Employee cash tips must be entered separately from other employee hours in order to track and tax them properly.

*Note* Most often the employee already has the money in hand and does not need the total added to their check.

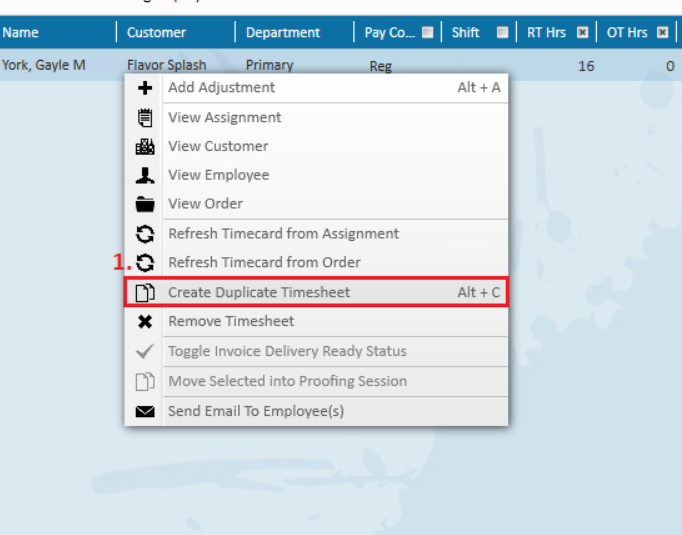

- Within time entry, select the transaction for which you need to enter tips.

- Right-click the selected transaction then select "Create Duplicate Timesheet". (If creating duplicate timesheets is something you need to do often, try the Alt + C keyboard shortcut once the transaction is selected!)

- Double-click the newly created timecard. This will expand the additional details of the timecard.

- Enter the "Units" and "Unit Pay".

- For example, if the employee made $100 in cash tips, enter "1" into the "Units" field and "$100.00" into the "Unit Pay" field. ("Unit Bill" will likely be $0.00.)

- Pay Code as "Tips" - this essentially adds it to the employee's gross wages, meaning the employee will be taxed.

- Note: If you do not see "Tips" as an option in the Pay Code drop-down menu, you will need to contact TempWorks to have this added.

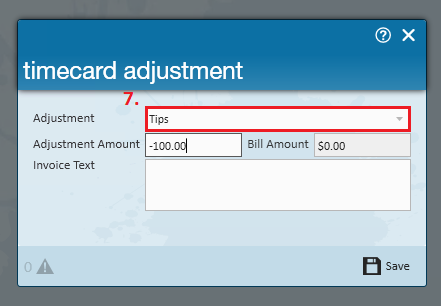

- Next, you'll need to add in an adjustment to reduce the employee's net pay, since in our example the employee already has cash in hand. Once the adjustment is added, the taxes they owe for the tips will come out of the employee's other pay on that check.

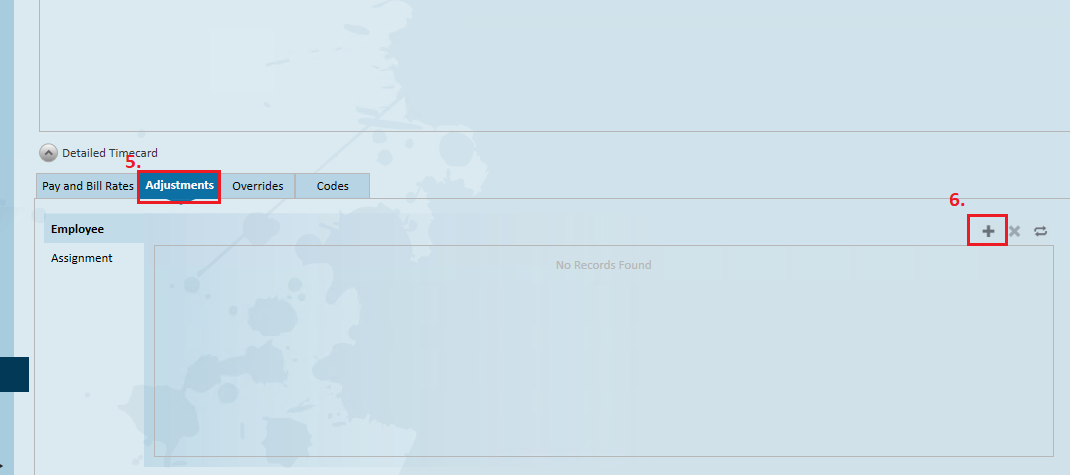

- On the duplicated timecard (the one with the tips added), select the "Adjustments" tab.

- Click the "+" icon to open the timecard adjustment window.

- Select the "Adjustment" drop-down and select "Tips":

*Note* If you don't see "Tips" as an adjustment type, your administrator will need to create it as an adjustment type in administration. See below for important adjustment specifications.

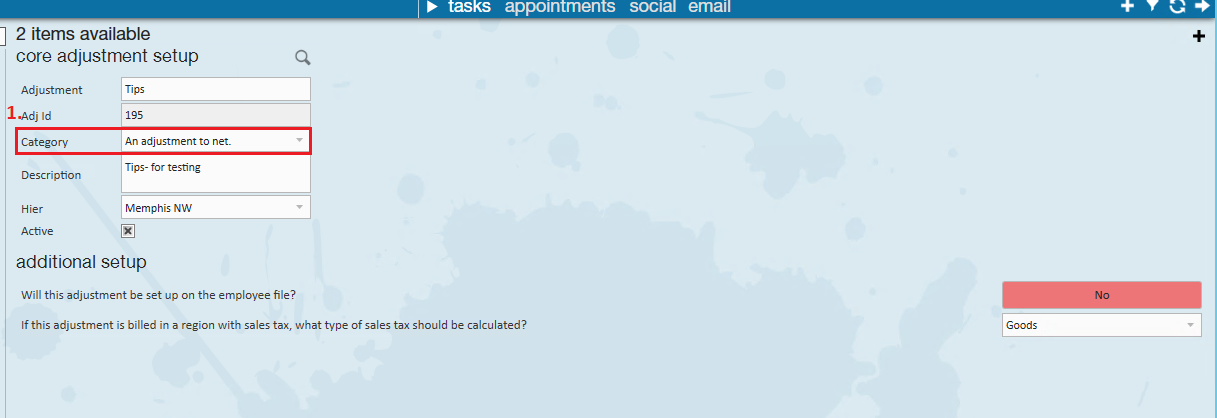

When adding the tips adjustment in administration is it important that the Category field is set to be "An adjustment to net".

You may verify that the tips were added properly by utilizing the staged checks report.