Welcome to February! This release brings the addition of the WOTC Eligibility charm in Beyond along with additional fixes and improvements across TempWorks products.

*Note* For all self-hosted clients, as always, ensure you install all updates to give your users the best experience and new features.

The Highlights

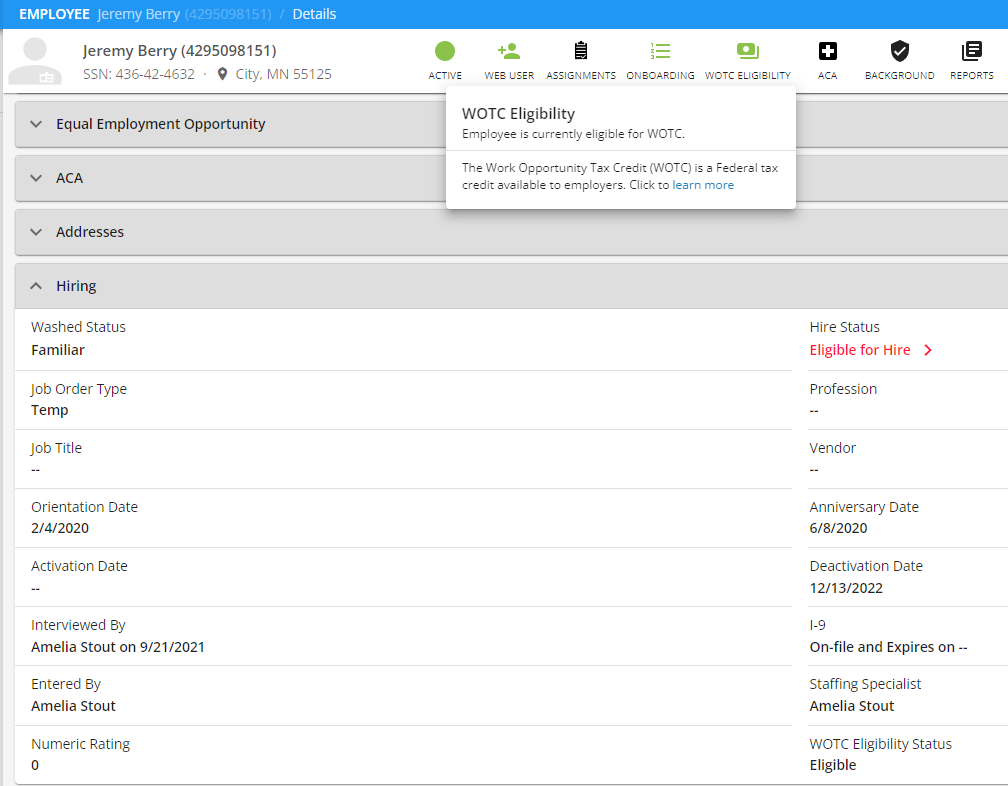

Beyond - WOTC Charm

|

Additional Updates

In Beyond

- Fixed an issue preventing messages from loading.

- Fixed an issue preventing PO Numbers from filtering as intended.

- Fixed an issue preventing employee saved searches from being editable.

- Fixed an error that would occur when attempting to edit Custom Data fields.

- Fixed an issue where the “Default Job Description“ warning would appear when no job title was selected in the event the customer record has a default job description set up.

In HRCenter

- Updated the Georgia W-4 based on the requirements from the state of Georgia.

- Updated the Maine W-4 based on the requirements from the state of Maine.

- Updated the Minnesota W-4 based on the requirements from the state of Minnesota.

- Updated the Montana W-4 based on the requirements from the state of Montana.

In Reports

- Updated the Unemployment Correction Detail report to show all correction run types.

Tax Updates:

- For Maryland, completed withholding changes based on the requirements from the state of Maryland.

- For Massachusetts, completed withholding changes based on the requirements from the state of Massachusetts.

- For North Dakota, updated tax tiers based on the requirements from the state of North Dakota.

Congratulations! You've made it to the end of the release notes. Like what you read? Click the thumbs up below.

Related Articles

- None