What is Considered an ACA Adjustment?

When we talk about ACA related Adjustments, we are talking about your benefit adjustments for employee and employer contributions. Before you can apply and adjustments to an employee's pay setup to be deducted from their checks, you must first set up the general adjustment settings in Administration.

*Note* This article is for Administrators. If you do not have access to the all options > administration section in Enterprise, then you will first need to gain the proper security role permissions before you will be able to set up adjustments.

We recommend having your benefit information in front of you as you fill out these adjustments to ensure they are accurate.

This article includes:

- Setting up Employer Paid Benefit Adjustment

- Setting Up Employee Paid Benefit Adjustment

- Spouse or Dependent Adjustments

- Employee/Employer Split Recommendations

- ACA Adjustments & Your GL

Setting up Employer Paid Benefit Adjustment

When we talk about employer paid benefit adjustments, we are referring to documenting the amount the employer is responsible for paying for any employee's benefits. We need to set up a specific adjustment type to code this information correctly so that it can be set up on the employee but not taken out of the employee's check.

*Note* We recommend navigating to System Level or your highest hierarchy level when adding adjustments in Enterprise. You can always select a lower hierarchy in the hier drop down if you do not want to have this adjustment available to the entire system.

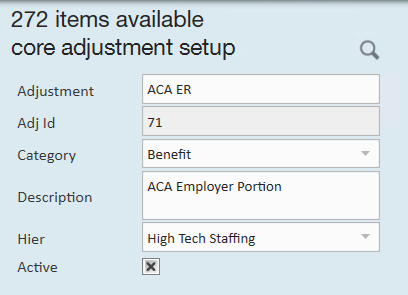

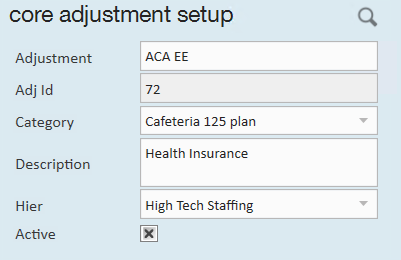

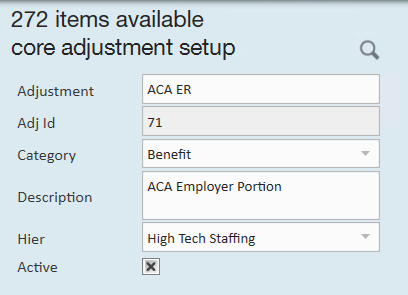

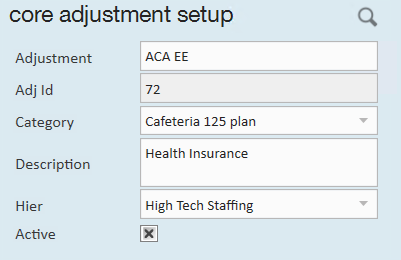

- Navigate to All Options > Administration > Adjustment in Enterprise

- Select the + in the upper right to add a new adjustment

- Name the adjustment

- We highly recommend having the adjustment name include Employer or ER to indicate this is the amount the employer is paying

