What is the Monthly Measurement Method?

The first method for determining an employee’s full-time status – the more straightforward of the two ACA eligibility-testing methods – is the monthly measurement method. This method isolates the tallying of an employee’s hours to individual months, identifying an eligible employee as one whose hours of service total 130 hours in any one month of a tax year.

This article covers:

- Monthly Measurement vs. Look Back Method

- How the Monthly Measurement Method Works

- Suggested Next Steps

Monthly Measurement Vs. Look Back Method

When the monthly measurement method is used to confirm an employee as full-time, an offer of coverage would have to be made the first day after the next two full months from the month for which eligibility was determined.

If you use look back measurement, you will enter your employer settings in administration and cycles will be generated for each employee. Look back periods allow employees to have a longer measurement period before offering insurance but they also lock in an eligibility status for a longer time.

Monthly measurement means they evaluate an employee's full time status every month. If the monthly measurement option is used, you will not need to enter information in the employer settings and will not have cycles generated. Instead, the employee hours reports will be used to determine who hit the hours threshold each month.

*Note* We strongly suggest monthly measurements for clients who go live on new software midyear. This means you measure who is full time and offer them insurance for the month that they were full time. This is something we can track in the system off new and past employees (past employees so long as they have a txns conversion).

Resources for learning more:

Here are a couple government resources for learning more about the ACA options. Keep in mind that you should always consult your benefits provider and a legal advisor if you are unsure how to stay compliant ACA regulations.

- Federal Register: https://www.federalregister.gov/documents/2014/02/12/2014-03082/shared-responsibility-for-employers-regarding-health-coverage

- IRS & ACA: https://www.irs.gov/affordable-care-act/employers

How Does the Monthly Measurement Method Work in TempWorks?

Each month you will review full time status and enroll employees in benefits based on their full-time status. Always work with your benefit provider to ensure you are offering to all eligible employees.

You will not need to set up ACA cycles in Administration to use this option.

The Monthly Measurement Method works in 3 easy steps:

- Review Employees' Full-Time Status

- Send out Benefit Information & Notices

- Setup & Deduct Insurance Premiums

Step 1: Review Employees' Full-Time Status

At the beginning of each month, you will need to see which employees met full time status in the month previous. For example, on February 10th, you might look at all the employees that worked in the month of January to determine who is considered "Full-Time."

Full-Time status could be considered any employee who works on average 30 hours a week or 130 hours per month but always check with a legal advisor, current ACA guidelines, and your benefits provider if you are unsure of what you should consider full-time.

Pulling the Employee Hours Report

In order to find a list of employees' hours for the month, you will need to pull the employee hours report or the employee hours range report. Make sure you are at a hierarchy level that you can see all employees (ex. system, subsystem, or entity).

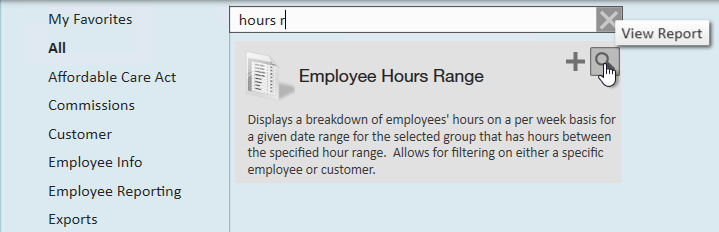

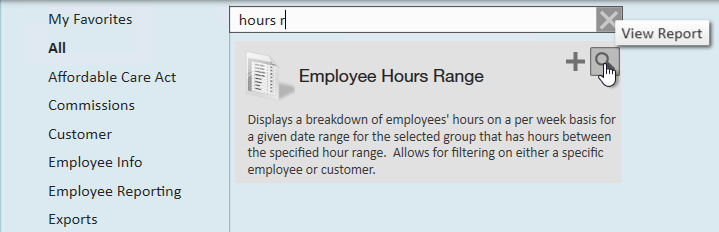

- Navigate to All Options > Reports

- Search for the Employee Hours Range Report under the All category:

- Select the magnifying glass to run the report

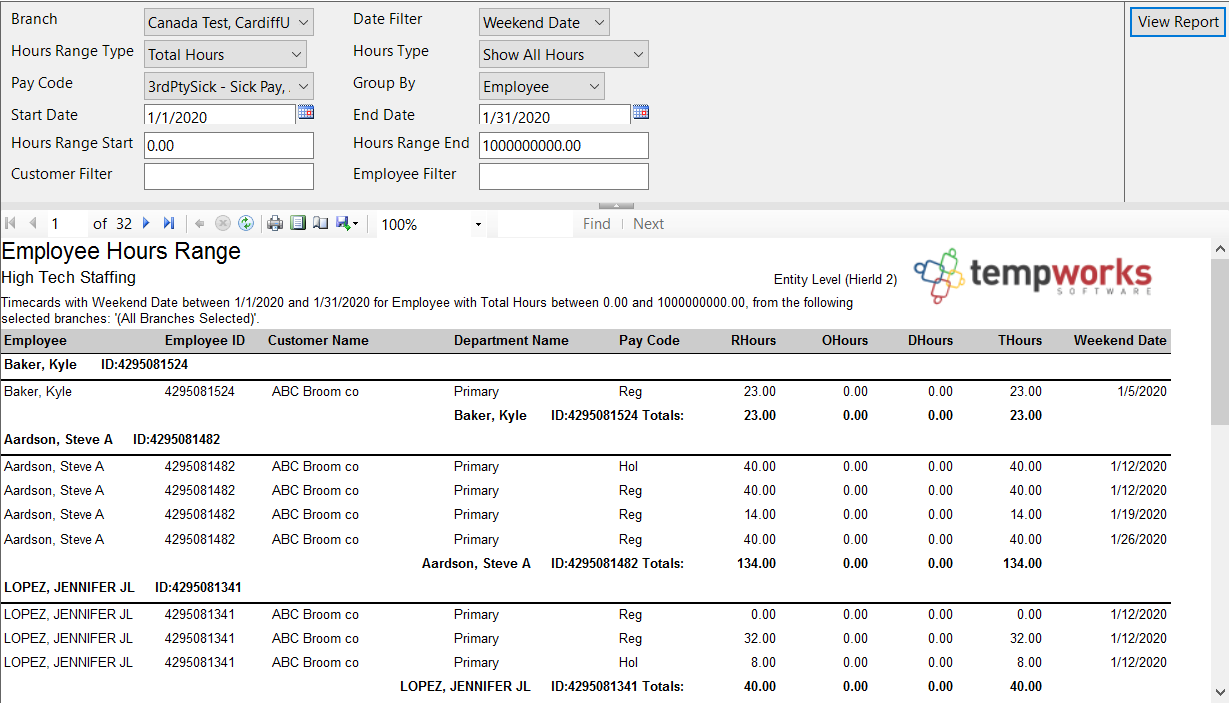

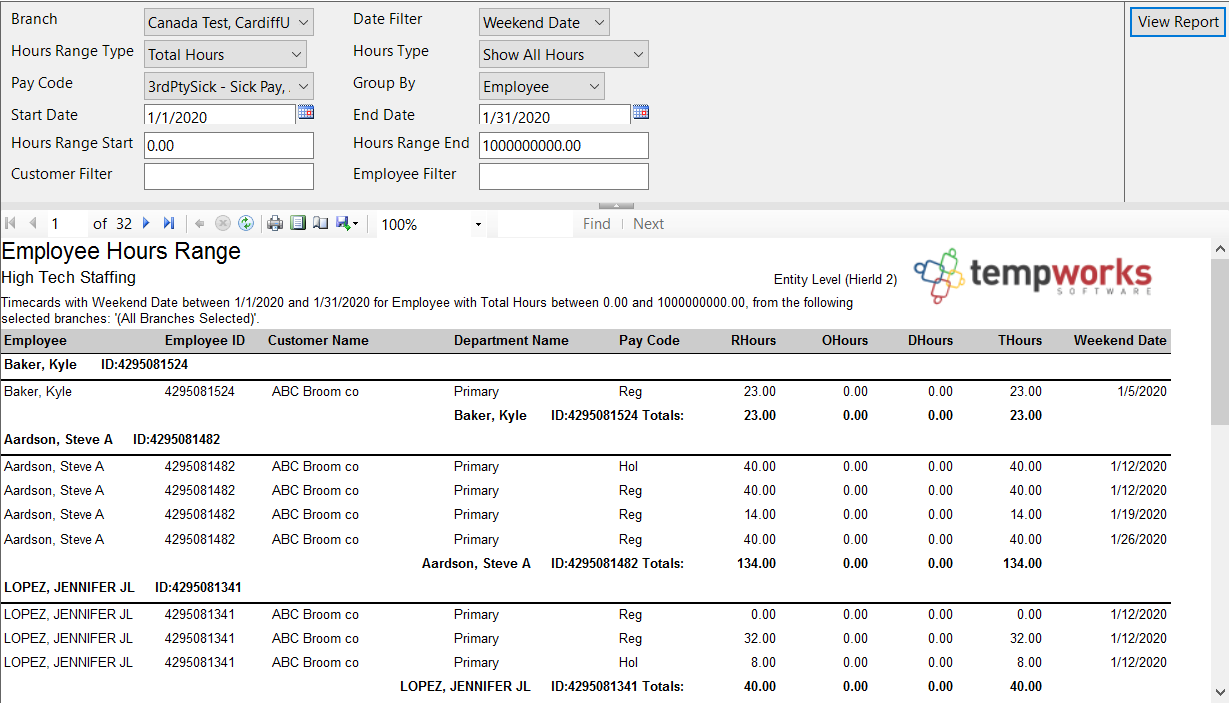

- Set the report parameters

- Set the start and end date to be the first and last day of last month

- Set the date filter to weekend date to include any time reported late, etc.

- Consider limiting the pay codes to only pay codes that reflect actual hours worked (ex. no bonus pay codes, etc.)

- Consider setting an hours range start and end to include only those that may be close or have exceeded the amount of hours to be considered full time this month

- Select View Report to run the report

Use this report to identify which of your employees worked the number of hours needed to be considered "Full-Time." These employees will be the ones that are offered insurance.

Double check this list vs. the list of employees that you currently have insured. There should be at least three groups of employees to consider:

- Employees that have just qualified this month and have not been offered insurance

- Employees that still qualify and have been offered insurance already

- Employees that are currently insured but no longer qualify for insurance based on last month's average hours

Step 2: Send Out Benefit Information & Notices

For employees who have now qualified for insurance but have not been offered, you will need to send benefit information to them. Typically, it is recommended to automatically enroll employees who have qualified into your insurance benefits unless they choose to opt out within a given time period.

For example, you may choose to give your employees from February 10th (when they were notified) until the 25th to opt out of insurance (15 day waiting period). Always work with your benefits provider or legal advisor for the required length of notice before deductions occur.

