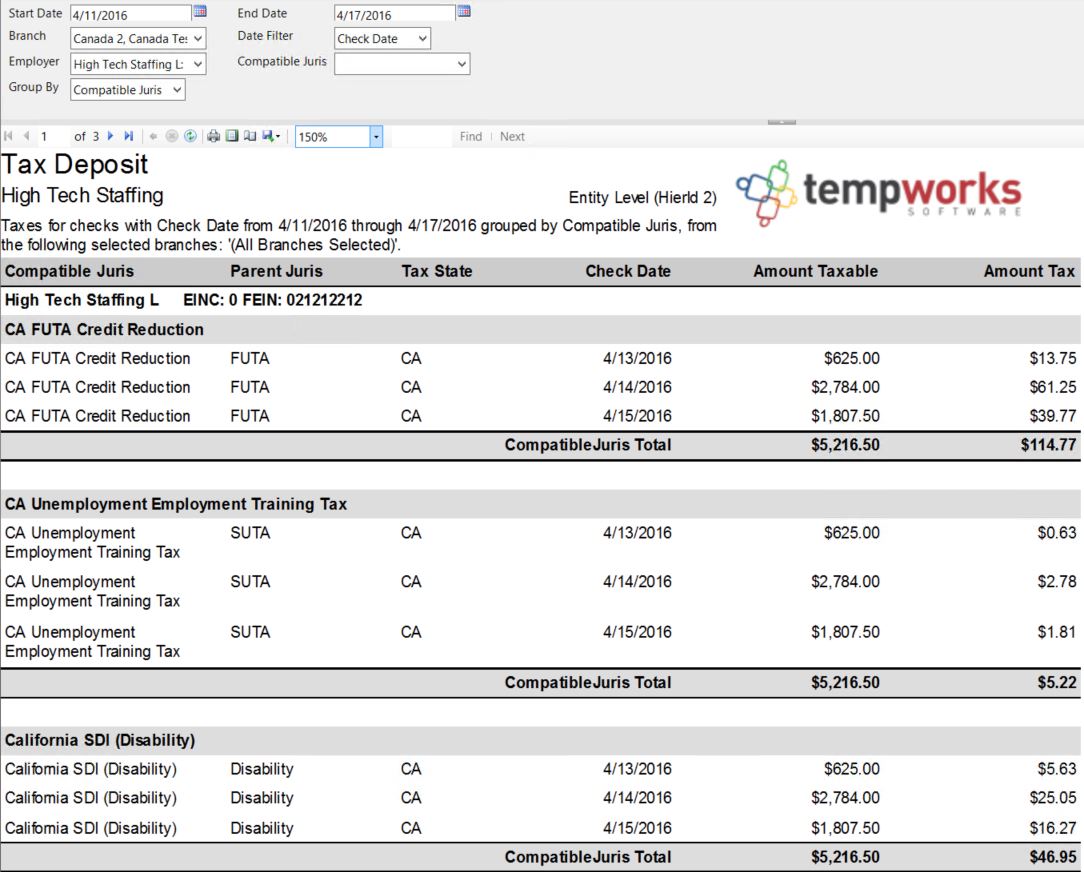

Tax Deposit

Purpose:

- This is an overarching tax deposit report that shows every tax withheld from an employee's check as well as all employer paid taxes. It is grouped by employer then grouped by the specified group by parameter. If this report is being used to file taxes it should always be run by Check Date.

Parameters:

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Filter: A drop down determining what field your date range filters on.

- Weekend Bill of the check

- Check Date of the check

- Branch: A drop down list of all branches in your current hierarchy. This is a multi-value parameter so all branches can be selected, just one branch can be selected or any combination of multiple branches can be selected from the list.

- Employer: A drop down list of all employers in your current hierarchy. This is a multi-value parameter so you can select all employers, specify just one employer or select any combination of multiple employers from the list.

- Compatible Juris: This is a drop down list of all compatible jurises. It is a multi-value parameter so you can select all compatible jurises, select just one specific juris or select any combination of multiple jurises from the list.

