COVID-19 Related Reporting

To help monitor, track, and understand credits and deferments related to COVID from the FFCRA and CARES acts, we have updated a few existing reports and created some new COVID related reports. This article will review all COVID related Reports for your reference.

*Note* When pulling reports in Enterprise, you will want to be mindful of your hierarchy level. To ensure you are including all the relevant transactions, records, and information, we recommend pulling reports at your highest hierarchy level available (system, subsystem, etc.). For more information on hierarchy, check out Hierarchy Training.

List of Reports with COVID Related Information:

- CARES Act PPP Loan Application

- CARES Act PPP Loan Forgiveness Estimator

- COVID Provisions Breakout

- Federal Tax Deposit - COVID Provisions

- Gross Profit Detail - COVID Provisions

- Gross Profit Summary - COVID Provisions

- Management - COVID Provisions

Running Reports in Enterprise

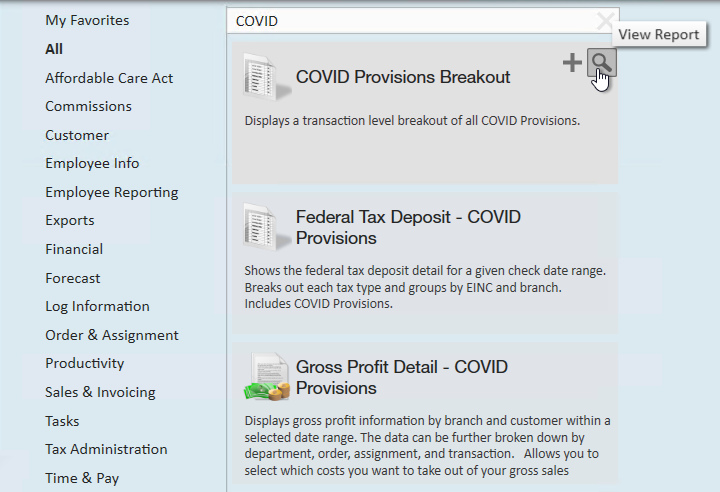

You can find all the COVID related reports in Enterprise by navigating to All Options > Reports. Select 'All' reports and search for "COVID"

Select the Magnifying Glass in the upper right on any report to view it.

*Note* Reports require Security Role Permissions to run. Typically, reports access is given by report category which is listed on each report below. Check out Enterprise - Security Roles for more information.

Cares Act PPP Loan Application

Purpose: This report displays financial information regarding the PPP Loan Application.

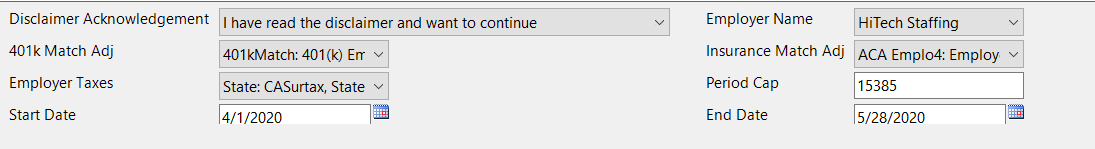

Parameters:

Disclaimer

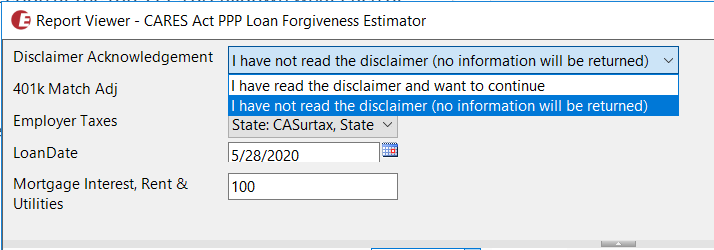

Because this report contains a lot of information that can be used for loan applications, we have a disclaimer listed at the beginning of the report.

In order to see any of the report, you will first need to read and agree to the disclaimer. If you select View Report, you will be shown the full disclaimer and the disclaimer will be saved with the report should it be exported.

Change the Disclaimer Acknowledgement to "I have read the disclaimer and want to continue" and select view report again in order to view the full report.

Here is a list of the remaining parameters for this report:

| Parameter | Definition |

|---|---|

| 401K Match Adj | In this drop down, select any adjustment types that are related to 401K match amounts that are paid by employers. This is used in calculations on this report. |

| Insurance Match Adj | In this drop down, select any adjustment types that are related to employer paid insurance or insurance match. This is used in calculations on this report. |

| Employer Taxes | In this drop down, select which Employer paid taxes should be included in calculations on this report. By default, this includes state taxes. |

| Period Cap | The maximum dollar amount of forgivable wages in the covered period |

| Start Date | First date of coverage for loan |

| End Date | Last date of coverage for loan |

Report Breakdown:

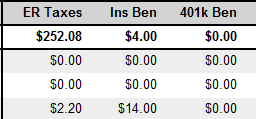

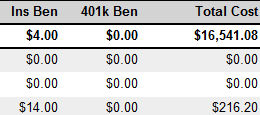

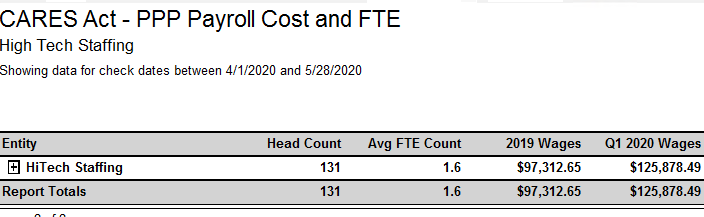

The following sections define the columns of information on the report:

