What is a Federal Levy?

According to the IRS:

A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens. A lien is a legal claim against property to secure payment of the tax debt, while a levy actually takes the property to satisfy the tax debt.

Check out the IRS page on Levies.

If you receive a Levy notice for an employee, you will need to set up an adjustment on the employee's record to adjust their pay for the levy.

*Note* The TempWorks default levy rates calculate based on 52 pay periods for the year.

If you require a different frequency, please contact TempWorks Support.

How to Add a Federal Levy Adjustment

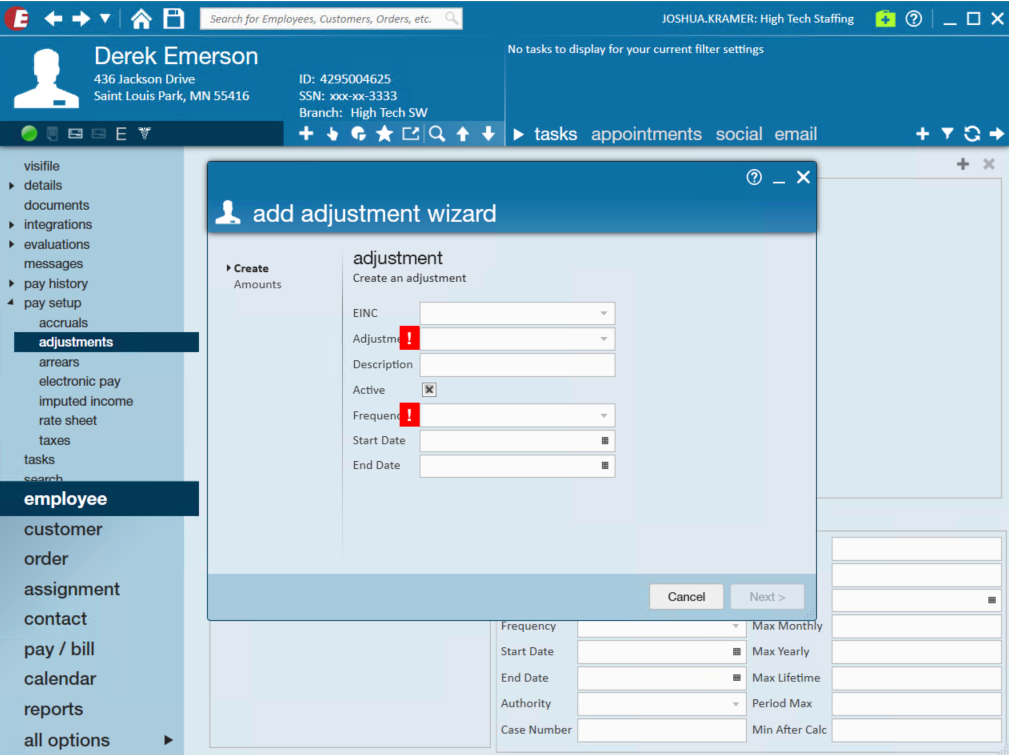

Begin by finding the employee's record you need to add the Levy for.

- On the employee's record navigate to Pay Setup > Adjustments

- Select the + to add a new adjustment

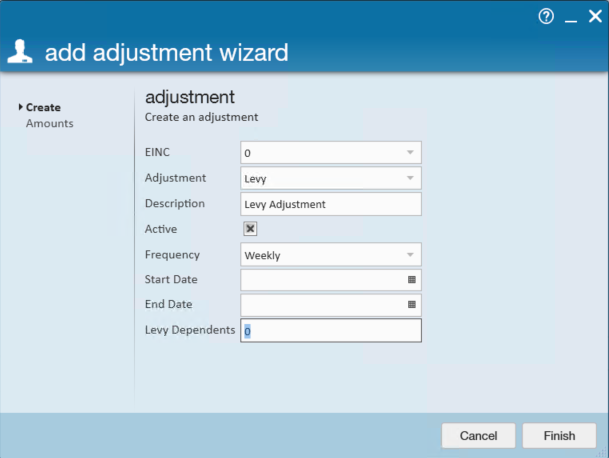

- Enter the following information:

- EINC: If the employee is only going to be located within a specific EINC, that can be entered here. This field can be left blank in order for the adjustment to apply to all EINC's that the employee may be a member of.

- Adjustment: Levy (If you do not see the levy adjustment type, your admin should be able to add it for you. See How to Set Up Adjustments in Administration)

- Description: This is an optional text field to place a specific description as to why the adjustment is for the employee.

- Frequency: This should match the pay frequency of the employee.

- Start Date: Optionally, if the notice includes a date that the levy should start being applied you can enter it as the start date. If no start date is entered, then the system will start taking the levy out immediately.

- End Date: If this adjustment is to have a specified end date, you may enter it here.

- Levy Dependents: The number of dependents is used to calculate the amount when the adjustment is a Levy.

- Select Finish

*Note* Once the adjustment is made, you will need to update the following fields in the lower right corner:

- Sequence

- Max Lifetime

- Case Number & Authority

See below for more information

Sequence

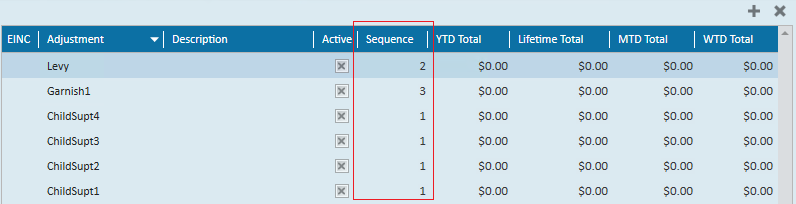

When an employee has multiple adjustments setup on their record, how does Enterprise know which adjustment to garnish first and which to garnish last? Sequence! The sequence determines the priority of an employee's adjustments.

For example, the image below shows an employee that has multiple child support adjustments added in addition to a levy. Since each child support garnishment is equally important (has equal priority), they are all given the sequence of 1. When the employee is paid, Enterprise will look at the employee's wages and as equitably as possible distribute the earnings among the adjustments.

After sequence 1 adjustments are calculated if the employee has garnishable wages remaining, Enterprise will then move on to any adjustments with a sequence of 2 (the levy in this example). This process will continue automatically until either the employee has no garnishable wages left or all adjustments have been fulfilled.

Max Lifetime

The levy you receive will list a total owed amount by the Employee. Enter that amount as the lifetime max and Enterprise will automatically calculate and track amounts (week to date, month to date, year to date, and lifetime totals) paid by the Employee.

Once the levy amount (max lifetime) has been paid, the adjustment will automatically deactivate and the employee's wages will no longer be garnished.

*Note* this field is required if you want Enterprise to deactivate the adjustment once the levy amount has been paid in full

Case Number & Authority

If you are printing authority checks or ACH files in Enterprise, you will need to include the authority on the adjustment. Levies typically come from the IRS. Check out How to Add Authorities to learn more about authority setup.

For your records, we recommend keeping track of a Levy case number under the case number section on the adjustment. This helps for reporting and record keeping purposes. You can also scan a copy of the notice and attach it to the employee's record under documents to keep it on file.