Setting up Pay for Employees

In order for employees to receive pay for their work, their Pay Setup needs to be completed. To complete this in Beyond™, see the steps below accessible from the Pay Setup tab in Beyond. The Payment Options and Basic Tax Setup cards allow payment delivery option designations, electronic pay setup and basic tax setup.

This Article Covers:

Payment Options

Begin by navigating to the employee's record and selecting the Pay Setup tab.

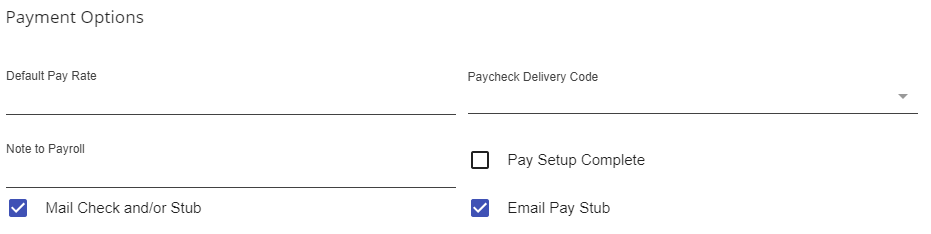

The Payment Options can be edited by selecting the pencil icon in the top right of the card.

- An employee record can have a designated default pay rate entered for all assignments.

- Paycheck Delivery Codes can be entered to establish the employee will be picking up their paychecks at a specific branch.

- Internal notes can be entered for Payroll communication.

- Mail Check or Email Pay Stub check boxes can be selected for employee payment preferences also.

- The Pay Setup Complete check box will be automatically checked once payment process is complete.

*Note* Ensure the employee has a valid email address to set up the Electronic Pay Stub option successfully.

Electronic Pay Setup

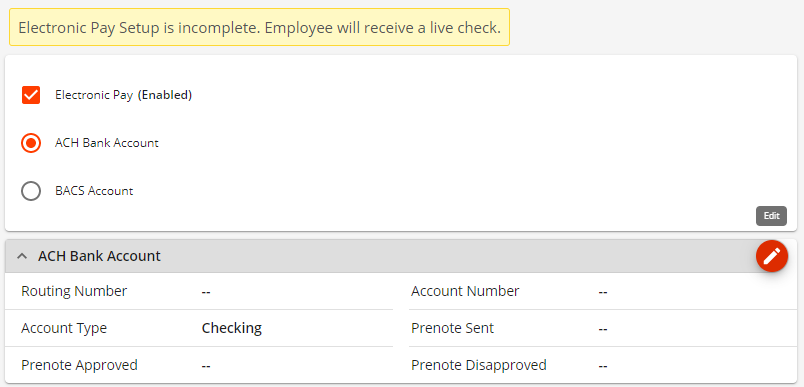

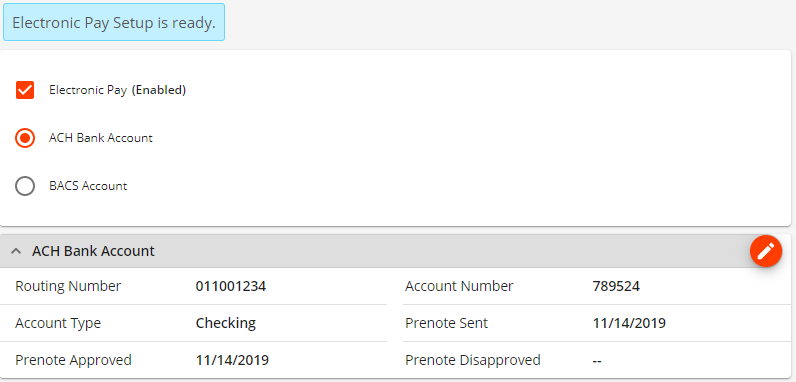

If an employee would like their pay automatically deposited into their bank accounts every pay period, or they are allowed to sign up for paycards, their bank/paycard information needs to be entered and saved into their employee record. To setup, follow the steps below:

- Select the Electronic Pay option from the Pay Setup drop down menu tab .

