Happy first day of May! 💐

*Note* For all self-hosted clients, as always, ensure you install all updates to give your users the best experience and new features.

The Highlights

Beyond Background Check IntegrationsWe've added the ability to request and check background check statuses straight from the employee record in Beyond making it easier for your recruiters to complete onboarding processes without ever having to leave the system. We currently integrated with PeopleG2. Talk to your TempWorks Account Manager today to get started!

To learn more about our integration check out: | |

COVID UpdatesTo continue to help provide easy tools for tracking COVID-19 related credits and deferrals, we've added some new proofing/payroll errors and report options to help you:

|

Additional Updates

In Beyond

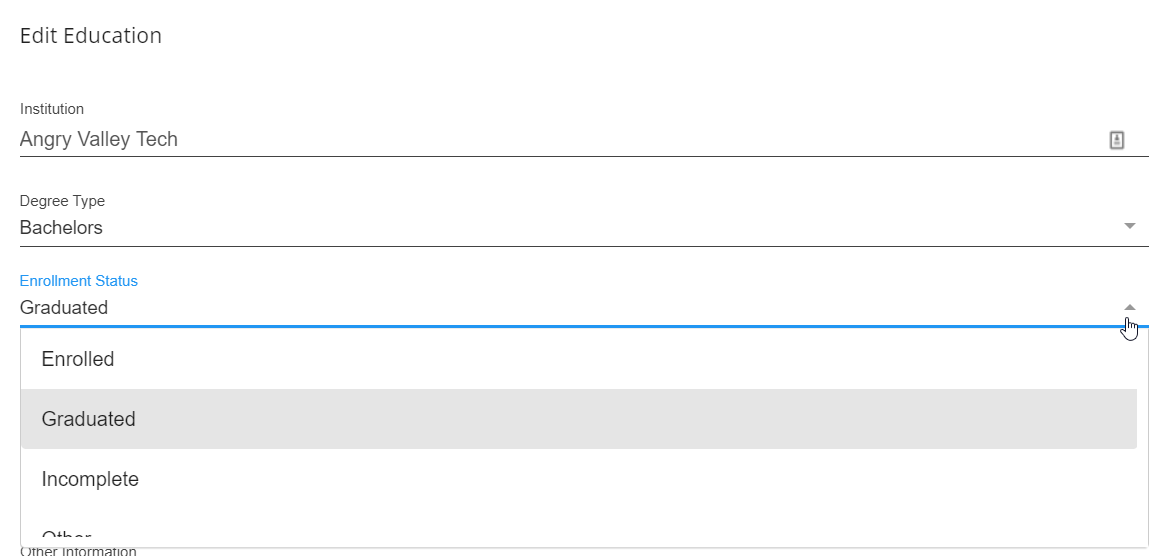

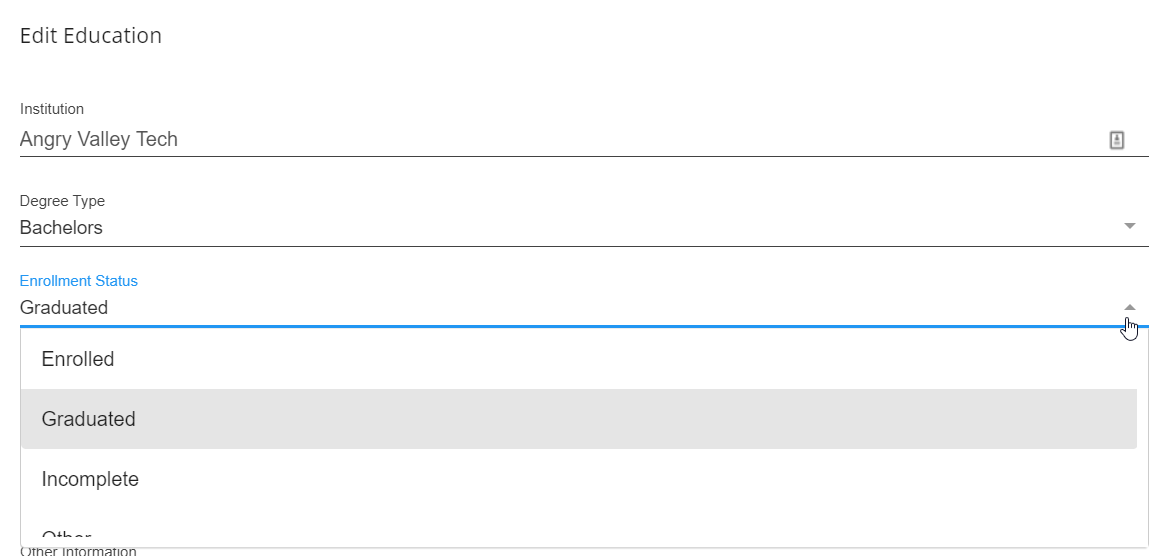

- A few small changes have been made to the education details under the Employee Story Tab:

- The field "Degree Awarded" has been changed to "Degree Type"

- A new field has been added called "Enrollment Status" which allows you to select whether they are Enrolled, Graduated, Incomplete, or Other

- The education address can now be configured to have optional or required address standardization. Check out Beyond - Address Standardization for more information.

In Enterprise:

- In accordance with the new updates for the CA Department of Child Support Services (DCSS), we have created a new export to work with their new ExpertPay system. This export will pull all the related electronic payment child support payments into a file separate from your regular ACH file. Check out Expert Pay Export for more information.

Tax Updates:

- Added 1% sales tax option in Williamstown, WV. Want to learn more about sales tax? Check out How to Set Up Sales Tax on a Customer.

- Updated Sales Tax rates for the state of Hawaii including adding a separate rate for Max Pass-on Rates (MPR) for each sales tax jurisdiction to give you the chance to choose between the state rate and the max pass-on rate. We highly recommend looking at each customer record and worksite to ensure the correct sales tax rates are applied when needed. Check out How to Set Up Sales Tax on a Customer for more information.

- A new standard export was released this week for "MA Paid Family/Medical Leave". This can be found under the Paid Family/Medical Leave category and will display YTD and quarter wages based on EINC. Check out Paid Family/Medical Leave Exports for more information.

Congratulations! You've made it to the end of the release notes. Like what you read? Click the thumbs up below.