Sales Tax in Enterprise can be applied to customers, departments and worksites.

*Note* Typically, sales tax is location specific, meaning it should be applied based on where the employee works.

*Note* Not all states require sales tax on staffing services, please consult your tax professional for specific information for your location.

Sales Tax by Worksite

This is a great option when one worksite does have sales tax or the sales tax is different for each worksite(location).

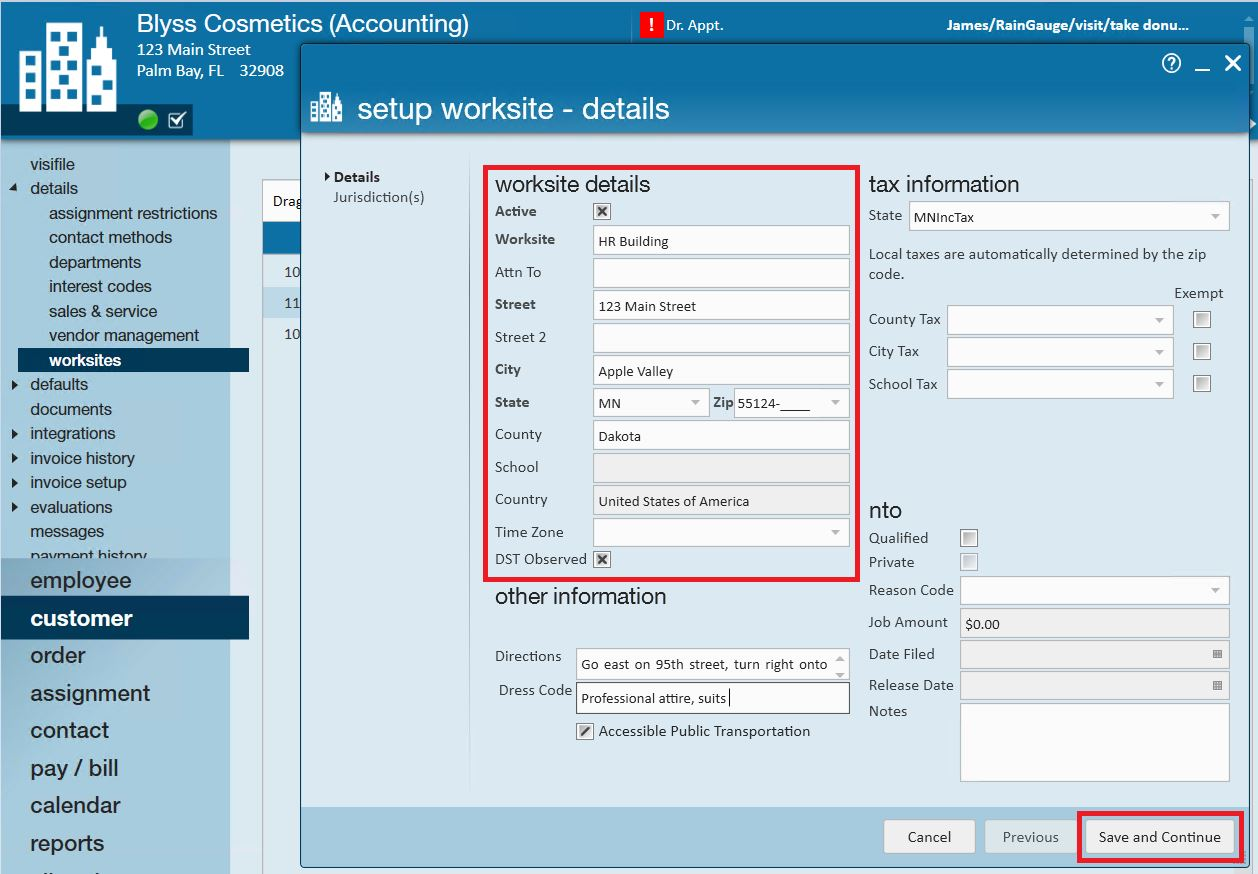

Navigate to the customer's worksite where sales tax should be applied, or create a new worksite that will need sales tax applied. Verify the address information in the worksite details section is correct:

Select save and continue to open the setup worksite - jurisdiction(s) form:

