Overview

Depending on the state, the respective states Department of Revenue (DOR) may have a specific way in which garnishments should be calculated on employees' paychecks. Wisconsin, for example, requires garnishments to be calculated in a specific way, via sequencing and based on Gross pay.

This article will outline the process of setting up a DOR garnishment adjustment along with examples of running through the payroll process based on how the adjustment is setup depending on the employee.

This article covers the following:

Setting Up the DOR Adjustment

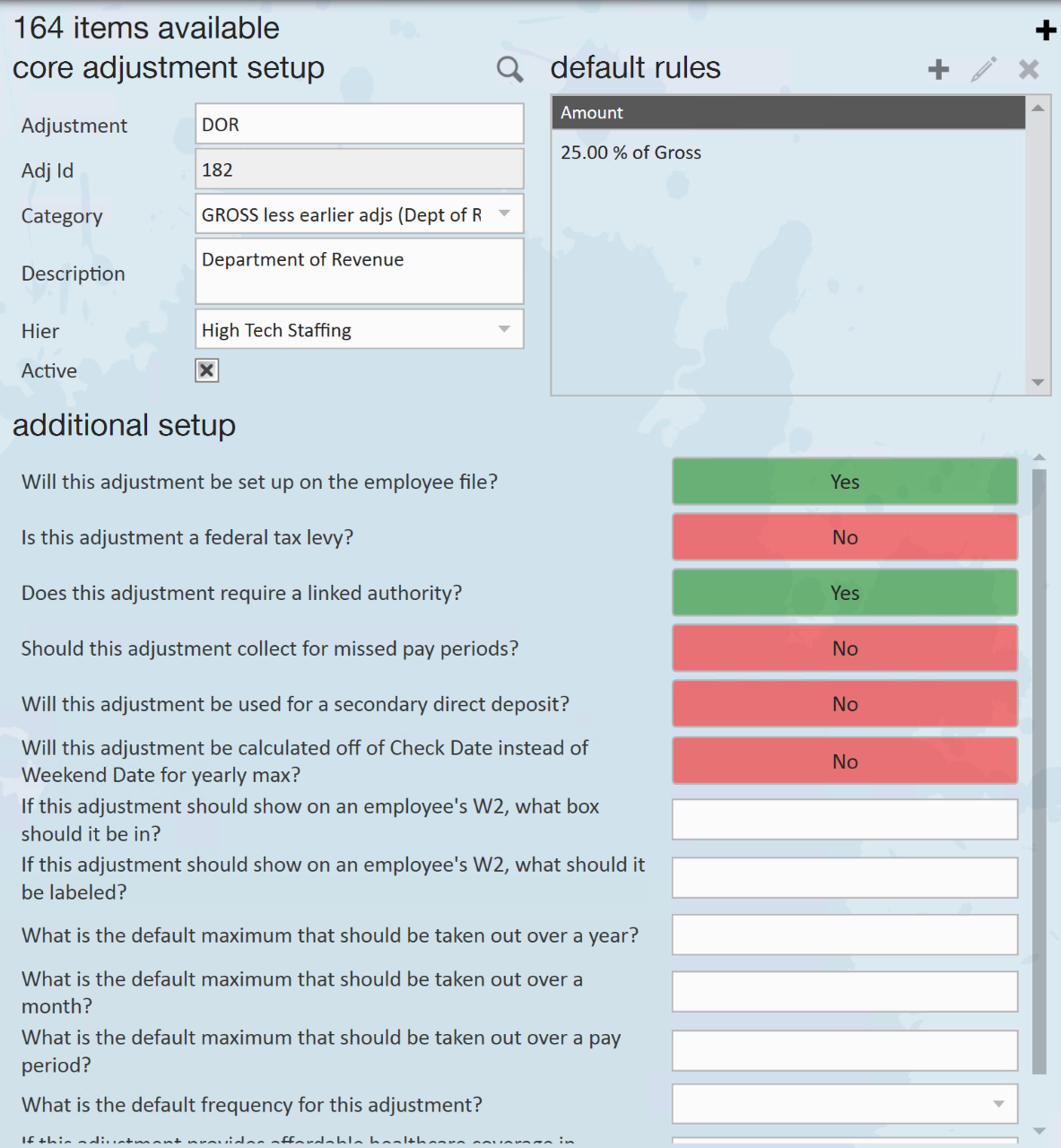

Begin by navigating to Enterprise > All Options > Administration > Adjustments and select the "+" option to create a new adjustment.

Within the adjustment setup screen, enter the following:

- Core Adjustment Setup

- Adjustment: The name of the adjustment

- Category: DOR

- This is the category that is required to be selected for this specific adjustment setup.

- Description: The description of the adjustment

- Additional Setup

- Will this adjustment be set up on the employee file? Yes

- Is this adjustment a federal tax levy? No

- Does this adjustment require a linked authority? Yes

- Should this adjustment collect for missed pay periods? No

- Will this adjustment be used for a secondary direct deposit? No

- Will this adjustment be calculated off of Check Date instead of Weekend Date for yearly max? No

*Note* The remainder of the questions within the adjustment setup can remain blank.

- Default Rules

- Enter any default rules you would like applied to employees for this adjustment.

*Note* The state should be sending you a letter with the intended amount/percentage to be garnished from the specific employee's paycheck.

Therefore, you may want to keep the "Default Rules" blank within the adjustment setup.

Once the adjustment has been setup as intended, select the "Save" option at the top left to complete the setup.

Adding the DOR Adjustment to Employees

As stated in the previous section of this article, the state's Department of Revenue will send you a letter with the intended amount/percentage to be garnished from the specific employee's paycheck.

