Overview

When setting up an accrual within Enterprise, you will have the option to enable the Break In Service functionality.

Break In Service allows for accrual balances to be automatically adjusted based on individual state laws when an employee has not worked on an assignment for an extended period of time, therefore putting the employee within a Break In Service period.

*Note* For more information on setting up accruals, please see the article titled Accrual Setup in Administration.

This article covers the following:

Enabling Break In Service

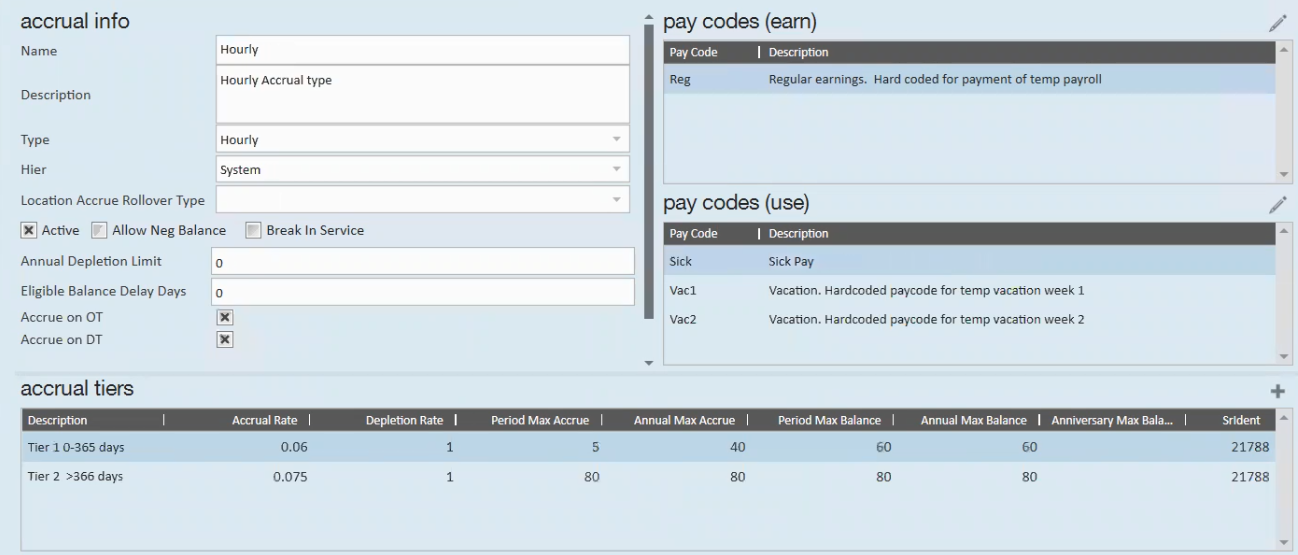

Begin by navigating to Enterprise > All Options > Administration > Accruals.

Either create a new accrual or select the accrual you would like to add the Break In Service to:

*Note* Break In Service will not function with accruals utilizing the "Annual" or "Anniversary" accrual types.

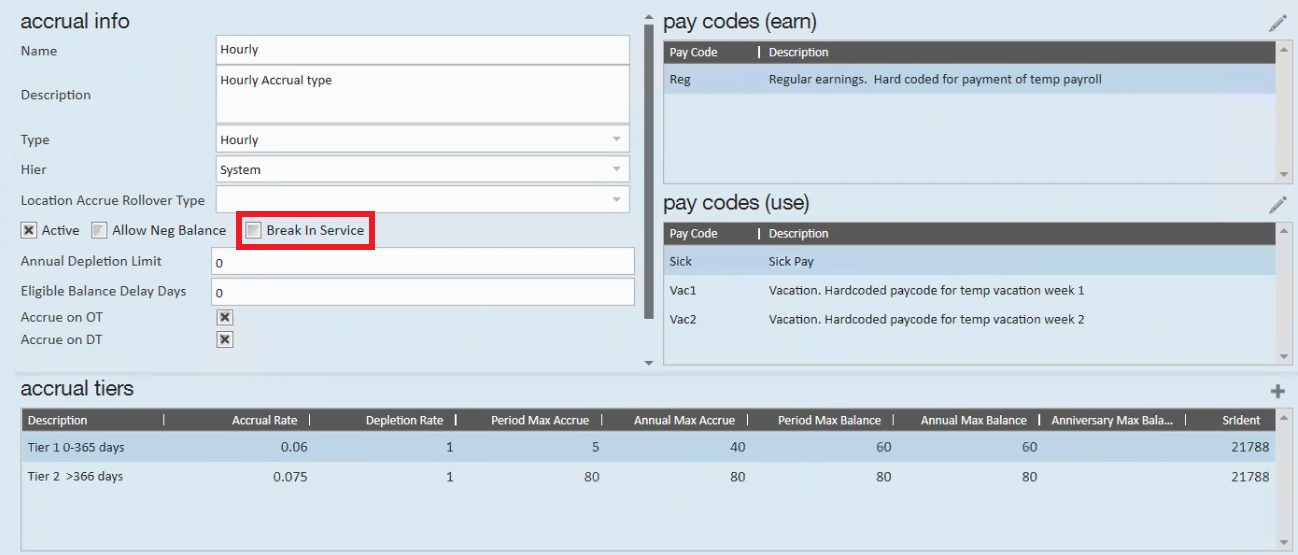

Select the checkbox for "Break In Service":

