To help answer your questions, we've put together a list of commonly asked questions and their answers here. Use this guide to learn more about payroll related functionality.

Top 15 Commonly Asked Questions:

- How do I correctly note that an employee is claiming exempt status on their W4?

- Do I need to fill out the dependents field on pay setup?

- How do I print a wage statement to give to the employee?

- Do we need to create a separate worksite record for each location that employees are sent to?

- If I update the pay rate and/or bill rate on the order will it automatically update the current open assignments for this order?

- I’m not able to select the multiplier code that applies to this order. How do I add it?

- If I update the pay rate and/or bill rate on the assignment will it automatically update the time card for this assignment?

- I need to give my employee a raise starting next week. Can that be set up in advance?

- How can my staffing specialists or front office managers leave important notes for payroll?

- In time entry, how can I single out just one customer or employee's transactions?

- Where should a mileage or parking reimbursement be entered?

- Can an adjustment be only billable or only payable?

- Where should a bonus or commission be entered?

- How do I determine if a check should be reissued, voided or reversed?

- What is the difference between reissuing and reprinting a check?

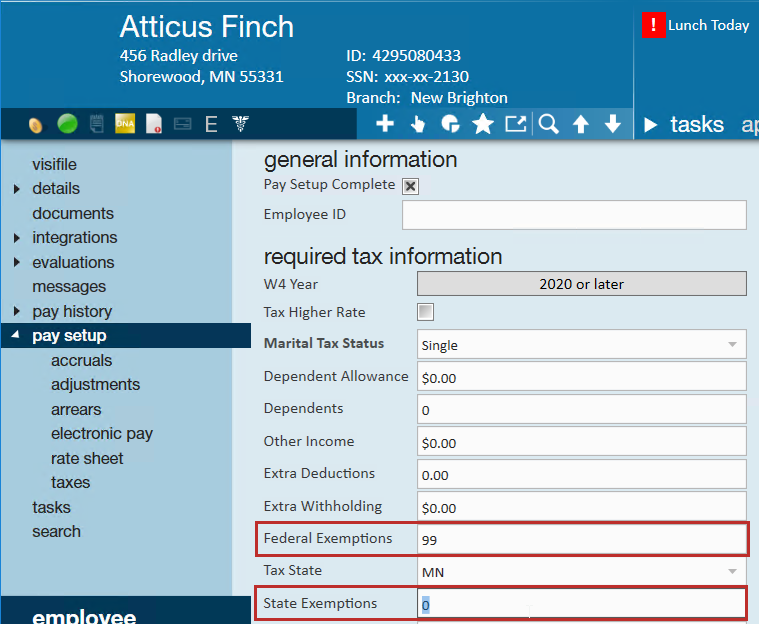

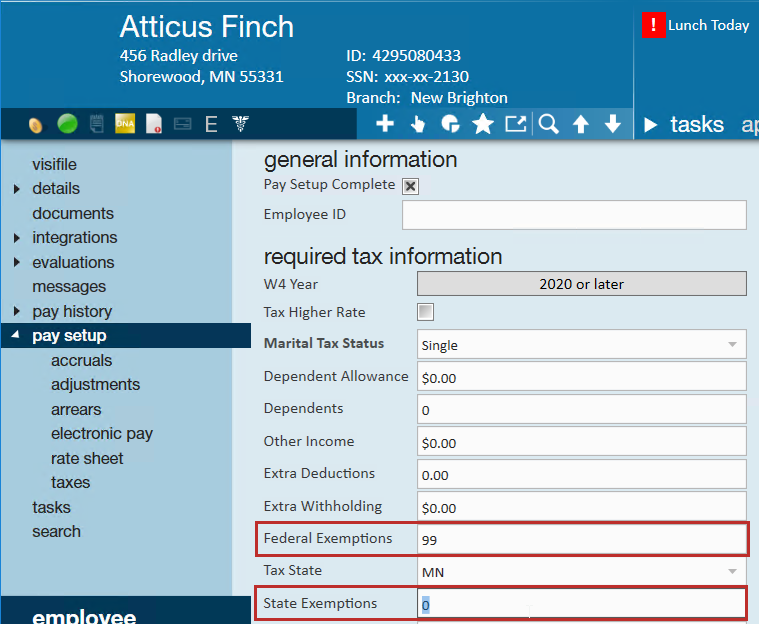

Q : The employee is claiming exempt status on their W4. How do I enter that into TempWorks Enterprise?