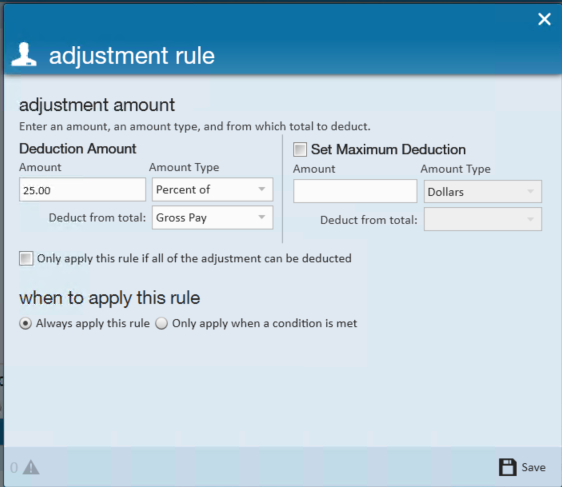

Therefore, when adding the adjustment to the employee, ensure you are entering the correct amount/percentage (for this example, it will be 25% of Gross).

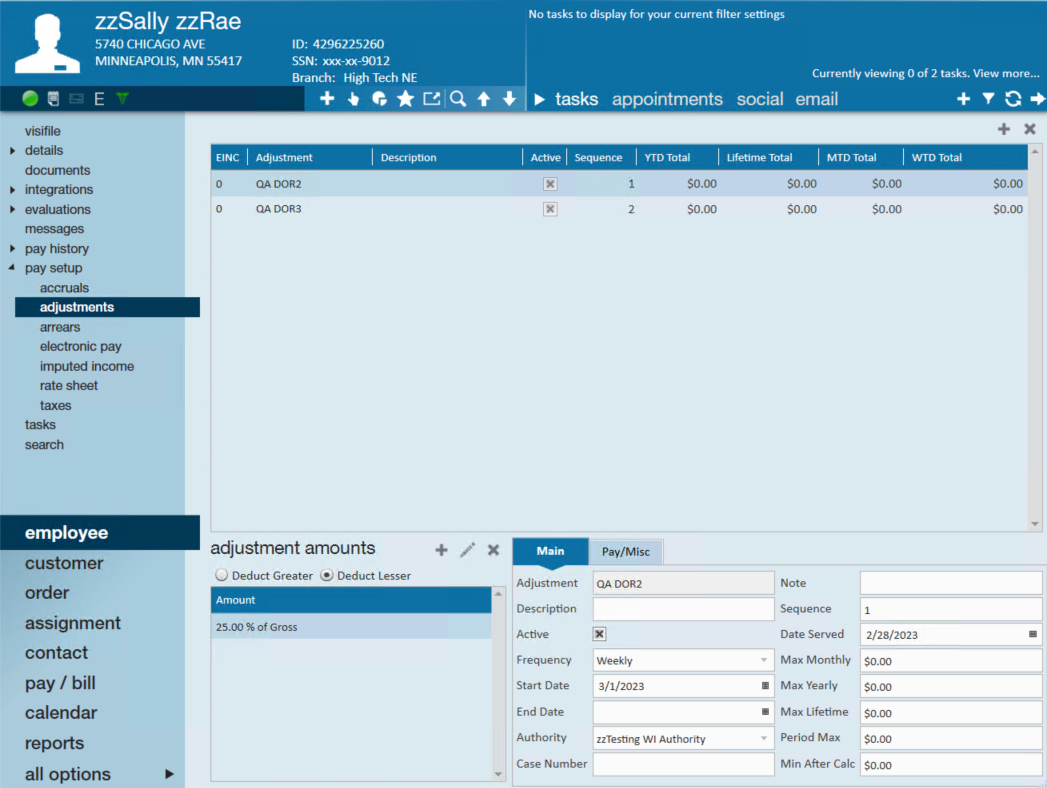

Navigate to the Employee Record > Pay Setup > Adjustments and select the "+" to add a new adjustment.

Within the Adjustment Rule window, enter the intended Deduction Amount, the Amount Type (Percent or Dollars), and ensure that you are deducting from Gross Pay:

Once the information has been entered, select "Save".