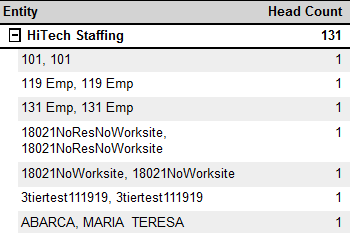

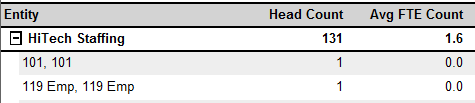

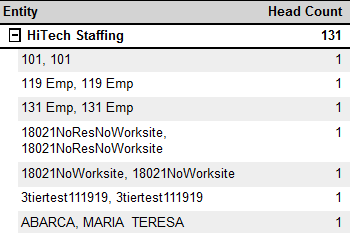

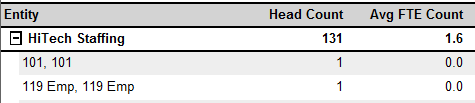

- Entity: Name of the Entity/Employer/EINC or Employee Name

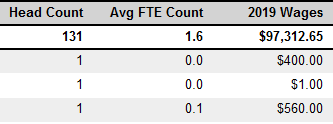

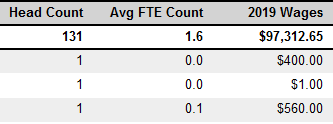

- Head Count: Total number of employees included in this report or considered in this row

- Avg FTE Count: This column indicates the average time the employee was considered a "Full Time Equivalent" employee during the reporting period.

- This is calculated by finding the average number of hours paid per week, divided by 40, and rounded to the nearest tenth. The maximum for each employee is 1.

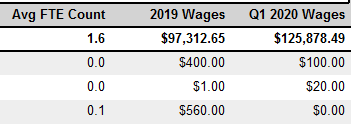

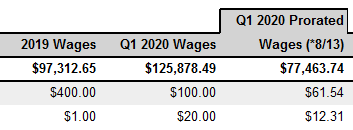

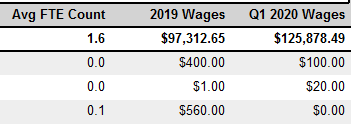

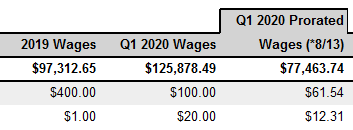

- 2019 Wages: Total wages from 2019 for reference purposes. This can help identify employees who made under or over $100,000 last year.

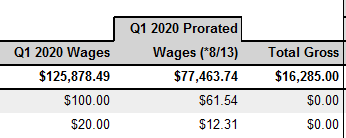

- Q1 2020 Wages: Total wages from 1/1/2020 to 3/31/2020

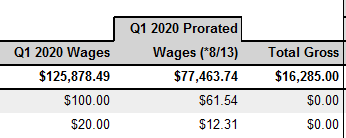

- Q1 2020 Prorated Wages: Q1wages divided by 13 and then multiplied by 8 to get the 8 week average from the 13 weeks in quarter 1

- Total Gross: total gross amount for employee in reporting period

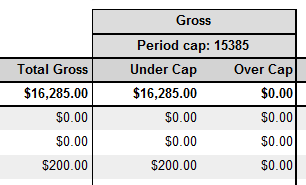

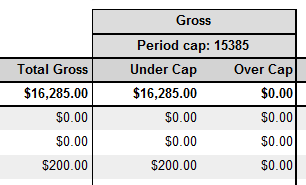

- Gross (Under vs. Over Cap): Gross amount divided into how much of the wages are under the Period cap and how much of the wages were over the Period Cap.

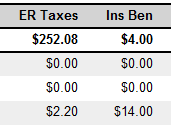

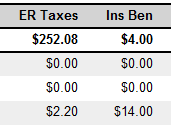

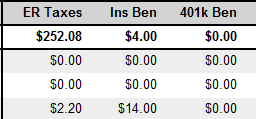

- ER Taxes: Any employer tax amounts that are included in this report

- Ins Ben: Any insurance benefit amounts that are included in this report

- 401k Ben: Any 401k match (employer costs) that are included in this report

- Total Cost: Under Cap amount + ER Taxes + Ins Ben + 401k Ben

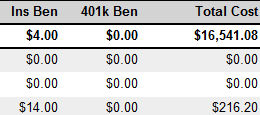

COVID Provisions Breakout

Purpose: Displays all transactions within the date filter that have FFCRA or EE Retention related paycodes.

*Note* This report is part of the Time & Pay report category. You may need security role that gives you access to the Time & Pay reports to access this report.