- Group By: This is a list of different fields by which the data can be grouped on the report. The group by can be by:

- Compatible Juris

- Parent Juris

- Tax State

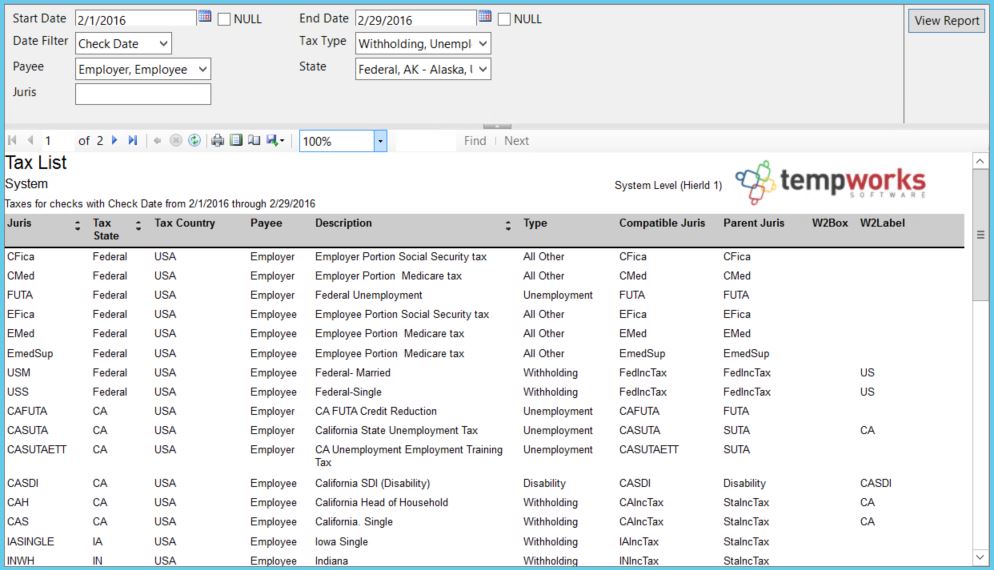

Tax List

Purpose:

- This report lists out all of the different payroll taxes that are set up in the TempWorks system. Since most of the reports in the system list only the tax “Juris” field, this report is designed to help you find more information on each individual tax beyond the “Juris” listed. This is especially useful for U.S. local taxes as the Juris code does not tell you the name of which city, school district, or county the tax is for.

- This data is also reportable by date range to help you find taxes that were processed between the entered date range. If no date range is entered, the report will list out all taxes we have setup in our system.

Parameters:

- Start Date: Starting date of your desired date range

- End Date: Ending date of your desired date range

- Date Filter: A drop down determining what field your date range filters on.

- Weekend Bill of the tax

- Check Date of the tax

- Tax Type: A drop down list of all the different types of payroll taxes in our system. This is a multi-value parameter so they can select all tax types, just one specific tax type or any combination of different tax types in the list. Has the following options:

- Withholding

- Unemployment

- Disability

- Local – City

- Local – County

- Local – School

- Worker Comp (Note: Oregon and Washington Employee Worker Comp charges are processed as a tax in our system)

- All Other

- Payee: List out the different individuals that are responsible for paying the given tax. This is a multi-value parameter so they can select all Payees or just one specific Payee. Has the following options:

- Employee

- Employer

- State: A drop down list of all the different states/provinces/regions. This is a multi-value parameter so they can select all states, just one specific state or any combination of different states in the list.

- Juris: A free text filter that allows you to enter in the specific juris you are wanting to look at or allows you to enter in the beginning portion of the juris and the report will return all juris’s that start with the entered value.

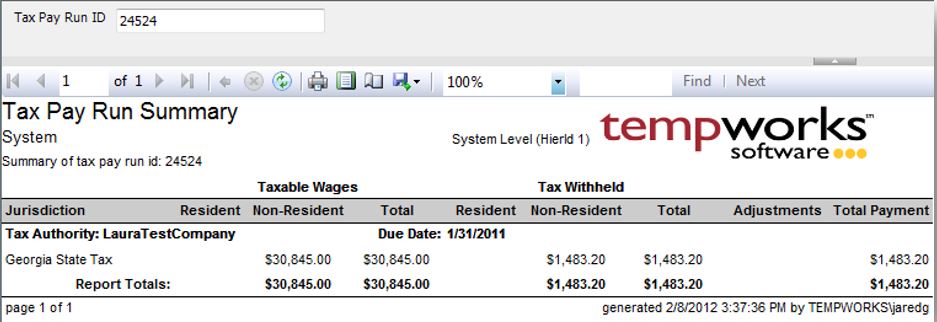

Tax Pay Run Summary

- This report is designed to assist with local taxes that are paid to the same authority. It will display the resident vs. the non-resident tax amounts to enable correct filing of taxes.