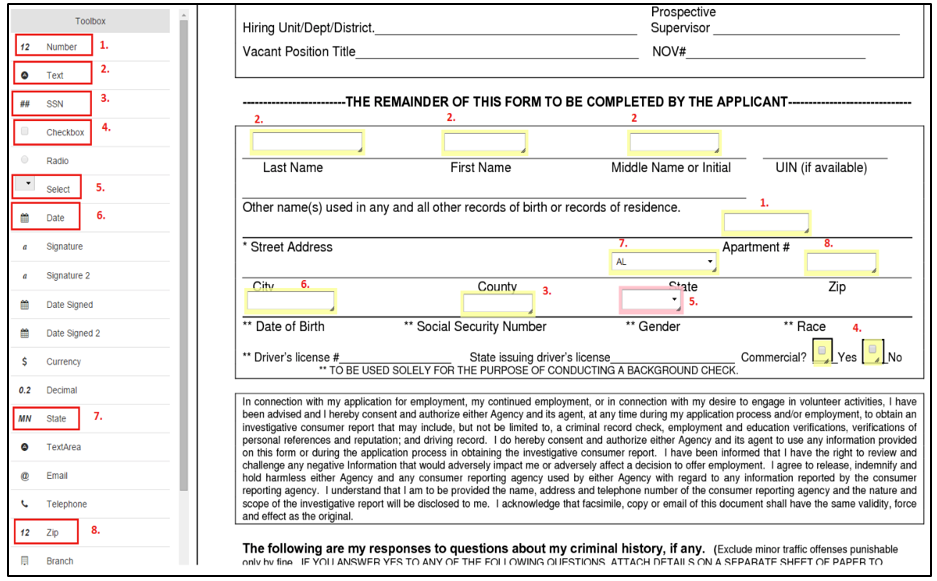

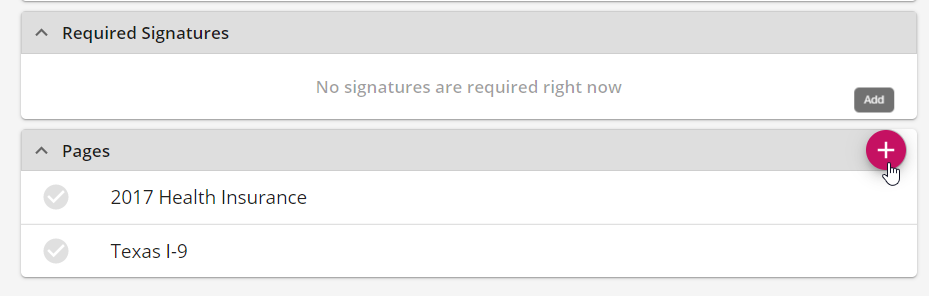

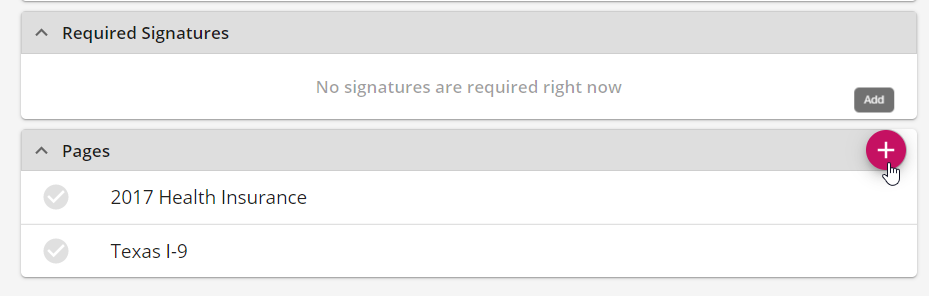

In TempWorks, it's easy to send benefit information and an opt out form using HRCenter to have the employees electronically opt out and view their options. This may take a little bit of set up but will be easy to continually use.