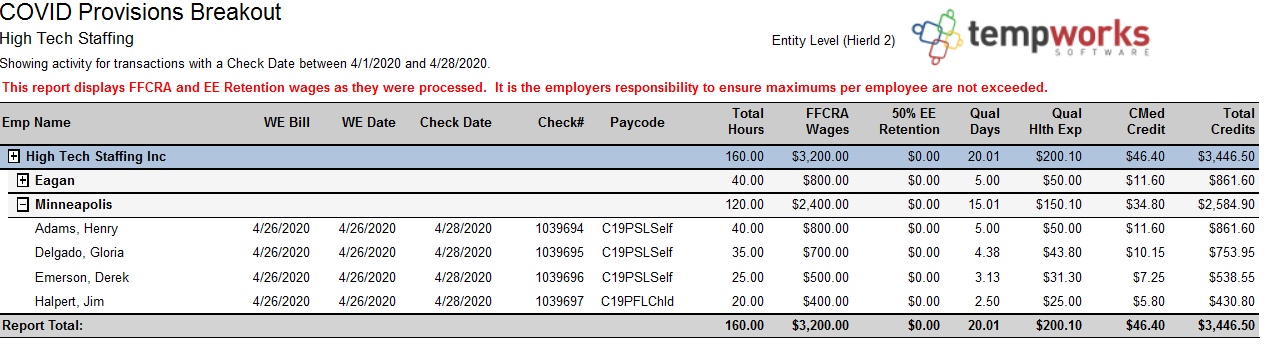

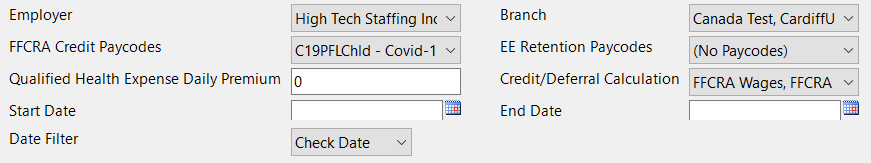

Parameters:

| Parameter | Description |

|---|---|

| Employer | Allows you to choose which EINC(s) should be shown on this report (all are selected by default). |

Branch | Allows you to choose which Branch(s) should be shown on this report (all are selected by default). |

| FFCRA Credit Paycodes | This option allows you to choose which paycodes in your system are FFCRA related and should be included in this report. By default, the C19PSLSelf, C19PSLOth, and C19PFLChld paycodes will be selected but if you have created additional paycodes for tracking purposes, you can select more here. |

| EE Retention Paycodes | This option allows you to choose which paycodes (if any) in your system are related to Employee Retention Credits (as part of the CARES Act). |

| Qualified Health Expense Daily Premium | Average daily healthcare premium (in dollars) for qualified health expenses. |

| Credit/Deferral Calculation | Determines which COVID related credits and deferrals are added in the calculations for the total credits column. For example, if you want to see totals without EE Retention Credits considered, you can uncheck this option. When you run the report it will show the total without the EE Retention Credits considered. |

| *Start & End Date | (Required) Date range you are pulling this report for (consider quarterly, monthly, or weekly). |

| Date Filter | Should start and end date pull transactions by Check Date or Weekend Bill. |

| Branch Source | This option allows you to choose whether the branch information is pulled from the check (Check) or from the timecard (Txns). |

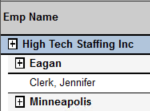

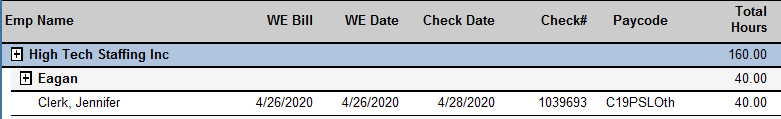

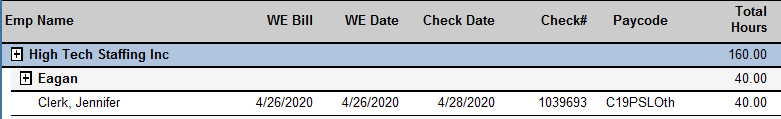

| Group By Primary & Secondary | There are two grouping options. The Primary will be the first grouping (Example from Screenshot: High Tech Staffing (Employer) and the secondary will further break down the groupings (Example from Screenshot: Each Branch). This allows you to break up the information showing different subtotals and visual groupings to help you. Options Available Include:

|

| Expand Details | This allows you to either have all group by options expanded or not when you run the report. You can always select the box next to each grouping to expand or contract the details in that grouping.

|

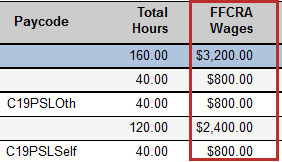

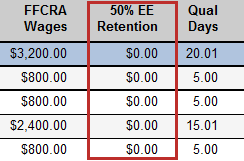

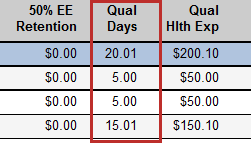

Report Breakdown:

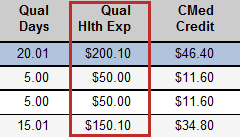

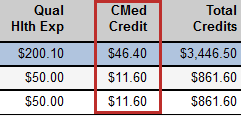

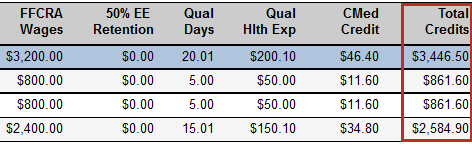

The following sections define the columns of information on the report:

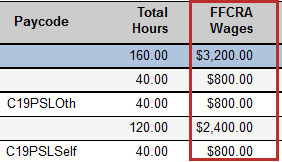

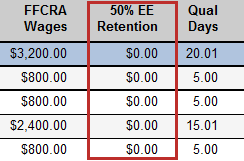

- Check Details: Weekend Bill date, Weekend Date, Check Date, Check #, Paycode and Total Hours are all the pertinent check information included on this report

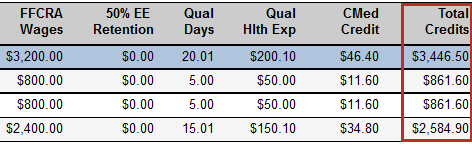

- FFCRA Wages: Gross wages from FFCRA Paycodes

- 50% EE Retention: 50% of the gross associated with EE Retention Paycodes

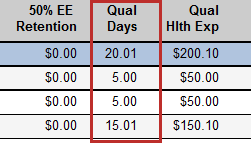

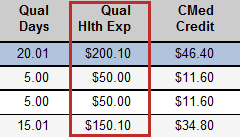

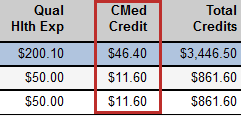

- Qual Days: Number of days with hours on the timecard tied to the check (if not entered daily take total hours divided by 8 hours per day)

- Qual Hlth Exp: Qual Days x Qualified Health Expense Daily Premium (same from FFCRA and EE Retention)

- CMed Credit: Employer Medicare taxes from FFCRA and EE Retention pay codes

- Total Credits: FFCRA Wages + 50% EE Retention + Qual Hlth Exp + CMed Credit = Total Credits

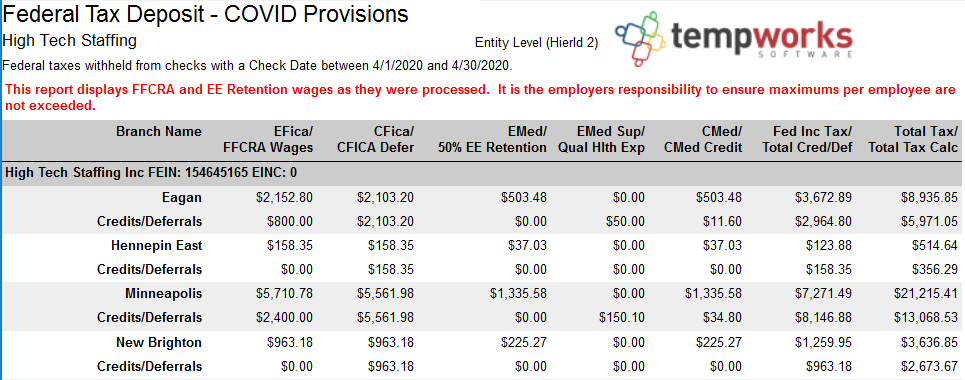

Federal Tax Deposit - COVID Provisions

Purpose: This report is a modified version of the Federal Tax Deposit report. It shows federal tax deposit details for a given check date range including COVID provisions.

*Note* This report is part of the Tax Administration report category. You may need security role that gives you access to the Tax Administration reports to access this report.

Parameters:

| Parameters | Description |

|---|---|

| Employer | Allows you to choose which EINC(s) should be shown on this report (all are selected by default). |

| Branch | Allows you to choose which Branch(s) should be shown on this report (all are selected by default). |

| FFCRA Credit Paycodes | This option allows you to choose which paycodes in your system are FFCRA related and should be included in this report. By default, the C19PSLSelf, C19PSLOth, and C19PFLChld paycodes will be selected but if you have created additional paycodes for tracking purposes, you can select more here. |

| EE Retention Pacyodes | This option allows you to choose which paycodes (if any) in your system are related to Employee Retention Credits (as part of the CARES Act). |

| Qualified Health Expense Daily Premium | Average daily healthcare premium (in dollars) for qualified health expenses. |

| Credit/Deferral Calculation | Determines which COVID related credits and deferrals are added in the calculations for the Total Cred/Def column. For example, if you want to see totals without EE Retention Credits considered, you can uncheck this option. When you run the report it will show the total without the EE Retention Credits considered. |

| *Start & End Date | (Required) Date range you are pulling this report for (consider quarterly, monthly, or weekly). |

| Date Filter | Should start and end date pull transactions by Check Date or Weekend Bill. |

