What is a 1099 Employee?

1099 employees are registered as independent contracts. Your staffing company pays the employees but the employees will be responsible for their own taxes. Instead of receiving a W-2, these employees will receive a 1099 form. For Information on how to create 1099 employees, click here.

This article covers:

- Time Entry & Proofing for 1099 Employees

- Running Payroll for 1099 Employees (SubPay)

- Additional Questions

Time Entry & Proofing for 1099 Employees

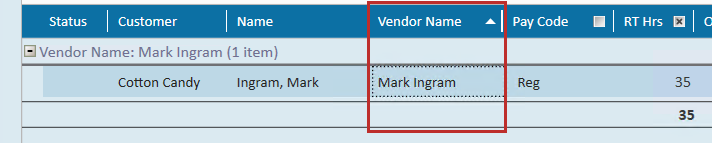

Time entry and proofing is done the same way any other timecard is in the system. You can identify a 1099 or independent contractor by looking at the Vendor Name column:

The Vendor Name should match the employee's name. Right click the column headers to change which columns display.

This timecard can have hours entered on it and be proofed at the same time as regular timecards.

Running Payroll for 1099 Employees

Once a 1099 timecard has been run through time entry and proofing, you will be able to pay it in a separate run. You will need to run the transactions through as a "SubPay" run in order to complete their payroll.

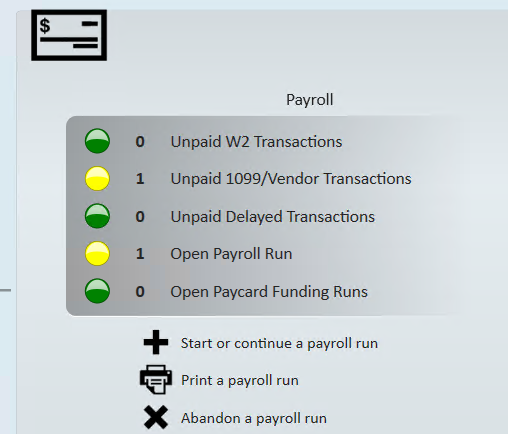

How Do I Know If I Have 1099 Employees to Pay?

When you look at the payroll section of pay/bill, 1099 transactions will be listed under "Unpaid 1099/Vendor Transactions"

Completing a SubPay Run:

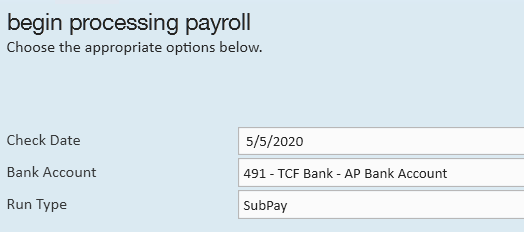

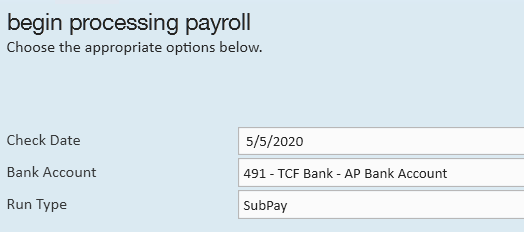

- In Pay/Bill navigate to the payroll section and select "Start or continue a payroll run"

- Select "Create a new payroll run"

- Select the Run Type of "SubPay" and choose next

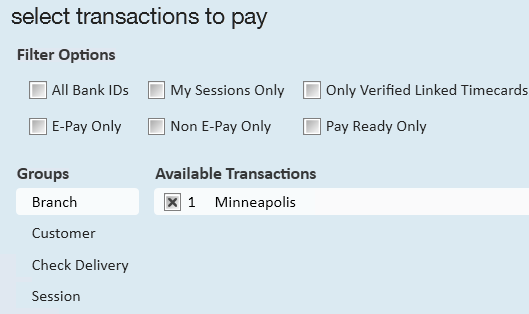

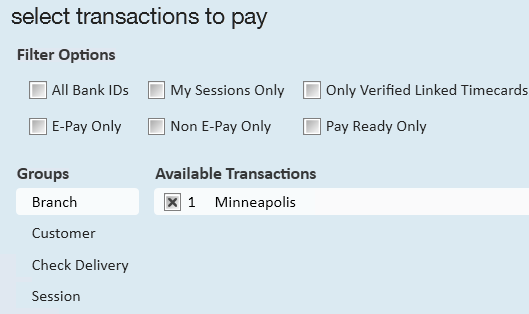

- Select the transactions you are ready to pay - the same way as any other payroll run:

- Review the transactions selected and click Next

- Review and correct any applicable payroll errors before selecting Next

- Check out Enterprise - Payroll Errors, Their Meanings, and How To Fix for more information

