When it comes to Affordable Care Act fines and penalties, guesswork can be risky business! Our ACA tool will take the guesswork out of the equation, keeping you in compliance no matter what happens in Washington. It’s flexible enough to adapt to changing regulations in a timely manner.

View the Affordable Care Act webinar: ACA - The Affordable Care Act Webinar

Employee Adjustments

As part of the ACA insurance regulations, an employee can only be required to pay a certain percentage of their gross pay for their portion of the contribution to the insurance costs.

*Note - At the time of the writing of this documentation that percentage is 9.5%.

TempWorks has the ability to setup the employee adjustments and associate them with a corresponding employer adjustment. The system will use the insurance premium amount, the maximum percentage allowed for employee contribution and calculate the remainder as the employer contribution.

Insurance Premium - (Employee Gross Pay * Adjustment %) = Employer Contribution

Setting Up Employer Contribution Adjustments

The first step in setting up your ACA insurance adjustments is to setup your employer contribution adjustments.

To set up the adjustment, click on all options/administration then in the menu on the left, click on adjustments.

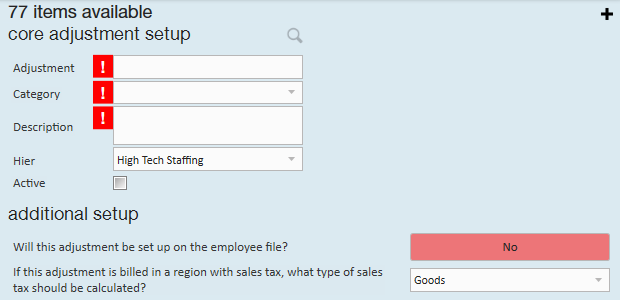

Click the plus sign on the right side of the window.

The following window will display:

Core Adjustment Set Up

Complete the information in the following fields:

- Adjustment - Enter up to 10 characters to identify the adjustment.

- Category - Select the correct adjustment category from the list. For employer portion adjustments you will need to select an adjustment category that is setup in your system as a benefit. They system will alert you when you save the adjustment if you have select employer portion for the adjustment but did not select a category that is set up as a benefit.

- *Note - If you obtained new medical insurance for ACA compliance you may need to have an applicable category added to the adjustments category list.

- Description - Enter in a detailed description for the adjustment. You may enter up to 150 characters.

- Hier - Select the appropriate hierarchy for the adjustment. Because the adjustments honor the hierarchy, you are able to set up adjustments in a way that will prohibit adjustments from being set up for employees in areas of your hierarchy that do not have that particular adjustment available to them. Example: All of your employees are under one health insurance provider except your employee who work for your New Mexico branch. You may set up a different adjustment specific to the New Mexico health insurance provider and associate that adjustment to the New Mexico branch in your hierarchy.

- Active - Check the Active box to make the adjustment active in the system. If you need to deactivate the adjustment at a later date you may deselect the checkbox.

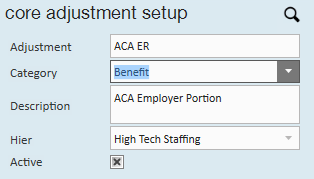

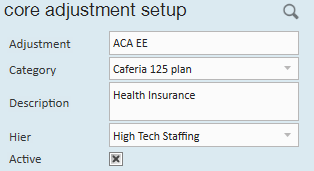

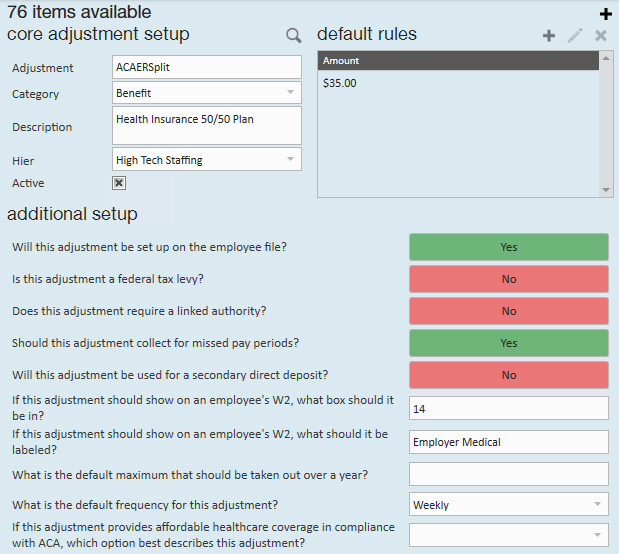

Following is an example of the setup for an employer portion medical adjustment for the core adjustment section of the window:

Additional Set Up

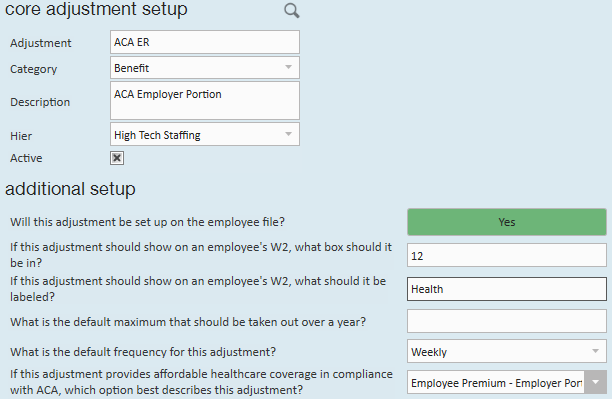

After you select the active checkbox, you will need to complete the additional setup section of the window.

The first field in the additional setup section is will this adjustment be setup on the employee file? Click to display Yes in the answer field.

After selecting Yes, additional fields will display:

Go to the last field labeled if this adjustment provides affordable healthcare coverage in compliance with ACA, which option best describes this adjustment. Select employee premium, employer portion.

After selecting this option many fields will be removed.

Complete the remainder of the fields based on which box on the W2 you would like the adjustment to show in and what W2 label you would like.

In the what is the default frequency for this adjustment field select from the dropdown field menu options.

Click the save button in the upper left: ![]() .

.

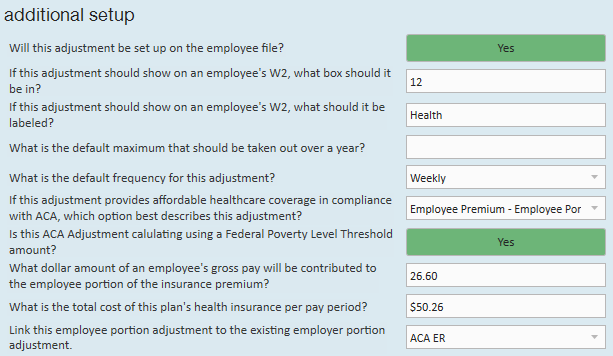

In the example below, the adjustment is an employer portion adjustment for employees who are paid weekly and their insurance will be deducted with each weekly paycheck.

Setting Up Employee Contribution Adjustments

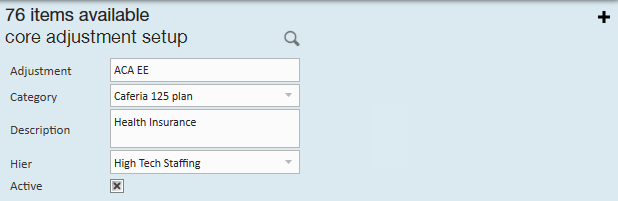

The second step in setting up your ACA insurance adjustments is to setup your employee contribution adjustments.

To set up the employee contribution adjustment click on all options/administration then in the menu to the left click on adjustments.

Click the plus sign on the right to add the employee contribution.

The following window will display:

Core Adjustment Set Up

Complete the information in the following fields:

- Adjustment - Enter up to 10 characters to identify the adjustment.

- Category - Select the correct adjustment category from the list. If you obtained new medical insurance for ACA compliance, you may need to have an applicable category added to the adjustment category list.

- Description - Enter a detailed description for the Adjustment. You may enter up to 150 characters.

- Hier - Select the appropriate hierarchy for the Adjustment. Because the Adjustments honor the hierarchy, you are able to set up Adjustments in a way that will prohibit Adjustments from being setup for employees in areas of your hierarchy that do not have that particular Adjustment available to them. Example: All of your employees are under one health insurance provider except your employee who work for your New Mexico branch. You may set up a different Adjustment specific to the New Mexico health insurance provider and associate that Adjustment to the New Mexico branch in your hierarchy.

- Active - Check the Active box to make the adjustment active in the system. If you need to deactivate the adjustment at a later date you may deselect the checkbox at that time.