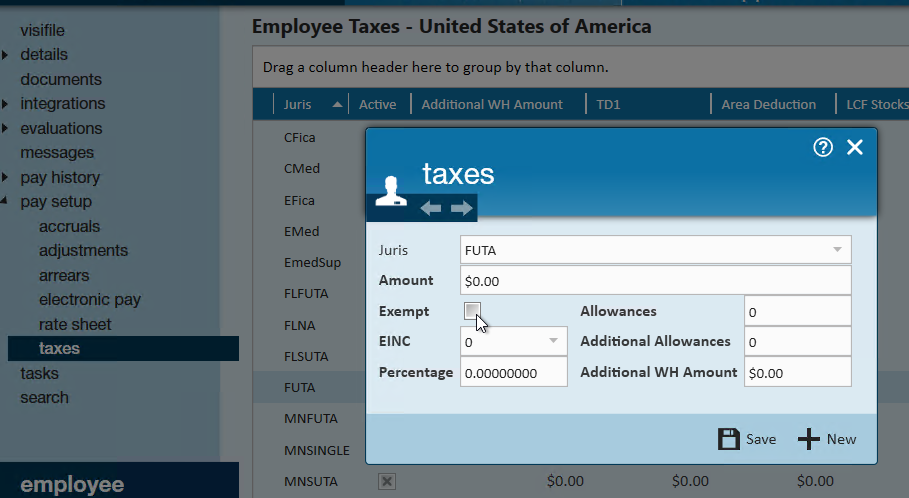

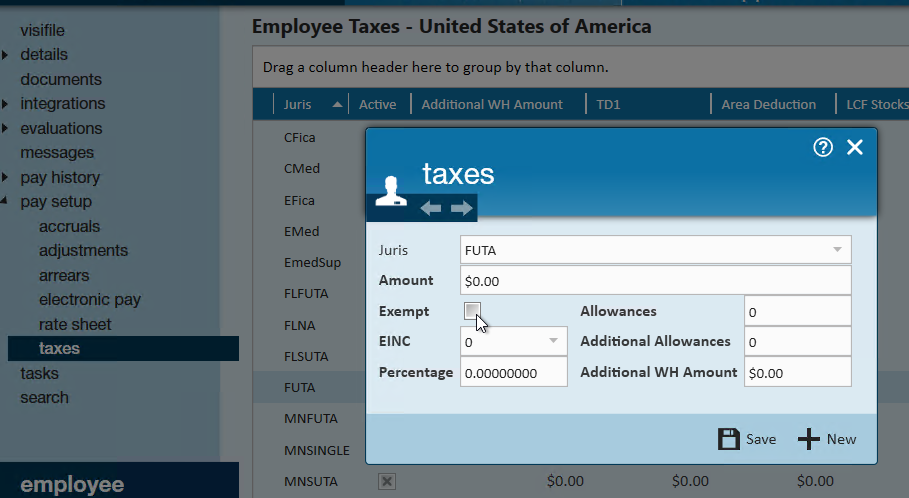

Answer: First determine if this is exempt from taxability or exempt from withholdings, as these are entered differently:

- If exempt from withholdings: on the pay setup form enter “99” in the applicable federal exemptions and/or state exemptions fields

- If exempt from taxability: Under Pay Setup > Taxes, double click the juris they are exempt from and select the exempt box:

- Learn more about W4: 2020 W-4 Form

- Learn more about employee taxes in Enterprise: Enterprise - How to Manage Employee Taxes

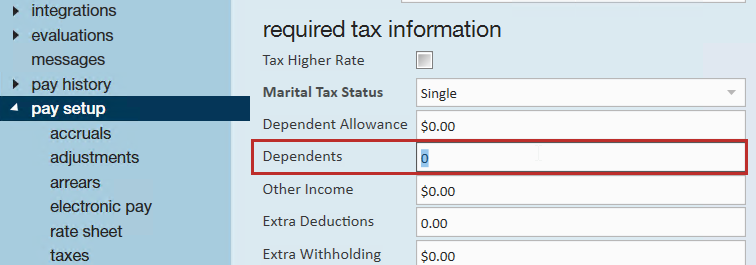

Q: Do I need to fill out the dependents field on pay setup?

Answer: If the employee is not a Louisiana resident, this field does not need to be populated. Employees living in Louisiana are only allowed to have 2 state exemptions. Any additional state exemptions need to be entered under dependents.

- Learn more about employee taxes in Enterprise: Enterprise - How to Manage Employee Taxes

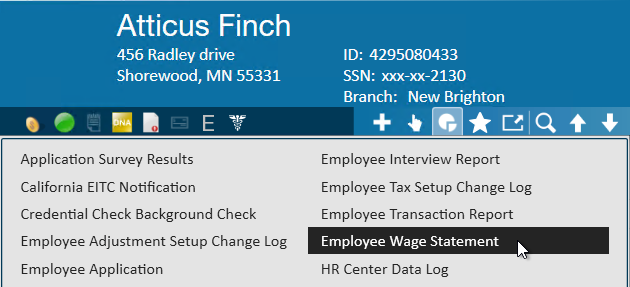

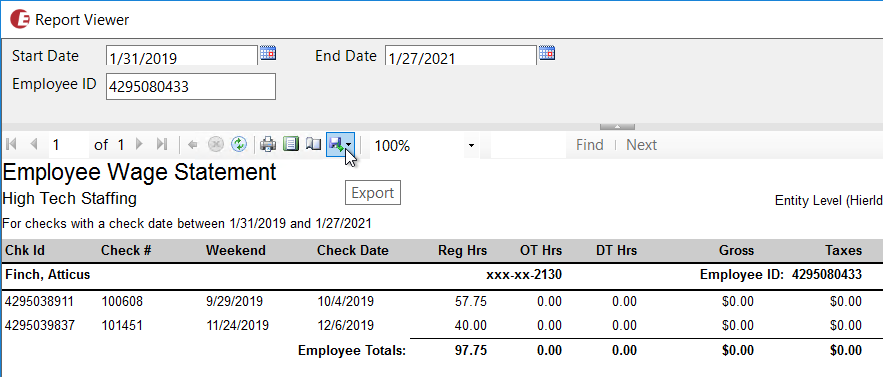

Q: How do I print a wage statement to give to the employee?

Answer: At the top of the employee record, click on the reports button and choose the employee wage statement. You will need to enter the start and end date in the report viewer and run it.

Once the report is displayed click on the print icon to print out or select the export option to save an electronic copy of the wage statement

- Learn more about Tax Related Documents: Enterprise - Reprinting Tax Documents (Wage Summaries)

