Overview

At the beginning of 2024, specific state accrual plans are changing to accommodate respective law changes.

*Note* If you require mass-inserts for the new accruals on employees currently working within the states outlined within this article, please contact TempWorks Support for assistance.

California

Starting at the beginning of the 2024, California is updating their “Healthy Workplaces, Healthy Families Act” which requires employers in the state of California to offer an accrual plan to employees that work over 30 days in a year.

Administrator Setup

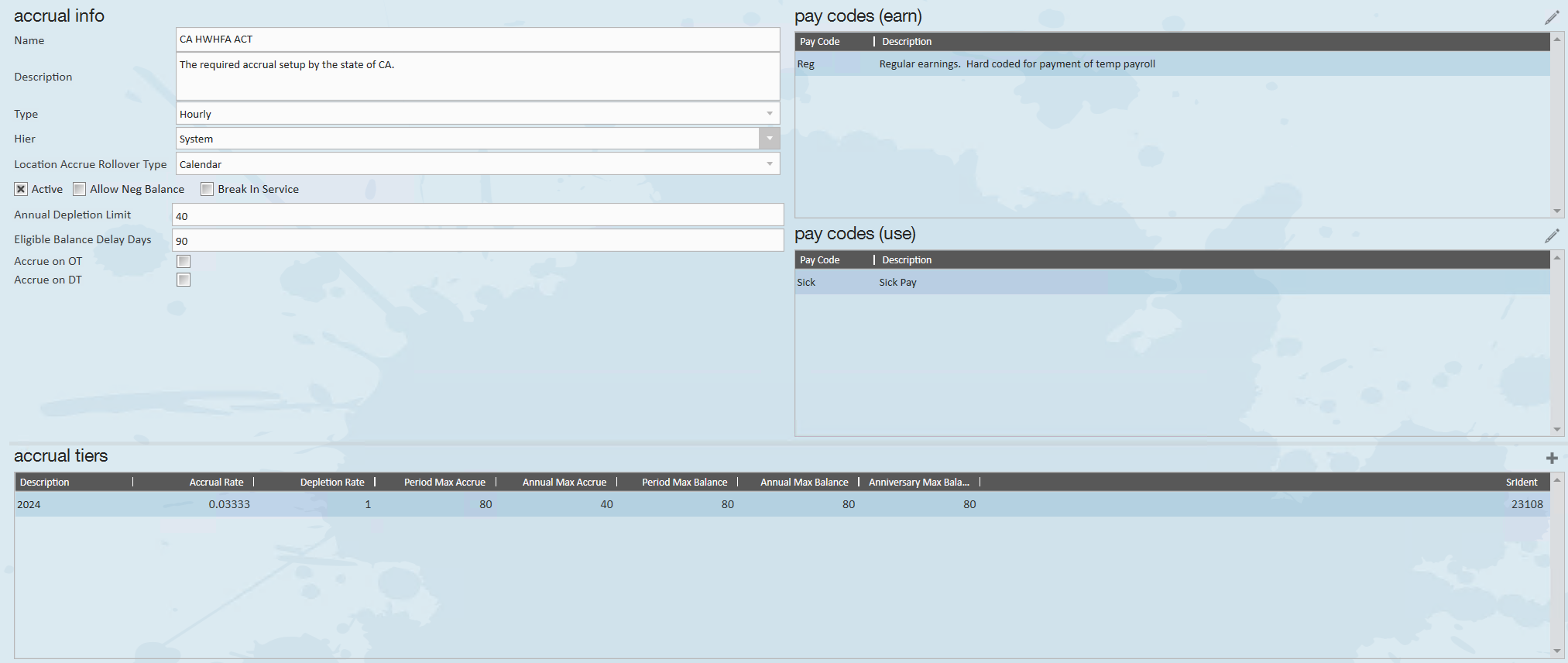

The following changes are being implemented for the California “Healthy Workplaces, Healthy Families Act”:

- Type: Hourly

- Annual Depletion Limit: 40

- Eligible Balance Delay Days: 90

- Accrual Rate: .03333

- This is the typical rate that is used but can be customized to your requirements.