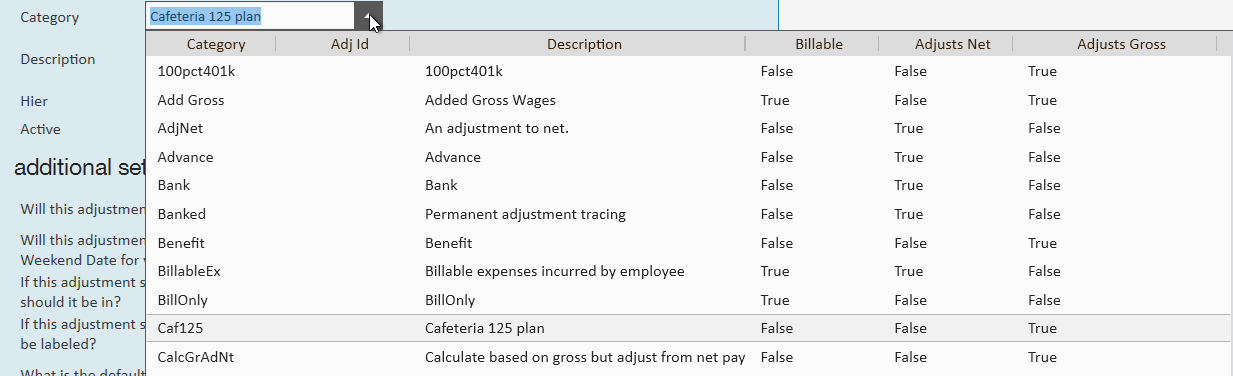

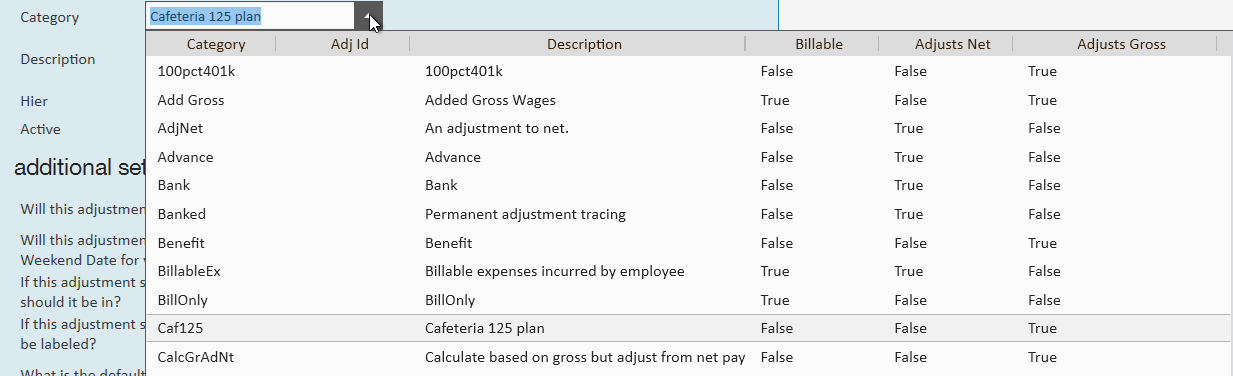

- Select the Category of "Benefit" since this is for an employee benefit

- Optionally, enter a description to help your team know when this adjustment should be used

- Select a Hierarchy under the Hier drop down

- If this adjustment needs to be available to the whole system - select System or SubSystem level

- If you only want this adjustment available to one branch or one EINC make sure to select the branch or entity this should be applicable to

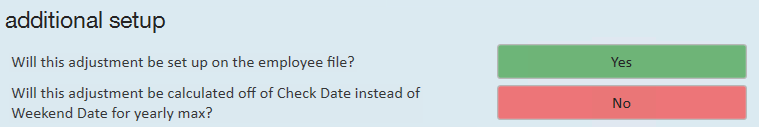

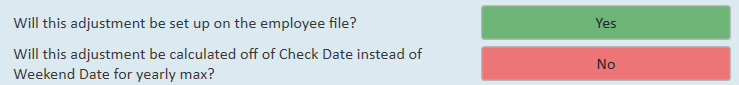

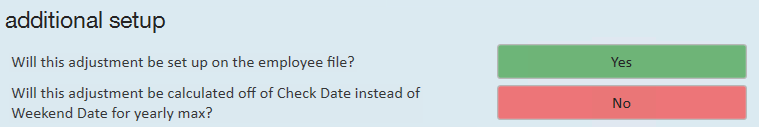

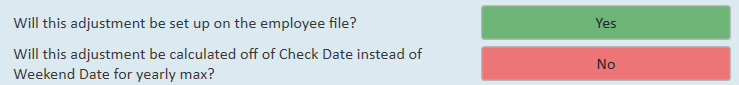

- Select "Yes" to the question "Will this adjustment be set up on the employee file?"

- If you have a yearly max, determine if you want yearly amounts to be calculated based on check date or weekend date

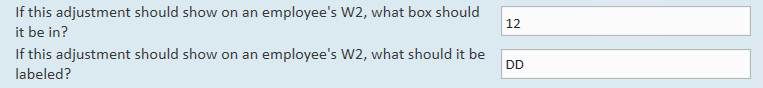

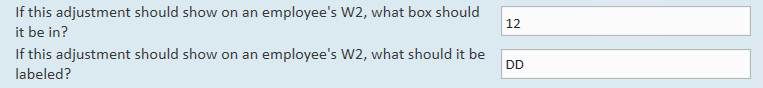

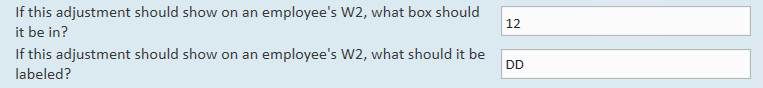

- If this adjustment needs to be added to the employee's W2, enter the box and label it should have

- Not sure? Always check with your tax advisor and benefit provider to make sure this information is entered correctly