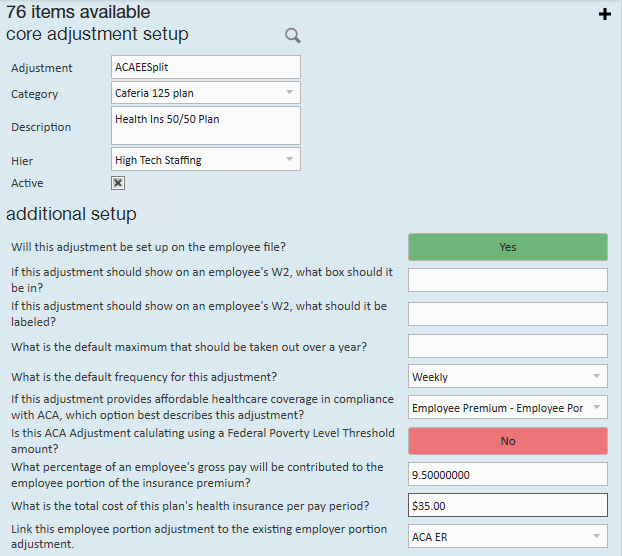

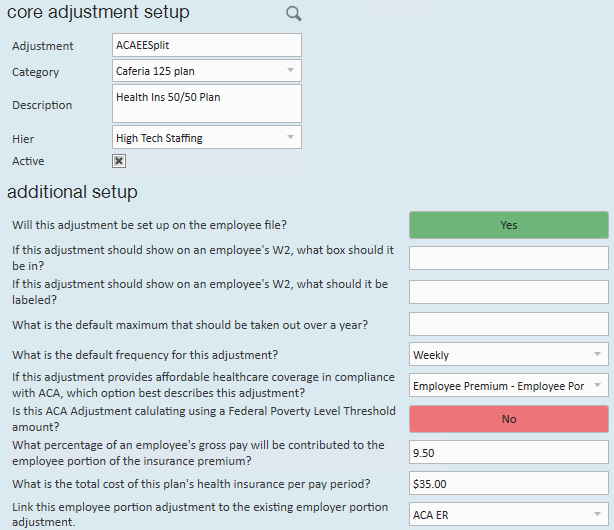

Following is an example of the setup for an employee portion medical adjustment for the core adjustment section of the window:

After you select the active checkbox, you will need to complete the additional setup section of the window.

Additional Set Up

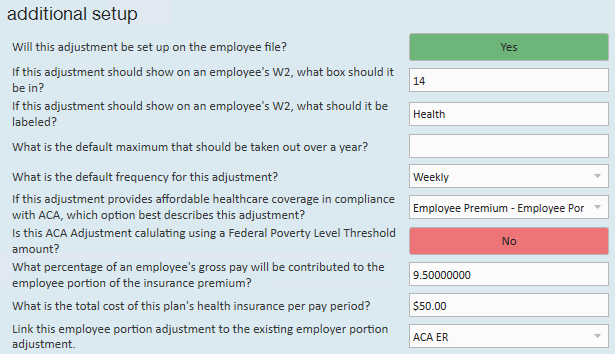

The first field in the additional setup section is will this adjustment be set up on the employee file? After selecting yes, additional fields will display.

Go to the last field labeled If this adjustment provides affordable healthcare coverage in compliance with ACA, which option best describes this adjustment? Select employee premium, employee portion from the dropdown.

After selecting this option some fields will be removed and some will be added:

Enter in the W2 box and label information.

If there is a default yearly maximum for the adjustment enter that amount in the what is the default maximum that should be taken out over a year field.

In the what is the default frequency for this adjustment field, select the appropriate frequency for the adjustment.

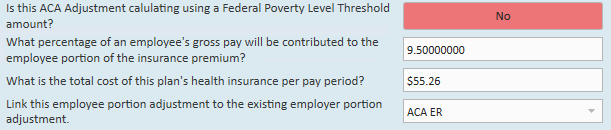

Is this ACA adjustment calculated using a federal poverty level threshold amount?

If yes, you will prompted for the flat amount which has been calculated.

If no, you will be prompted for the percentage, which, at the time of this writing is 9.5%:

In the what percentage of an employee's gross pay will be contributed... OR what dollar amount of an employee's gross pay will be contributed... field, enter the percentage or rate. For the percentage calculation, at the time of the writing of this documentation, the maximum allowable deduction is 9.5% of gross pay. The dollar amount, if using the federal poverty level threshold, needs to be calculated for the pay period amount.

In the what is the total cost of this plan's health insurance per pay period field, enter a dollar amount based on your per employee insurance premiums. For example, if you are setting up an adjustment for weekly pay frequency you will enter the weekly insurance cost. If you pay weekly but your insurance premiums are quoted to you by your insurance company as a monthly premium, consult with your insurance provider for the weekly amounts to be deducted. Depending on the insurance provider, your premiums may be based on calendar month or may be based on a 4 week increment.

In the link this employee portion adjustment to the existing employer portion adjustment field select the corresponding employer portion you previously set up.

When done, click the save button in the upper left.

In the example below the adjustment is an employee portion adjustment for employees who are paid weekly and their insurance will be deducted with each weekly paycheck.

