Overview

This article will walk through report suggestions for back office payroll and billing related information. For a full list of report options we have available, check out Full Reports Manual.

*Note* You will need the correct Security Role in Enterprise or Security Group permissions in Beyond in order to view these reports. For more information check out Reports & Administrators.

This article includes:

- Time & Pay Reporting

- Profit Analysis

- Tax Reports

- Invoice Related Reporting

- Balancing your AR

Time & Pay Reporting

We recommend the following reports to help keep track of time entered and checks processed in your system.

- Throughout the week, pull the Missing Timecard Report to see what timecards we were expecting to pay this week but have no time entered on them yet

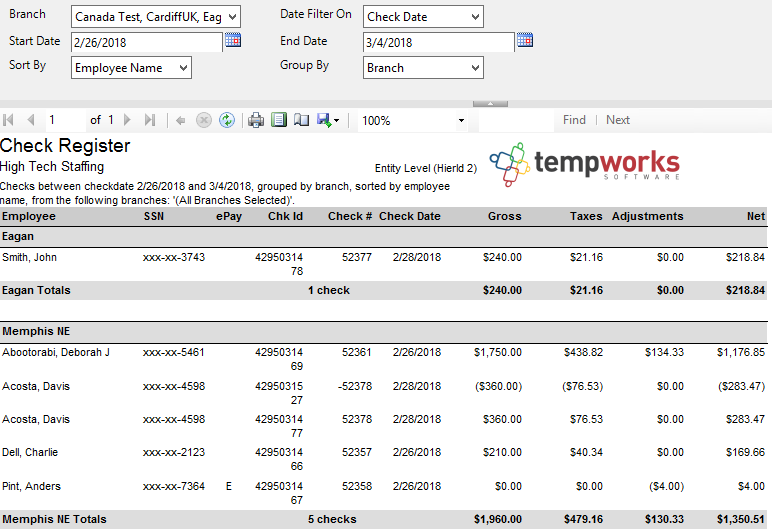

- Check out an overview of all your checks with the Check Register Report

- To balance your ACH file and review your electronic deposits, check out Direct Deposit Register Report

- Double check all electronic payments have been pulled into your ACH files with the ACH Verification Report

- Use the Check Sign Off Report to keep track of which employees have picked up their checks from onsite locations

Profit Analysis

Looking to double check your numbers? Looking to see how sales is doing? Check out the following reports to help keep track of your earnings.

- For an overview of the important numbers, check out the Management Report

- Utilize the Gross Profit Summary Report & Gross Profit Detail Report to review your gross profit amounts

- Check out the Scorecard Report to look at detailed gross profit transactions per sales team or rep