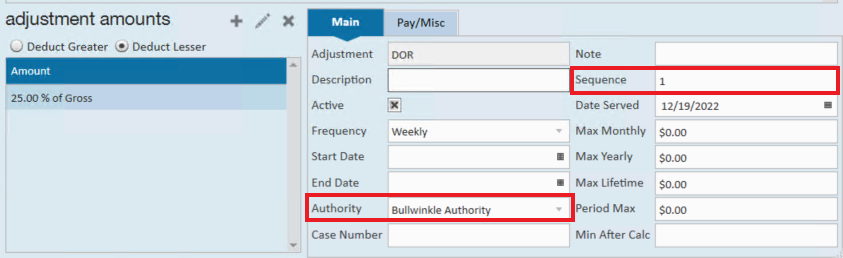

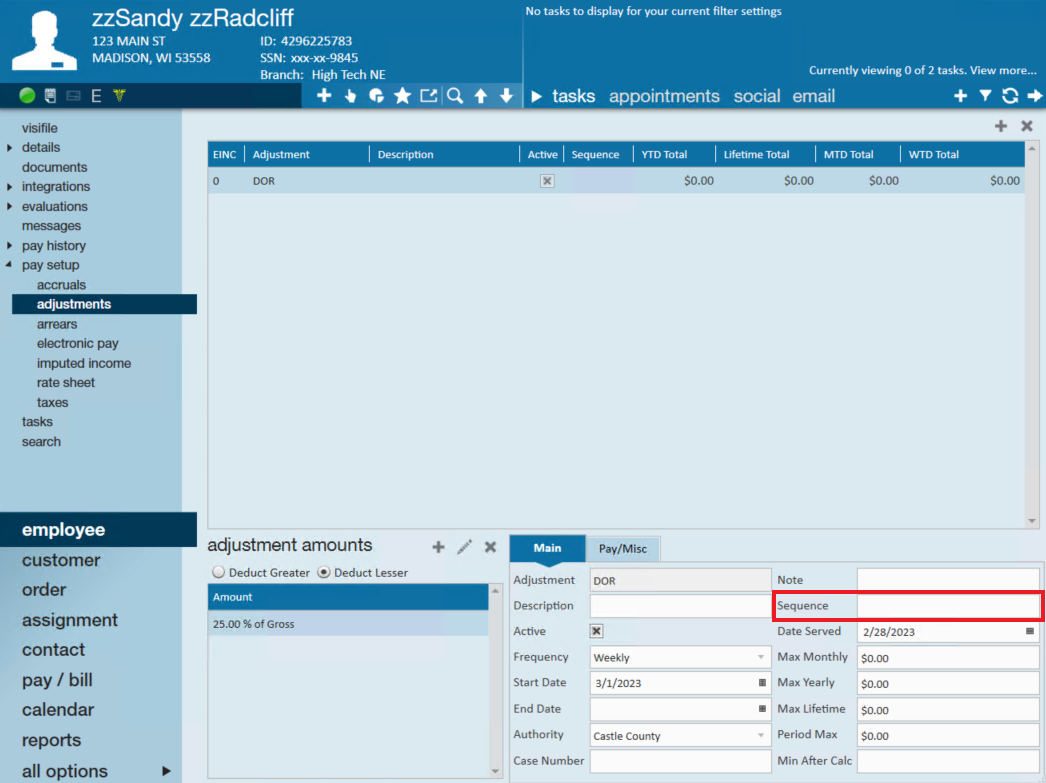

Within the "Main" tab of the adjustment details, you will need to have selected an "Authority" and entered a "Sequence" of "1" in order for the DOR garnishment adjustment to calculate as intended:

*Note* The DOR garnishment adjustment will not calculate correctly if the following conditions are not met:

- An authority is not linked to the adjustment.

- Sequencing is not setup on the adjustment.

Regarding sequencing, while the state of Wisconsin may hold Child Support adjustments to a higher level of importance over DOR garnishments, you will need to setup the sequencing of adjustments as you see fit.

Please keep in mind that the aforementioned adjustments must have different sequencing values in order for the DOR garnishment to calculate as intended.

More information will be shared within the payroll examples later within this article.

Once the adjustment has been setup as intended, select the "Save" option at the top left to complete the setup on the employee record.

Once the DOR garnishment adjustment has been applied to all employees who need it, along with intended values/percentages, timecards are ready to be created and run through proofing & payroll.

Calculating Payroll

Due to the complexity of the DOR garnishment adjustment, this section will contain four different examples of employees being run through payroll, based on their adjustment(s) setup.

Example #1 - Calculates as Intended

*Note* The following example will result in correct payroll calculations of DOR garnishment adjustments.

