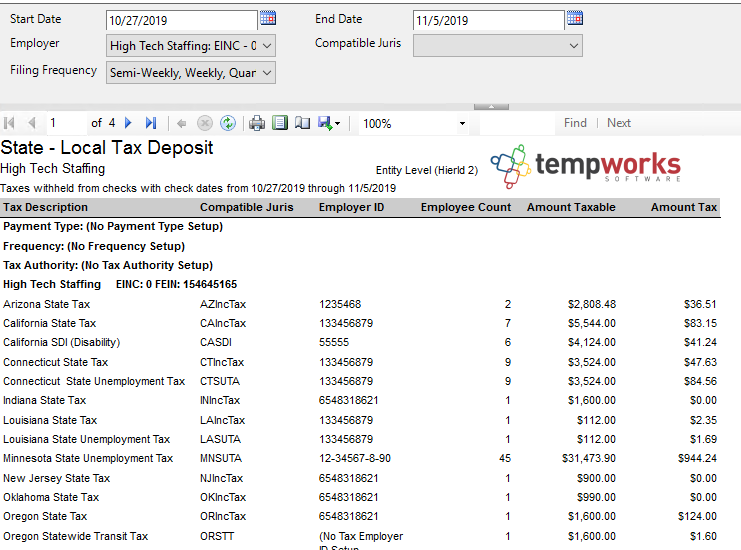

Purpose

This report is designed to be used to make your state and local tax deposits. It pulls the payment type, filing frequency, and tax authority from the tax management/tax pay area. If you are not using this, these will not be set up.

The report groups data by Payment Type, Frequency, Tax Authority and EINC.

Where You Can Run This Report

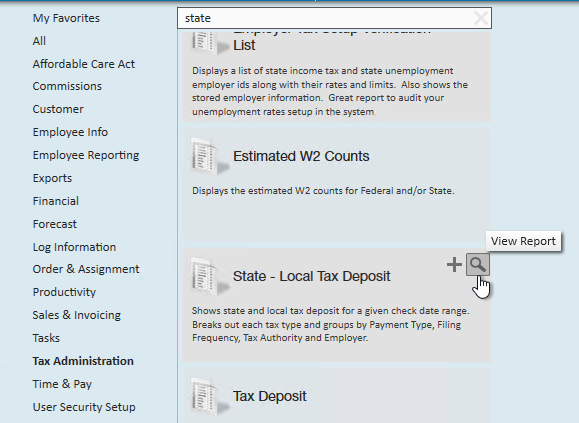

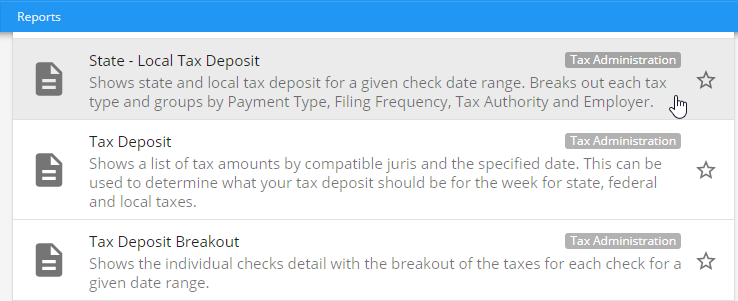

This report can be run in Enterprise under All Options > Reports. Select the Tax Administration category on the left.

You can also run this report in Beyond under the B menu > Reports. Select All Reports and search by the report name or select the Tax Administration report group

Parameters

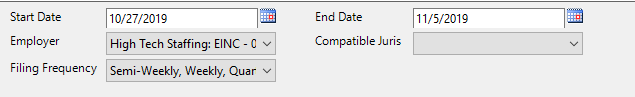

- Start Date: Starting Invoice date of your desired date range

- End Date: Ending Invoice date of your desired date range

- Employer: A drop down list of all employers in the user's current hierarchy. This is a multi-value parameter, you can select all employers, any one specific employer or any combination of multiple employers in the list.

- Compatible Juris: This is a drop down list of all compatable jurises. This is a multi-value parameter therefore, you can select all jurises, just one specific juris or any combination of multiple jurises from the list.

- Filing Frequency: This is a drop down list of all filing frequencies. This is a multi-value parameter therefore, you can select all filing frequencies, just one specific filing frequency or any combination of multiple filing frequencies from the list.