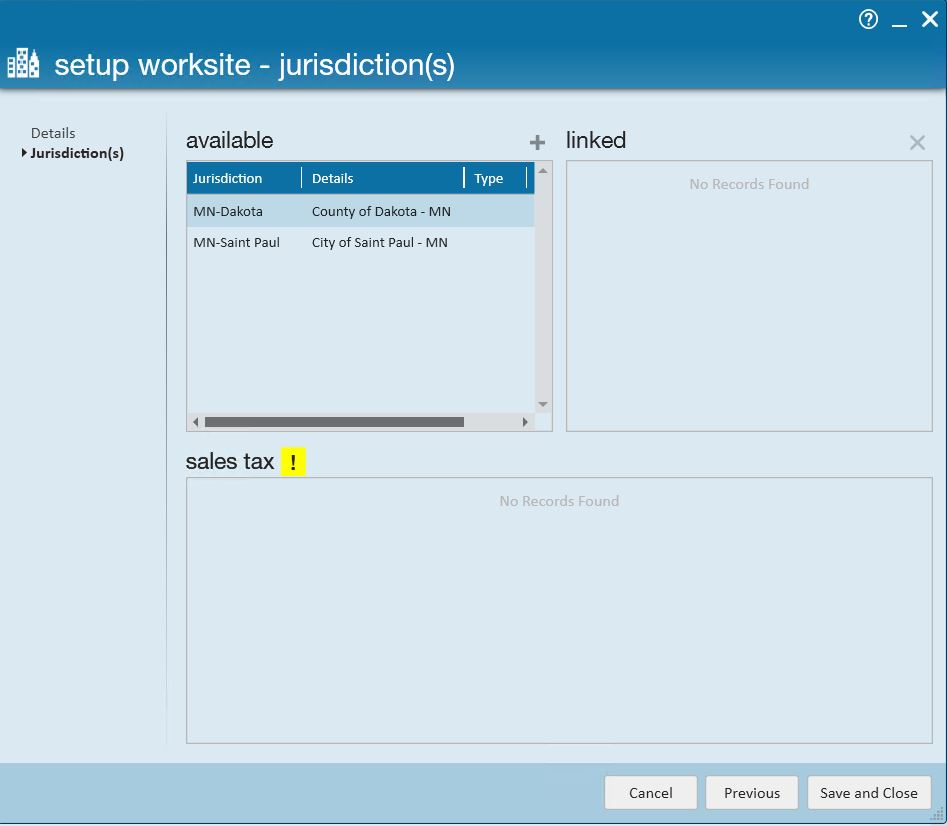

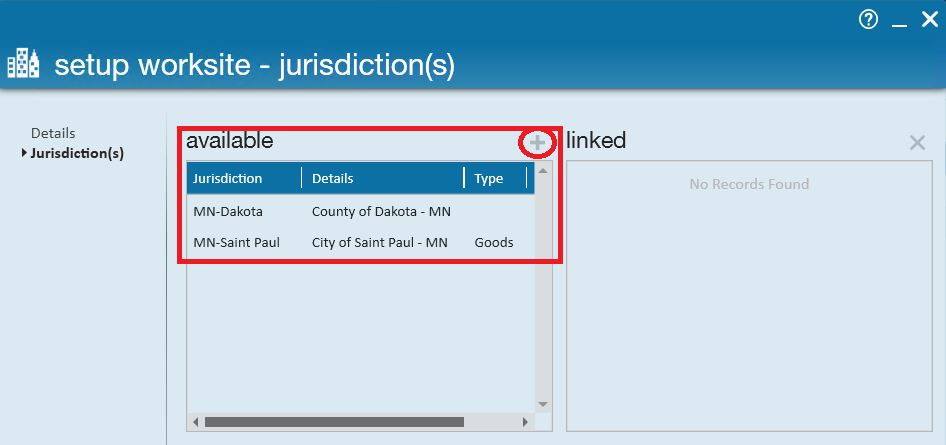

Click to highlight the appropriate sales tax for this worksite then select the add button to apply that sales tax:

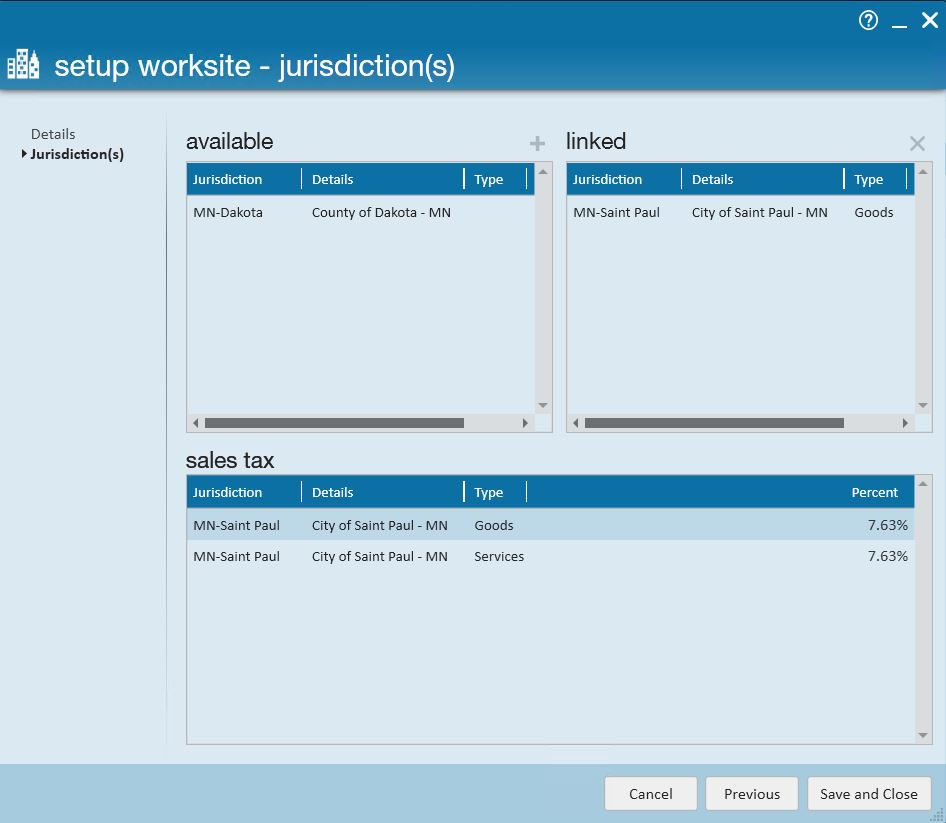

The selected tax jurisdiction will be displayed in the linked area as well as the sales tax area:

Select save and close to apply sales tax to any future billing.

If sales tax has been applied to a worksite but needs to be removed or changed, navigate to the worksite, select save and continue to get to the setup worksite - jurisdiction(s) form for that worksite. Click to highlight the jurisdiction listed in the linked area and click the x to remove. Either save and close if there should be no sales tax applied to this worksite or select the proper sales tax jurisdiction to apply.

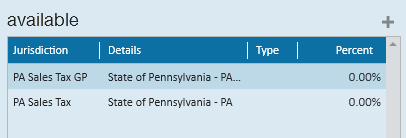

*Note* For Pennsylvanian folks, you may have multiple sales tax options:

This is because sales tax in Pennsylvania can be calculated based on Gross Profit (GP) or Total Amount Billed. Work with your team to decide which option applies for your company and that worksite.

