What is an Adjustment?

Adjustments are garnishments or reimbursements - essentially, any misc items that change (adjust) an employee's paycheck and/or an invoice. Some adjustments are calculated before or after taxes, billable or not billable, and might be set up in different places in the system.

*Note* To learn more about how adjustments work in your system, please see the following articles:

Before adjustments can be added to an employee, job order, assignment, or timecard; the adjustment must first be added within System Settings.

*Note* Users that belong to a Security Group that contains the "can-administrate" permission will be able to access the System Settings.

For more information on Security Groups, please see the article titled Beyond - Managing Security Groups.

*Note* We recommend navigating to System Level or your highest hierarchy level when adding adjustments in Beyond. You can always select a lower hierarchy in the hierarchy drop down if you do not want to have the adjustment available to the entire system.

This article covers the following:

How to Set Up an Adjustment in Beyond

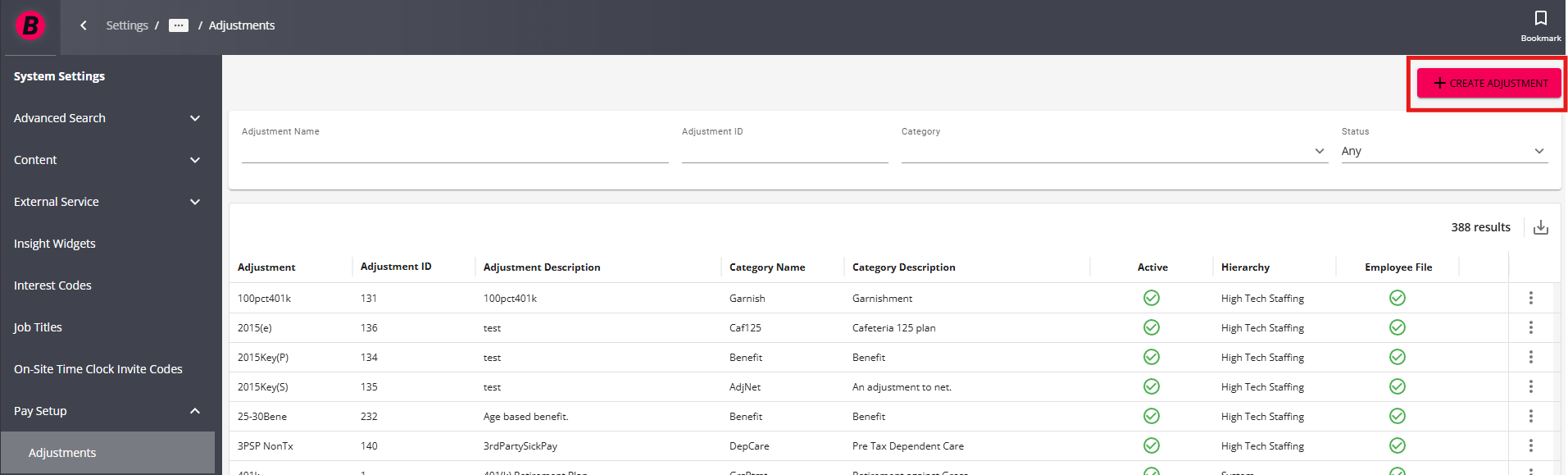

If there is a new adjustment type you need to setup for your users, navigate to B Menu > System Settings > Pay Setup > Adjustments and select "+ Create Adjustment":

This section outlines how to setup the following types of adjustments:

Job Order, Assignment, or Timecard Adjustments

Within the "Create Adjustment" window, you will enter the following information:

- Active: So long as the active check box is selected, the adjustment will display as an option in the adjustment wizard.

- Adjustment: A unique title (10 character limit) to classify the adjustment.

- Category: The foundation of the adjustment itself.

*Note* The category dropdown contains four very important columns:

- Billable

- Adjust Net

- Adjust Gross

- Benefit

When selecting a category from this dropdown, verify that the four columns mentioned match your intentions for this adjustment. Consult with your finance team if you have questions on what category to select.

Common examples include:

| Adjustment Type | Billable? | Adjusts Net | Adjusts Gross | Benefit |

| Child Support | No | True | False | False |

| 401K Employee contribution | No | False | True | False |

| 401K Employer match | No | False | True | True |

| Per Diem | Yes | True | False | False |

- Hierarchy: Determines the reach of the adjustment and where it will be visible in your database. For example, if you are setting up a 401K or insurance adjustment that is specific to the internal staff, consider setting the hierarchy to the staff branch. This way, the adjustment cannot be added to any temporary employees as it will be visible/listed in the dropdown.

- Adjustment Description: A field used to describe and expand on the purpose of the adjustment.

- Set up Adjustment on Employee File: For job order, assignment, or timecard adjustments (one-time or assignment specific adjustments), set the toggle to "No".

*Note* The following are examples of job order, assignment, or timecard adjustments:

- Drug test/background check fee

- Employee uniform fee

- Parking reimbursement

- Mileage reimbursement

- Per Diem reimbursement

- If this adjustment is billed in a region with sales tax, what type of sales tax should be calculated: Answer this if this adjustment is billed (or could be billed) in a region with sales tax.

*Note* If you are unsure whether or not your region has sales tax, and/or what tax type to use, please see a member of your finance department.

Once the information has been entered and verified, select "Submit". The adjustment will now be available to use within your system:

Employee Adjustments

General Setup

Within the "Create Adjustment" window, you will enter the following information:

- Active: So long as the active check box is selected, the adjustment will display as an option in the adjustment wizard.

- Adjustment: A unique title (10 character limit) to classify the adjustment.

- Category: The foundation of the adjustment itself.

*Note* The category dropdown contains four very important columns:

- Billable

- Adjust Net

- Adjust Gross

- Benefit

When selecting a category from this dropdown, verify that the four columns mentioned match your intentions for this adjustment. Consult with your finance team if you have questions on what category to select.

Common examples include:

| Adjustment Type | Billable? | Adjusts Net | Adjusts Gross | Benefit |

| Child Support | No | True | False | False |

| 401K Employee contribution | No | False | True | False |

| 401K Employer match | No | False | True | True |

| Per Diem | Yes | True | False | False |

- Hierarchy: Determines the reach of the adjustment and where it will be visible in your database. For example, if you are setting up a 401K or insurance adjustment that is specific to the internal staff, consider setting the hierarchy to the staff branch. This way, the adjustment cannot be added to any temporary employees as it will be visible/listed in the dropdown.

- Adjustment Description: A field used to describe and expand on the purpose of the adjustment.

- Set up Adjustment on Employee File: For employee adjustments (reoccurring adjustments not tied to a specific job), set the toggle to "Yes".

*Note* The following are examples of employee adjustments, in which, the toggle will be set to "Yes":

- Secondary direct deposit

- Child support

- Federal levy

- 401K contributions

- Generic wage garnishments

- ACA adjustments

*Note* In the event "Yes" is selected, you will be provided with an additional question:

- If this adjustment provides affordable healthcare coverage in compliance with ACA, which option best describes this adjustment?

- If this adjustment is being setup for ACA, it is recommended you begin with the "Employer" portion. If you begin with the "Employee" portion, you will be asked to link the "Employer" portion within the setup process.

For more information on setting up ACA Adjustments within Beyond, please see the article titled Beyond - Setting Up ACA Adjustments.

If the adjustment is not being setup for ACA, this question can be disregarded.

Once the information has been entered and verified, select "Next":

Default Rules (Optional)

If you have a standard adjustment for employees, consider saving setup time by establishing default rules for said adjustment.

For example, perhaps you offer an individual dental plan and when an employee enrolls in this type of plan the cost to them is $7.00, deducted per week. As opposed to configuring this on every employee record, we can define it as a default rule. Thus, whenever the individual dental plan is added as an employee adjustment, the $7.00 rule will automatically attach itself to the adjustment.

Begin by selecting "+ Add Rule":

This will open the "New Default Rule" card. Following our example, $7.00 is added as the weekly deduction amount:

With the deduction amount now defined, whenever this adjustment is added on an employee record the default rule amount will automatically attach itself.

At this point you can add additional rules or select "Next" to continue with the setup process:

Finish Setup

You will be asked to answer/complete the following:

- Adjustment is a federal tax levy: Leave the toggle button set to "No" unless you are setting up a federal tax levy adjustment, in which case switch to a "yes" setting.

- Adjustment requires a linked authority: When monies are garnished from this adjustment, does the money need to be sent to another body/agency? Child support is a great example of a time when an authority link should be required.

- Adjustment should collect for missed payments: It is important to remember that adjustments are calculated based on weekend date. In the common case where an employee turns in a late timecard, the system will recognize that the employee's wages have not yet been garnished for that weekend date and will calculate adjustments accordingly. Again, this happens automatically when the toggle button is set to "no".

