Welcome to Enterprise™ for Payroll!

TempWorks® Enterprise system is the heart of our software. It includes a full front and back office functionality and integrates seamlessly with our other software as well as with 3rd party integrations. This guide is here to provide a road map for back office payroll clerks to help them understand the full functionality of Enterprise.

When we talk about payroll processors, we mean anyone who is involved in the process of paying an employee their wages. This can include:

New to Enterprise?

If you are brand new to our software, we recommend you start by checking out our TempWorks University Videos. These videos are designed to give you an overview of our system and walk you through some of the basic functionality. For Payroll Processors, we recommend the following sections:

- Enterprise 101 - provides an overview of important information including how to navigate and what is hierarchy

- Pay/Bill 101- provides an overview of basic payroll related functionality

There are many videos under these topics that you can watch. We recommend watching just a few videos at a time and following along with the quizzes and workbooks provided.

*Note* If you are looking for more training, we offer weekly webinars that you (or your admin) can find and sign up for via Bridge.

The following sections of this guide provide links to articles to learn about different functionality. These sections are separated by topic and are organized to help you navigate from basic functionality to some of our more advanced options all with the payroll processor responsibilities in mind.

Employee Pay Setup

What is an Employee Record?

The Employee section of Enterprise includes all applicants, current & past employees. These records contain information such as current employment status, compliance documents, past jobs, direct deposit, tax information and more.

Check out the following links to learn more about the employee pay options:

Pay Setup Basics

Start with the following articles to gather more fundamental knowledge related to employee pay:

- Video: Payroll Part 1: The Basics of Employee Setup

- Enterprise - Employee Searching

- Enterprise - How to Manage Employee Taxes

- Enterprise - How to Enroll Employees in Direct Deposit

- Enterprise - How to Set up Employee Adjustments

- Enterprise - How to Set up Child Support Garnishments

- Enterprise - How to Email Pay Stubs

Additional Pay Setup Options

Once you have a grasp on the basics, here are a few additional options related to Pay Setup:

- Pay-card Provider Integrations

- Enterprise - How to Set up a Federal Levy Garnishment

- Enterprise - How to Set up Benefit Adjustments for Employees and Employers

- Enterprise - How to Set up a Secondary Direct Deposit

- Enterprise - How to Manage Arrears

- Enterprise - How to Setup and Manage Accruals

Pay Setup Process Questions to Consider

Download this file as a PDF (click the PDF icon at the top) and take notes or discuss these questions with your team:

| Question | Answer |

|---|---|

| Will you have your employees fill out W-4 information via HRCenter or will you manually be entering tax information? | |

| Will you have your employees fill out direct deposit information via HRCenter or who will manually enter this information? | |

| Will you allow your temporary employees to sign up for secondary direct deposit and who will enter this information? | |

| Who will be entering Child Support Garnishments/Levies, etc. in the system? | |

| Will you be offering the option for employees to receive their paychecks via email? What email address will this come from? | |

| Are you offering/tracking sick time/pto/vacation time for internal or temporary employees? Are there different accrual packages in different areas? Are some of these options location based? | |

| Are you using any TempWorks Paycard Integrations? |

Time Entry & Proofing

Check out the following links to learn more about the entering time and reviewing it:

Time Entry & Proofing Basics

Start with the following basic options for entering time and reviewing it:

- Video: Time Entry Part 1: The Basics

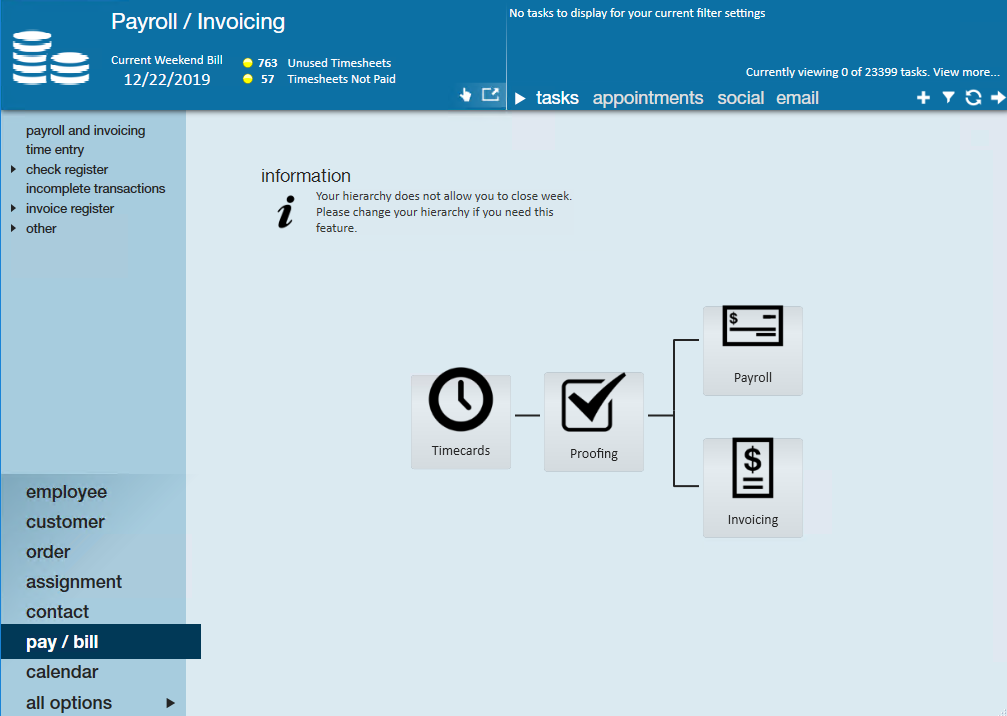

- Enterprise - Pay/Bill Overview

- Enterprise - Time Entry Tricks

- Enterprise - How to Duplicate Timecards

- Enterprise - Proofing Time Entry Sessions

- Enterprise - Proofing Errors, Their Meanings, and How To Fix

Additional Time Entry Scenarios and Tools:

