Employee benefits often include a variety of programs that employers can choose to offer employees, for example:

- Health Care Insurance (including coverage in accordance with ACA)

- Disability Insurance

- Life Insurance

- 401K/Retirement Plans

In order for benefits to be tracked accurately in Enterprise, two adjustments need to be created in administration - one to document the employer benefit contribution and another to document the employee contribution. In addition, both adjustments must be attached to the employee's record. This article will walk through both pieces.

Part One: Creating Benefit Adjustments in Administration

Step 1: Navigate to the administration section of Enterprise and from the adjustments page, select the + icon to add a new adjustment.

*Note* Only certain users have access to the administration module within Enterprise. If you are not seeing administration from the "all options" list, please see your manager for assistance.

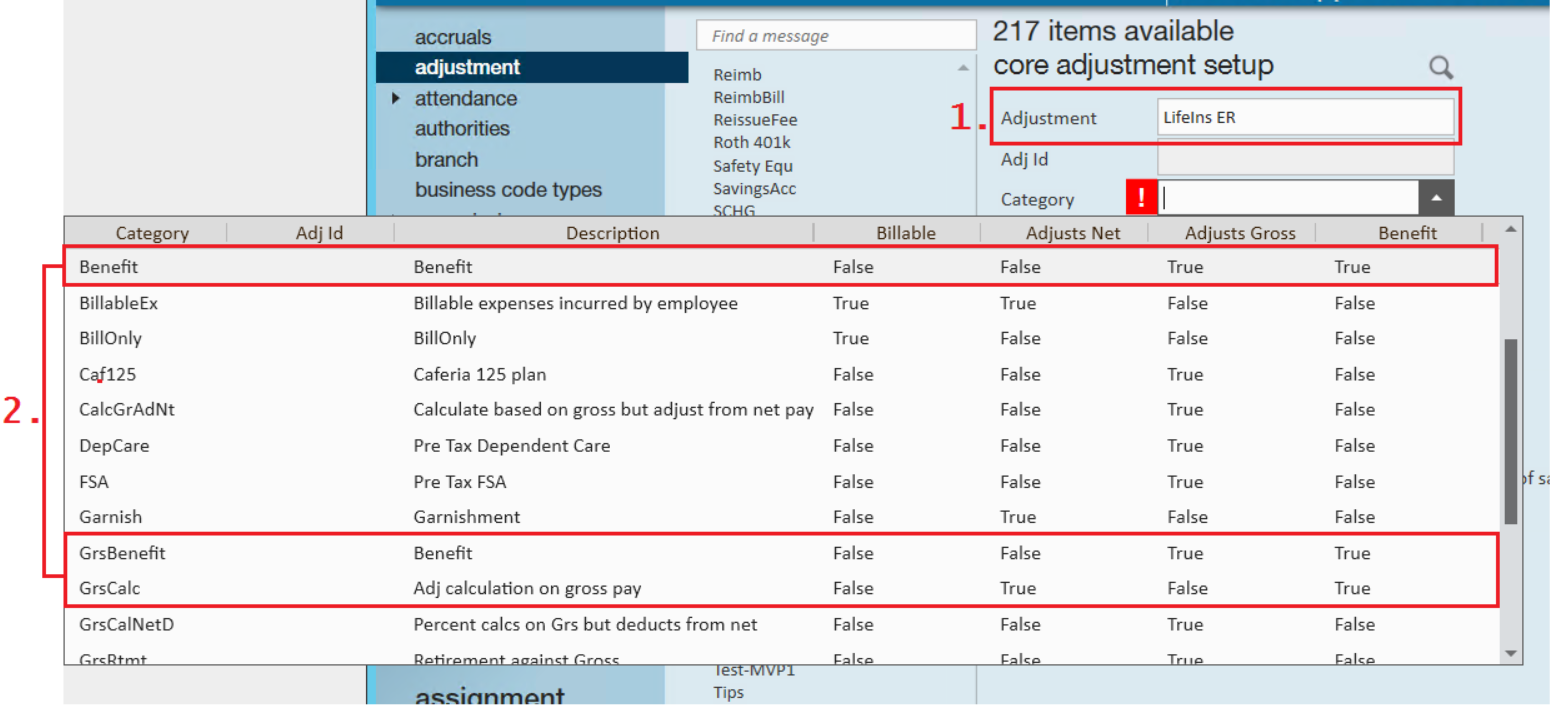

In this example, we'll be adding the employer portion first. Within the core adjustment setup, be sure to select a category that is listed as a benefit and that reflects the correct adjustment type, i.e. if the benefit is pre tax (adjust gross) or post tax (adjust net).

