What is Reverse Billing?

When voiding or reversing checks in Enterprise, within the check management wizard users will see the option to "reverse billing". When this option is selected, the automatically generated negative transaction (visible in time entry) will be required to go through invoicing. This is how the client is credited for an item that was originally billed incorrectly.

How to Correctly Complete a Reverse Billing

Step 1:

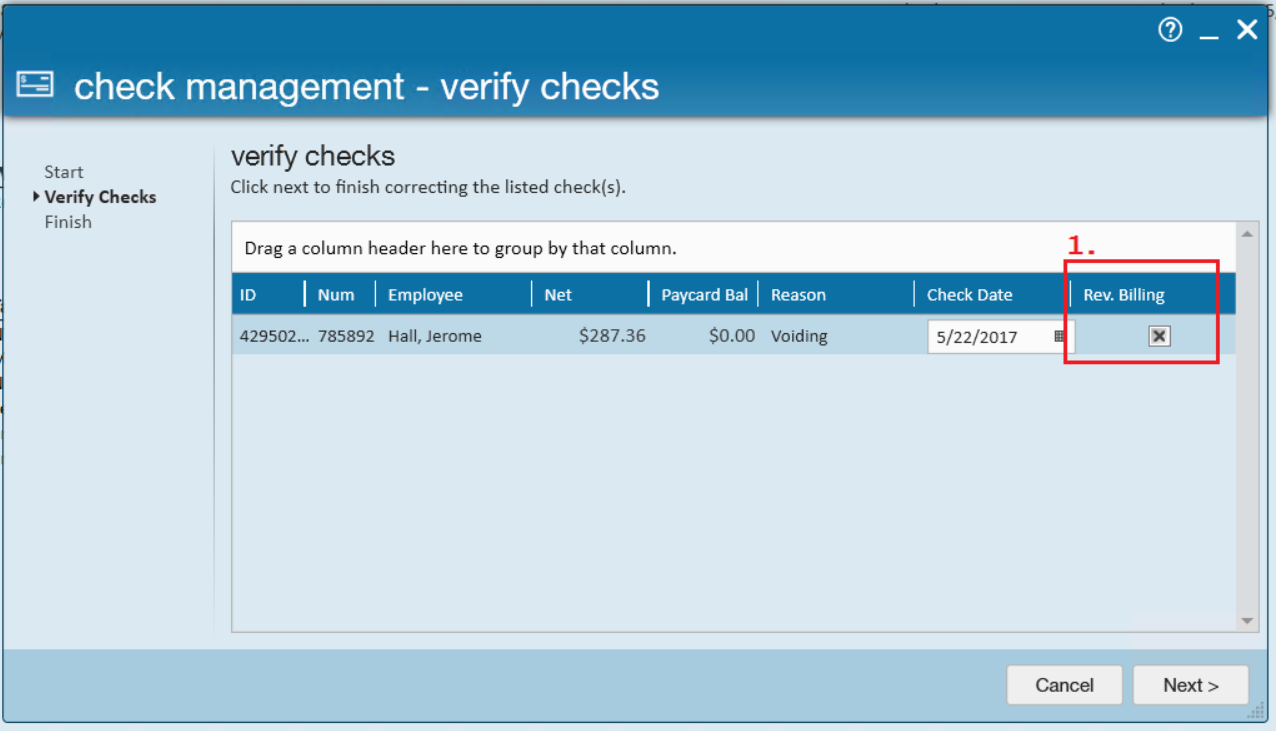

In the check management wizard, select the (1.) reverse billing check box:

Step 2:

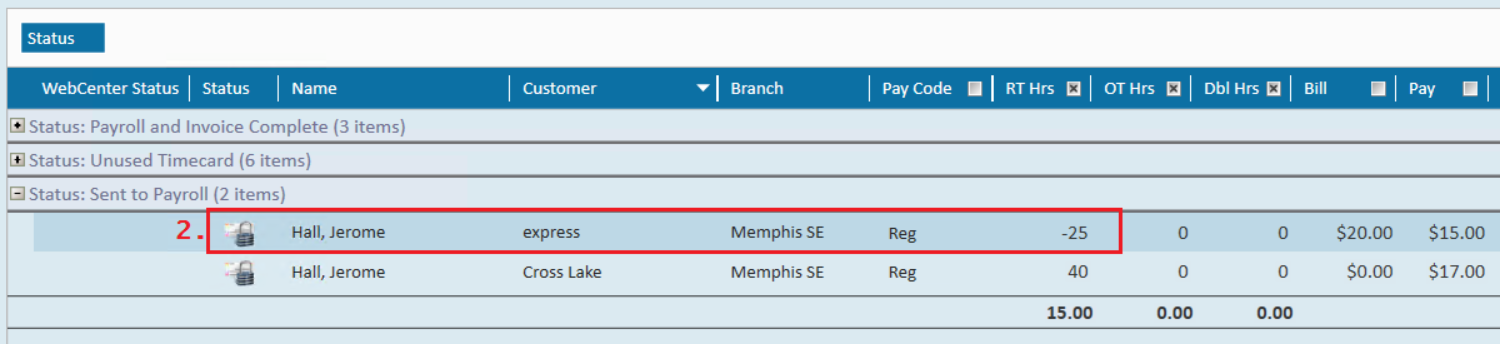

Once the check correction is finished, navigate to time entry to enter in the hours the employee should have been paid. You will see that the negating transaction is listed with the status (2.) "sent to payroll":

Step 3:

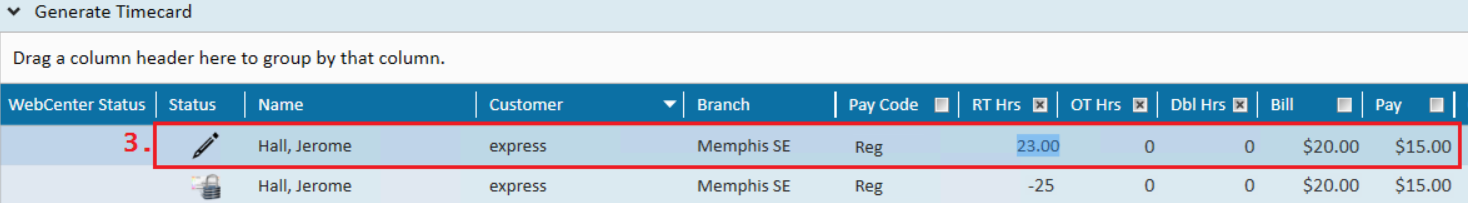

Duplicate the timesheet and (3.) enter the hours the employee was meant to be paid/billed for:

Step 4:

Proof and pay as normal.

Step 5:

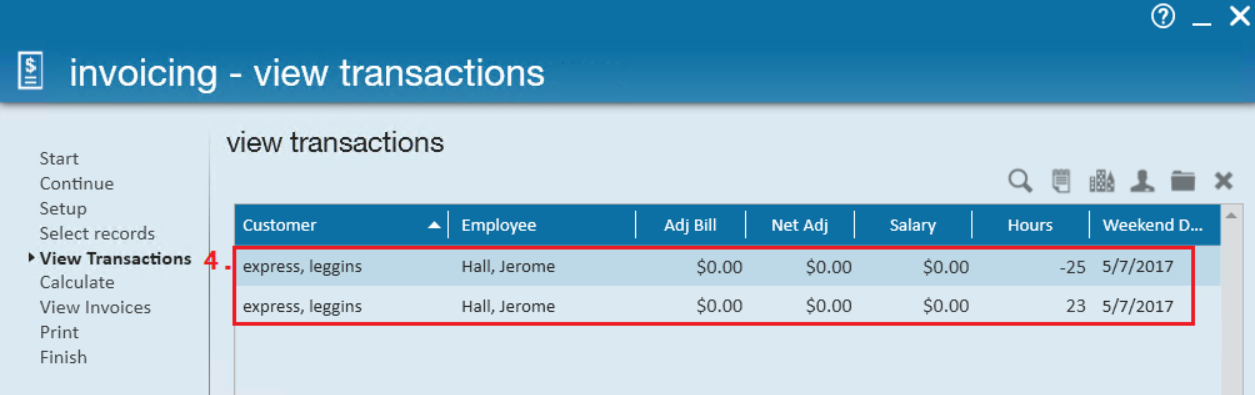

When invoicing the client, note that there are (4.) two transactions related to the check correction that need to be "billed" - the negating transaction and the correcting transaction:

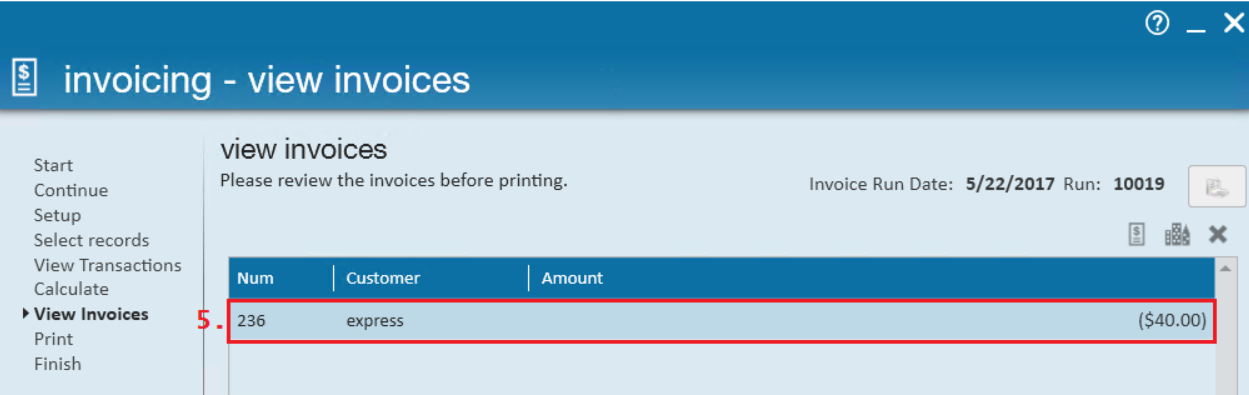

This will then calculate as a (5.) credit:

The credit memo could then be sent separately or merged with the original invoice.