Parameters:

- Tax Pay Run ID: Tax pay run id of the given run to be viewed.

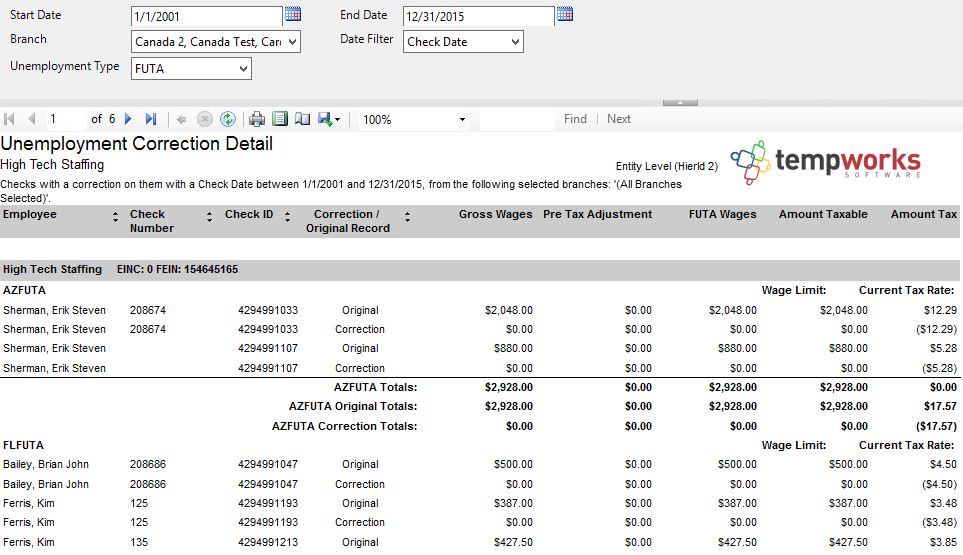

Unemployment Correction Detail

Purpose:

- This report is designed to display the detail of the corrections completed to the unemployment calculated on each paycheck. The main reason for a correction is due to a rate change in unemployment rates that is effective for the entire year and the notice is received after the 1st of the year. This report does not show all checks for a given date range, only checks that have had a correction made to them.

Parameters:

- Start Date: Starting date of the desired date range

- End Date: Ending date of the desired date range

- Date Filter: This is a dropdown to allowing the selection of what the date fields filter on:

- Weekend Bill of the check

- Check date of the check

- Branch: This is a dropdown list of all branches in the current hierarchy view. This is a multi-value parameter so all branches, only one specific branch or any combination of different branches may be selected.

- Unemployment Type: Allows the selection of State or Federal Unemployment

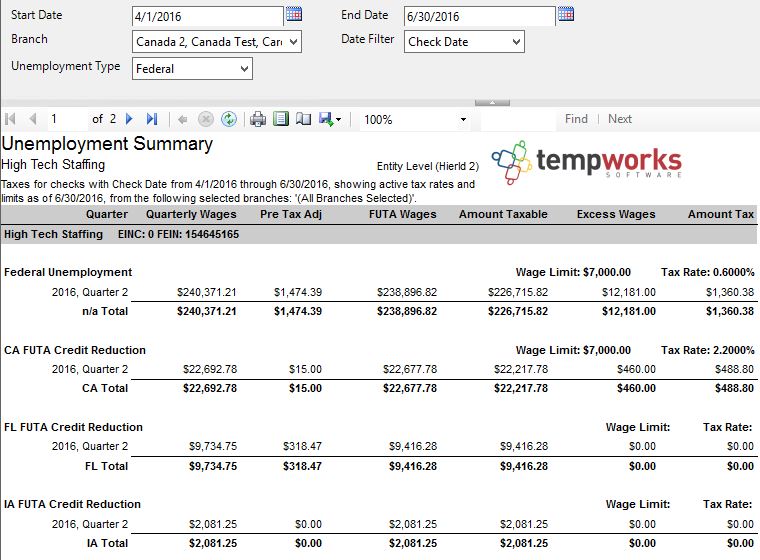

Unemployment Summary

Purpose:

- This report is designed specifically to use to file quarterly unemployment returns.

*Note* To fill out the wage detail worksheets use our Unemployment Tax report. The wage limit and tax rate are indicative of the limit and rate in TempWorks that are active as of the entered End Date parameter.