Based on the setup examples above, when the employee ACA adjustment is setup on an employee, TempWorks will look at the employees' gross pay, and deduct the $50 weekly insurance premium from their pay. If however the employees earnings are low enough where $50 represents more than 9.5% of their gross pay, the system will deduct 9.5% of their gross pay for the employee portion of the insurance premium and the remainder of the $50 insurance premium will be placed under the Employer ACA adjustment.

Tip: An ACA report is available which will allow you to report on the ACA employer portion contributions. This report can be found in the reports sections of TempWorks titled ACA Employee Adjustments.

*Note - If your insurance provider has different premiums for different groups of employees (by age, different levels of plan, etc) you can either setup one adjustment for the insurance and then adjust the rates on a per employee basis, or you can set up one adjustment for each group of employee/premium combinations.

*Note - At the time of the writing of this document, the ACA regulations require that insurance be offered to employee dependents 25 years of age and younger. However, the employer does not need to contribute to the insurance premium regardless of the cost to the employee vs. their gross pay. You may also, as an employer, offer insurance to employee spouses but it is not required. For both cases you will want to have a separate adjustment code set up for dependent/spousal insurance. For the dependent/spousal adjustment code you will not associate it with an employer portion adjustment and therefore you will not incur any employer cost for this insurance offering.

*Note - if you are using a general ledger feed from TempWorks, you may need to adjust your general ledger account mapping to accommodate the new adjustments you are setting up for ACA insurance.

*Note - Additional adjustment scenario: If you are calculating a premium split but you still need to not deduct an amount over the 9.5% from the employee's gross wages.

For instance: The total of the premium per week may be $70.00 You may want to share the cost with the employee where you each contribute $35.00. In this scenario, the employee would be responsible for $35.00. You would pay the additional $35.00. However, if the $35.00 employee portion is greater than the 9.5% maximum limit of the gross for the employee for a given week, the employee would be responsible for less than $35.00.

Example:

Employee earns $9.00/40hours = $360.00

9.5% of employee gross wages = $34.20

In this case the employee cannot be asked to contribute the additional $.80

To handle this you will set up the employee adjustment and link it to the employer benefit adjustment as usual.

Using the example above, when setting up the employee adjustment, you will identify it as an ACA employee adjustment with a maximum of 9.5% with the total cost to the employee of $35.00 and should be linked to the employer benefit adjustment.

This combination will track the employee's responsibility and, if the dollar amount exceeds the 9.5%, it will track the overage which you will need to pick up because this adjustment it is linked to the employer ACA benefit adjustment.

***An additional benefit adjustment must be set up and added to the employee's record to track the employer's original benefit responsibility. This adjustment should NOT be linked to the ACA employer adjustment.

*** When setting up the ACA insurance adjustment on the employee's record, the employee's portion and the additional benefit adjustment must both be set.

Setting Up the Employee for Insurance Adjustments

To code employees for ACA; access an employee record. From the employee's navigational tree select pay setup.

The Affordable Care Act section is in the lower right corner of the window.

Please see the Affordable Care Act Employee Set Up Article for details on setting up the Employee for their specific ACA stats.

During the process of employee ACA coding, you are given the opportunity to choose the insurance status. This status can be changed as the employee is moved through the insurance enrollment process. For example; the employee may be offered the insurance but immediately upon that offer they neither accept nor decline the insurance and are given a period time to make a decision. In this scenario the employee's ACA insurance status would be set to offered with an offered date recorded.

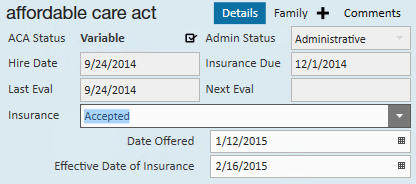

At the point the employee makes a decision to accept the insurance, their ACA insurance status will be edited to reflect accepted:

After changing the ACA insurance status to accepted, and upon saving the employee record changes, the adjustment setup wizard will display to remind and guide the user through the ACA adjustment setup process.