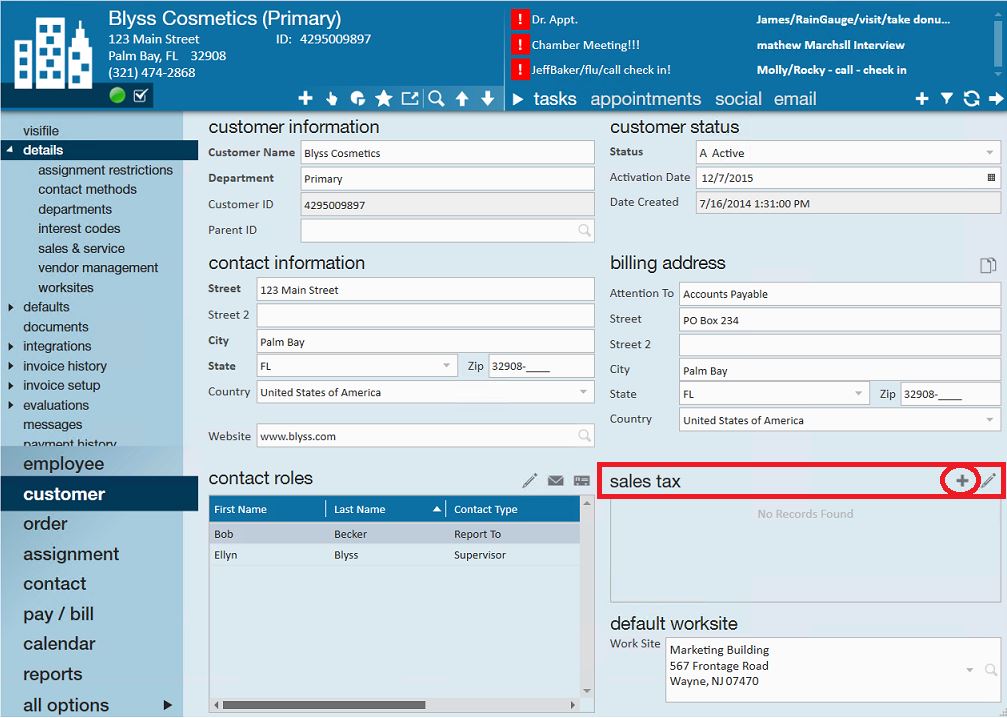

Sales Tax by Customer

If sales tax should be applied to all employees and who work at any location for a specific customer, the sales tax can be set up from the details page of the customer record:

We typically recommend setting up sales taxes on each worksite as each worksite might be subject to different sales tax amounts, etc.