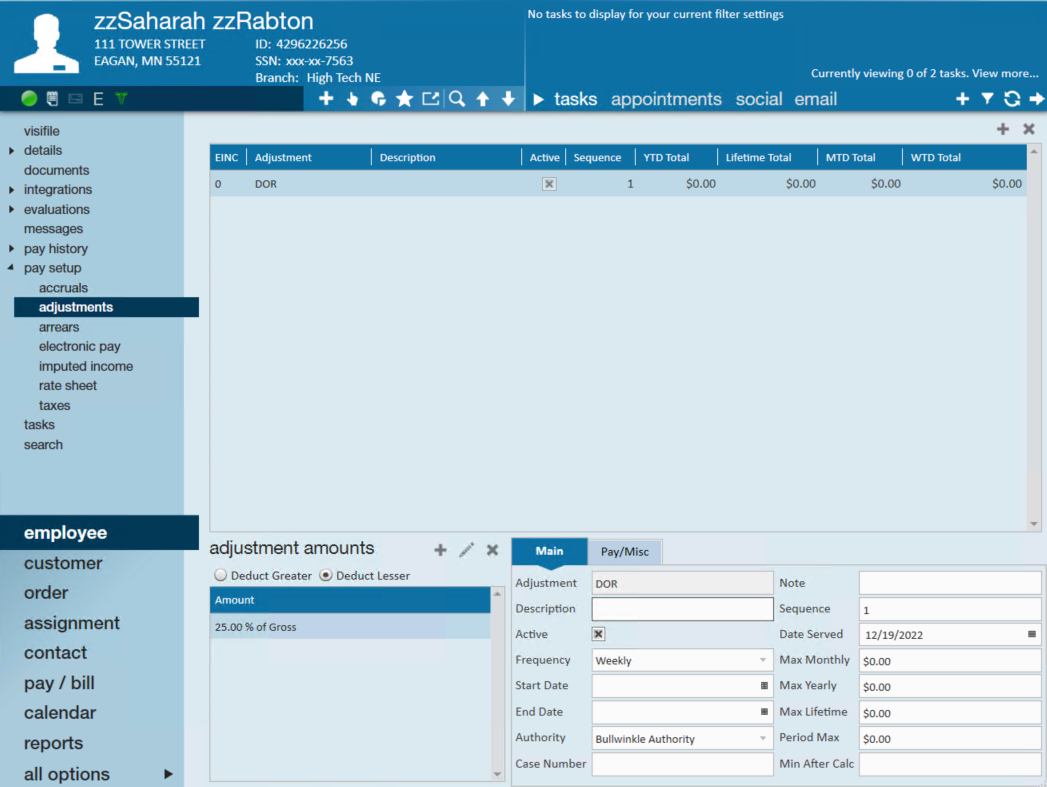

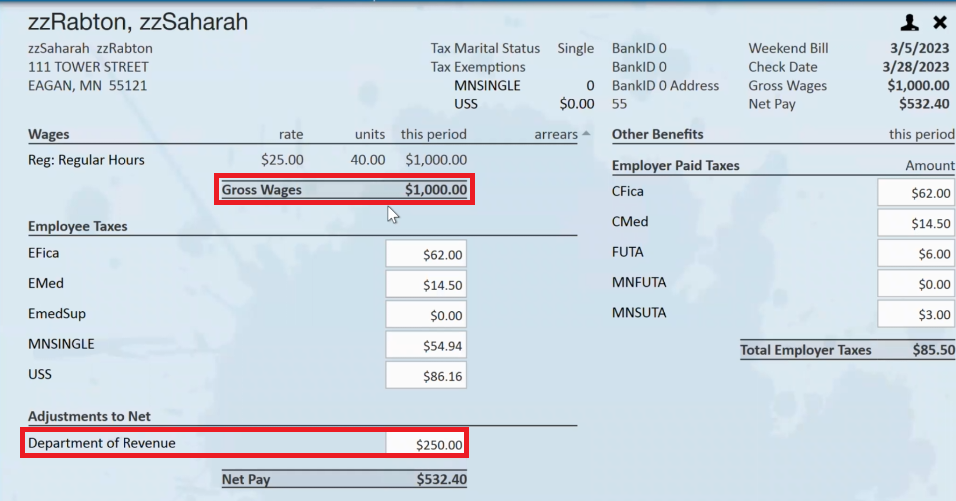

For this example, our employee has the one DOR garnishment adjustment applied to their record:

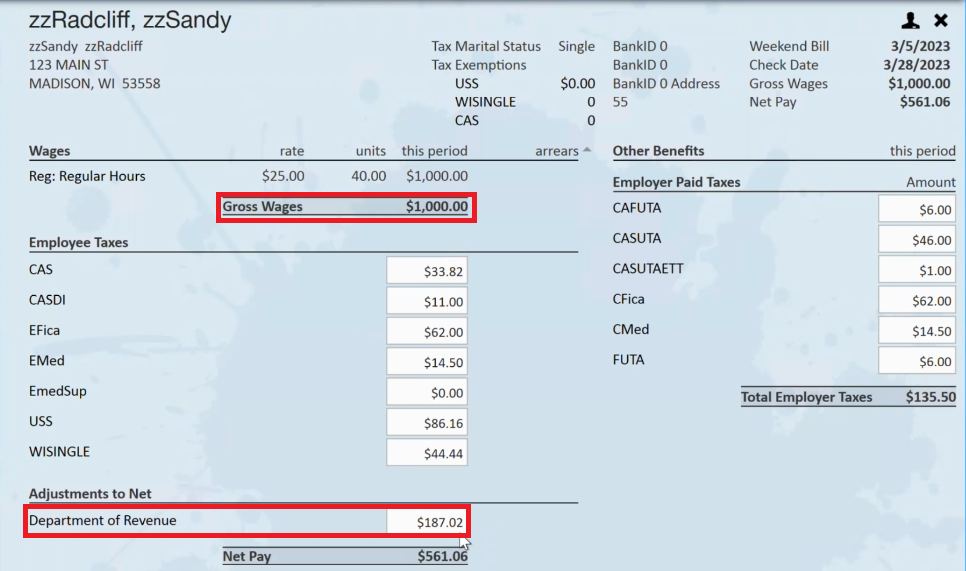

When running this employee through payroll, you will see the DOR garnishment adjustment taking the 25% of the gross ($1000) and the check calculating without issue:

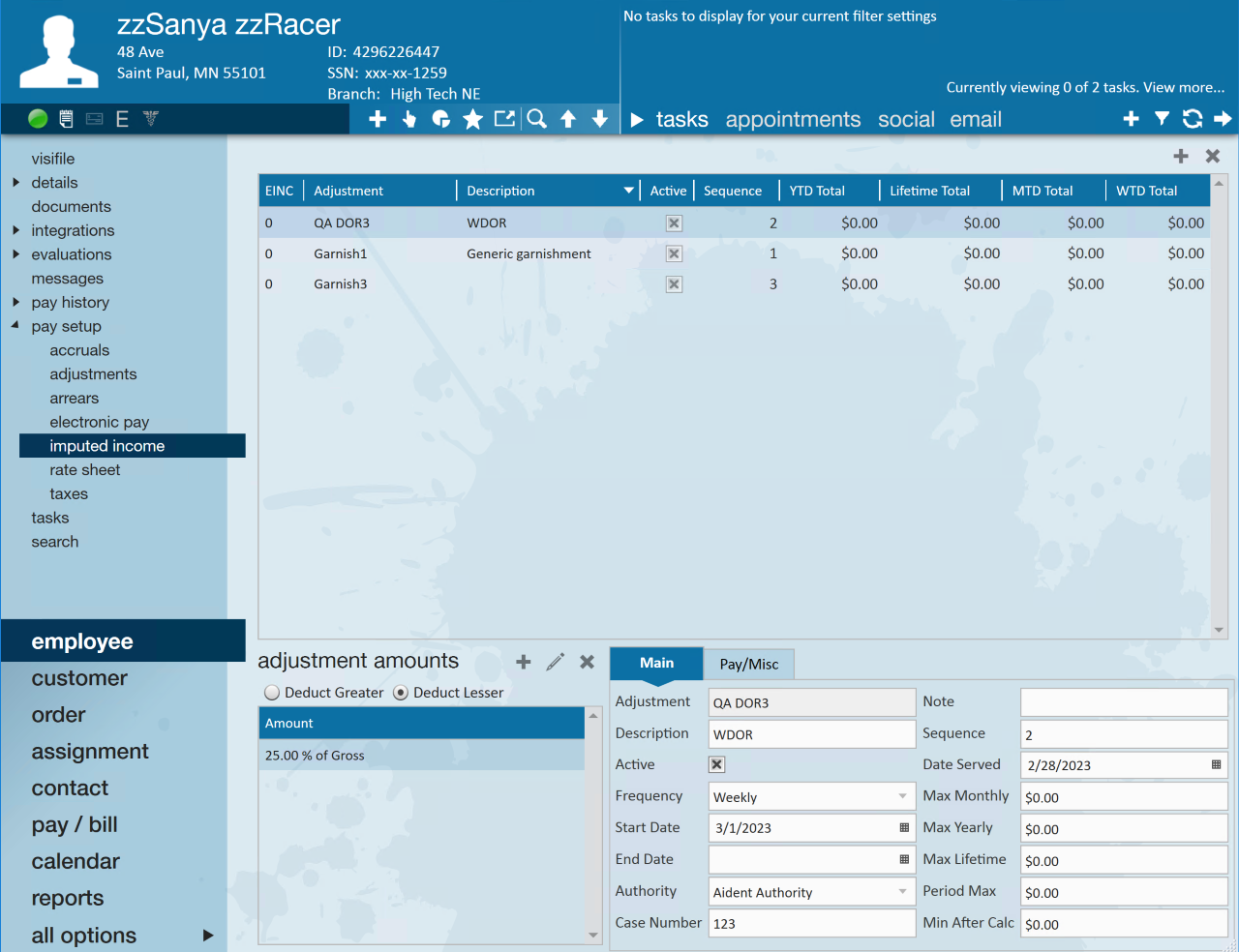

Example #2 - Multiple Garnishment Adjustments w/Sequencing

*Note* The following example will result in correct payroll calculations of DOR garnishment adjustments.

For this example, our employee has multiple garnishment adjustments applied to their record, each with a different sequencing value:

- Sequence 1 for the generic garnishment (Garnish1) adjustment.

- Sequence 2 for the DOR garnishment adjustment.

- Sequence 3 for the other generic garnishment (Garnish3) adjustment.

When running this employee through payroll, you will see the following string of events:

- The initial $18.18 is deducted from the gross of the employee's check ($1000) due to the generic garnishment adjustment having a sequence of "1".

- The DOR garnishment adjustment now takes the 25% of the adjusted gross ($981.82) for a total of $245.46.

Example #3 - Matching Authorities

*Note* The following example will result in correct payroll calculations of DOR garnishment adjustments.

For this example, our employee has multiple DOR garnishment adjustments with the same linked authority and proper sequencing:

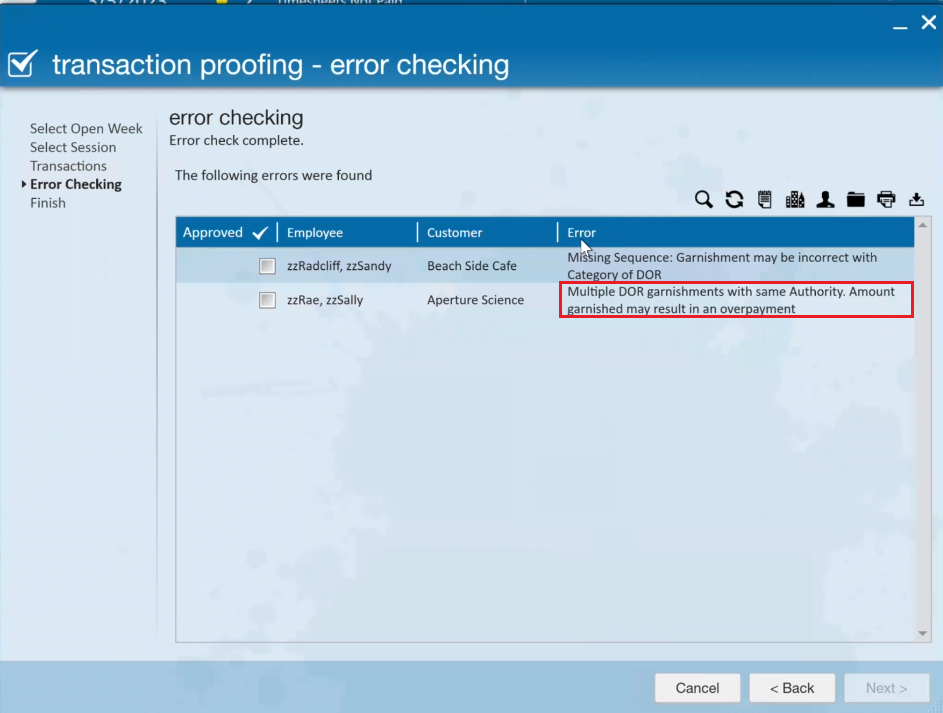

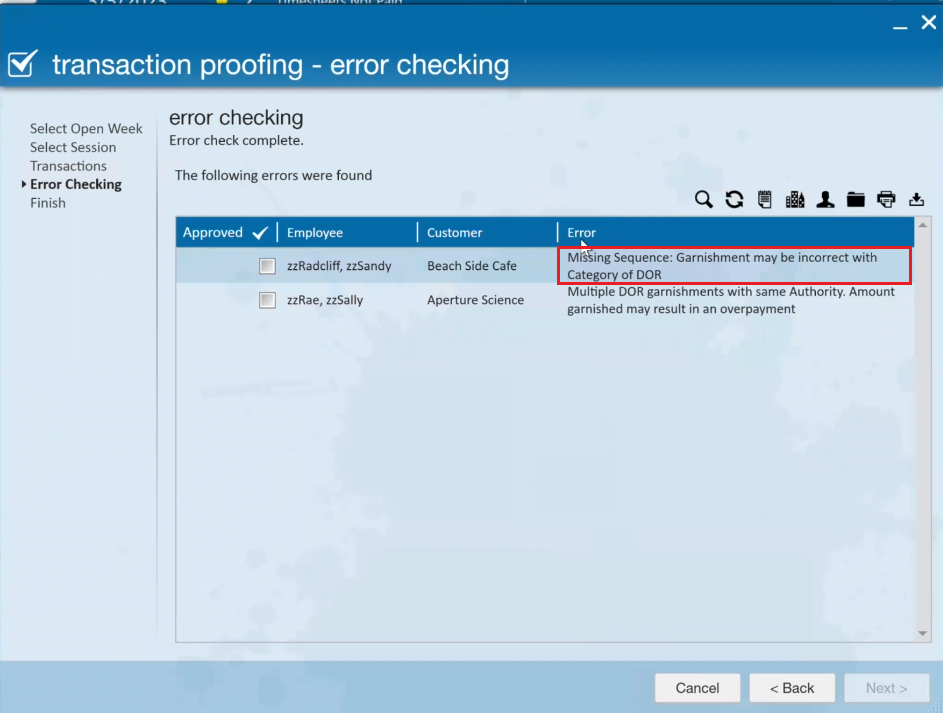

When running this employee through proofing payroll, you will receive the following proofing warning:

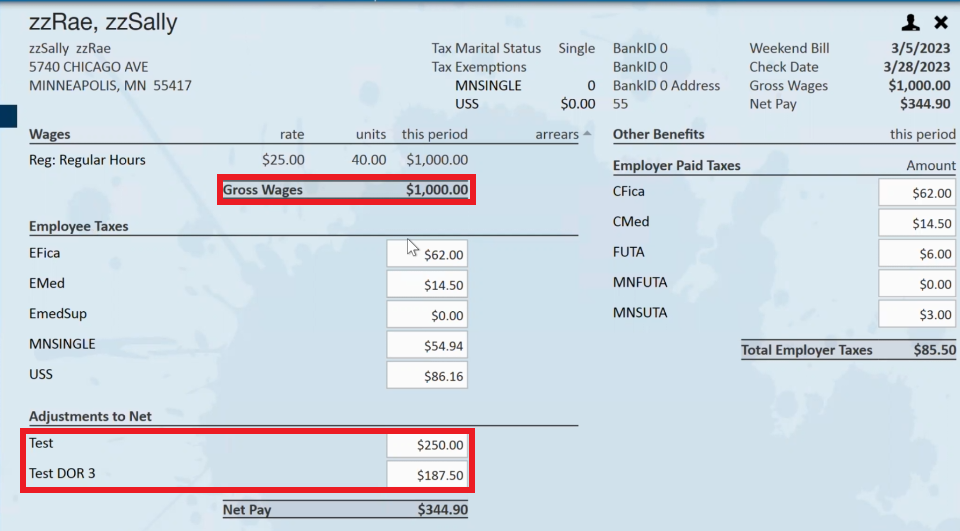

If the proofing warning is accepted, during payroll calculation, you will see the following:

- The DOR garnishment adjustment with the sequencing of "1" will calculate first, with 25% being deducted from the $1000 gross pay.

- The second DOR garnishment adjustment with the sequencing of "2" will calculate second, with 25% being deducted from the new adjusted gross pay of $750, totaling $187.50.