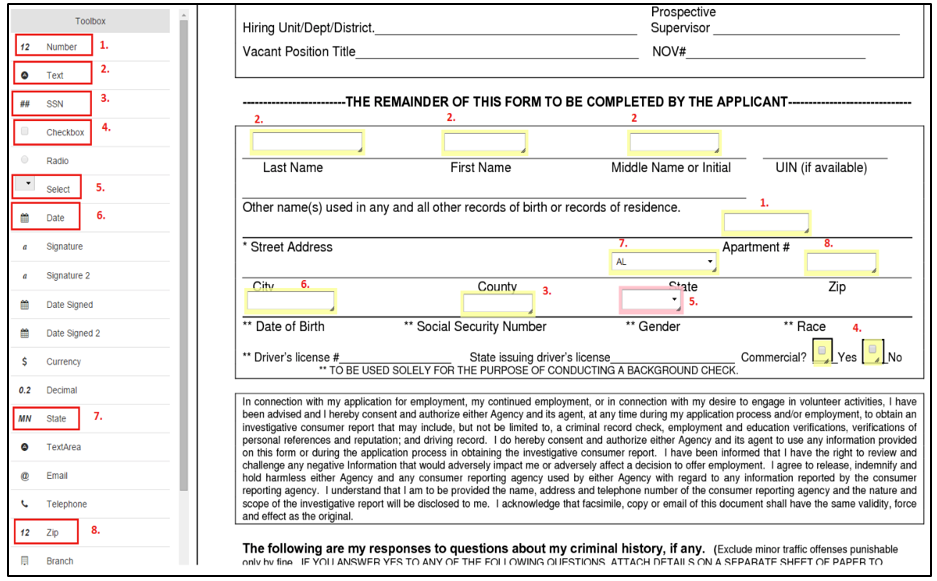

- To create a form that employees will need to review and sign, check out HRCenter Admin: Form Builder

- To send a workflow or page to an employee, check out Beyond - How to Assign a New HRCenter Workflow or Page or Assigning HRCenter Workflows/pages from Enterprise

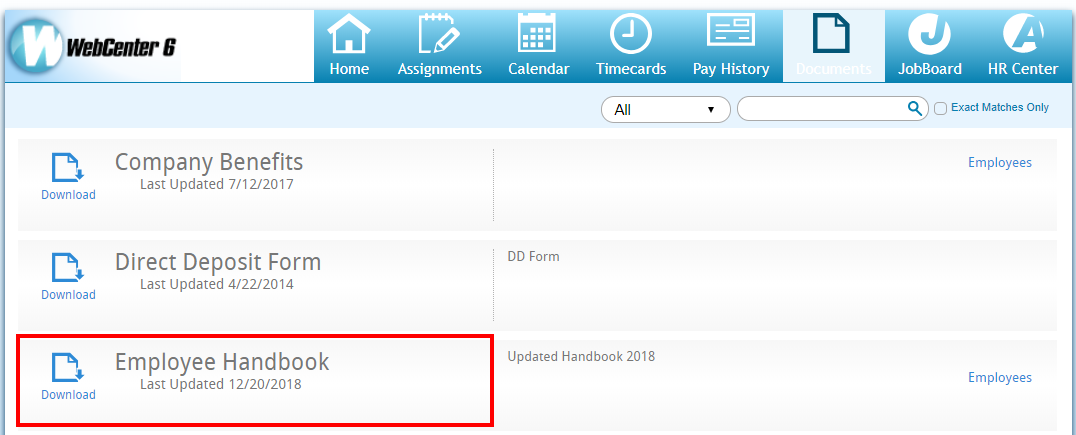

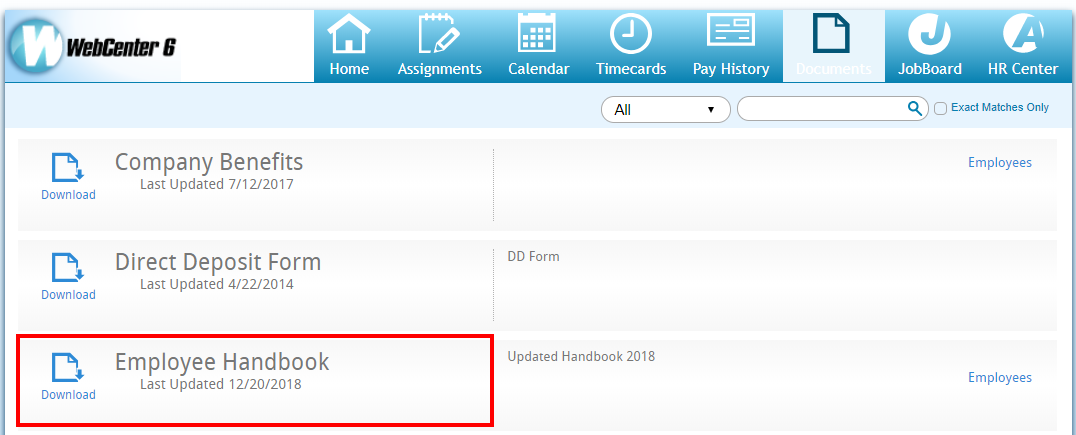

- To add a benefit package document in WebCenter, check out WebCenter Admin - How to Add Documents to Portals

- If you want to track opt out or offered statuses, consider creating a custom data field

If you are utilizing Essential Staffcare (ESC) for your benefit tracking, check out our integration.