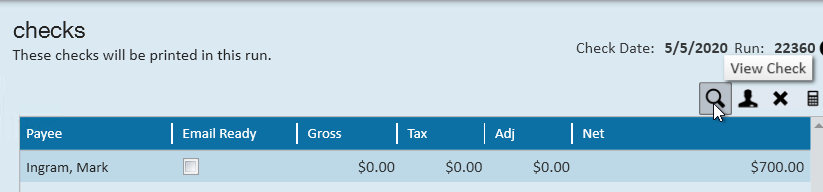

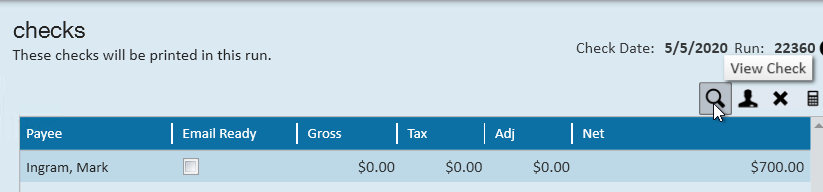

- Review the check(s)

- Note that tax amounts are not being taken out of this check because this is a 1099 employee.

- Use the magnifying glass in the upper right to see check details

- Select Next

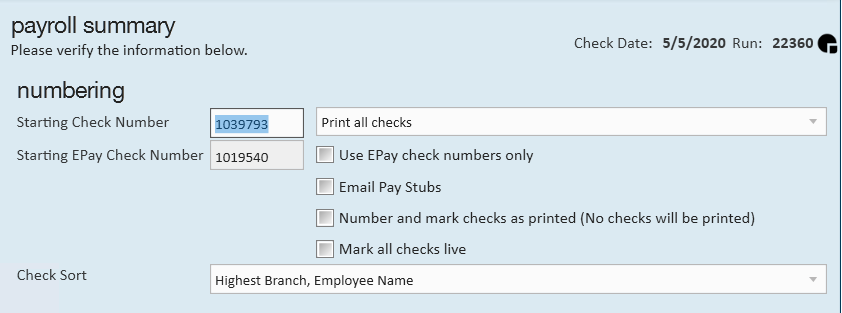

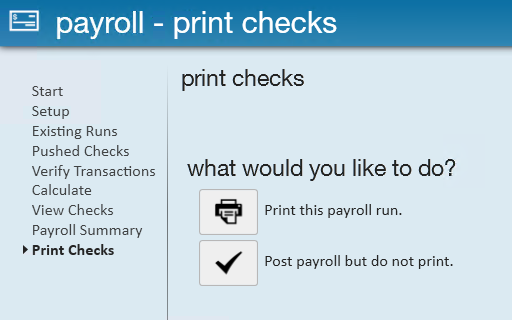

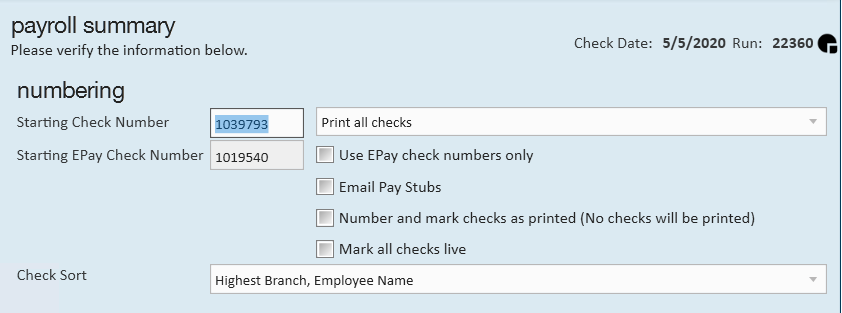

- Choose your printing settings

- Select Next

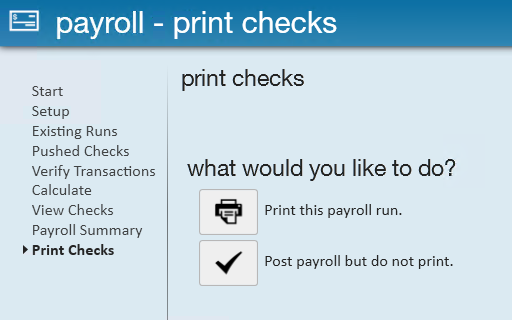

- Select "Print this payroll run"

- When printing is completed, select finish

Now you have your checks to send to your 1099 employees!

What About..

- Invoicing? 1099 transactions are invoiced the same as any other transaction. Check out The Invoicing Wizard for more information

- Finding Processed Checks? Checks for 1099 employees can be found in the check register in pay/bill or on the employee's record pay history - just like any other employee. Check out Employee: The Pay History Tab for more information.

- Check Corrections? Check corrections will work the same way as any other check. Check out Enterprise - How to Void and/or Reverse Checks for more information