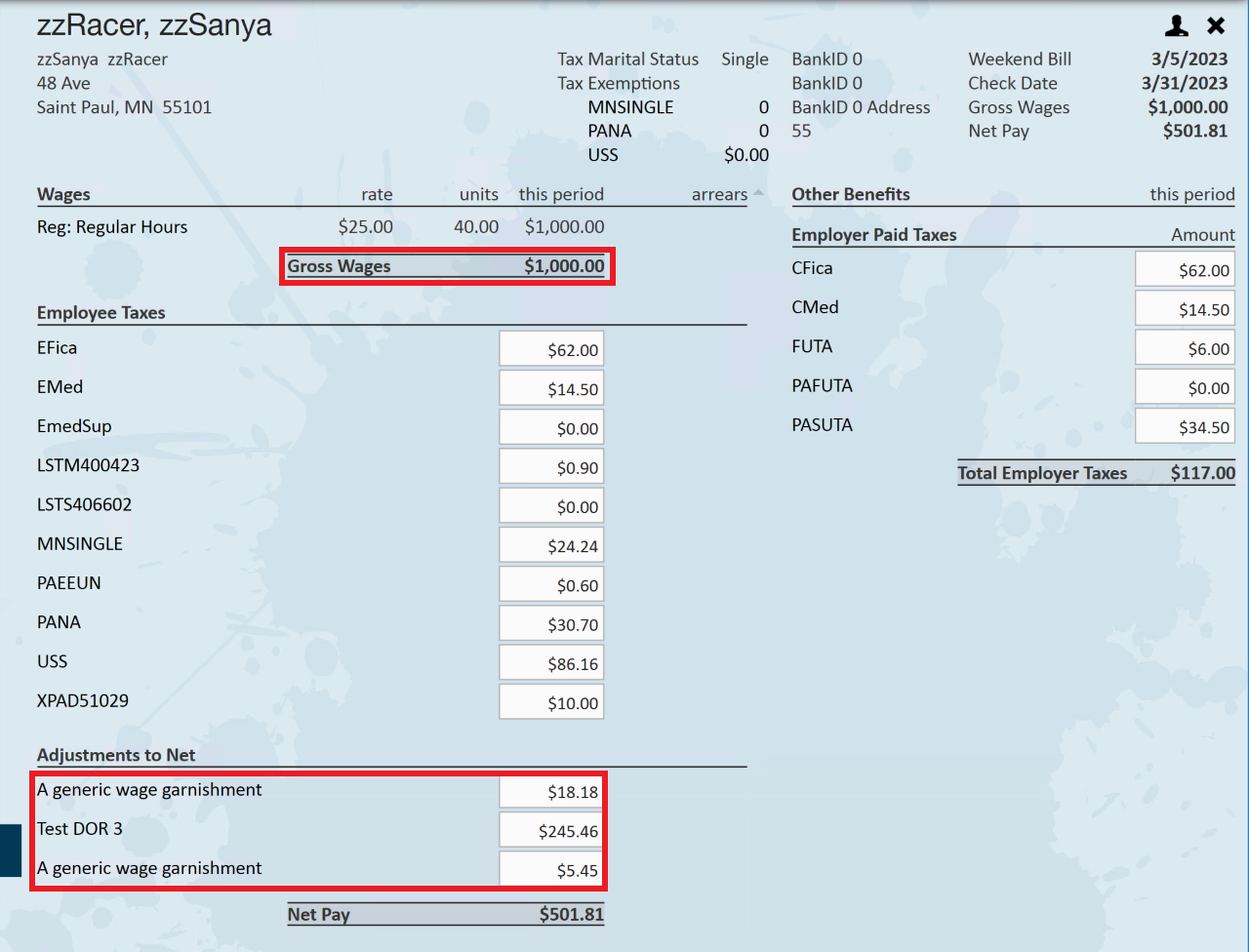

Example #4 - Missing Sequencing

*Note* The following example is meant for educational purposes only and, if followed, will result in incorrect adjustment calculations.

For this example, our employee has the one DOR garnishment adjustment applied to their record without a sequencing value:

When running this employee through proofing payroll, you will receive the following proofing warning:

If the proofing warning is accepted, during payroll calculation, you will see that instead of $250 being deducted from the $1000 gross pay, it was only $187.02 being deducted from the net pay due to the sequencing not existing within the adjustment setup:

*Note* As stated previously within this article, it is required that DOR garnishment adjustments be linked to an authority and have proper sequencing to ensure payroll is being calculated accurately based on the setup of the respective adjustment.

Example #5 - Competing Sequence with Different Authorities

*Note* The following example is meant for educational purposes only and, if followed, will result in incorrect adjustment calculations.

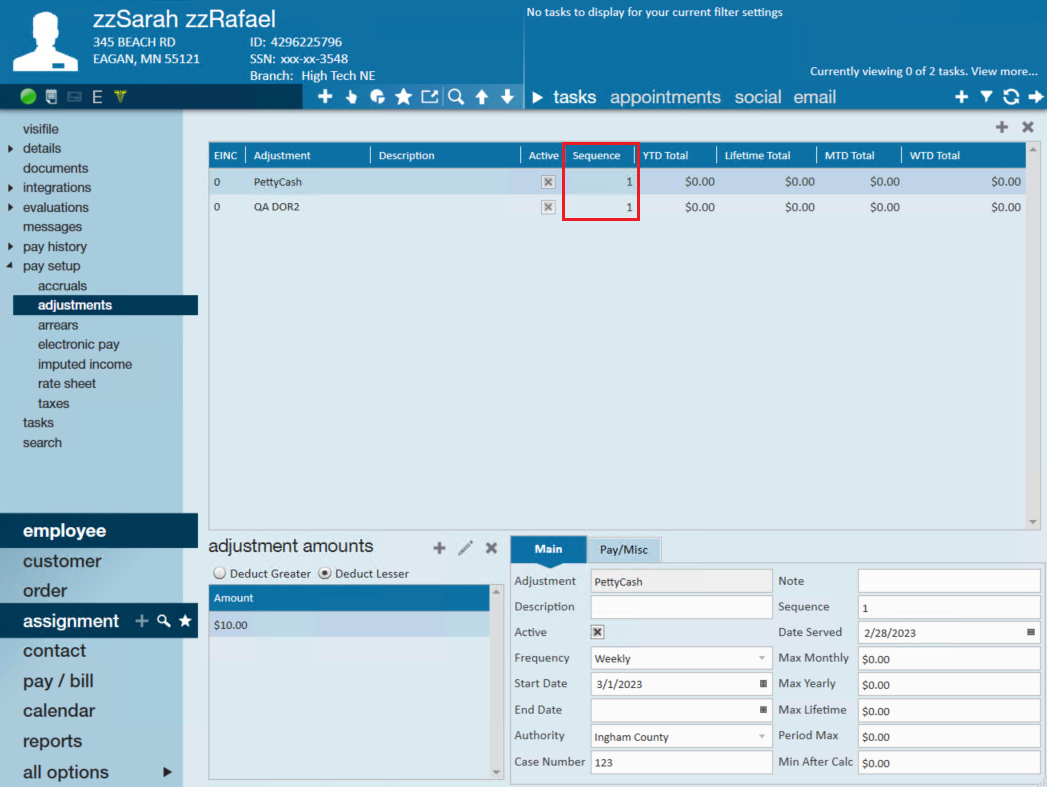

For this example, our employee has multiple garnishment adjustments with the same sequencing of "1":

