Unit Pay And Bill from TempWorks Software on Vimeo.

Do you ever pay your employees a type of bonus or commission? Or do they ever earn cash tips? Do employees earn $1.00 for every widget they manufacture? If you answered "yes" to any of these questions you have come to right place. This document will walk users through how to correctly account for unit pay.

Do you ever pay your employees a type of bonus or commission? Or do they ever earn cash tips? Do employees earn $1.00 for every widget they manufacture? If you answered "yes" to any of these questions you have come to right place. This document will walk users through how to correctly account for unit pay.

To Create a Bonus or Holiday Timecard:

Step 1: Duplicate the Timecard

When paying out a bonus or a commission in Enterprise the first step is to duplicate the timecard. To do this, simply highlight and right-click the appropriate transaction in Time Entry and select Create Duplicate Timesheet. This will automatically create a second (blank) copy of the timecard.

Step 2: Update the Pay Code and Enter the Units

Option 1 - From the Time Entry Dashboard:

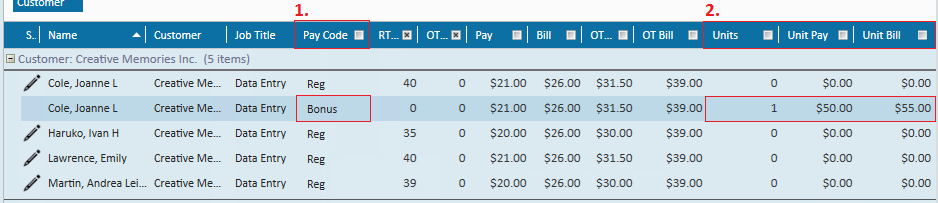

If a large number of your employees will be receiving a form of unit pay consider adding the columns Units, Unit Pay, and Unit Bill into your Time Entry dashboard. You can accomplish this by right-clicking the dashboard column header and selecting the columns (those marked with a check will be included):

With these columns added simply selecting the appropriate (1.) pay code from the dropdown and entering in the number of (2.) units being paid and the rate of pay/bill per unit:

Option 2 - From the Detailed Timecard:

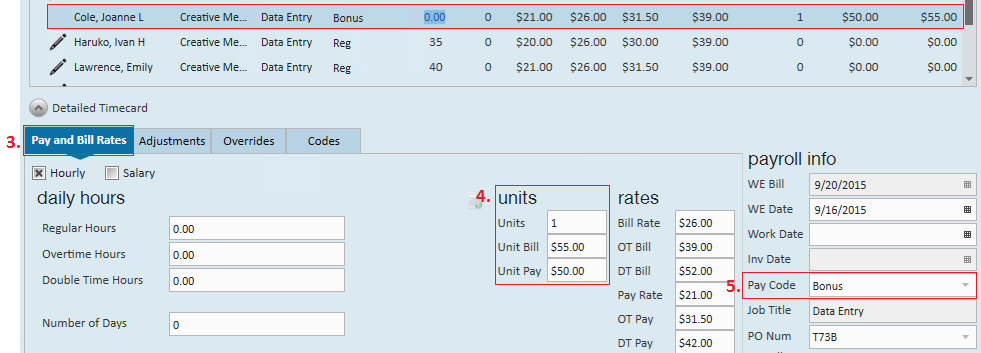

Users can also input unit pay from the detailed timecard. To access the detailed timecard either highlight and double-click the transaction that needs the unit pay added or select "Detailed Timecard" at the bottom of your time entry dashboard:

With the detailed timecard now expanded, verify that you are within the (3.) pay and bill rates tab, enter the (4.) amount of units you are paying and how much per unit you are paying and billing. Lastly, update the (5.) pay code to bonus.

Other Unit Pay Scenarios:

It is unlikely that bonuses are the only times one will need to use unit pay. If and when you have a different type of unit pay that needs to be accounted for follow the first two steps outlined in this document with one small change - the pay code. The pay code should always represent the type of pay the employee is receiving - retro, holiday, tips, commission, etc.

For example, in the instance you need to pay commissions to an employee simply select the matching pay code and enter the payment as a unit: