This document details the necessary steps to be followed in order to complete the Quarter End Processing in TempWorks Software.

*Note* Review the TempWorks Quarter End calendar, including start and end dates of all Quarter End services, here.

In order to manage the high volume of Quarter End needs in a limited time frame, we ask that clients proactively generate these files well in advance of the deadline. This allows us to ensure we have enough resources allocated to each clients’ need.

Quarter End Hot Days are defined as the 5 business days preceding a quarterly filing deadline and will be billed at an increased hourly rate.

If you have any questions relating to Hot Day rates, please reach out to your TempWorks Account Manager.

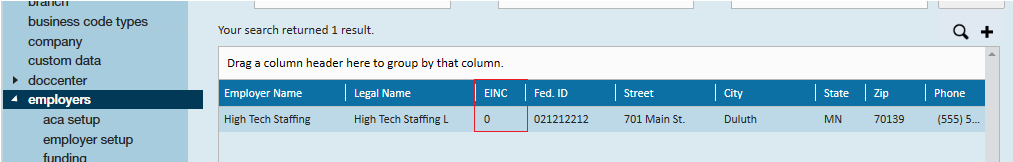

Prior to exporting data for your Mag Media files, if you would like to export separately for different EINCs, you should know your EINCs prior to the export. You'll also want to have the Mag Media details set up.

*Note* This process should be completed at System or Entity level, depending on your company's internal hierarchy and database. If in doubt please contact the TempWorks Support Team.

Navigate to Administration, and Employers to find your EINC:

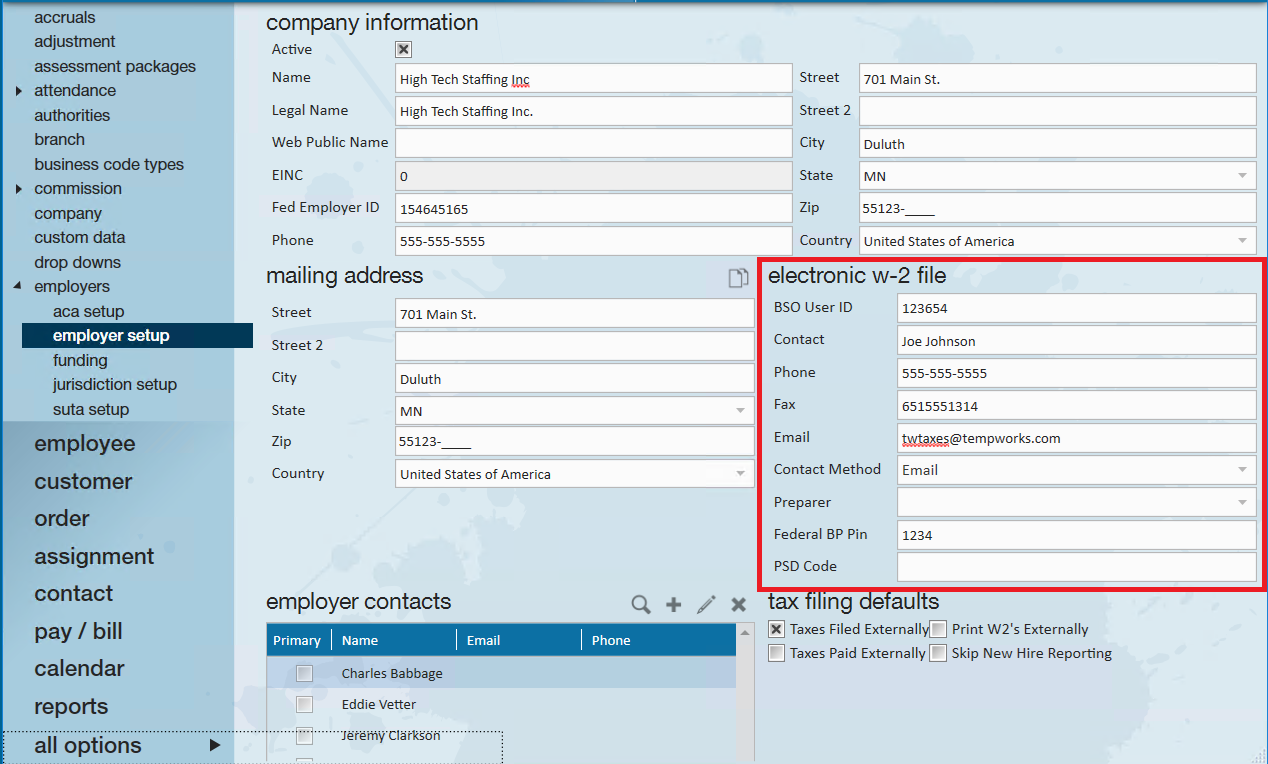

Double-click on the Employer to enter/view the Mag Media information:

*Note* This information should already be set up in your database.

*Note* Prior to Exporting Quarter End data, it is recommended you run the Data Integrity Check found in Step 1 of Year End.

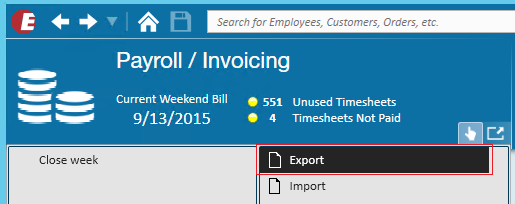

To begin the Quarter End export, from your navigation bar, click on the Pay/Bill section.

Once in the Pay/Bill area, click on the 'Actions' button and select 'Export'.

After clicking on the 'Export' button the export file window will be displayed.

- Select category: Select "Taxes" from this dropdown for Quarter End processing.

- Select procedure: Select "Quarterly Mag Media Files".

- Parameters: Enter the appropriate parameters in the respective fields:

- Year: Enter the desired Year

- Quarter: Enter the desired Quarter: 1, 2, 3 or 4

- Tax State: Enter the 2 character abbreviation for the desired state or leave blank if you would like to export Mag Media files for all states.

*Note* The 'Tax State' field is optional. You can run the exports by state, or, if left blank exports will be produced for all states in which you have done business with this EINC.

- EINC: Enter the EINC Code for the Company you would like to export Mag Media files for.

*Note* The 'EINC' is an optional field, if left blank the Export will include files for all EINCs.

Once all parameters have been entered, click 'Export File' in the bottom right.

This will produce the file(s) for the respective Quarter, EINC, and if indicated, State. Save the file(s) where desired.

Reports:

Within the reports section of Enterprise are the reports which will support the files exported:

Quarter End Mag Media Employee Detail:

This report will display the total amounts per employee that were used in the mag media files for the selected year and quarter.

Quarter End Mag Media Files Summary:

This report will display a summary by Tax State for the selected year and quarter.