- Adjustment will be used for a secondary direct deposit: Set this toggle button to "yes" if you are creating a secondary direct deposit (or IRA/Roth IRA adjustment for example). If you leave the adjustments page of the employee record without including a routing and account number (when setting up this type of adjustment on an employee's record), an error message will pop-up warning that this information is missing.

- Adjustment will be calculated off Check Date instead of Weekend Date for yearly max: Leave the toggle button set to "yes" unless you would like the yearly max calculation to be affected by Weekend Date rather than Check Date. The adjustment itself will always pull based on Weekend Date. This toggle is only to determine what the yearly max calculation goes off of.

- W2 Display Box: If, for example, you are creating a healthcare insurance adjustment you would in all likelihood want the benefit and amounts listed in box 12.

- W2 Display Label Name: Should be labeled appropriately based on the adjustment type.

- Yearly Default Maximum Amount: If a default annual maximum is entered here, it will automatically populate into the "Max Yearly" field within the adjustment details on the employee record.

- Monthly Default Maximum Amount: If a default monthly maximum amount is entered here, it will automatically populate into the " Max Monthly" field within the adjustment details of the employee record.

- Pay Period Default Maximum Amount: If a default pay period maximum amount is entered here, it will automatically populate into the "Period Max" field within the adjustment details of the employee record.

- Default Frequency: If a frequency is selected here, it will automatically populate in the frequency dropdown within the adjustment wizard on the employee record.

Once the information has been entered and verified, select "Submit". The adjustment will now be available to use within your system:

Managing Adjustments

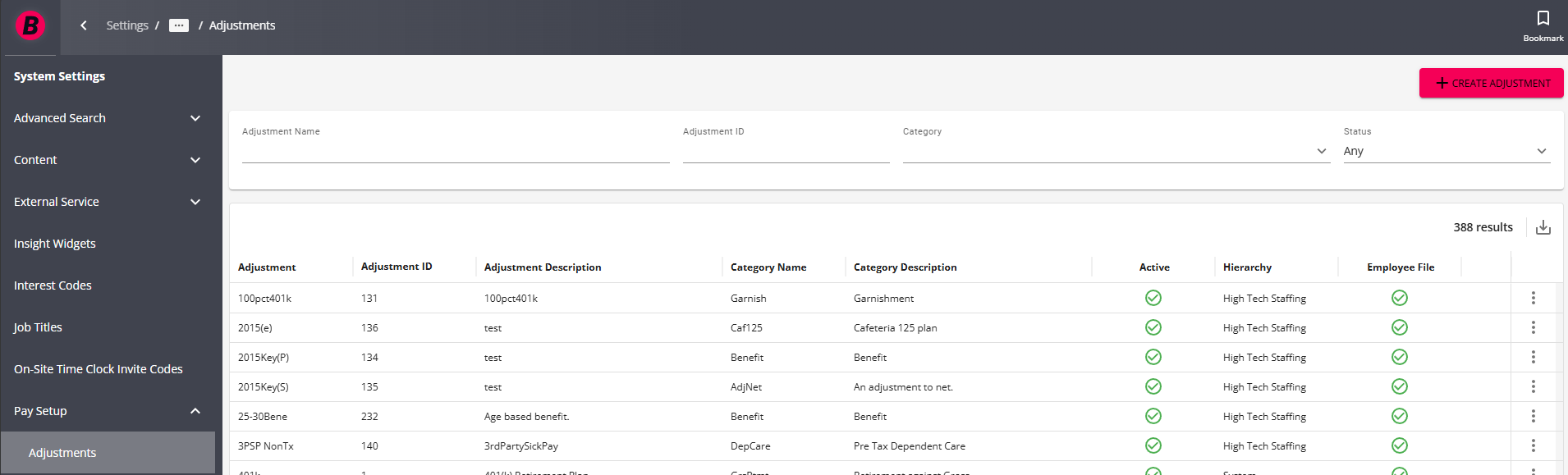

Once the adjustments have been created, you can edit/activate/deactivate them via B Menu > System Settings > Pay Setup > Adjustments:

For adjustments within your allowed hierarchy, you can select the  icon to the right of the adjustment and select one of the following options:

icon to the right of the adjustment and select one of the following options:

- Activate

- Deactivate

- Edit

When editing an adjustment, there are fields that are unable to be edited, including the Category among others:

*Note* For adjustments outside of your allowed hierarchy, selecting the  icon to the right of the adjustment will provide the "View" option.

icon to the right of the adjustment will provide the "View" option.