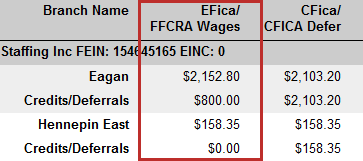

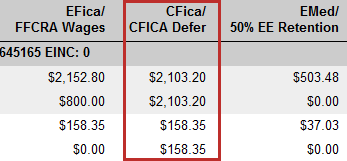

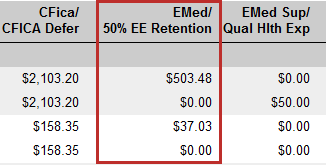

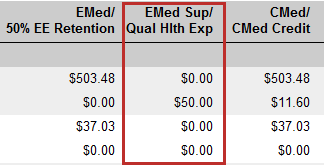

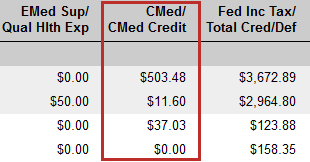

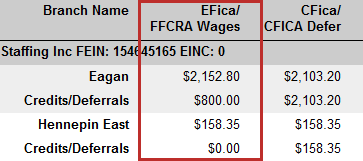

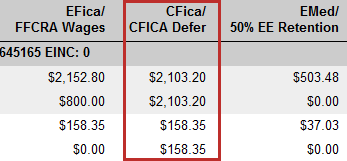

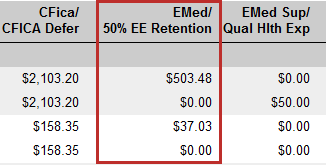

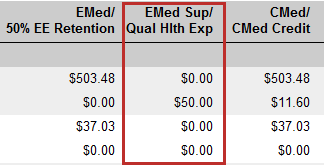

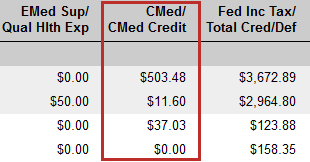

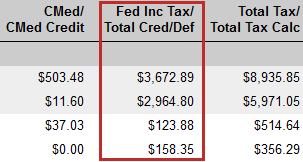

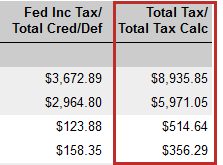

Report Breakdown

The following sections define the columns of information on the report:

- EFica/FFCRA Wages: Shows EFICA total on top and any FFCRA credits/deferral amounts based on FFCRA paycodes

- CFica/CFICA Defer: Show Employer FICA Taxes and amount that may be able to be deferred at this time

- EMed/50% EE Retention: Shows EMed on top and then potential Employee Retention Credits based on 50% of EE Retention Credit Paycodes

- EMed Sup/Qual Hlth Exp: Shows EMed Sup on top and then potential Qualified Health Expenses underneath (Qualified Health Expense Daily Premium x Qualified Days Worked)

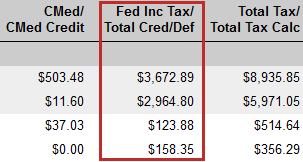

- CMed/CMed Credit: Shows Company Medicare costs on top and Employer Medicare taxes from FFCRA and EE Retention Paycodes selected underneath

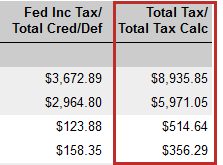

- Fed Inc Tax/Total Cred/Def: Shows total tax on top and total credits and defferals calculated by FFCRA wages + FFCRA ER Medicare Credit + Employer FICA Deferral + Employee Retention Credit + Qualified Health Expenses

- Total Tax/Total Tax Calc: Total Tax - Total Cred/Def = Total Tax Calc

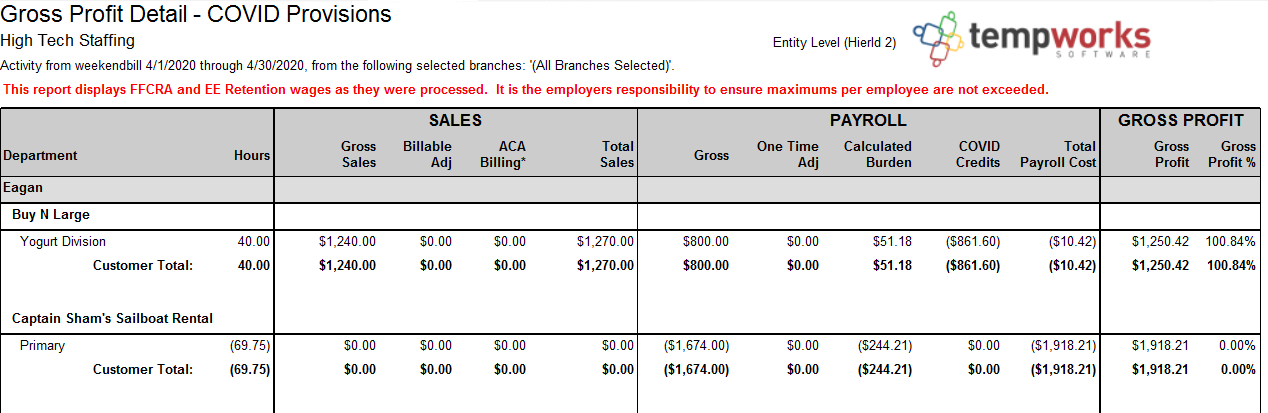

Gross Profit Detail - COVID Provisions

Purpose: This modified version of the Gross Profit Detail report shows the gross profit information by branch and customer within a selected date range including FFCRA and EE Retention credit information. This is a great report if you want to factor COVID related credits into your Gross Profit Calculations.

*Note* This report is part of the Financial report category. You may need security role that gives you access to the Financial reports to access this report.