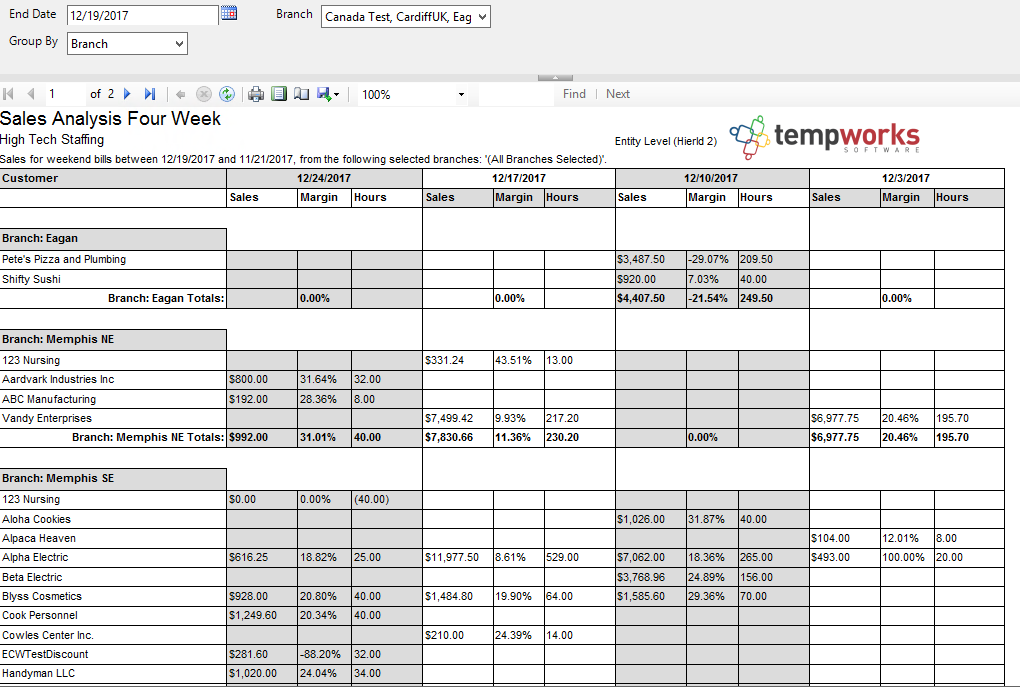

- To see the sales growth over the last 4 weeks, check out the Sales Analysis Four Week Comparison Report

Tax Reports

The following reports are all related to keeping tabs on tax amounts throughout the year. Keep in mind, we recommend always running tax reporting by check date.

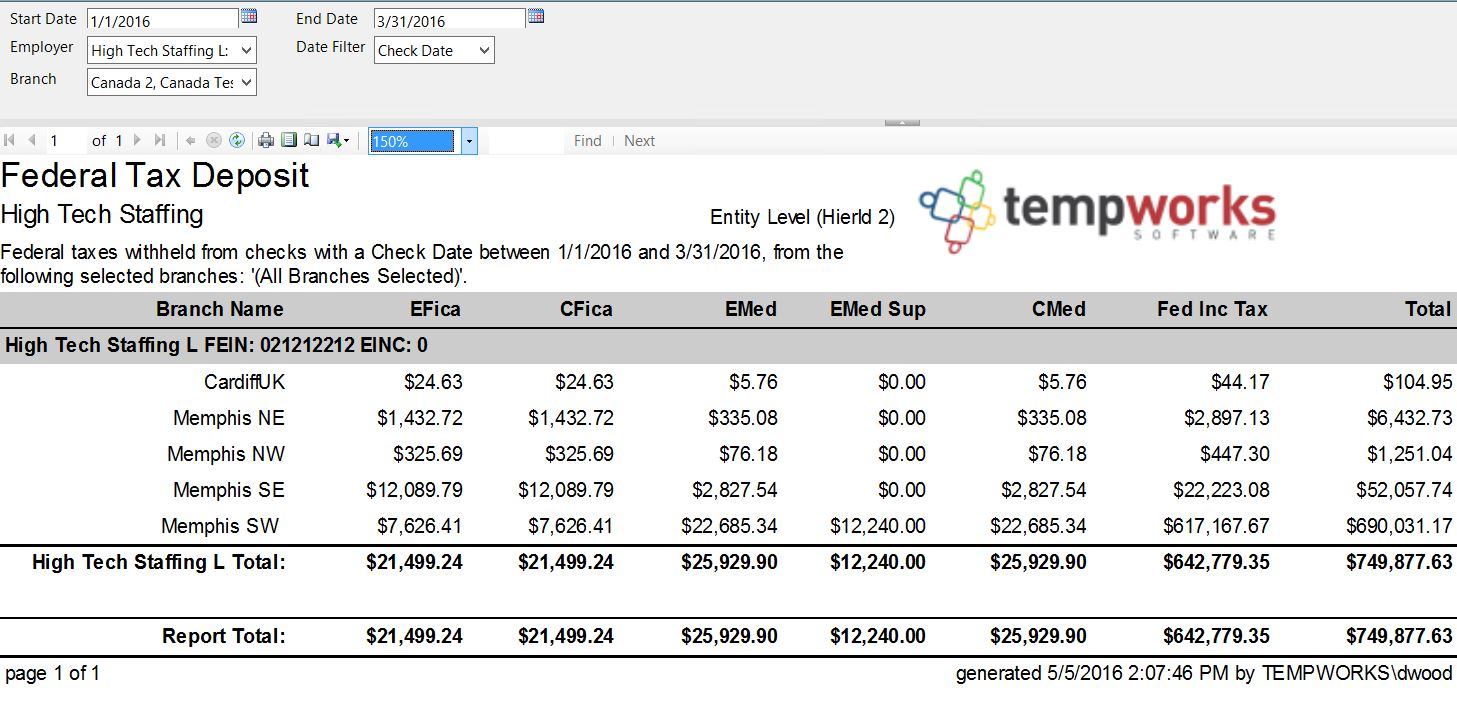

- Use the Tax Deposit Report to take a look at an overview of employee and employer paid taxes

- Check out the Federal Tax Deposit Report & State - Local Tax Deposit for specific tax deposit amounts

- If you live somewhere where sales tax is applicable and have set up sales tax in the system, check out the Sales Tax Deposit

Invoicing Related Reports

Utilize the following reports to keep track of the invoices being processed in your system.