- Learn more about Employee Related Reports: Employee Reporting

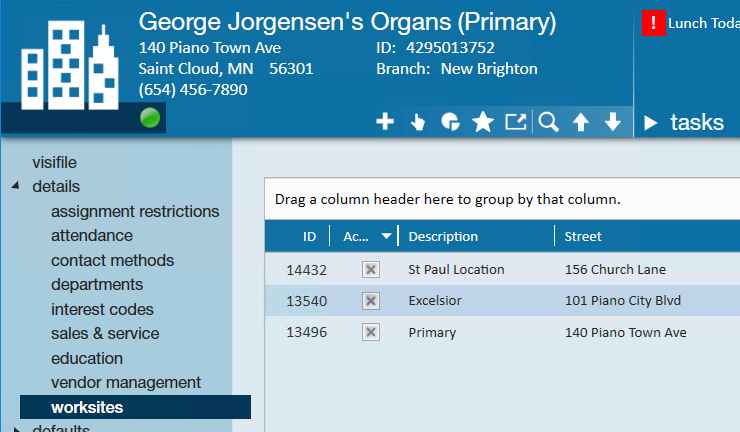

Q: Do we need to create a separate worksite record for each location that employees are sent to?

Answer: Yes. The worksite is very important because an employee’s income taxes are based on both their home (permanent and resident) address and where they work (worksite). The worksite must also be selected correctly on the order to make sure that payroll and invoicing are processed correctly.

- Learn more about Worksites: Enterprise - Worksites

- Learn more about Order Record Details: *Orders Part 2: Order Details

Q: If I update the pay rate and/or bill rate on the order will it automatically update the current open assignments for this order?

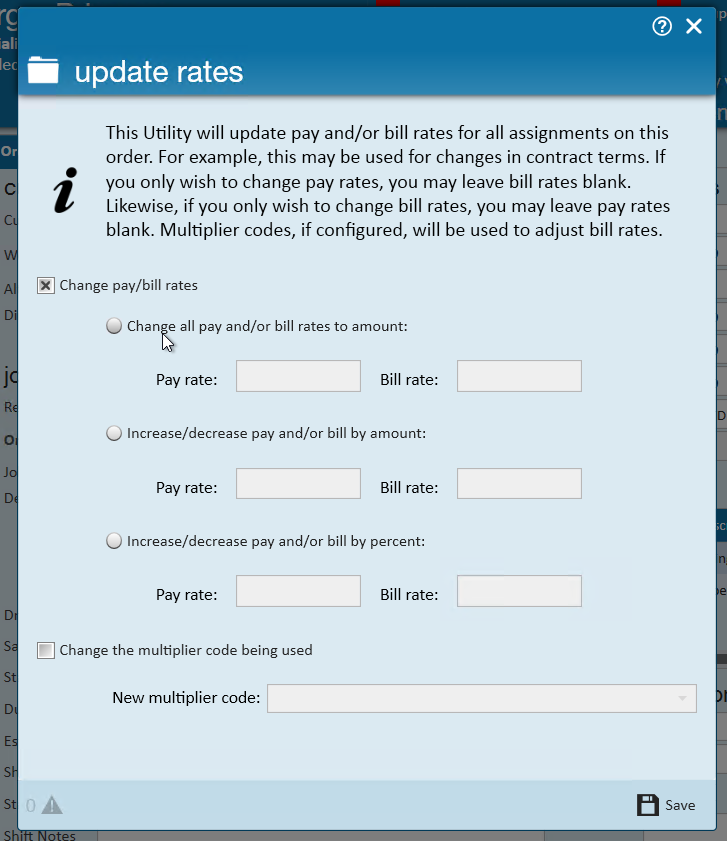

Answer: Not automatically. Navigate to the action menu and choose mass update rates. The rates can be increased or decreased by percentage, amount or changed to specific rates. The multiplier code can also be changed this way.

*Note* This MUST be done via the mass update rates, if you simply change the rates on the order details form the rates will NOT update the assignments.

- Learn more about mass update rates functionality: Enterprise - How to Mass Update/End Assignments From the Order.

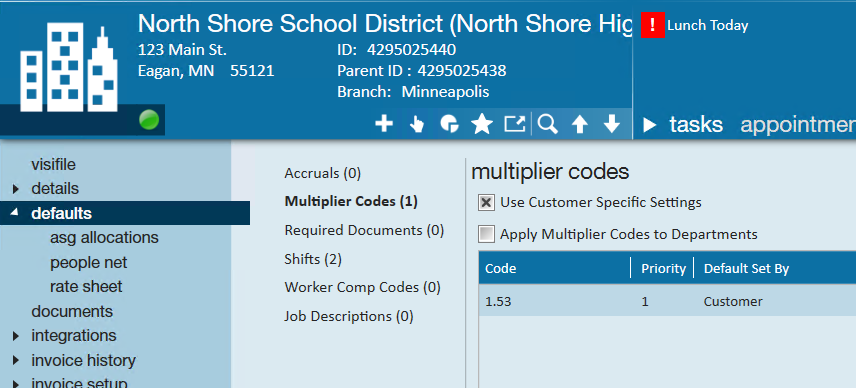

Q: I’m not able to select the multiplier code that applies to this order. How do I add it?

Answer: Multiplier codes must be added into your system first by an administrator who will set up the math behind the code and name it. Once it's in your system, you will want to make sure you add it to the defaults list for the customer.

Think of the default list as the only multiplier code options available for that customer and should only include multiplier codes that match your negotiated contract terms.

- Learn more about Multiplier Codes: Enterprise - Creating Multiplier Codes

- Learn more about Customer Defaults: Enterprise - How to Set up Customer Defaults

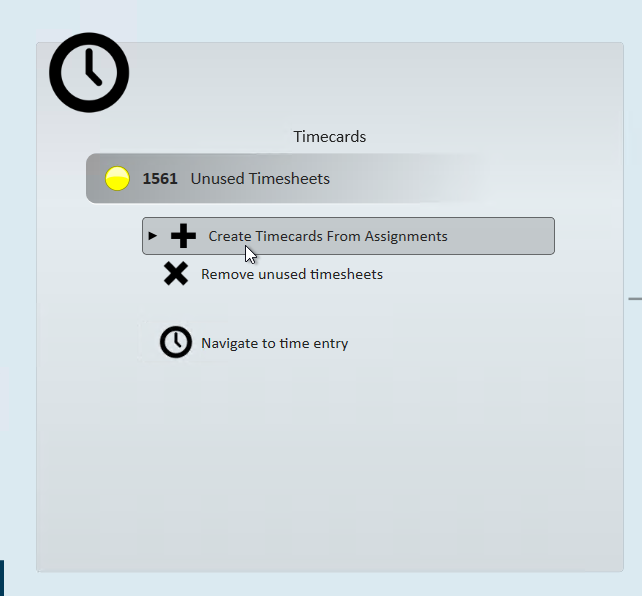

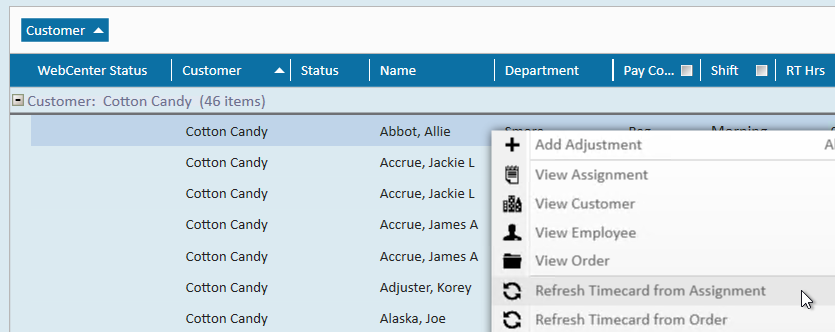

Q: If I update the pay rate and/or bill rate on the assignment will it automatically update the time card for this assignment?

Answer: Not necessarily. If you update the rates immediately, before payroll/billing has created a transaction, then yes, it will be updated. However, if payroll/billing has already created the timecards for this week THEN you make the change then, no, the transaction will not automatically be updated.

You can refresh a timecard while in Time Entry which could update rates from an assignment

- Learn more about refreshing timecards: Enterprise - How to Refresh Timecards

- Learn more about Time Entry: Time Entry Part 1: The Basics

Q: I need to give my employee a raise starting next week. Can that be set up in advance?

A: Yes! We encourage you to set up a rate change or raise ahead of time in the system so that you don't have to time it perfectly later when you have enough other things to do.

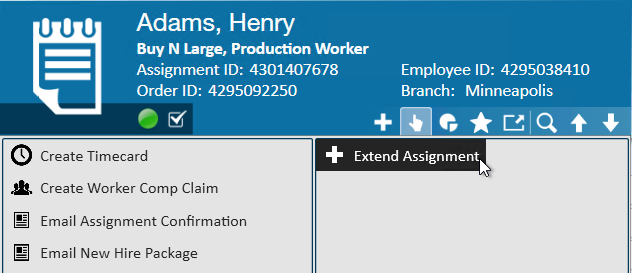

On the assignment, open the action menu and select extend assignment. TempWorks will prompt you for the date the rate change should take effect. TempWorks will then create a new assignment on which you can enter the new rates.

*Note* During this process TempWorks will automatically end the original assignment as of the date before the rate change takes effect with a status of RC (rate change). This is also great for reporting because you can track how many employees were given raises based on the assignment status.

- Learn more about pay raises: Enterprise - How to Document Employee Pay Raises

Q: How can my staffing specialists or front office managers leave important notes for payroll?

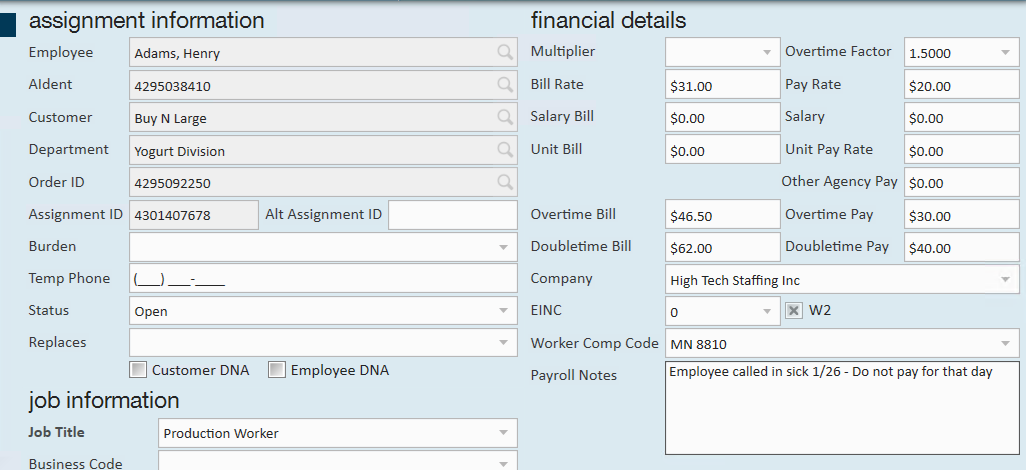

Answer: When you need to communicate when an employee calls in sick, or additional deductions are needed, etc. you can use the Payroll Notes field from the employee, customer, order, or assignment record.

- If this note pertains to the employee, no matter where they work, the note should be entered on the employee > pay setup > note to payroll field

- If this note pertains to everyone who has been placed on an order the note should be entered on the order > details > po setup > payroll note field

- If this note pertains to a specific assignment the note should be entered on the assignment > details > payroll notes field.

Q: In time entry, how can I single out just one customer or employee's transactions?

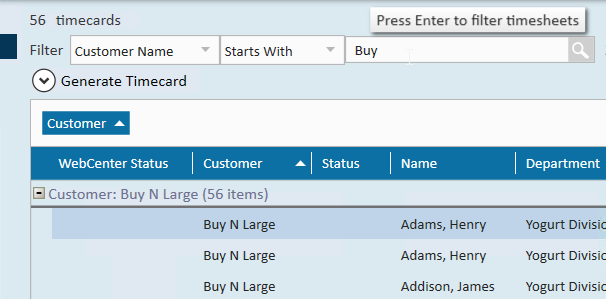

Answer: At the top of the time entry form there are filter options. Filter for the employee name, SSN or customer name, in the filter text field enter the first few characters of the employee's last name, SSN or customer's name.

- Learn more tips for Time Entry: Enterprise - Time Entry Tricks

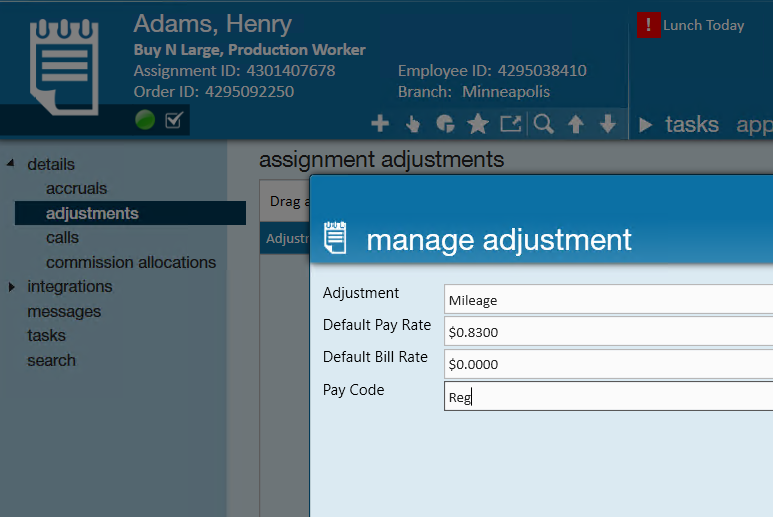

Q: Where should a mileage or parking reimbursement be entered?

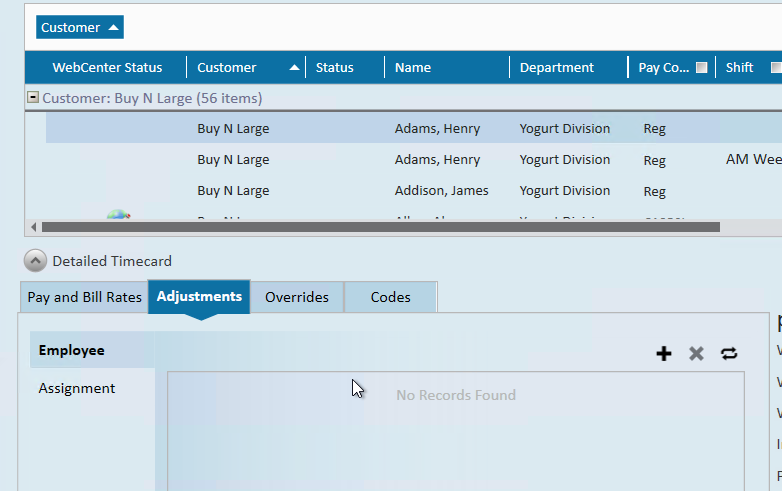

Answer: Mileage and parking reimbursements are great examples of adjustments that may happen one-time or have different amounts each time. If this adjustment only needs to happen once, you can enter it on the time card under details > adjustments:

If this adjustment is happening often for their current assignment, you can also set up adjustments on the assignment:

- Learn more about one-time adjustments: Enterprise - One-Time Adjustments and Overrides

- Learn more about assignment adjustments: Enterprise - How to Utilize Assignment Adjustments

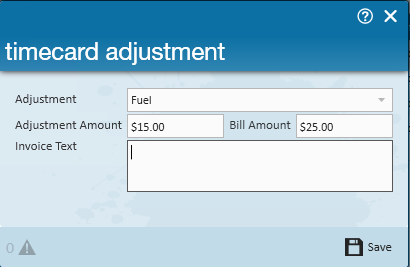

Q: Can an adjustment be only billable or only payable?

Answer: Yes, adjustment pay and bill amounts do not have to be equal. You can 0 out or change the rate on on the pay or bill options on any one-time adjustment.

- Learn more about one-time adjustments: Enterprise - One-Time Adjustments and Overrides

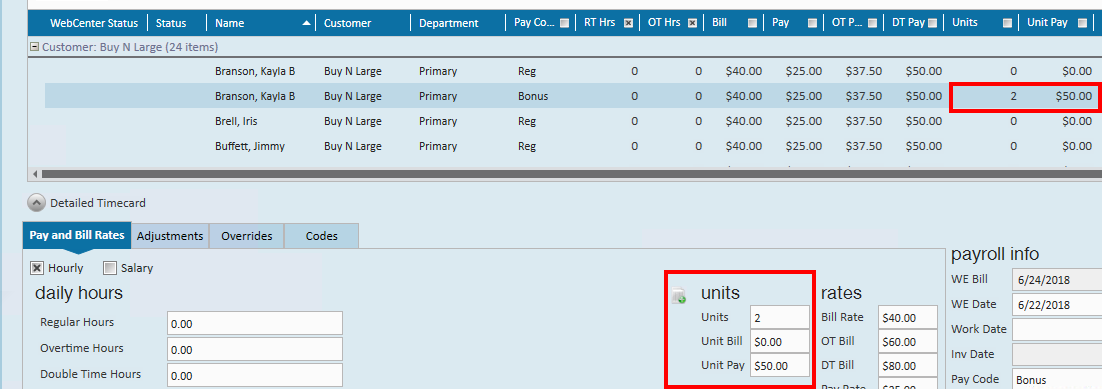

Q: Where should a bonus or commission be entered?

Answer: A bonus, commission or other taxable adjustment should be entered as a duplicate (new) transaction in the time entry form. For bonuses and commissions, units, unit pay and unit bill should be used instead of hours and hourly amounts.

Make sure to change the pay code to reflect the type of money being paid.

- Learn more about bonuses: Enterprise - How to Enter Bonus Pay

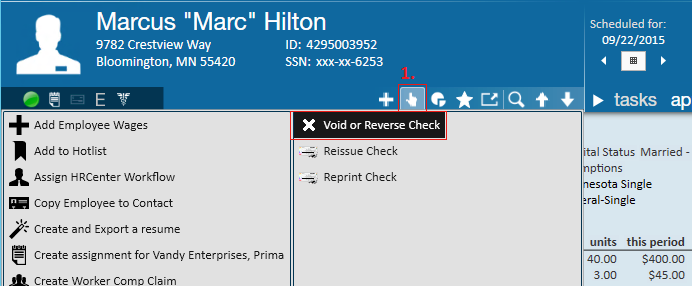

Q: How do I determine if a check should be reissued, voided or reversed?

Answer: Ask yourself the following questions: Has the check been cashed? Was the check correct?

1. If the check has not been cashed and it was correct you will reissue the check.

- The check was put through the washing machine

- You printed the check then immediately spilled coffee on it

- The employee was overpaid

- You issued the check to the wrong person

- You had the incorrect deductions or adjustments

- The hours or pay rate were incorrect on the check (the employee was overpaid) and the employee took the money and ran.

- Learn more about check corrections: Enterprise - How to Void and/or Reverse Checks & Enterprise - How to Reissue Checks

Q: What is the difference between reissuing and reprinting a check?

Answer: Reissuing a check will reissue the net amount on a new check number. This should be used for pre-printed and numbered check stock.

Reprinting a check will reprint the original check on a new piece of paper. This should be used for accounts where the checks are printed on plain paper.

- Learn more about Reissuing a Check: Enterprise - How to Reissue Checks

- Learn more about Reprinting a Check: Enterprise - How to Reprint a Paycheck or Payroll Run