When W-2s have already been sent out, any changes/corrections that are made and need to be reflected on an employee's W-2 will need to be generated on a W-2C. There are two reasons why you would need to generate a W-2C:

Correcting Personal Info on an Employee Profile

Sometimes employee information is incorrect on a W-2 and we need to update the employee's information. For example, the Social Security number may be incorrect or there may be a typo in the spelling of an employee's name or address.

In order to create a W-2C with the proper information, the first thing you will need to do is update the information on the employee details page of the employee's profile.

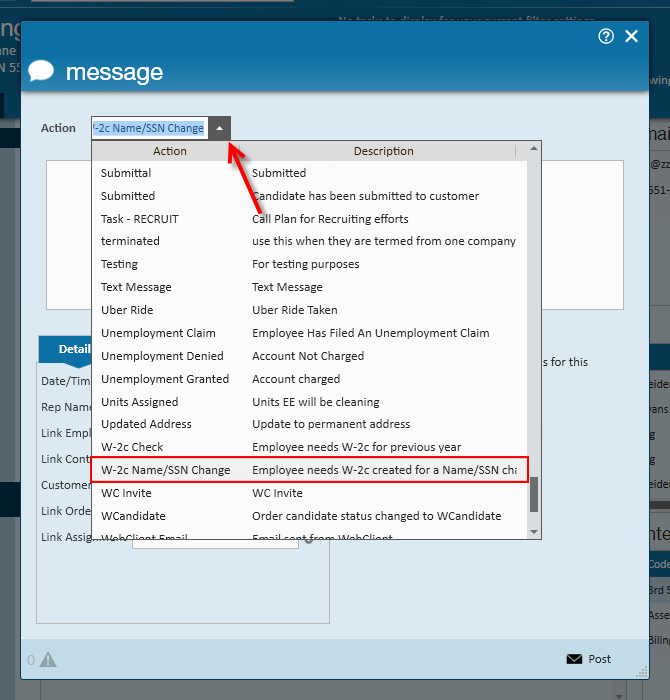

Then, you will need to log a message on the employee record to notify Enterprise that a W-2C is needed. You will need to use the Message Action Code: "W-2c Name/SSN Change":

Once this is done you will move to the Pay/Bill section of Enterprise to generate the W-2C.

Correcting Pay History on an Employee Profile

If you need to make changes to an employee's pay history from the previous year, you will need to generate a W-2C after the corrections have been made.

Corrections that would require a W-2C include, but are not limited to:

- Voiding a check from the prior year

- Reversing and recreating a check from the prior year due to under or over-payment

- Updating tax information on checks from a prior year.

Once you've made these corrections, you will see a message automatically logged on the employee's profile labeled "W-2c Check".

If the message was not automatically logged, check to make sure that your check corrections are accurate and dated for the year they were originally processed in. If the checks are dated correctly and the message did not automatically log, you can enter in the message manually, selecting the Message Action Code: "W-2c Check".

Once this is complete, please continue onto the next section of this article for generating the W-2C.

Generating the W-2C

In order to generate and print the W-2C, navigate to Pay/Bill > Other > Year End and select the year that the W-2C is needed for.

Once within the year end worksheet, navigate to Step 4 and select to Print W-2C's.

*Note* If you are still in the Year End process, and the W-2's have been generated, but have not been printed or sent out yet, please select 'Cancel' and contact the Tempworks Support Year End Team for assistance with W-2 corrections.

The following window will pop up, notifying you that once you create W-2C's, modifications to W-2's cannot be made. Generally, when you are at this stage, W-2's have already been sent out, so you will not need to modify W-2's. Since you will be sending a W-2C when corrections are made, you can check the box and select 'OK'.

Once you select 'OK', the window will bring up a list of groupings and filters you can use for printing.

*Note* While you can print W-2C's in bulk, it is best to print W-2C's individually by entering the employee's Social Security number in the filter.

After you have selected your filters, you can select 'Print.'

A PDF file of the W-2C will pop up on your screen that you can then save as a digital file, or print to give to your employee.

*Note* If an error is received during printing, the error will provide the fields that are not allowing the printing.