For employees who no longer qualify for insurance, you will need to notify them when their insurance coverage will end. Work with your benefits provider or legal advisor for the best option for this.

Step 3: Setup & Deduct Insurance Premiums

For all employees that have qualified and have not opted out of their insurance benefits, you will want to set up their premiums to start deducting when coverage begins. Work with your benefits provider for more details and requirements.

For the example we have been using, the insurance premium could be taken out starting on March 1st if they did not decline their insurance option.

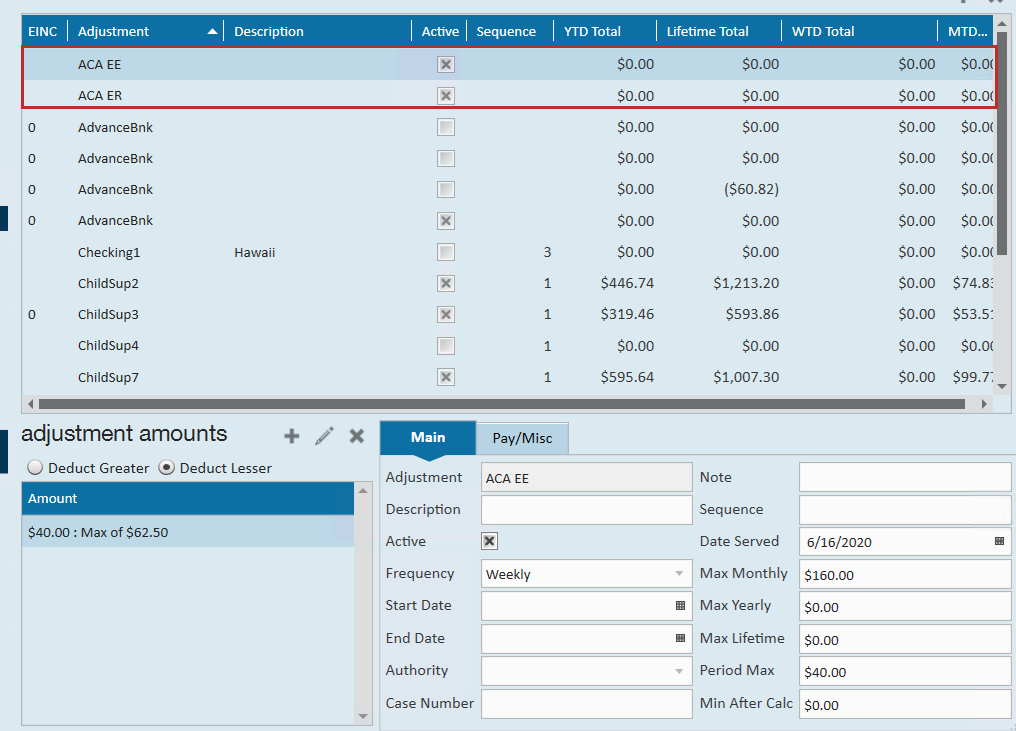

- To setup insurance adjustments in TempWorks, check out ACA Admin: Setting Up ACA Adjustments in Administration

- To add the adjustments to the employee's file, check out Managing ACA Adjustments for Employees

Next Steps

Here are some additional administrative steps to consider once you have set your up your monthly measurement process.

- Create Benefit Adjustments: ACA Admin: Setting Up ACA Adjustments in Administration

- Adding ACA Adjustments to Employees: Managing ACA Adjustments for Employees

- Consider ACA Surcharges: ACA Admin: Setting Up ACA Surcharges for Customers