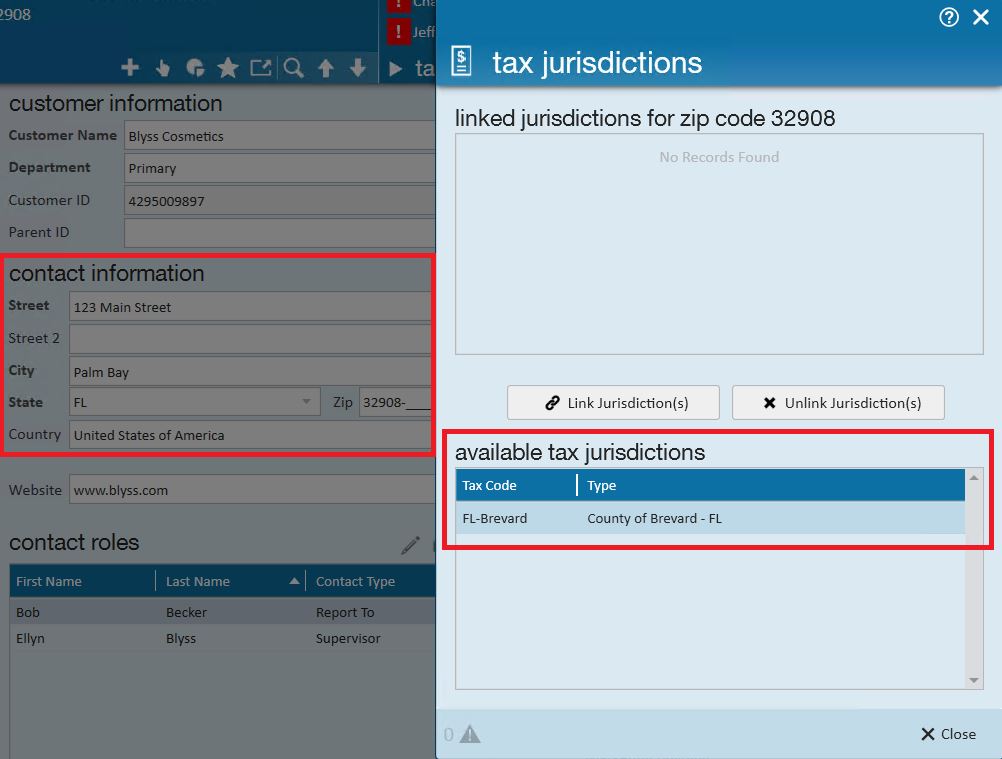

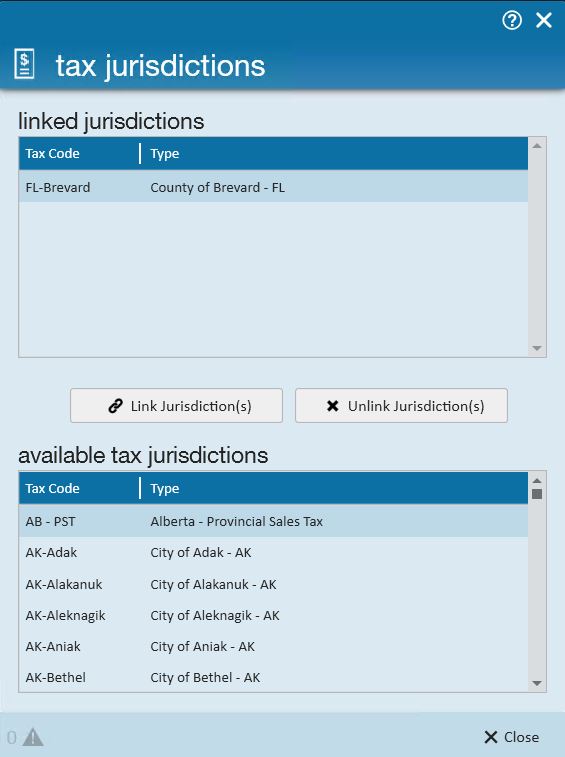

Click the add new button to apply sales tax, this will open the tax jurisdictions form. At the bottom of the form will be listed any available tax jurisdictions based on the customer's address within their contact information area:

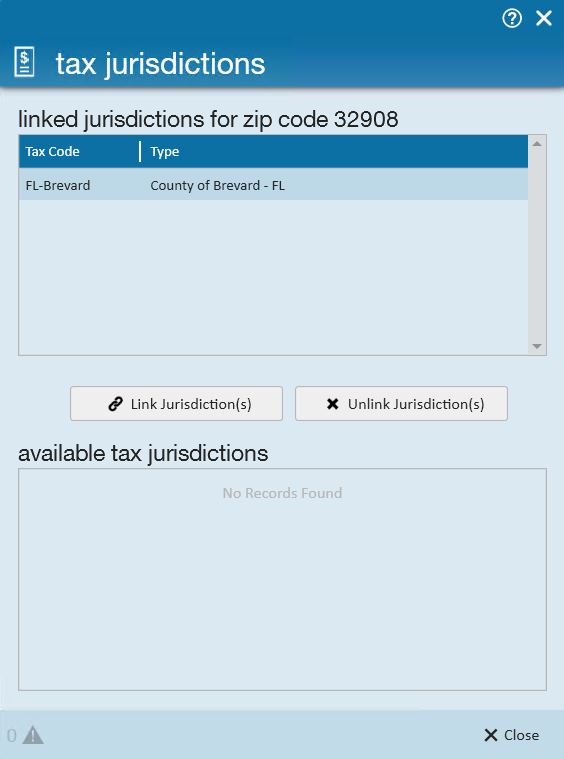

Click to select and highlight the available tax jurisdiction then click the link jurisdiction(s) button. Once this is done, the tax jurisdiction will be displayed in the linked jurisdictions for zip code area:

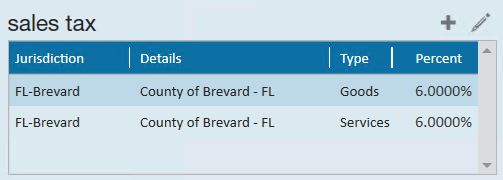

Upon clicking close, the the sales tax will be displayed, including the percentage amount and this tax will apply to all future invoicing.

If sales tax has been applied to a customer but must be removed or changed, from the customer/details/sales tax area, select the edit button to open the tax jurisdictions form. Verify the tax jurisdiction to be removed is highlighted then click the unlink jurisdiction(s) button. Click to select close and the sales tax jurisdiction will be removed.

If needing to apply a correct jurisdiction, select the correct available tax jurisdiction to apply by clicking to highlight then click the link jurisdiction(s) button to link it.

Sales Tax by Department

To apply sales tax by department navigate to the customer/department/details form and follow the same instructions as sales tax by customer. Setting the sales tax at the department level will apply the sales tax to all invoices produced by this department.