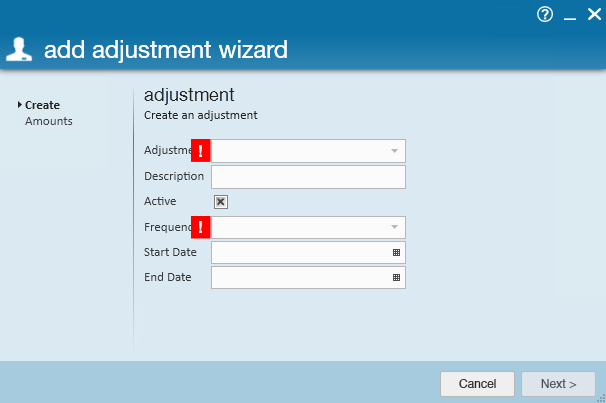

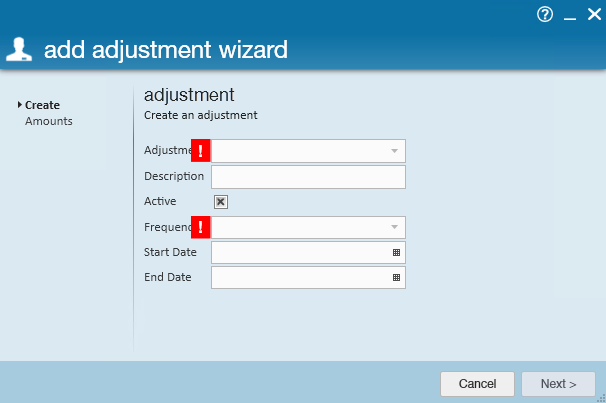

After clicking save from the employee record the add adjustment wizard window will display:

Complete the following fields:

- Adjustment - Select the appropriate employee portion adjustment your administrator has set up for ACA insurance. Only adjustments that were set up in administration as ACA related adjustments will appear in this selection list.

- Description - Enter a description, if desired.

- Active - the active box will default to be checked indicating the adjustment is active.

- Frequency - The frequency field will default to the frequency that was set for this adjustment when the adjustment was set up in administration. If a frequency does not default, input the frequency with which this employee is paid.

- Start date - If you are delaying the start date of the insurance, you may enter the date the adjustment will start. The adjustment will be deducted from the employee's check if the start date falls within the date range of the weekend date of the paycheck. Leaving the start date blank will cause the adjustment to be deducted on the next paycheck processed for the employee.

- End date - This is the date the adjustment will stop being deducted on the employee's paycheck. Generally, you will not be entering an end date for an ACA insurance adjustment at the time you are setting it up but can come back later if and when the insurance should stop being deducted.

Click next.

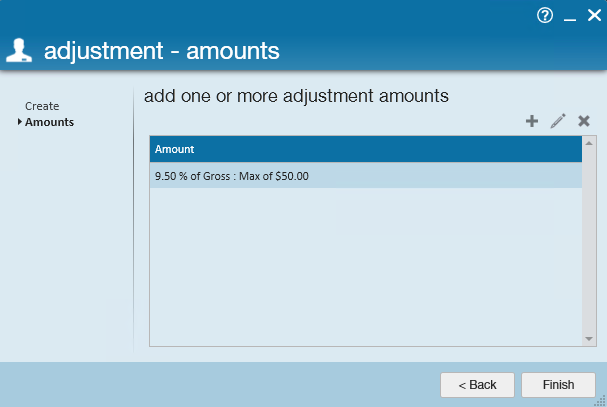

The adjustment amounts window will display:

The percentage amount and the insurance premium amount will default based on what your administrator setup in administration.

If you would like to edit those amounts click the pencil in the upper right corner.

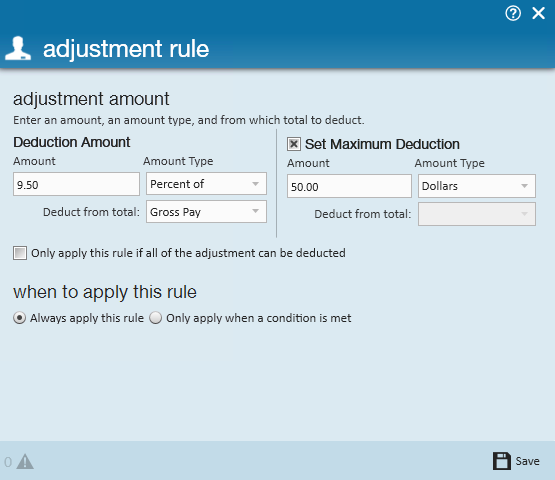

The adjustment rule window will display.

Make any changes to the deduction amount or maximum deduction then click save.

*Note - Your administrator, during set up of the adjustment, associated the employee insurance adjustment to the corresponding employer adjustment. There is no need to set up a separate adjustment for the employee portion on the employee record.

TempWorks will automatically calculate the employer portion based on the settings in the employee adjustment and the employee's gross pay.

*Note - for an ACA employee insurance adjustment that is linked to an employer adjustment do NOT check the box next to only apply this rule if all of the adjustment can be deducted.

After clicking save you will be returned to the adjustment amount window.

Click finish.