- Depletion Rate: 1

- Period Max Accrue: 80

- As long as the employee can accrue 1 hour for every 30 hours worked, this value can be customized to your requirements.

- Annual Max Accrue: 40

- Period Max Balance: 80

- Annual Max Balance: 80

- Anniversary Max Balance: 80

- Due to not using an “Anniversary” type accrual, this field can be left blank if desired.

The following shows the proper setup for the changes being implemented for 2024:

*Note* When editing/adding this accrual, a new tier for 2024 will need to be added, as shown below.

*Note* For more information on setting up accruals in Enterprise, please see the article titled Accrual Setup in Administration.

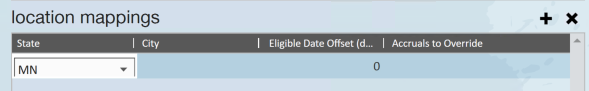

Location Mappings

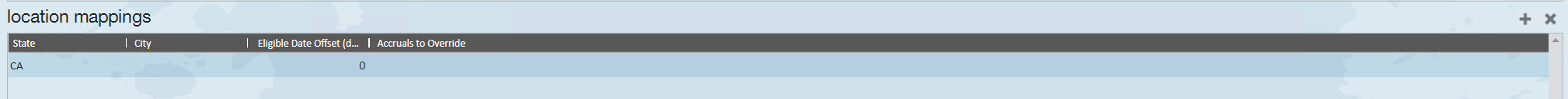

If you prefer, you can add an entry to the “Location Mappings” section of the accrual setup.

By only setting the state to CA (leaving "City" blank and "Eligible Date Offset" as "0"), the accrual will automatically apply to employees that work in the state of California (based on worksite).

*Note* For more information on location-based accruals, please see the article titled Multiple Location-Based Accruals.

Illinois

The Illinois Paid Leave All Workers Act will take effect on January 1st, 2024, and enacts a state specific accrual that grants 40 hours of PTO to all employees working in IL with an accrual effective date of 1/1/2024 or their start date following 1/1/2024. If you have employees working within Illinois, you will need to set up a specific accrual for Illinois with the amount to accrue per hour.

*Note* For more information on setting up accruals in Enterprise, please see the article titled Accrual Setup in Administration.

Location Mappings

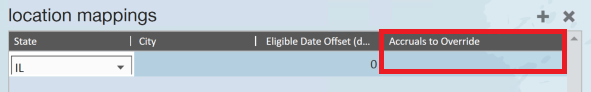

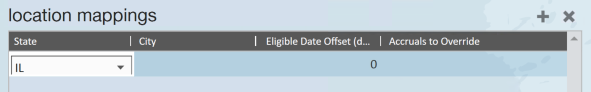

Due to these accruals being location specific, you will want to ensure to update the location mappings on the new accrual, so this only applies to employees working in IL.

*Note* Because Chicago and Cook County have similar accruals, you will also likely need to set up overrides so that employees do not have accruals for both state and city (if they are assigned in Chicago/Cook County).

By only setting the state to IL (leaving "City" blank and "Eligible Date Offset" as "0"), the accrual will automatically apply to employees that work in the state of Illinois (based on worksite).

*Note* For more information on location-based accruals, please see the article titled Multiple Location-Based Accruals.

Minnesota

Effective January 1st, 2024, Minnesota’s earned sick and safe time law requires employers to provide paid leave to employees who work in the state. An employee working in MN earns one hour of sick and safe time for every 30 hours worked and can earn a maximum of 48 hours each year unless the employer agrees to a higher amount. MN clients will need to set up a specific accrual for Minnesota with the amount to accrue per hour (instructions linked here).

*Note* For more information on setting up accruals in Enterprise, please see the article titled Accrual Setup in Administration.

Location Mappings

Due to these accruals being location specific, you will want to ensure to update the location mappings on the new accrual, so this only applies to employees working in MN.

By only setting the state to MN (leaving "City" blank and "Eligible Date Offset" as "0"), the accrual will automatically apply to employees that work in the state of Minnesota (based on worksite).

*Note* For more information on location-based accruals, please see the article titled Multiple Location-Based Accruals.