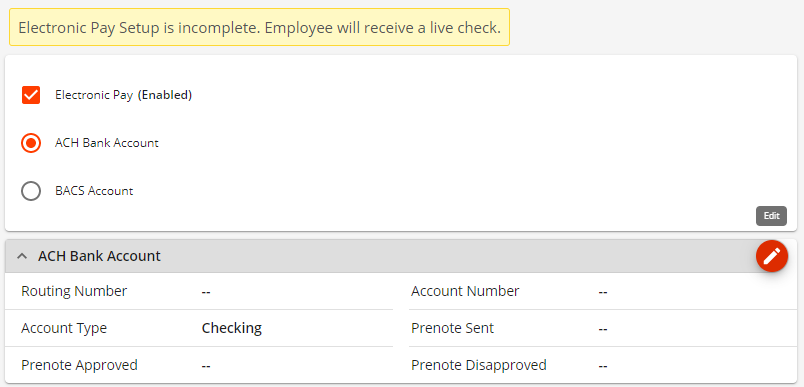

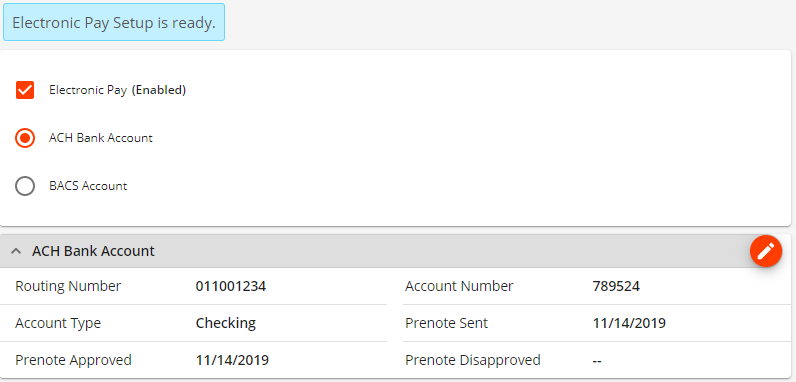

- In the Electronic Pay card, check the Electronic Pay (Enabled) box. Choose either ACH Bank Account or BACS Account.

- From the Edit pencil icon, enter the Routing Number, Account Number and Account Type.

- Once the information is entered and the Pre-note process approved (if applicable), an alert box indicates the Electronic Pay Setup is ready.

- The dollar sign charm also indicates the Direct Deposit status.