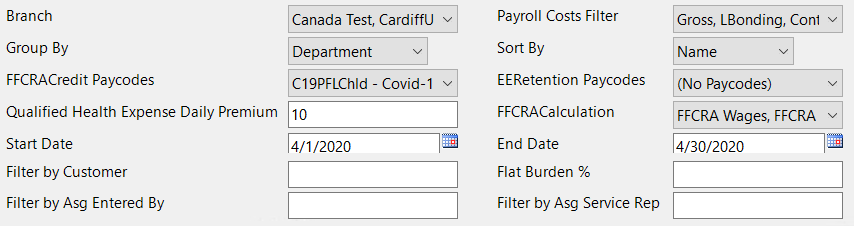

Parameters:

| Parameters | Description |

|---|---|

| Branch | Allows you to choose which Branch(s) should be shown on this report (all are selected by default). |

Payroll Costs Filter | Determines which payroll costs will be considered in the payroll totals and factored in for Gross Profit. Uncheck any option you do not want factored into your GP. |

| Group By | Changes what criteria the report groups information. |

| Sort By | Changes how the items in the groups are organized. |

| FFCRA Credit Paycodes | This option allows you to choose which paycodes in your system are FFCRA related and should be included in this report. By default, the C19PSLSelf, C19PSLOth, and C19PFLChld paycodes will be selected but if you have created additional paycodes for tracking purposes, you can select more here. |

| EE Retention Paycodes | This option allows you to choose which paycodes (if any) in your system are related to Employee Retention Credits (as part of the CARES Act). |

| Qualified Health Expense Daily Premium | Average daily healthcare premium (in dollars) for qualified health expenses. |

| FFCRA Calculations | Determines which COVID related credits and deferrals are added in the calculations for the COVID Credits column. For Example, if you want to see totals without EE Retention Credits considered, you can uncheck this option. When you run the report it will show the total without the EE Retention Credits considered. |

| *Start & End Date | (Required) Date range you are pulling this report for (consider quarterly, monthly, or weekly). |

| Filter By Customer | Allows you to limit the report to show only the customer name entered here. |

| Flat Burden % | Optionally, enter a % as your flat burden rate. |

| Filter by Asg Entered By | Allows you to limit the report to show only data related to assignments that were created by a specific service rep. |

| Filter by Asg Service Rep | Allows you to limit the report to show only data related to assignments that have a particular person listed as the Service Rep on the assignment. |

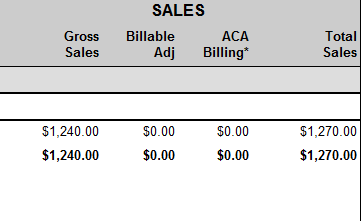

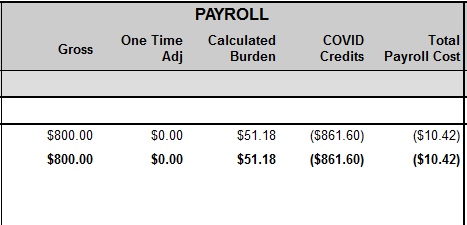

Report Breakdown

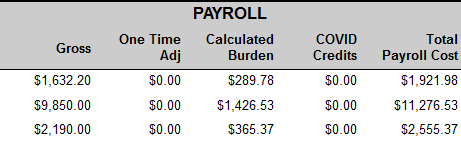

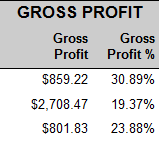

The following sections define the columns of information on the report:

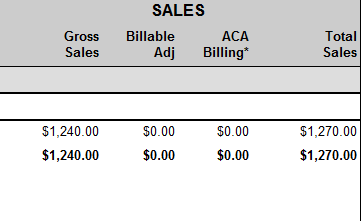

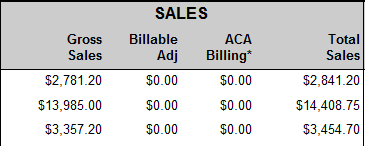

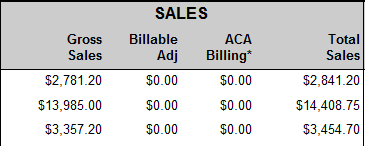

- Sales: Includes gross sales amount, any billable adjustment amounts, applicable ACA billing, and total sales

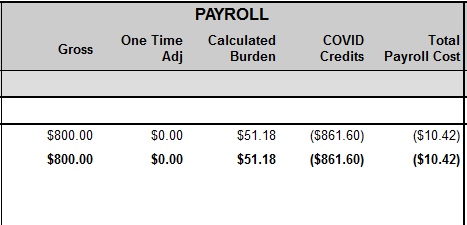

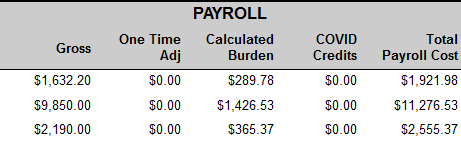

- Payroll: Includes gross payroll, any one-time payable adjustments, calculated burden (Employer taxes + Worker Comp Costs + LBonding + Branch Burden + COVID Credits - Rebate Amount - Credit Card Expense Amount), COVID Credits (Total amount for FFCRA and EE Retention related credits), and total payroll costs

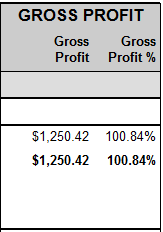

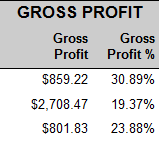

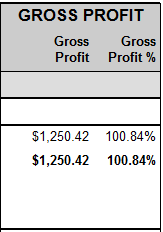

- Gross Profit: Includes Gross Profit Amount( Gross Sales +One time Adj + ACA Billing - Payroll Costs) and Gross Profit % (gross profit / (gross sales + one time adj + ACA Billing))

