When you want to give an employee a bonus, use the following steps to process the bonus pay correctly in Enterprise.

1. Navigate to Time Entry

In Enterprise, Navigate to Pay/Bill > Time Entry. Locate a time sheet for the employee you wish to give a bonus to.

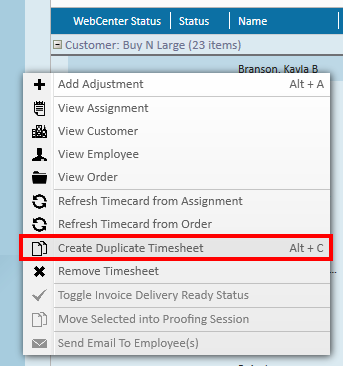

2. Duplicate the Timesheet

Right click and select "Create Duplicate Timesheet"

OR

Select the Time Sheet and press the Duplicate Button.

Trainer Tip: You can also use the keyboard shortcut: Alt + C

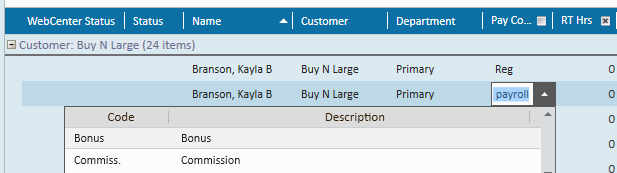

3. Change the Pay Code

On the new time sheet, click on the pay code and select "Bonus" from the drop-down. This ensures that it will be taxed correctly.

*Note* Pay code names may differ slightly in each database. Contact your Administrator or Talk to TempWorks Support if you are unsure which pay code to select.

4. Enter the Bonus Amount

*Note* Not sure about the bonus amount? Use the Gross Up Calculator to calculate a bonus from the desired net rate.

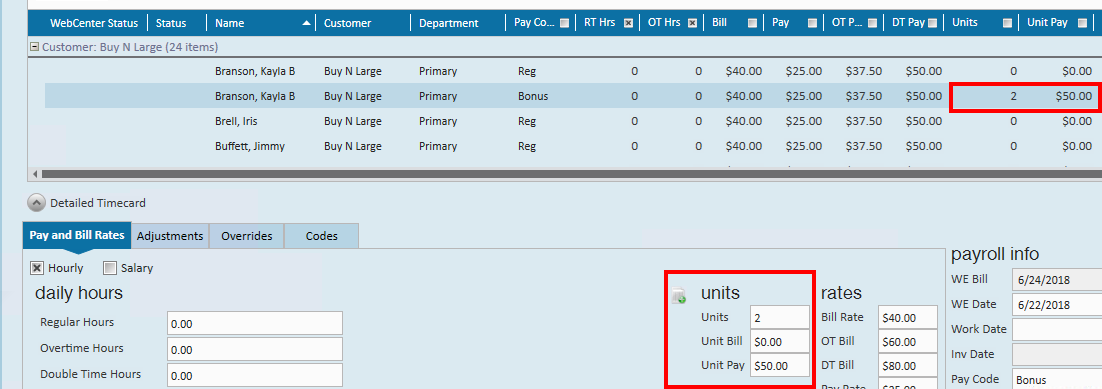

Option A: Enter the bonus using units

This option is ideal for bonuses that are based on amounts and not additional hours or time.

Unit information can be found either in the timesheet line items or by double-clicking on a timesheet to open the detailed timecard.

Enter the unit pay, unit bill (if applicable), and number of units (at least one).

For Example: Let's say the staffing agency gives out a $50 bonus for each employee referral that is hired. This is not billable back to the customer. If an employee earned 2 referral bonuses, then I can denote that by entering 2 units for $50 each with a $0 bill rate.

*Note* you can add notes under payroll notes to say what this bonus is for other payroll processors.

For more information on unit pay see Unit Pay Transactions.

Option B: Enter the bonus using hours

You can also enter bonus pay using the RT hours, bill and pay columns. This option is less common because bonus hours are typically categorized as "Holiday" pay.

- If the bonus is not being billed back to the customer, make sure to set the bill rate to $0.

- Adjust the pay rate, if needed.

- Enter the number of hours.

5. Complete the Payroll Process as Usual

Run the transaction through proofing, payroll, and invoicing (if applicable).