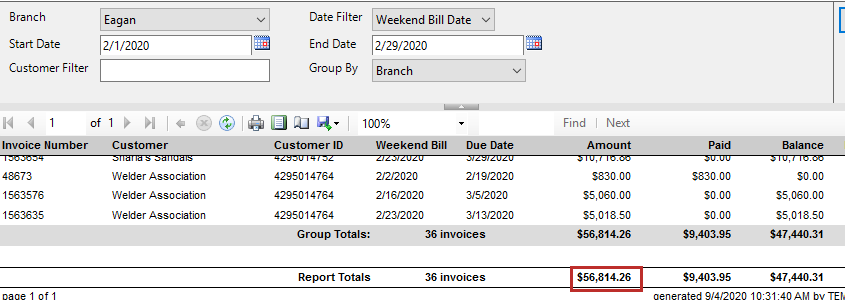

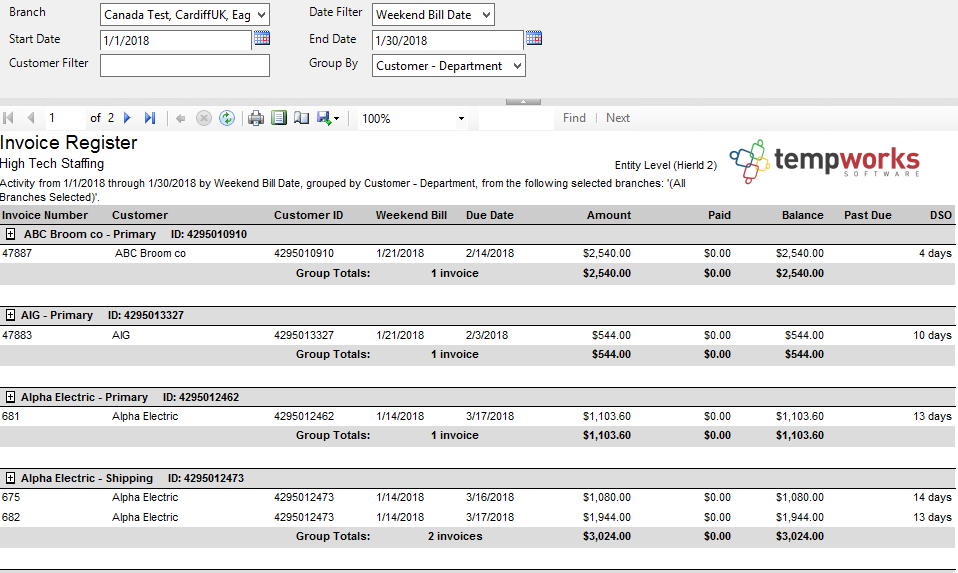

- Check out the Invoice Register Report for an overview of the invoices processed

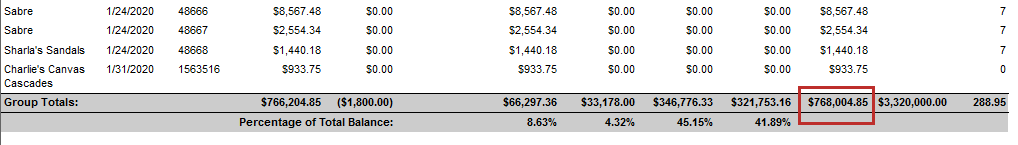

- Use the Invoice Aging Report to check out invoices that still have a balance or credit

Balancing Your AR

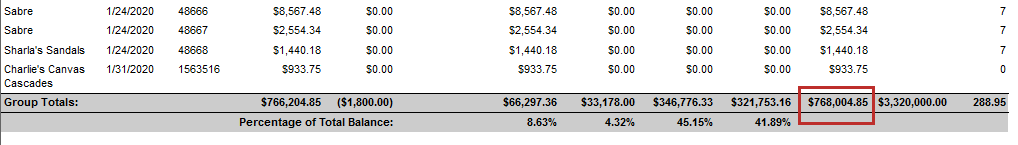

Balancing your accounts receivable can be difficult. Below is an example way to double check your AR balance. Keep in mind that your reports might be customized and work differently than the default example here.