Step 2: Once you have successfully added the first adjustment, select the + icon to create the second adjustment in administration (remember, we need an employer and employee adjustment).

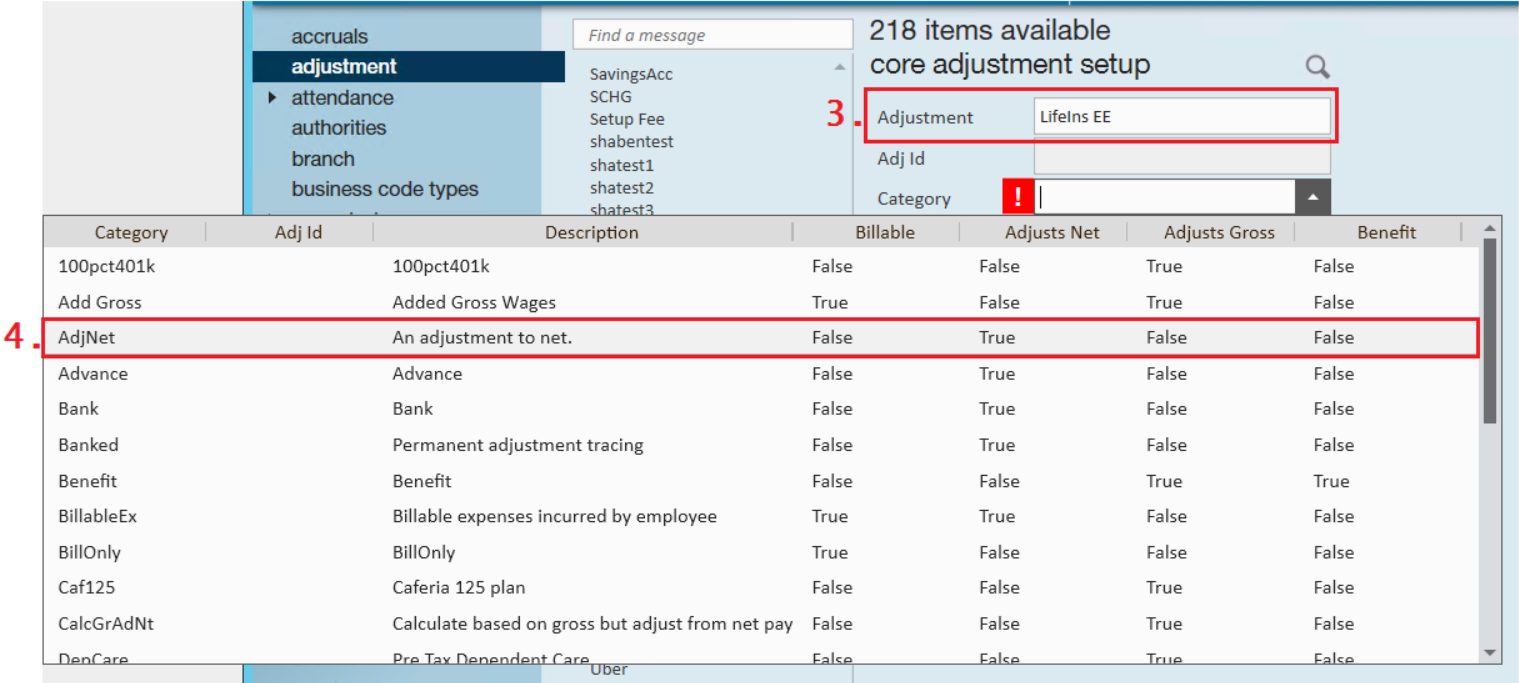

Following our example, we will now add the employee portion and name the adjustment to reflect this. Within the core adjustment setup, be sure to select a category that accurately reflects whether the employee's portion of the contribution is pre tax (adjust gross) or post tax (adjust net). The employee portion should NOT be listed as a benefit.

With the adjustments now created in administration, we are ready to attach them to an employee record.