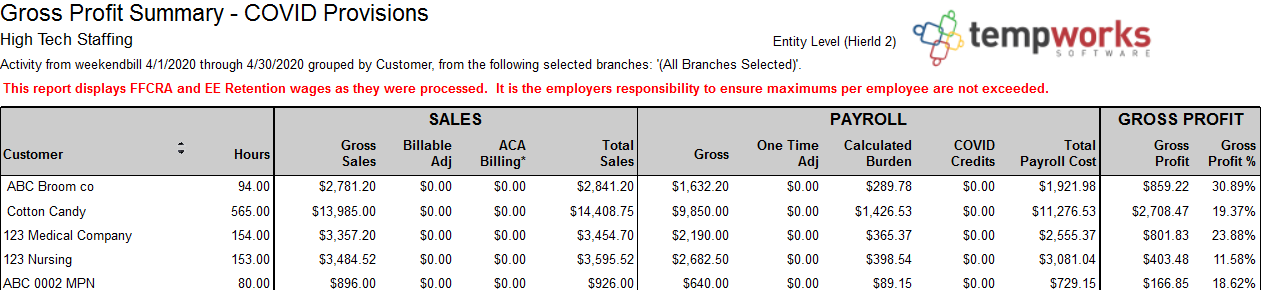

Gross Profit Summary- COVID Provisions

Purpose: This modified version of the Gross Profit Summary report shows a summary of the gross profit information by branch and customer within a selected date range including FFCRA and EE Retention credit information.

The Gross Profit Summary allows for different groupings and provides more of an overview while the Gross Profit Detail can be more in-depth. This is another great report if you want to factor COVID related credits into your Gross Profit Calculations.

*Note* This report is part of the Financial report category. You may need security role that gives you access to the Financial reports to access this report.

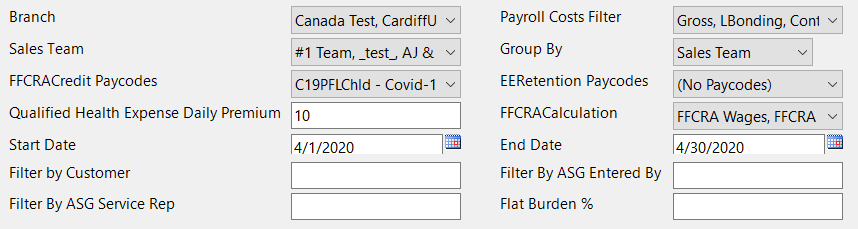

Parameters

| Parameters | Description |

|---|---|

| Branch | Allows you to choose which Branch(s) should be shown on this report (all are selected by default). |

Payroll Costs Filter | Determines which payroll costs will be considered in the payroll totals and factored in for Gross Profit. Uncheck any option you do not want factored into your GP. |

| Sales Team | Allows you to choose which sales team's transactions to include in the report. |

| Group By | Changes what criteria the report groups information. |

| FFCRA Credit Paycodes | This option allows you to choose which paycodes in your system are FFCRA related and should be included in this report. By default, the C19PSLSelf, C19PSLOth, and C19PFLChld paycodes will be selected but if you have created additional paycodes for tracking purposes, you can select more here. |

| EE Retention Paycodes | This option allows you to choose which paycodes (if any) in your system are related to Employee Retention Credits (as part of the CARES Act). |

| Qualified Health Expense Daily Premium | Average daily healthcare premium (in dollars) for qualified health expenses. |

| FFCRA Calculations | Determines which COVID related credits and deferrals are added in the calculations for the COVID Credits column. For Example, if you want to see totals without EE Retention Credits considered, you can uncheck this option. When you run the report it will show the total without the EE Retention Credits considered. |

| *Start & End Date | (Required) Date range you are pulling this report for (consider quarterly, monthly, or weekly). |

| Filter By Customer | Allows you to limit the report to show only the customer name entered here. |

| Filter by Asg Entered By | Allows you to limit the report to show only data related to assignments that were created by a specific service rep. |

| Filter by Asg Service Rep | Allows you to limit the report to show only data related to assignments that have a particular person listed as the Service Rep on the assignment. |

| Flat Burden % | Optionally, enter a % as your flat burden rate. |

Report Breakdown

The following sections define the columns of information on the report:

- Sales: Includes gross sales amount, any billable adjustment amounts, applicable ACA billing, and total sales

- Payroll: Includes gross payroll, any one-time payable adjustments, calculated burden (Employer taxes + Worker Comp Costs + LBonding + Branch Burden + COVID Credits - Rebate Amount - Credit Card Expense Amount), COVID Credits (Total amount for FFCRA and EE Retention related credits), and total payroll costs

- Gross Profit: Includes Gross Profit Amount( Gross Sales +One time Adj + ACA Billing - Payroll Costs) and Gross Profit % (gross profit / (gross sales + one time adj + ACA Billing))