Parameters:

- Start Date: Starting date of the desired date range

- End Date: Ending date of the desired date range

- Date Filter: This is a dropdown determining what field the date range is filtering on

- Weekend Bill of the check

- Check Date of the check

- Branch: This is a dropdown list of all branches in the current hierarchy. This is a multi-value parameter so all branches, just one specific branch or any combination of different branches may be selected.

- Unemployment Type: Allows the selection of viewing State or Federal Unemployment

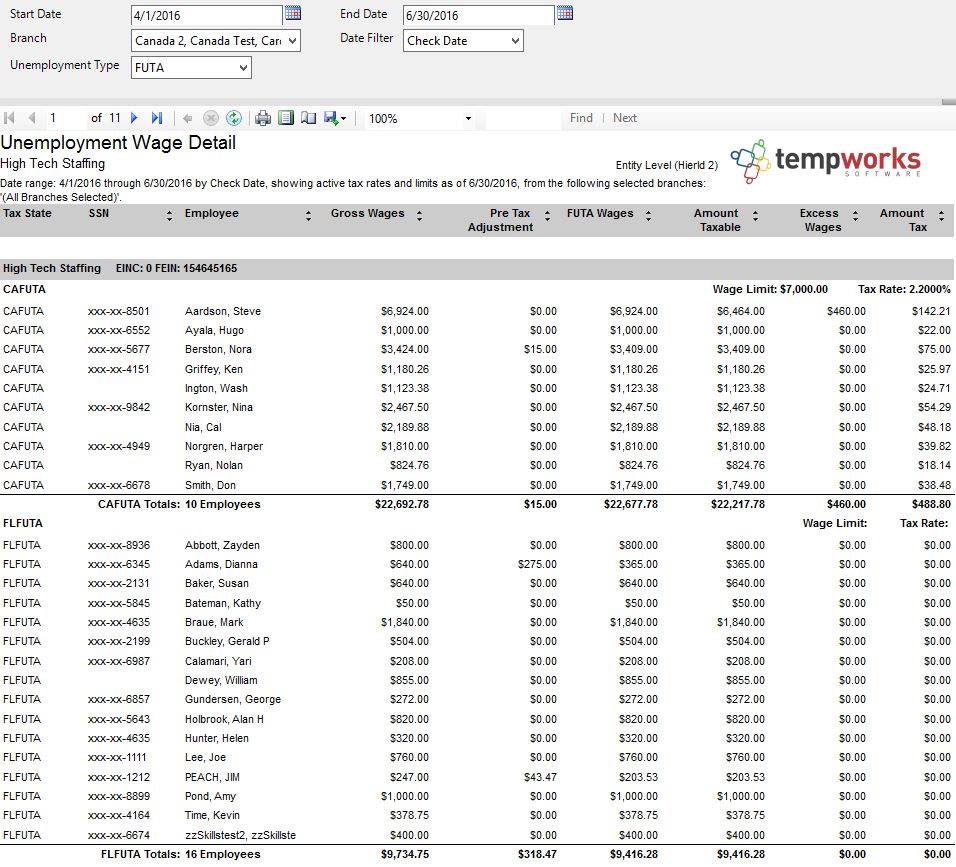

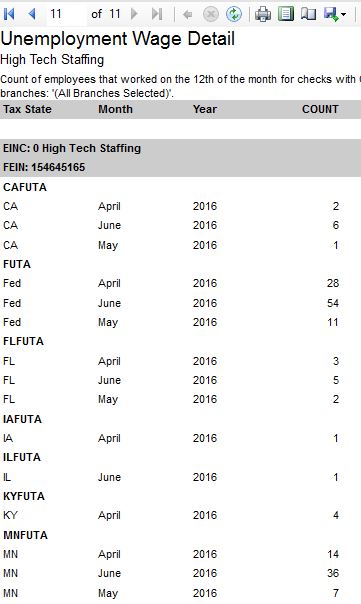

Unemployment Wage Detail

Purpose:

- This report is designed specifically to be used to fill out the wage detail portions of unemployment returns. This should be used in conjunction with the Unemployment Summary report. The wage limit and tax rates are indicative of the limits and rates that are active as of the entered End Date parameter. At the end of the report is a breakout of how many employees worked on the 12th day of the 1st, 2nd and 3rd months of the quarter. This data can also be used for completing unemployment returns.