Check out the following articles for more advanced time entering options:

- Enterprise - Documenting Cash Tips

- Enterprise - Gross Up Calculator

- Enterprise - How to Enter Late Time

- Enterprise - How to Import Timecards

- Enterprise - How to Process Bi-Weekly Payroll

- Enterprise - How to Pay Salaried Employees

- Enterprise - Marking Transactions as Not Payable or Not Billable

- Enterprise - Unit Pay Transactions

- Enterprise - One-Time Adjustments and Overrides

Time Entry & Proofing Process Questions to Consider

Download this file as a PDF (click the PDF icon at the top of this article) and take notes or discuss these questions with your team:

| Question | Answer |

|---|---|

| What Paycodes will your team using? (reg, bonus, holiday, etc.) | |

| What types of one-time adjustments might you need to enter? | |

| Do you enter in hours by day or total hours for the week? | |

| Are there instances where you should enter units instead of hours? | |

| Will you be paying anyone bi-weekly, using the salaried options, or just weekly pay? | |

| When might you create a pay only or bill only transaction? |

Cutting Checks and Pulling ACH Files

Check out the following links to learn more about payroll processing options:

Payroll Basics

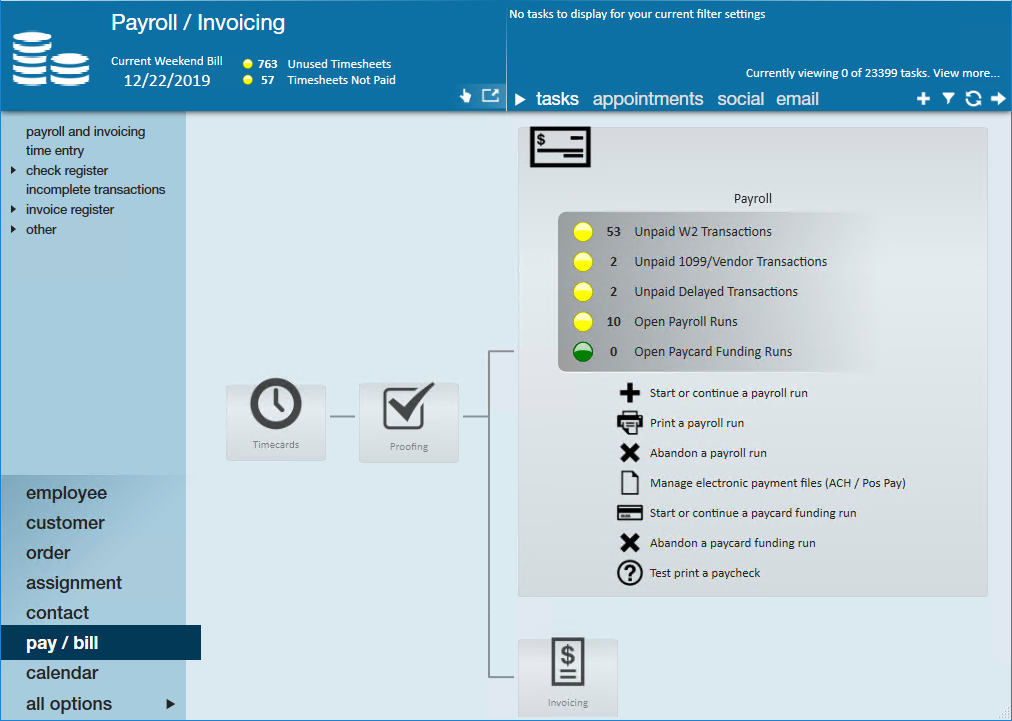

Use the following links to learn more about Payroll Runs

- Video: The Payroll Wizard

- Enterprise - Payroll Errors, Their Meanings, and How To Fix

- Enterprise - How to Create ACH and Positive Pay Files

- Commonly Asked Questions - Payroll

- Understanding Your Paycheck/Paystub

- Closing the Week

Payroll Advanced Topics

Check out the following additional payroll topics to consider:

- Enterprise - How to Complete Authority Check Runs

- Enterprise - How to Email Pay Stubs

- Enterprise - How to Reissue Checks

- Enterprise - How to Reprint a Paycheck or Payroll Run

- Enterprise - How to Void and/or Reverse Checks

Topic Process Questions to Consider

Download this file as a PDF (click the PDF icon at the top of this article) and take notes or discuss these questions with your team:

| Question | Answer |

|---|---|

| What is your default check date? | |

| What is the default Bank ID you should use for payroll? | |

| Are you processing only e-pay, live checks, or both? | |

| Are you emailing check stubs? If yes, what email will you use? | |

| Do you print pay stubs? | |

| How should your checks be sorted? | |

| What payroll reports should be run during or after the payroll process? |