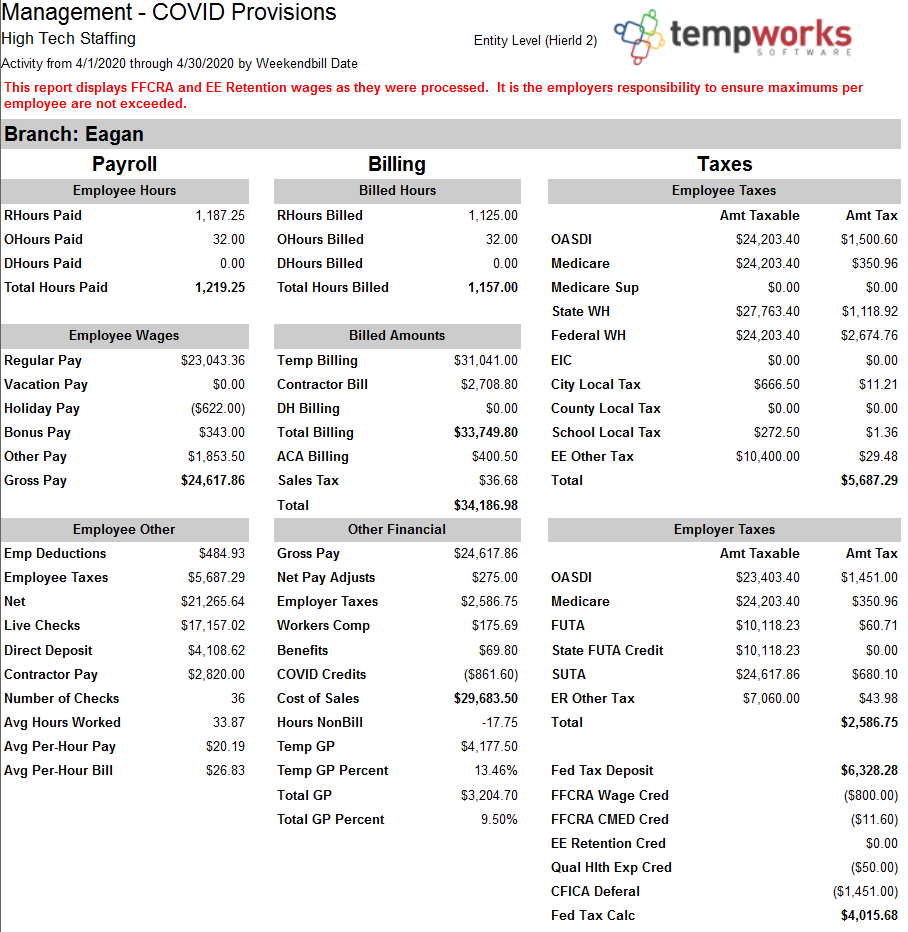

Management - COVID Provisions

Purpose: This modified version of the Management report displays important metrics and financial figures based on a specified date range. This report runs based on weekend bill date and can only be run for closed weeks. This version of the Management report factors in COVID provisions.

*Note* This report is part of the Financial report category. You may need security role that gives you access to the Financial reports to access this report.

Parameters

| Parameter | Description |

|---|---|

| FFCRA Credit Paycodes | This option allows you to choose which paycodes in your system are FFCRA related and should be included in this report. By default, the C19PSLSelf, C19PSLOth, and C19PFLChld paycodes will be selected but if you have created additional paycodes for tracking purposes, you can select more here. |

| EE Retention Paycodes | This option allows you to choose which paycodes (if any) in your system are related to Employee Retention Credits (as part of the CARES Act). |

| Qualified Health Expense Daily Premium | Average daily healthcare premium (in dollars) for qualified health expenses. |

| FFCRA Calculations | Determines which COVID related credits and deferrals are added in the calculations for the COVID Credits column. For Example, if you want to see totals without EE Retention Credits considered, you can uncheck this option. When you run the report it will show the total without the EE Retention Credits considered. |

| *Start & End Date | (Required) Date range you are pulling this report for (consider quarterly, monthly, or weekly). |

COVID Provision Additions

The following sections break down the COVID related additions to the Management Report. For more information on the management report, check out Management Report.

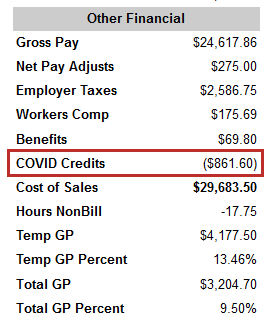

Other Financial

- COVID Credits: Total credits calculated from FFCRA, EE Retention, FFCRA CMED, and Qual Hlth Exp

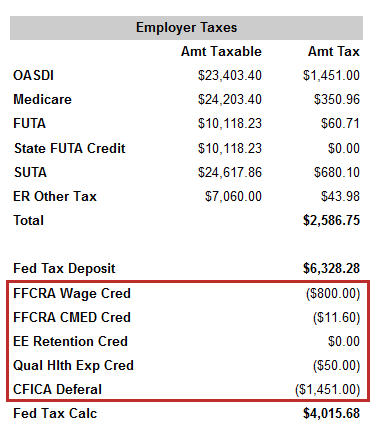

Employer Taxes

- FFCRA Wage Cred: Gross wages from FFCRA Paycodes

- FFCRA CMED Cred: Employer medicare taxes from FFCRA Paycodes

- EE Retention Cred: 50% gross wages from EE Retention Credit Paycodes

- Qual Hlth Exp Cred: Qualified health expenses daily premium (from parameters) x Qualified Days Worked (number of days worked on FFCRA and EE Retention Paycodes - If using daily hours 1 day per day total entered - If using total hours take total hours/8 hours per day)

- CFICA Deferral: Employer FICA taxes that could be deferred