Parameters:

- Start Date: Starting date of the desired date range

- End Date: Ending date of the desired date range

- Date Filter: This is a dropdown determining what field the date range is filtering on

- Weekend Bill of the check

- Check Date of the check

- Branch: This is a dropdown list of all branches in the current hierarchy. This is a multi-value parameter so all branches, just one specific branch or any combination of different branches may be selected.

- Unemployment Type: Allows the selection of viewing State or Federal Unemployment

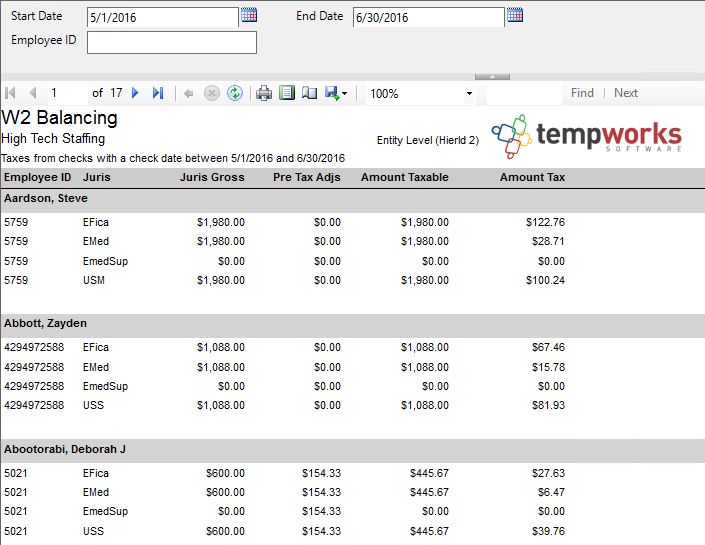

W-2 Balancing

Purpose:

- This report displays employee gross wages, pre-tax adjustments, taxable wages, and tax withheld for federal taxes.

Parameters:

- Start Date: Starting date of the desired date range

- End Date: Ending date of the desired date range

- Employee ID: ID of the employee

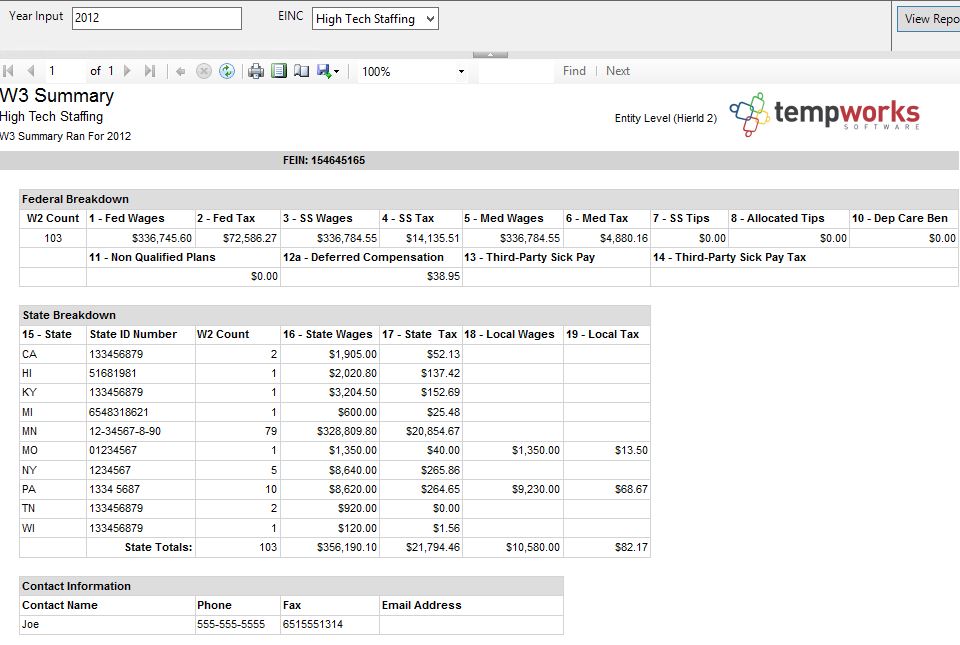

W3 Summary

- This report displays a summary of information that is used on the W3 form.

Parameters:

- EINC: This is a dropdown list of all EINCs in the current hierarchy. This is a multi-value parameter so all EINCs can be selected, just one specific EINC can be selected or any combinations of EINCs.

- Year Input: The is the calendar year

Related Articles

- None