Gross Up Calculator from TempWorks Software on Vimeo.

What is the Gross Up Calculator?

The gross up calculator will help you determine how much to pay an employee to achieve a desired net. For example, you may want to pay an employee $500.00 net as a bonus, how much gross will you need to put on the check? This document will walk you through a convenient and easy way to calculate gross wages.

*Note* Users must have the secrole "GU, Can Use Gross up Calculator", in order to access this functionality.

The Gross Up Calculator is meant to be used with tax supplemental pay codes, which will withhold at the supplemental rate instead of the standard calculation. Keep in mind that this calculator is an approximation not an exact figure.

How to Use the Gross Up Calculator

Navigate to pay/bill (1.), actions (2.),and select open gross up calculator (3.)

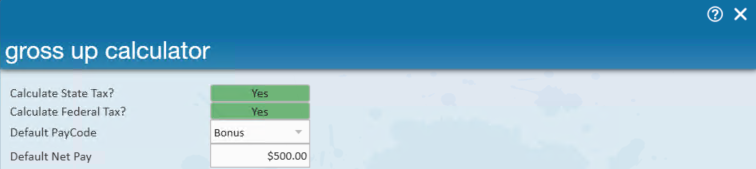

Adjust the filters to your desired specifications including state and federal tax, default pay code, and enter the desired net pay.

Select the employee and assignment from the drop down and enter the desired net pay.

Within a few seconds the gross pay will calculate, select the refresh icon if the gross pay is not calculating.

To add additional line items and make another calculation select the + icon. Enter the employee and assignment information, the default net pay will automatically populate and gross pay will display.

Once all information is added and you are ready to create the timecards, select create.

Timecards will be created with 1 unit and a unit pay rate equal to the gross pay calculated from the gross up calculator. It also automatically inserts overrides to make sure all employee adjustments are changed to zero.

The pay code will reflect what you selected from the gross up calculator. Right- click on the column headers to insert the units and unit pay headers.