Part Two: Attaching the Benefit Adjustments to an Employee Record

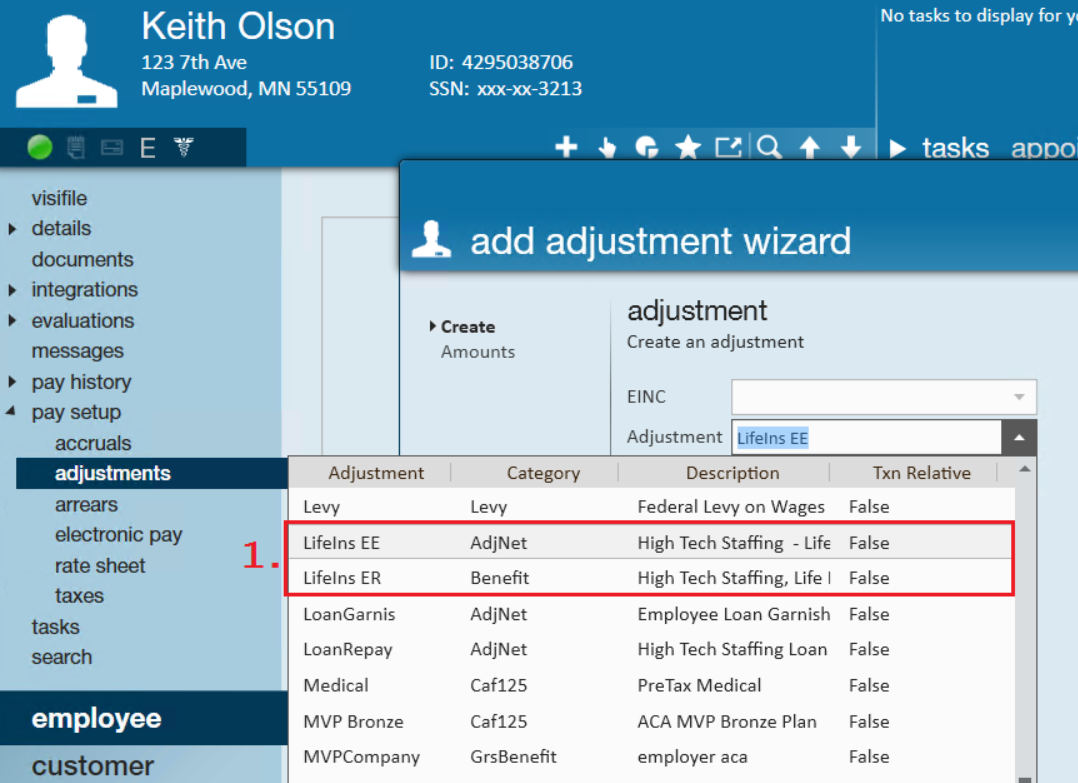

Step 1: Within the adjustments page of the employee record, select the + icon to open the add adjustment wizard. Following our example from above, we will need to attach two adjustments - the employee portion for life insurance and the employer benefit contribution.

