What is Retro Pay?

Retro pay, retroactive pay, or back pay is defined as income from a previous weekend date being owed and paid to an employee. This may be utilized for a multitude of reasons including having an incorrect pay rate originally established and paid out to the employee, or a missed pay raise.

How to Document Retro Pay in Enterprise:

Step 1:

Make sure you have made the appropriate corrections to the related assignment. This could be simply updating the pay and bill rate information (if it was originally entered incorrectly) or completing a pay raise. This is important so that going forward, the employee is paid correctly and future errors are avoided.

Step 2:

In time entry, enter the hours and rates as the difference owed. To do this, locate the employee's timecard in time entry and create a duplicate timesheet. In this example, let's say our employee was paid $16.00/hr last week for 40 hours worked when they should have been paid at a rate of $17.00/hr.

*Note* If the timecard was already created for this week at last week's incorrect pay/bill rate, you will need to refresh the timecard after making the appropriate updates to the related assignment record.

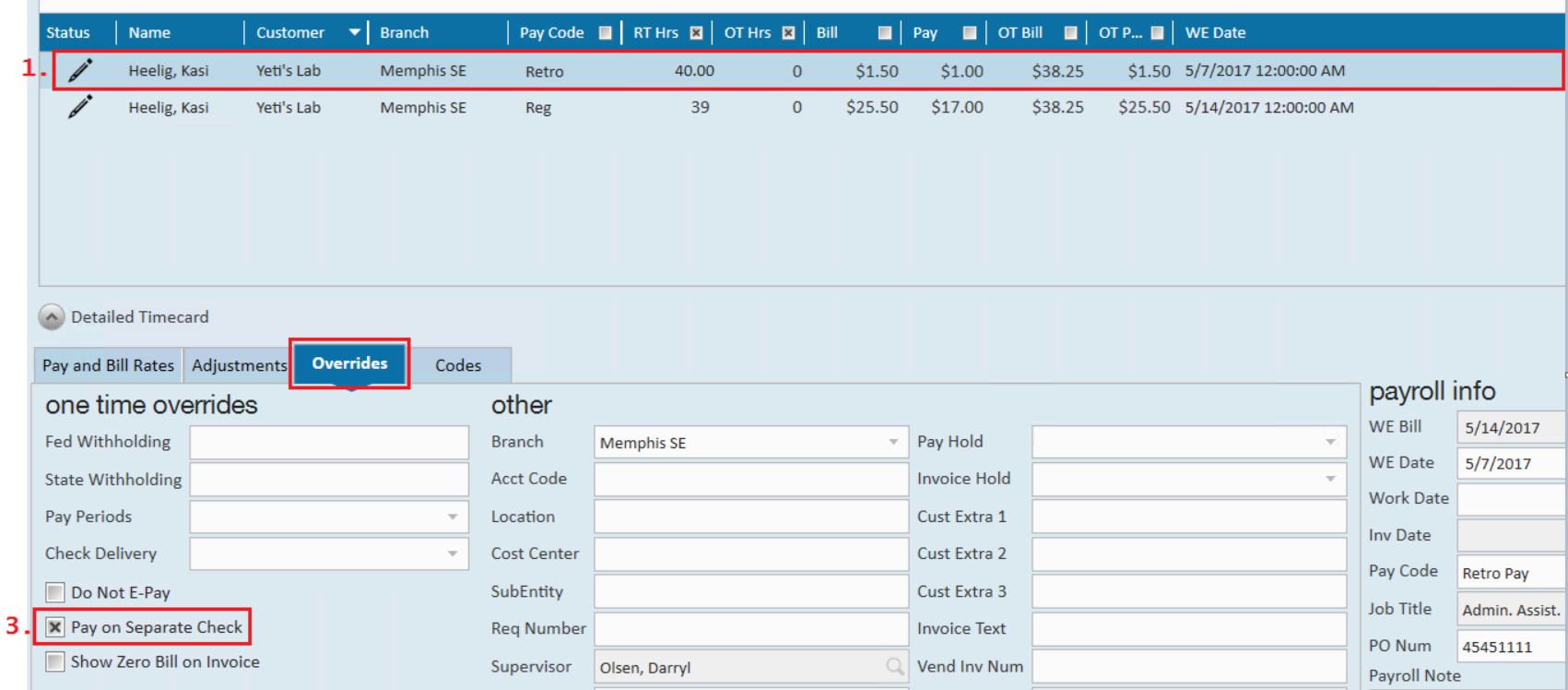

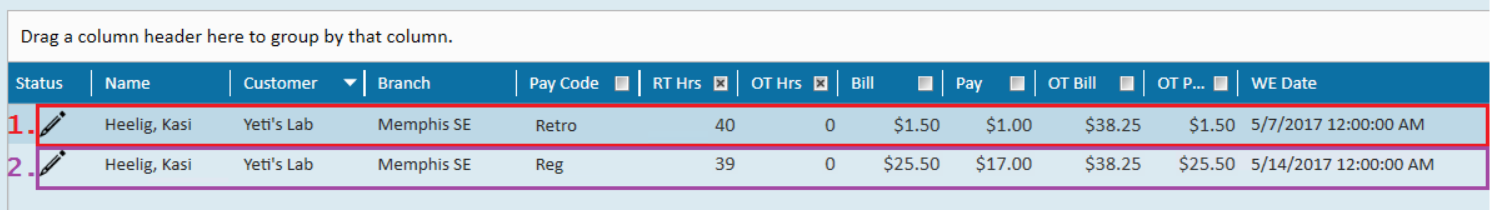

In timecard one, the pay code is updated to retro, the hours worked last week are entered, the pay rate and bill rate is entered as the difference owed, and the weekend date is set to the prior week.

In timecard two, the hours are entered as normal, but the updated/correct pay and bill rates are reflected.

Step 3:

Within the overrides tab of the detailed timecard for timecard one, it is recommended to opt to pay the retro pay on a separate check. This ensures that adjustments tied to the employee record will calculate correctly.

*Note* If there is a transaction for the employee in the same Weekend Bill as the Retro Pay transaction that has not been processed yet, you will need to process the non-Retro Pay transaction through a payroll run and post it first before you can process the Retro Pay transaction.