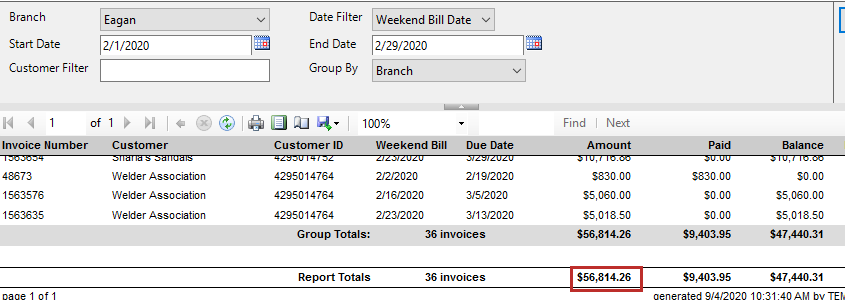

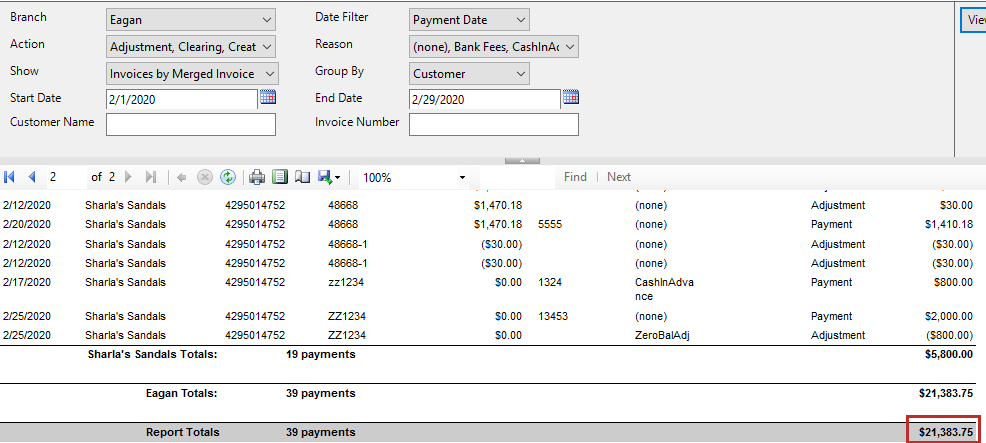

- Run the Invoice Aging Report as of 1/31 and take the ending balance

- Add the total amount from the Invoice Register Report run for 2/1 - 2/29

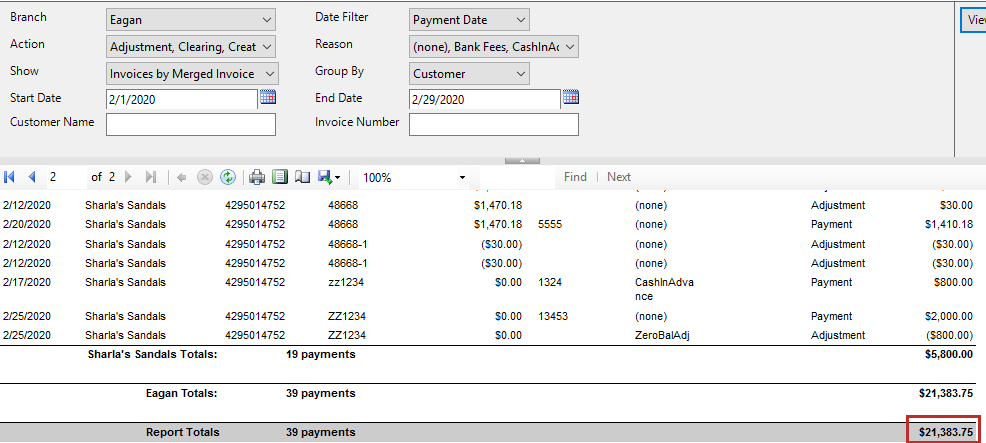

- Subtract the total amount from the Invoice Payments Report run 2/1 - 2/29

- This number should match the final balance on the Invoice Aging Report as of 2/29