Basic Tax Setup

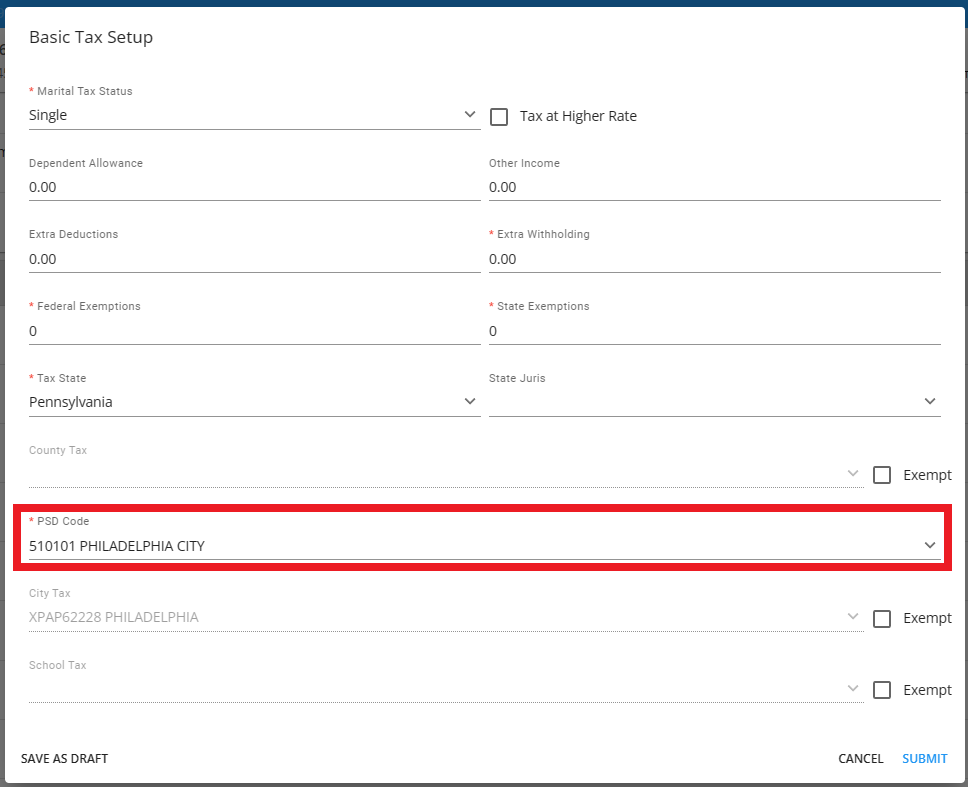

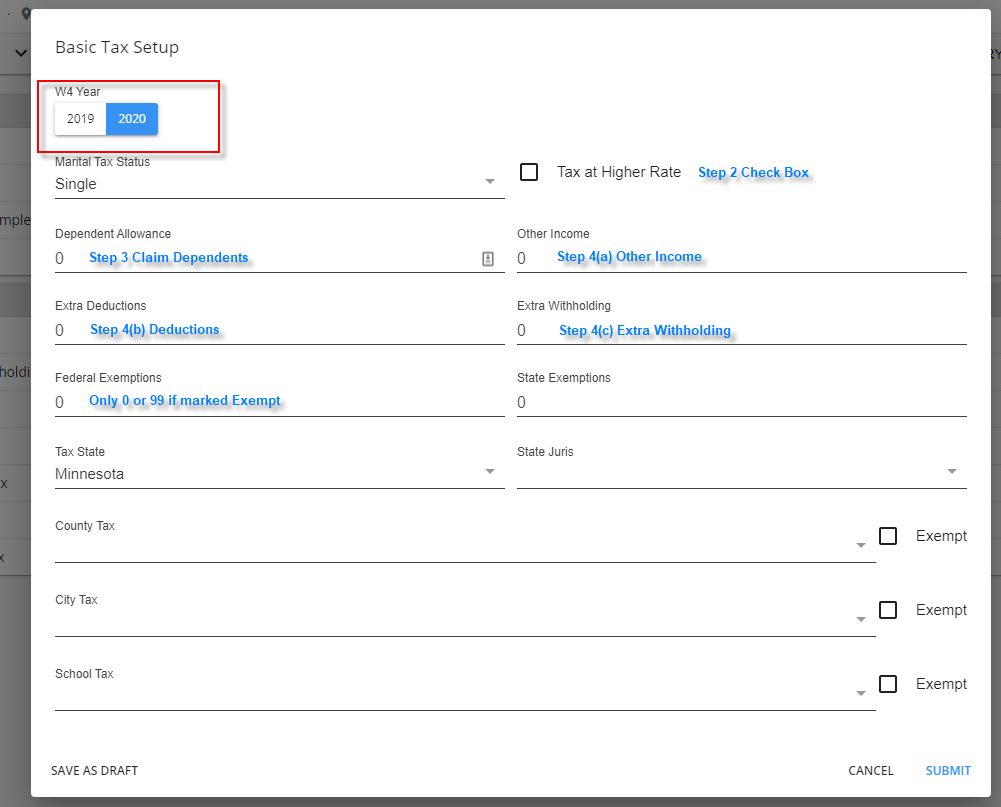

To indicate Federal or State exemptions and other tax related information, edit the Basic Tax Setup card from the pencil icon to make appropriate selections.

*Note* For employees with a Tax State of PA, a PSD Code will need to be selected within Employee > Pay Setup > Basic Tax Setup:

The PSD Code will need to be selected within the "PSD Code" field found via Employee > Pay Setup > Basic Tax Setup > PSD Code:

Once a PSD Code is selected, the County Tax, City Tax, and School District Tax fields will not be able to be edited:

If your employee worked for you before the 2020 W-4 changes, you will be able to toggle the W-4 year option.

Here is a break down the basic tax setup based on the 2020 W-4:

*Note* The "Tax at Higher Rate" option can be used for employees who...

- Work more than one job at a time and/or

- Are married-filing jointly and have a spouse who also works

It can be beneficial to tax at a higher rate to accommodate the multiple W-2s you may be filing at the end of the year. Always consult a tax professional if you are unsure about a tax setup.

If your employee's are filling out their W-4s (federal and state - if applicable) via HRCenter, this information will automatically be populated.

*Note* The Dependents field is only applicable to those in Louisiana due to their state tax exemptions.