What is Employee Pay Setup?

Pay setup is found under the Employee record. This section allows users to enroll employees in electronic pay stubs via email, set default pay rate that trumps pay rates on orders, set ACA hire date, status, and specify their insurance enrollment, and enter tax information.

Note: keep in mind that once you have set up the employee’s pay information, check the box at the top of the pay setup marked pay.

Not sure how to navigate to an employee record? See Core - Employee Searching for more information.

Required Tax Information

When you select an employee record and select pay setup you will see Required Tax Information section on the left. Enter any applicable tax exemptions under Federal or State Exemption fields. If the employee is completely exempt for either federal or state taxes, then enter 99.

Keep in mind that the W4 year changes what tax options you see.

Tax State, Tax Juris, and Local tax information is automatically entered when the employee’s address zip code is entered under the details section of the employee's record.

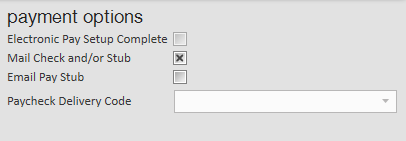

Payment Options

Payment Options are found under the employee record > Pay setup section. This area allows you to default how this employee wants to receive payment information.

- Check the box next to Mail check and/or stub if the employee prefers their pay information mailed to their address.

- Check the box next to email pay stub if the employee would like to receive an email with their pay stub information.

- The employee will need to have an email on file (under employee visifile > phone/email). You will also need to set up your email to be able to send from enterprise by selecting the E in the upper left corner and selecting options > email.

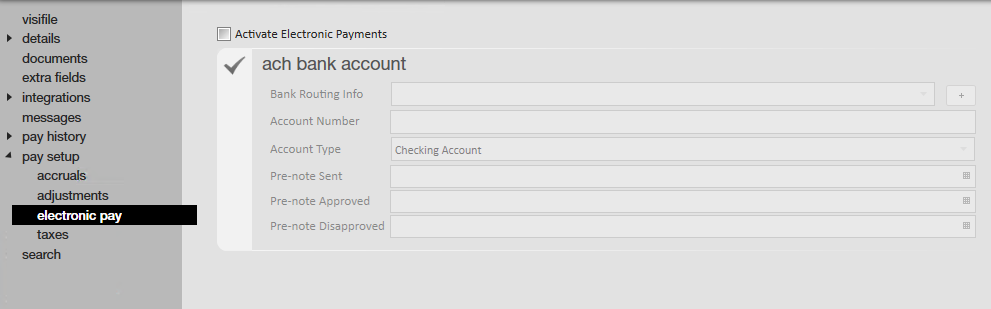

Saving Electronic Payment Information

When an employee wants their check direct deposited, you can save their information in Core for your records.

To Add Direct Deposit Info:

- Check the box next to Activate Electronic Payments

- Under ACH bank account, enter Bank routing and account number

- Choose an account type from the drop down

- If you send pre-notes, you can enter the date the pre-note is sent and either approved or disapproved for your records.

*Note* While Core will help you calculate pay amounts, it will not send payment info to the bank for you. You will not be able to pay employees directly through Core. This would just be to save the direct deposit information for your own records.

Adjustments

Adjustments in Enterprise Core refer to both garnishments and reimbursements for an employee. Adjustments that are reoccurring, such as child support payments or levies, will be set up on the employee record under adjustments.

For more information on Adjustments see Core - Employee Adjustments.

For one time adjustments, such as an equipment fee or mileage reimbursement, see Core - One Time Adjustments.