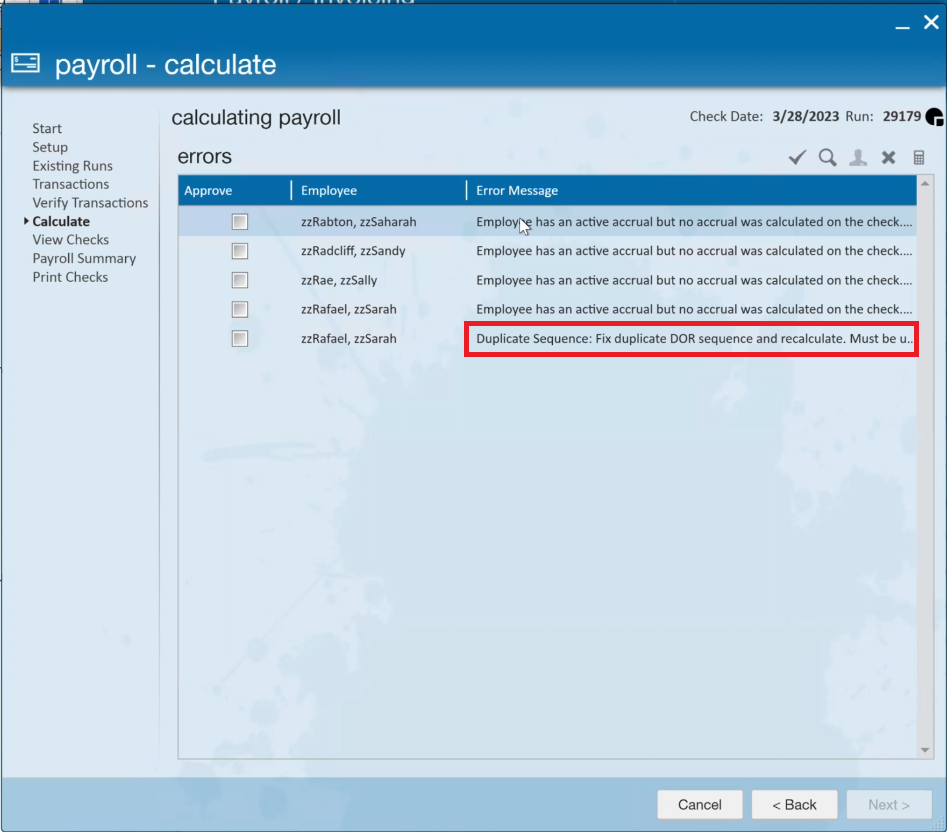

When running this employee through payroll, you will receive the following payroll error that states "Duplicate Sequence: Fix duplicate DOR sequence and recalculate. Must be unique to calculate properly.":

*Note* It is at this point that you must update the sequencing of adjustments on the employee record for the DOR garnishment adjustment to calculate as intended.

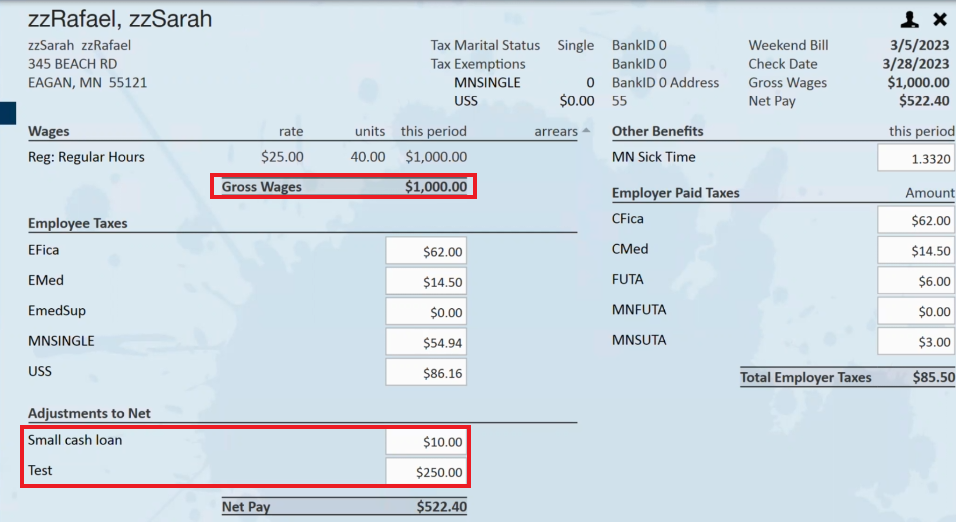

Due to this being an example, if you choose to approve the payroll error, you will see the following:

- Due to the conflicting sequencing, both garnishment adjustments calculate based on the $1000 gross instead of calculating properly. Therefore, with this example, the DOR adjustment is calculating incorrectly as it should be calculating off $990 ($1000 - $10 from the first garnishment adjustment). Instead, it is calculating off the original $1000 gross.

*Note* As stated previously within this article, it is required that DOR garnishment adjustments be linked to an authority and have proper sequencing to ensure payroll is being calculated accurately based on the setup of the respective adjustment.

Related Articles

- None