During a payroll run, if users attempt to date checks prior to today’s date a backdated check payroll error will be triggered and will read as: “There is a check with a checkdate prior to today's date. Please set the checkdate for either today or a future date.“ What this means is you are about to create a check that may result in tax liabilities and penalties. You should not approve this error. Instead, investigate and work to get the check dated for today or future.

What’s the problem with backdating checks?

Backdating checks can cause significant issues with the reporting of payroll, as well as accuracy of a company’s books and records. Every quarter, Form 941 reports are transmitted to the IRS and the states in which your company operates. Any time a 941 is filed with the federal government, but payroll is subsequently amended, the 941 is no longer accurate, and can lead to significant tax issues. These include audit, as well as an argument by the IRS that the backdating was a tax obstruction violation under IRC § 7212.

In addition, under the law of constructive receipt, employers may be subject to penalties if checks are backdated. These penalties can be substantial.

In sum, for a variety of reasons, the backdating of checks presents a myriad of risks to an employer and is a practice that should be avoided.

Why do people want to backdate checks?

It’s ironic that people backdate checks because they want clean data when ultimately it creates bad data isn’t it? Yes, it is. It’s an easy trap to fall into, and we've shared some common reasons people feel the need to backdate checks and how to avoid such traps.

SCENARIO 1: This employee is no longer working for us but turned in a timecard from weeks ago. I don’t want to report the wages for this quarter!

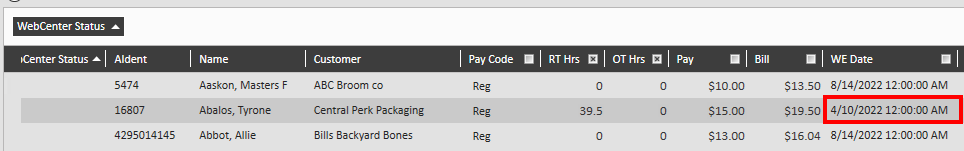

The good news here is we can report when the hours were worked through use of the “weekend date” field on the timecard. It is appropriate to backdate the weekend date. Even though the timecard is days, or weeks, or months late at this point the wages are being realized by the employee this week, so it would be inaccurate for the check date to be backdated because the employee isn’t constructively receiving that money until now.

SCENARIO 2: I need to reissue/void this check from a previous quarter, and the new check should be dated for with the original check date.

The only time a reissued check should maintain its original check date from a previous quarter is if using today’s date would create a negative wage situation. If a check correction doesn’t create a negative wage situation, it should be voided for today.

Learn more about using original check dates vs. today's date in the voiding check date validation article.

SCENARIO 3: I had an employee assigned to an incorrect state. I said they worked in state X, but they actually worked in state Y. I need to report those wages belonged to state Y, not X. I need to recreate and backdate the checks to match the originals.

Check corrections do need to happen here, but the checks should not be backdated. Remember, check date is the distribution date of the wages, as defined by the IRS. If the new checks are distributed today, then the check is dated for today. The weekend date or day worked on the new checks should be backdated to match the original. Tax amendments will also need to occur to address the issue of wages being originally reported to the incorrect state.

SCENARIO 4: It’s January 3rd and an employee turned in a timecard from last year! We need to backdate it so that the wages show as last years wages.

Let's break this down into an example. Say that you paid an employee with a live check at the end of the year. For tax purposes, this person must report wages from the live check as constructively received income for that year, even if they did not actually deposit the check until after the new year. Furthermore, if that employee turned in a late timecard this year for hours worked last year, the timecard should have a weekend date (week worked) for last year, but because the money was constructively received by the employee until this year the check date needs to reflect that.

Related Articles

- None