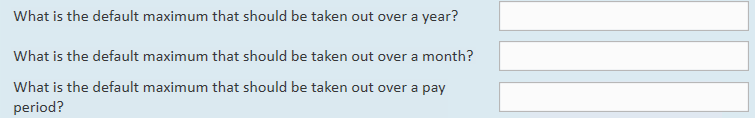

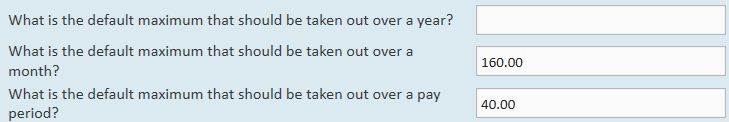

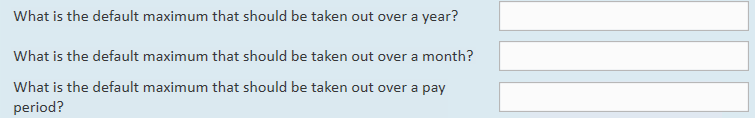

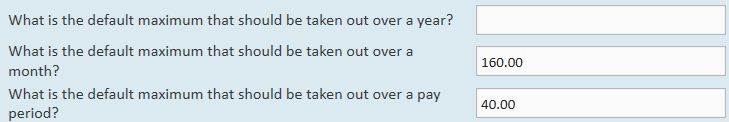

- If there is a default max per pay period, month or year, enter the max in the appropriate box

- Otherwise, leave blank

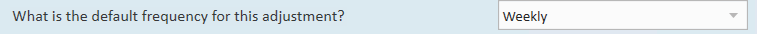

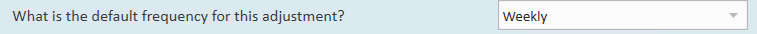

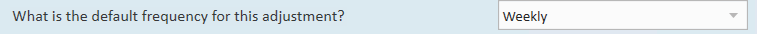

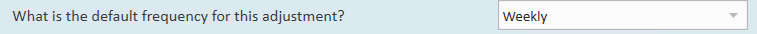

- For the default frequency, this frequency should match how frequently your employee's are paid (usually weekly)

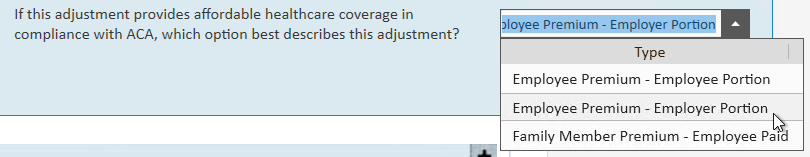

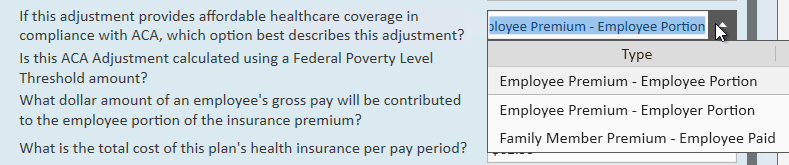

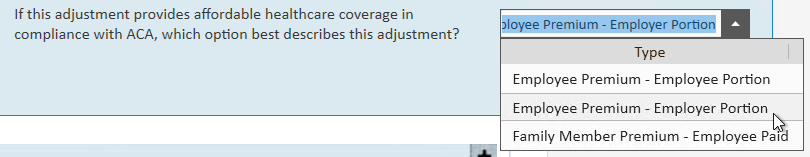

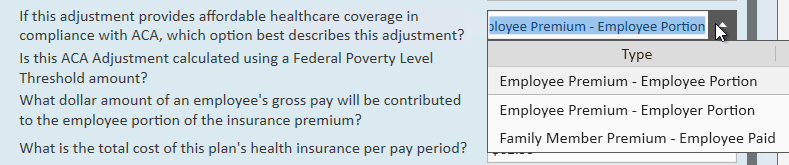

- Since this adjustment is related to affordable healthcare coverage, you will want to select the correct option from the drop down

- In this case, we are setting up the portion paid by the employer, so you can select the "Employee Premium - Employer Portion"

- Select Save in the upper left (CTRL + S)

Setting up Employee Paid Benefit Adjustment

When we talk about an "Employee Paid Benefit Adjustment" we are referring to the adjustment that will be set up on the employee's record to cover the employee's portion of benefit costs which will be paid out each pay period for that employee. This does not include dependents or family members.

We recommend doing this option after you have set up the Employer Paid Adjustment.

- Navigate to All Options > Administration > Adjustment in Enterprise

- Select the + in the upper right to add a new adjustment

- Name the adjustment

- We highly recommend having the adjustment name include Employee or EE to indicate this is the amount the employer is paying

- Select the appropriate adjustment category for this benefit

- Keep in mind Billable/Adjust Net/Adjust Gross categories in the drop down.