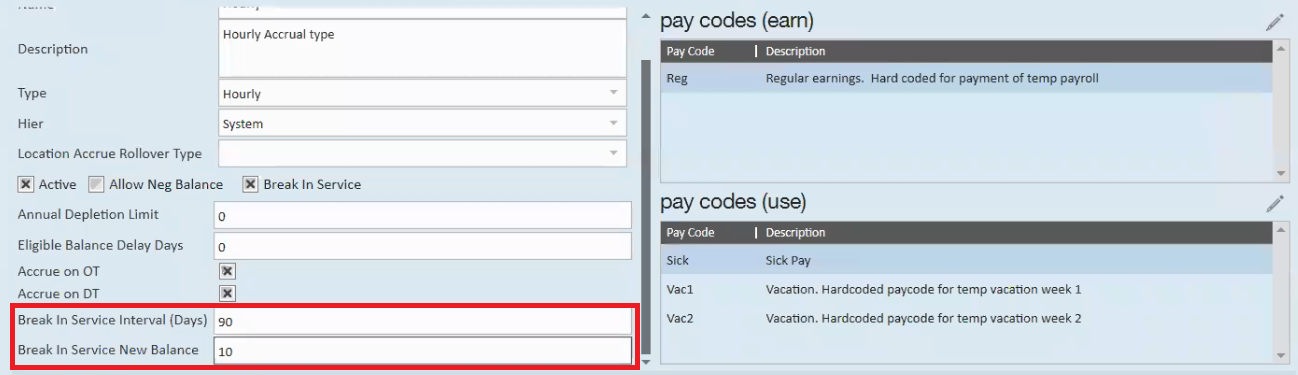

Selecting the check box will expand two additional fields:

- Break In Service Interval (Days) - REQUIRED

- This value determines the numbers of days until an employee is considered within a Break In Service period.

- For example, if 90 is entered within the "Break In Service Interval (Days)" field, then the employee will be placed within a Break In Service period after not working 90 days since the last weekend date of their most recent timecard that contains the accrual.

*Note* This value is based on the weekend date of the last timecard for the employee with the accrual and the timecard must have a Pay Code that signifies hours that the employee has actually worked (therefore not sick leave, vacation, bonus, etc).

- Break In Service New Balance - REQUIRED

- This value determines the new accrual balance for the employee once the employee has entered a Break In Service period.

- For example, if 90 is entered within the "Break In Service Interval (Days)" field, and a value of 10 is entered within the "Break In Service New Balance" field, then after an employee hasn't worked on an assignment for 90 days (therefore in a Break In Service period), the employees accrual balance for that accrual will be lowered to 10 as long as their accrual balance was over 10 by the time the Break In Service period began.

*Note* The Break In Service functionality is only meant to deduct hours, not add.

Therefore, if the amount within the "Break In Service New Balance" is greater than the balance the employee has for the accrual when entering a Break In Service period, that balance will not be adjusted. The employee will retain their previous accrual balance.

Once the fields have been filled out with the intended values, and the rest of the accrual has been setup, select the "Save" icon at the top left to save the changes.

*Note* The Break In Service logic will run once the week has been closed.

Employee Break In Service

With the accrual setup complete, the accrual is able to be added to the employee(s) record(s) that require it.

*Note* For more information on attaching an accrual package to an employee record, please see the article titled Employee, Customer, and Assignment Accruals.

Once the accrual has been attached, and the employee(s) record(s) enter a Break In Service, that accrual will then be automatically deactivated on the record and, if applicable, an accrual adjustment will be presented within their accrual history.

*Note* Break In Service cannot be run in a week that has previously been closed.

In the event employees need accrual adjustments for a week that has been previously closed, these will need to be done manually.

In the event the employee returns to work and the same accrual and rules should apply, the accrual will need to be reactivated manually on the employee record.

Break In Service Scenarios

The following scenarios can be taken into consideration when utilizing the Break In Service for accruals:

Scenario 1

- Employee goes 90 days without working and has their accrual balance removed due to the value entered within the "Break In Service New Balance" field and the employee now being within a Break In Service period based on the value within the “Break In Service Interval (Days)” field.

- Two weeks after the employee has their accrual balance removed, the service rep finds out that the employee should have received a paycheck three weeks in the past.

- The service rep creates a timecard for the employee, backdating it three weeks in the past.

- Due to the removal of the employee’s accrual balance already taking place, the service rep will need to do a manual accrual adjustment on the employee’s record for the missing accrual balance.

Scenario 2

- Employee has an accrual balance of "6" when they enter a Break In Service period.

- The "Break In Service New Balance" field has a value of "10" within the accrual setup.

- Employee will NOT have their balance adjusted to be ABOVE what their previous accrual balance was leading into the Break In Service period.

Scenario 3

- Employee has multiple accruals setup within their record.

- Each accrual has the Break In Service setup.

- The Break In Service logic will apply separately for each accrual balance.

Scenario 4

- When the employee has never submitted a timecard but has an existing accrual balance that has been manually added, then the Break In Service logic will not be applied.

Related Articles

- None