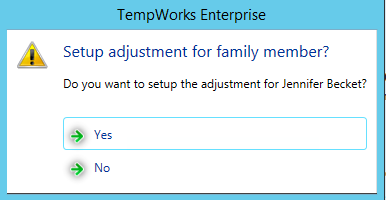

If the employee also has dependent insurance with a status of enrolled the following window will display:

Clicking no will return you to the employee pay setup window.

Clicking yes will prompt you to set up an additional adjustment through the add adjustment wizard.

Select the adjustment that was created in administration for dependent insurance and continue with the adjustment set up.

*Note - The adjustment selection for dependent insurance will not have a corresponding employer portion and the employee will be responsible for paying the full insurance premium regardless of their earnings. If your company voluntarily offers an employer contribution for the dependent and spousal insurance, your administrator will have set up these benefit adjustments accordingly.

After setup of the adjustments is complete, you will be returned to the employee pay setup window and all changes will have been saved.

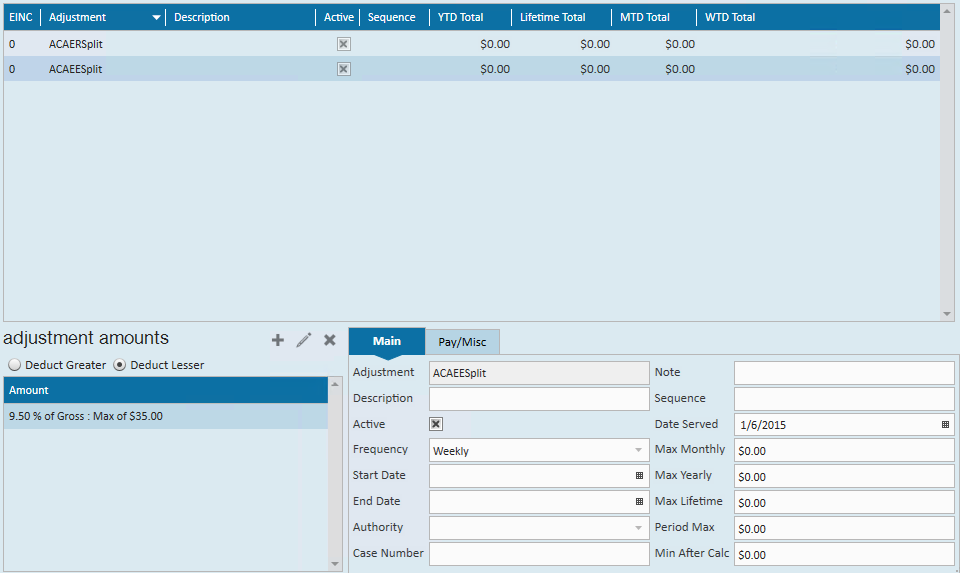

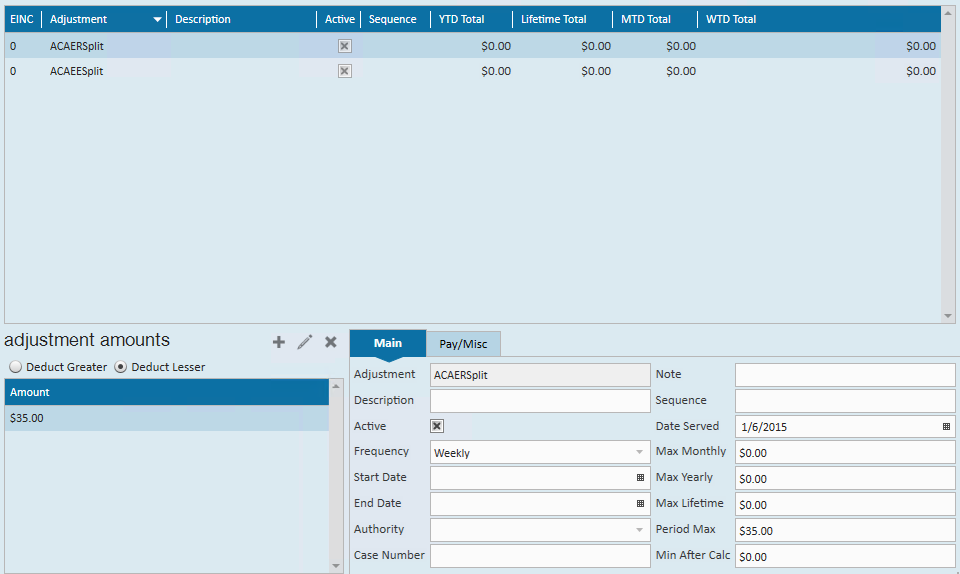

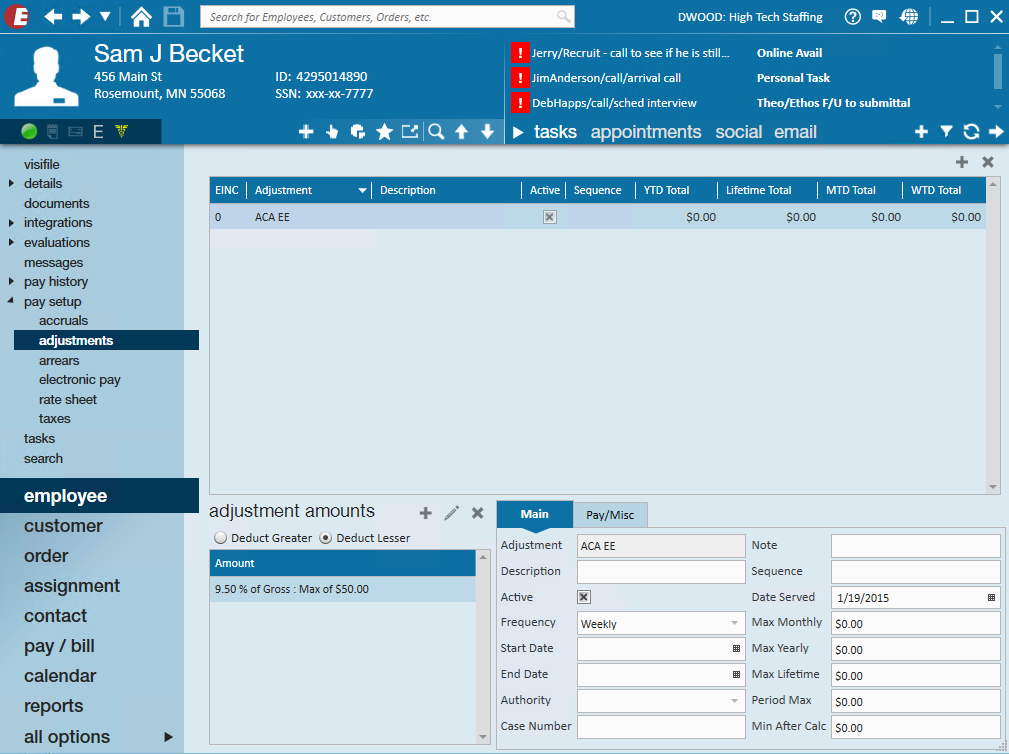

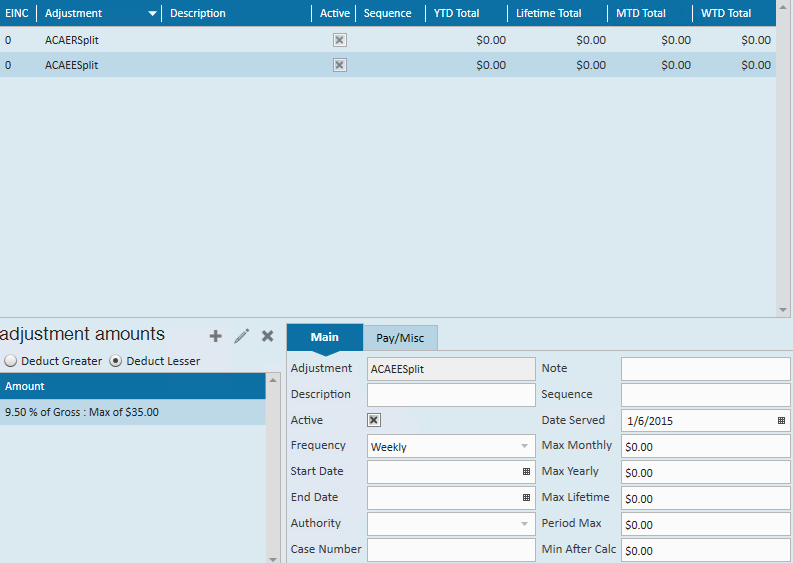

Viewing Adjustments on the Employee Record

To view employee adjustments select pay setup/adjustments form the employee record.

The following window will display:

All adjustments set up for an employee will be displayed in this window.