- Optionally, enter a description to help your team know when this adjustment should be used

- Select a Hierarchy under the Hier drop down

- If this adjustment needs to be available to the whole system - select System or SubSystem level

- If you only want this adjustment available to one branch or one EINC make sure to select the branch or entity this should be applicable to

- Select "Yes" to the question "Will this adjustment be set up on the employee file?"

- If you have a yearly max, determine if you want yearly amounts to be calculated based on check date or weekend date?

- If this adjustment needs to be added to the employee's W2, enter the box and label it should have

- Not sure? Always check with your tax advisor and benefit provider to make sure this information is entered correctly

- If there is a default max per pay period, month or year, enter the max in the appropriate box

- For the default frequency, this frequency should match how frequently your employees are paid (usually weekly)

- Since this adjustment is related to affordable healthcare coverage, you will want to select the correct option from the drop down

- In this case, we are setting up the portion paid by the employee, so you can select the "Employee Premium - Employee Portion"

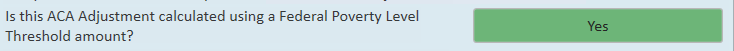

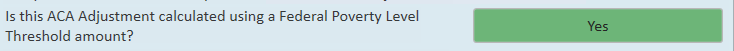

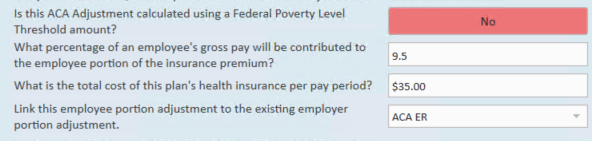

- Select "Yes" if the ACA Adjustment is being calculated based on the Federal Poverty Level Threshold Amount

- Not sure? Check with your Benefit provider

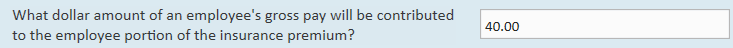

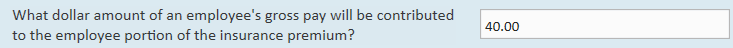

- Enter the dollar amount of the employee's gross pay for the insurance premium

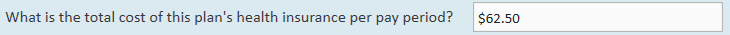

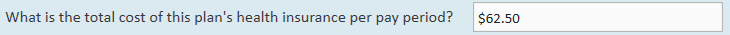

- Enter the total cost of the plan's health insurance per pay period (including employer costs)

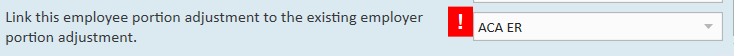

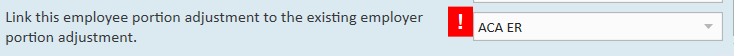

- Select the employer portion adjustment related to this adjustment

- Keep in mind that each employer adjustment can only be linked to one employee portion adjustment

- Employer portions only need to be linked when the employer may cover some the employee's expenses when the total health insurance plan amount exceeds the % the employee can pay.

- Select Save in the upper left (CTRL + S)

Spouse or Dependent Adjustments

Additional adjustments can be created for insurance offered to dependents or spouses. In these cases, there may or may not be an employer paid portion. Follow the same steps as above but this time filling out the adjustment for the additional insurance options.

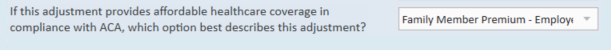

You will want to select the "Family Member Premium - Employee Paid" under the question "If this adjustment provides affordable healthcare coverage in compliance with ACA, which option best describes this adjustment?"

Make sure you do not affiliate these adjustments with an employer paid adjustment if there is no employer paid portion.

Employee/Employer Split Recommendations

If you are having employees and employer costs split, you will want to set up the employee adjustment slightly differently.

Employee Adjustment Differences

Let's say you have a flat amount of $35 that the employee pays normally. What happens when that is over the max % of their total pay that you can take out for benefits? (ex. 9.5%) In this case, you can set up your employee adjustment with a max percentage and max amount:

When the percentage of gross pay is less than $35 the difference will be added to the employer adjustment.

You can still enter the max amounts for the employer (ex. $35 per pay period) but more may be taken out when the employee does not make enough.

ACA Adjustments & Your GL

If you are utilizing a general ledger feed to feed payroll details to your accounting software, you may need to update it now that you have added additional adjustments. Check out Enterprise - GL Journal Entry Export Setup Guide for more details.