What is the Dynamic State W-4?

There are a few states that require a specific state version of the W-4 in addition to the federal W-4 form that all employees fill out. The dynamic state W-4 is a default form in HRCenter™ that will automatically assign the correct state W-4, if applicable, based on the employee's address.

*Note* You should always assign the Federal W-4 in addition to the dynamic state W-4 because all employees will need to fill out the federal option for federal tax information in addition to any state W-4.

How it Works

When you assign the dynamic state W-4 form to a new employee, the form will show the applicable state W-4 the employee must fill out if their state is one that requires it.

The state the employee lives is determined by their address.

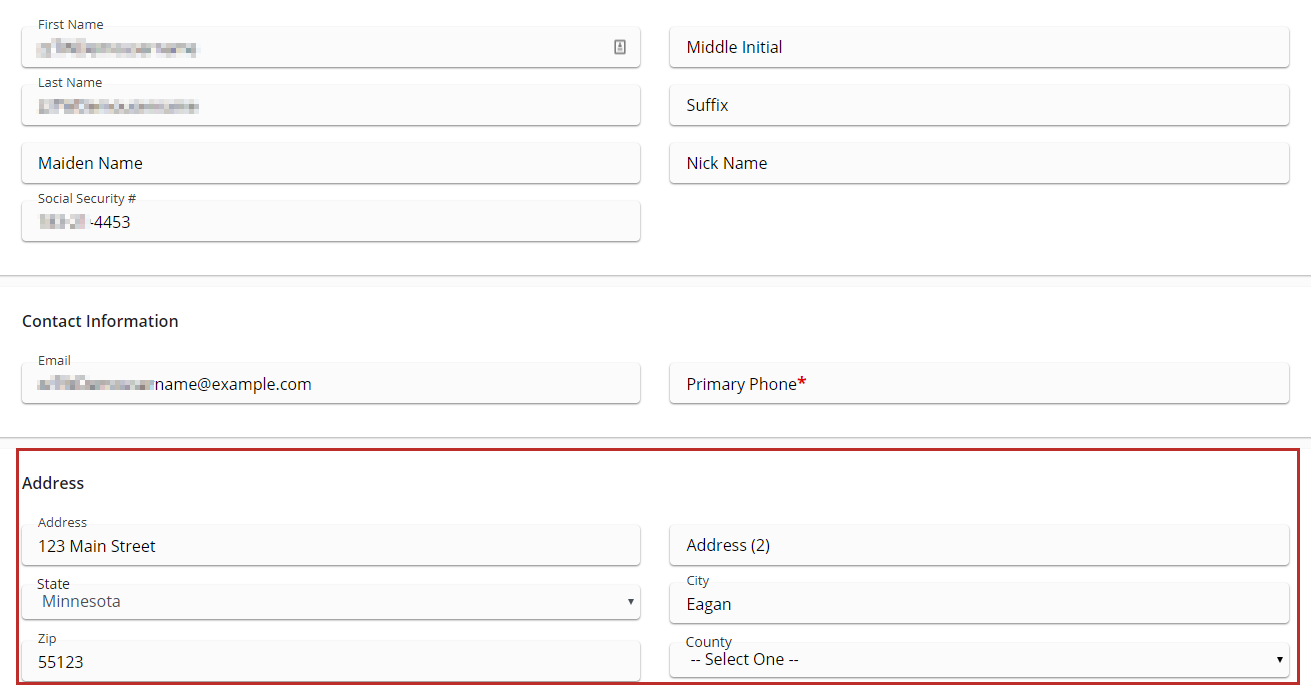

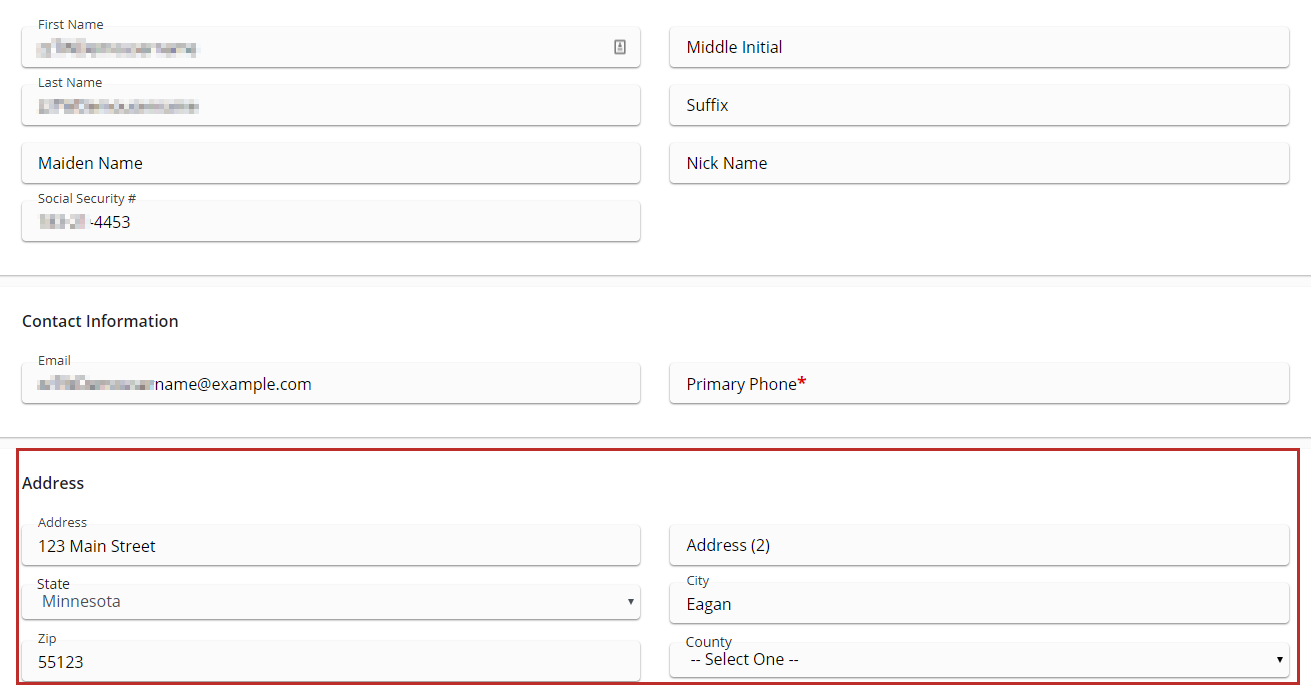

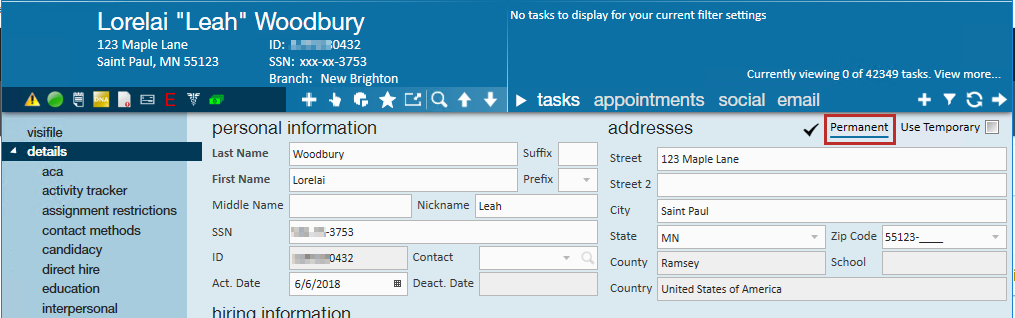

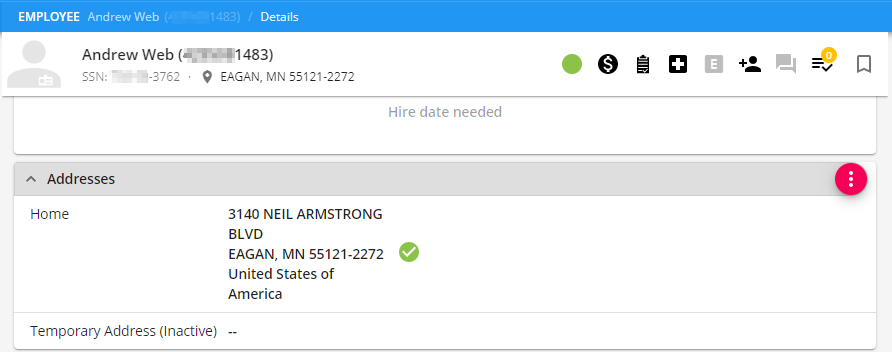

- This can be entered by the employee/applicant on the basic information page:

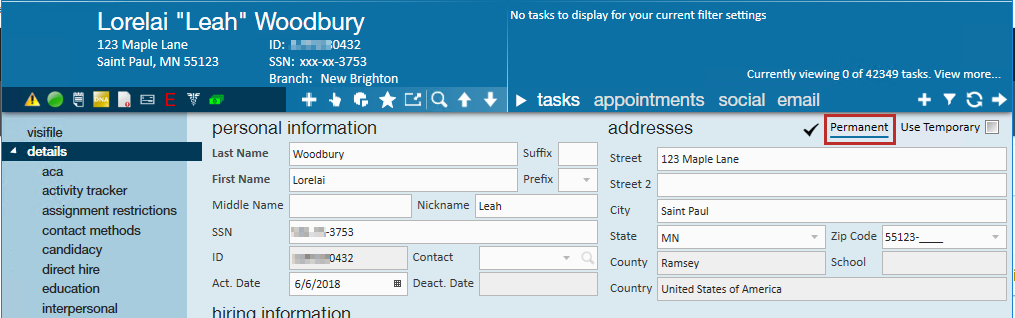

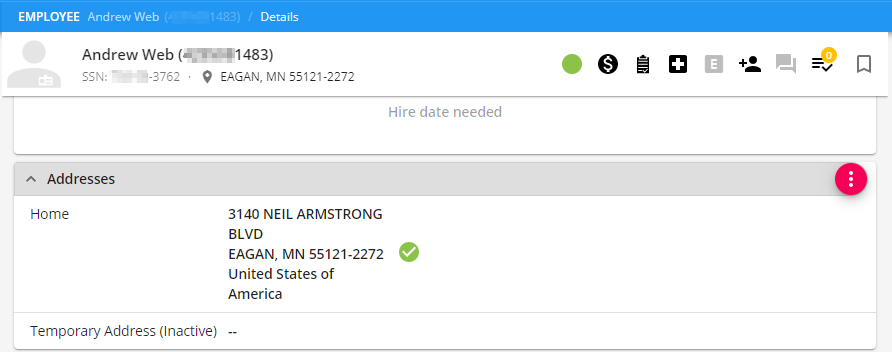

- Entered on their record in Enterprise or Beyond:

If the state listed on their record has a specific state W-4 then the employee will be asked to fill it out in HRCenter. If the employee's state does not have a specific W-4, they will not be shown a W-4 to fill out.

*Note* If your employee does not have an address on file yet, the system will look at the branch address to determine what state they are in. For this reason, we recommend ensuring the employee has their address filled out before assigning the dynamic state W-4.

How to Assign It

This default form page in HRCenter should be assigned when a new employee is about to start their first assignment. We don't recommend throwing it in with the basic application as addresses can be missed, entered incorrectly, or changed during the application process before they find work.

Assign the Federal W-4 & the Dynamic State W-4 default form pages together and if the applicant lives in a state where their is a separate state W-4, it will display for them to fill out. These can either be assigned in an on-boarding workflow or as individual additional pages.

*Note* For more information on creating a workflow, check out How to Create & Edit Workflows.

In Enterprise:

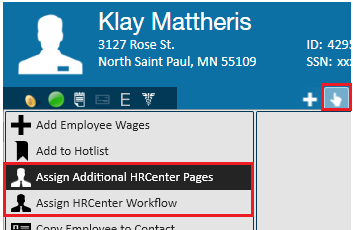

Navigate to the employee's record > select the actions menu > Choose "Assign Additional Workflow" or "Assign Additional HRCenter Pages"

*Note* For more information on assigning within Enterprise, click here.

In Beyond:

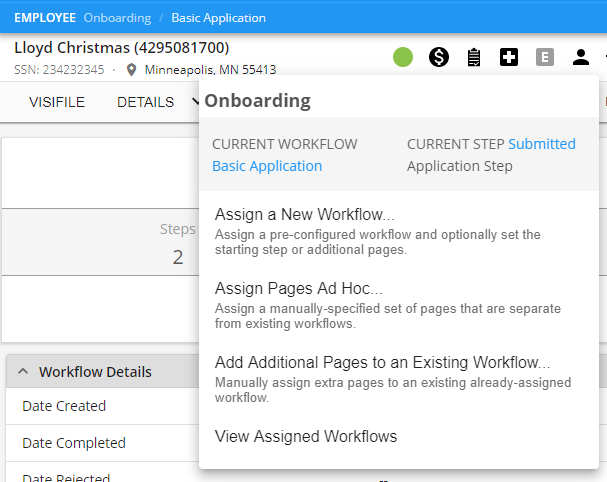

Navigate to the employee's record > select the onboarding charm > Choose "Assign A New Workflow" or "Assign Pages Ad Hoc..."

*Note* For more information on assigning within Beyond, click here.

What Happens Next:

The employee will fill out the Federal W-4 and if applicable, the state W-4. Whichever forms they fill out will be saved on their record under documents and tax information will be saved on the employee record under pay setup > taxes.