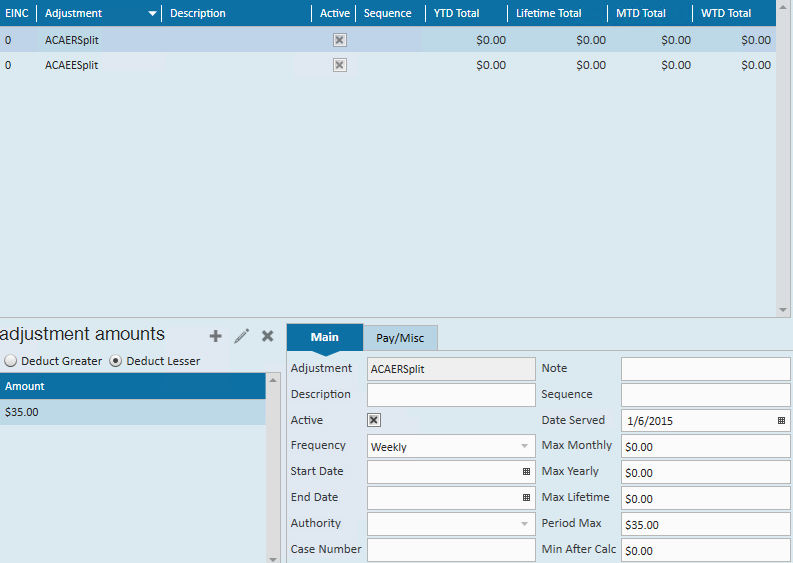

*Note - Additional adjustment scenario:

If you are calculating a premium split or the federal poverty level but you still need to not deduct an amount over the 9.5% from the employee's gross wages.

For instance: The total of the premium per week may be $70.00 You may want to share the cost with the employee where you each contribute $35.00. In this scenario, the employee would be responsible for $35.00. You would pay the additional $35.00. However, if the $35.00 employee portion is greater than the 9.5% maximum limit of the gross for the employee for a given week, the employee would be responsible for less than $35.00.

Example:

Employee earns $9.00/40 hours = $360.00

9.5% of employee gross wages = $34.20

In this case the employee cannot be asked to contribute the additional $.80

To handle this you will set up the employee adjustment and link it to the employer benefit adjustment as usual.

Using the example above, when setting up the employee adjustment, you will identify it as an ACA employee adjustment with a maximum of 9.5% with the total cost to the employee of $35.00 and should be linked to the employer benefit adjustment.

This combination will track the employee's responsibility and, if the dollar amount exceeds the 9.5%, it will track the overage which you will need to pick up because this adjustment it is linked to the employer ACA benefit adjustment.

***An additional benefit adjustment must be set up and added to the employee's record to track the employer's original benefit responsibility. This adjustment should NOT be linked to the ACA employer adjustment.

When setting up the ACA insurance adjustments on the employee's record, the employee's portion of the ***additional benefit adjustment must be set.

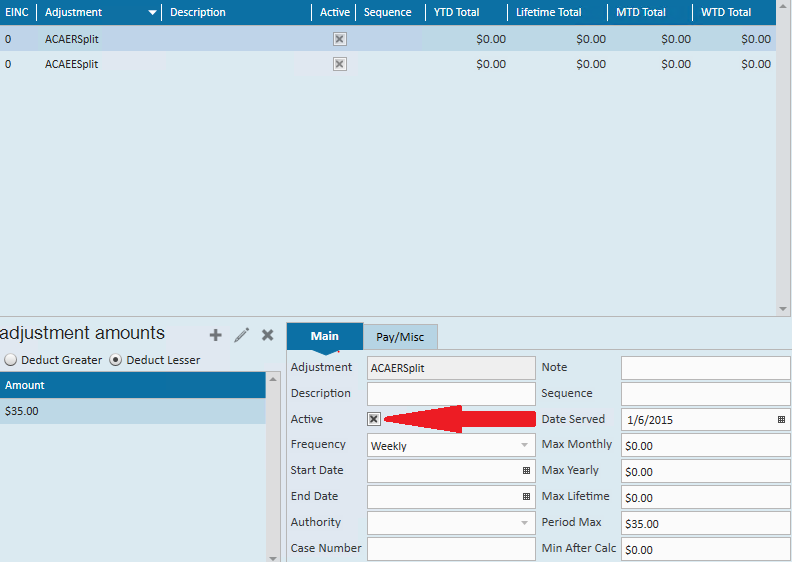

Inactivating Adjustments

If an employee is no longer eligible for your insurance or chooses to cancel their insurance you will want to inactivate their ACA insurance adjustment code(s).

To inactivate an adjustment access the employee record. In the left hand menu select pay setup/adjustments. The following window will display:

Click to highlight the adjustment you would like to inactivate.

In the lower portion of the window on the main tab there is an active field with a check box.

Click to deselect the check box.

Click the save button in the upper left corner of the window.

For complete documentation on all the features of the adjustment window please refer to the How to Setup Garnishments article.

Related Articles

- None