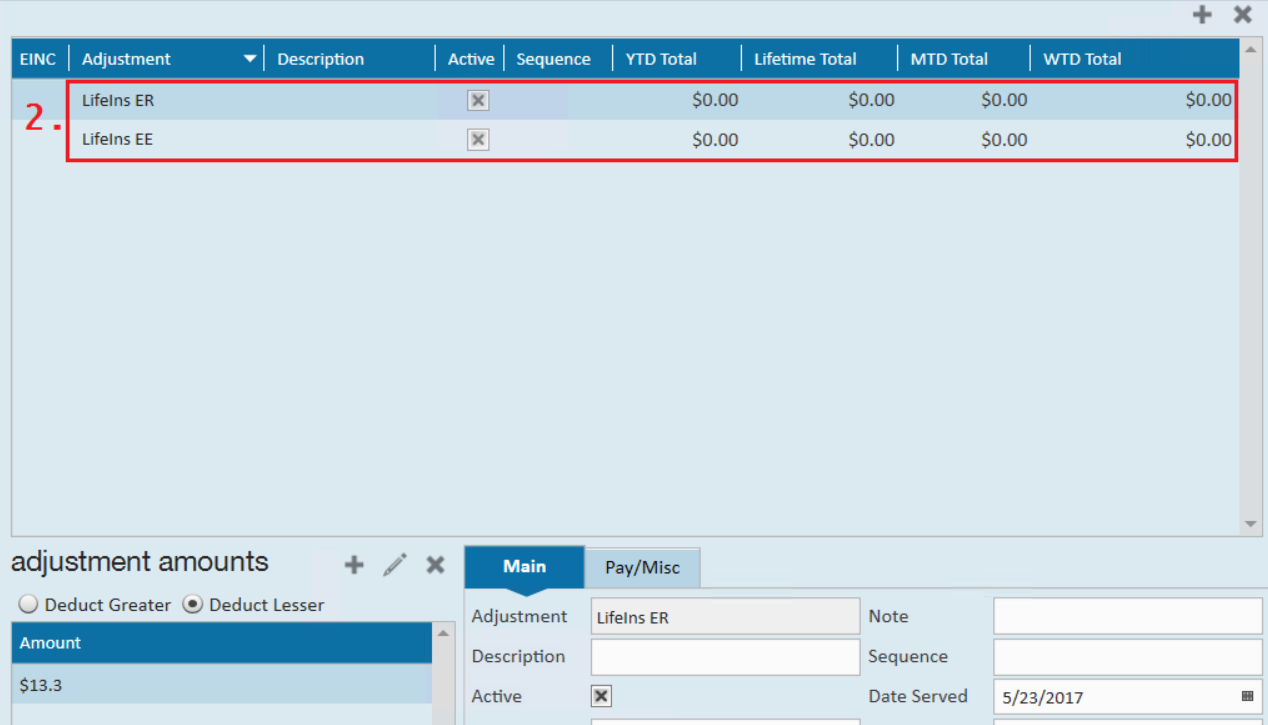

Before moving on, both adjustments should be added and reflected in the employee's adjustment table:

*Note* The employer benefit contribution should be entered as a positive number. In the example below, we have entered LifeIns ER as a $13.30 benefit per pay period for our employee. Enterprise will know to treat this as a benefit so long as the adjustment has been tied to the benefit category (reminder that this is done within administration).

Reviewing Check Details:

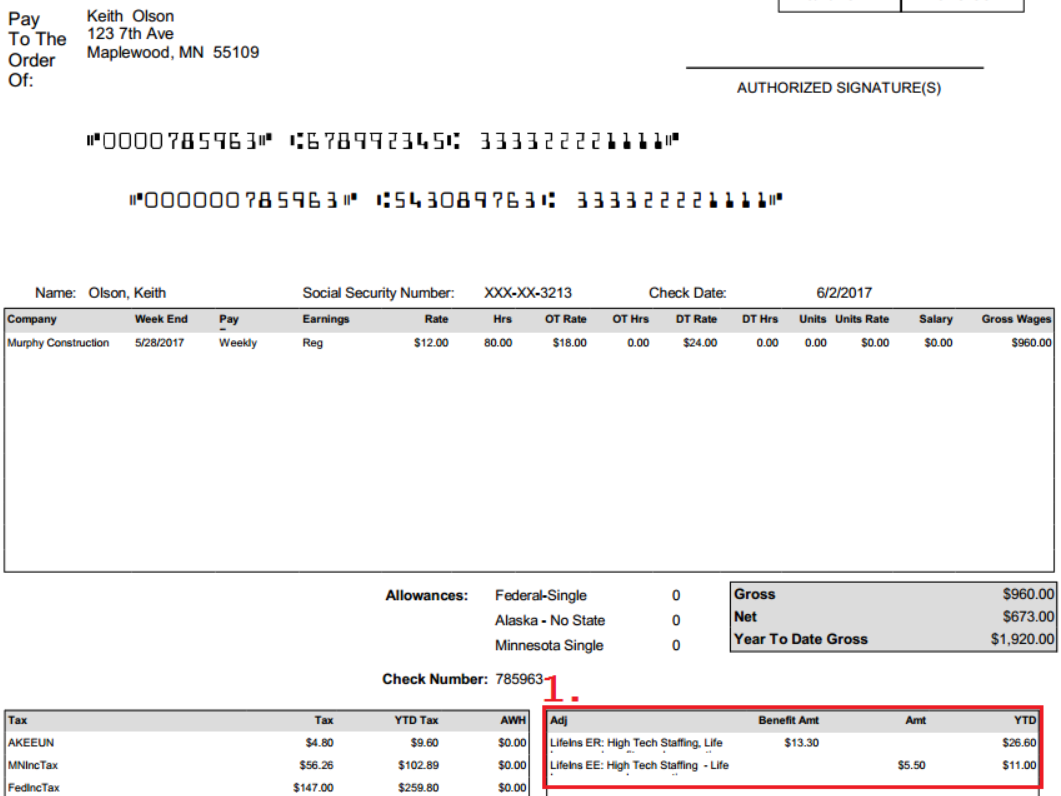

When reviewing a check for our example employee, we see both the (1.) employee contribution and employer benefit listed in the check stub: