Coronavirus, FFCRA, & Paid Sick Leave

In accordance with the Families First Coronavirus Response Act (FFCRA), as of April 1st, 2020 certain employers are required to provide their employees with sick, family, and medical leave. To help accurately document and correctly tax these different leave options, TempWorks has added a few new options for Payroll.

NOTICE: Continue to check back here for more information as we continue to make changes related to COVID-19 Response.

Resources to Learn More:

- Learn more about FFCRA: https://www.dol.gov/agencies/whd/pandemic/ffcra-employer-paid-leave

- FFCRA Q&A: https://www.dol.gov/agencies/whd/pandemic/ffcra-questions

- Learn more about the IRS Coronavirus Tax Relief: https://www.irs.gov/coronavirus

- Learn more about the IRS Tax Credits: https://www.irs.gov/newsroom/treasury-irs-and-labor-announce-plan-to-implement-coronavirus-related-paid-leave-for-workers-and-tax-credits-for-small-and-midsize-businesses-to-swiftly-recover-the-cost-of-providing-coronavirus

- IRS Tax Credit Q&A: https://www.irs.gov/newsroom/covid-19-related-tax-credits-for-required-paid-leave-provided-by-small-and-midsize-businesses-faqs

This Article Covers:

- Documenting Requested and Approved Paid Leave with Message Action Codes & Document Types

- Using Coronavirus Related Pay Codes

- Proofing & Payroll Errors

Documenting Requested and Approved Paid Leave

It's important that the sick leave employees are taking is properly documented and approved before payroll. To help with this, we have added a few new message action codes and document types to help your team. The following options will help document when an employee is taking sick leave and which qualifying reason it is related to FFCRA.

Message Action Codes

You can log messages on the employee's record when a specific paid leave time has been requested or approved for this employee. This is important because payroll will see a proofing error when trying to pay time with Coronavirus specified paycodes if they do not have the correct corresponding message action code showing the time has been approved.

*Note* Message Action Codes may require additional security. In Beyond, users will need to have the correct message action security group. In Enterprise, users will need to be able to log nonsecure messages - see Enterprise - Security Roles for more information.

In Enterprise:

In Beyond:

- Use the Req (requested) message action codes to denote the request has been made by the employee

- Use the Appvd (approved) message action code to denote the request has been approved

| Message Action Code | When to Use |

|---|---|

| Covid PSL Self Req | Covid-19 Paid Sick Leave for Self Requested (Qualifying Reasons 1-3) |

| Covid PSL Other Req | Covid-19 Paid Sick Leave Type 2 Requested (Qualifying Reasons 4 - 6) |

| Covid PFL Childcare Req | Covid-19 Expanded Paid Family Leave for Child Care Requested (Qualifying Reason 5) |

| Covid PSL Self Appved | Covid-19 Paid Sick Leave Type 2 Approved(Qualifying Reasons 1 - 3) |

| Covid PSL Other Appvd | Covid-19 Paid Sick Leave Type 2 Approved(Qualifying Reasons 4 - 6) |

| Covid PFL Childcare Appvd | Covid-19 Expanded Paid Family Leave for Child Care Approved (Qualifying Reason 5) |

To learn more about logging messages, check out: Beyond - Message Logging & Enterprise - Tips for Message Logging.

Qualifying Reasons From the FFCRA:

Qualifying Reasons for Leave:

Under the FFCRA, an employee qualifies for paid sick time if the employee is unable to work (or unable to telework) due to a need for leave because the employee:

- is subject to a Federal, State, or local quarantine or isolation order related to COVID-19;

- has been advised by a health care provider to self-quarantine related to COVID-19;

- is experiencing COVID-19 symptoms and is seeking a medical diagnosis;

- is caring for an individual subject to an order described in (1) or self-quarantine as described in (2);

- is caring for a child whose school or place of care is closed (or child care provider is unavailable) for reasons related to COVID-19; or

- is experiencing any other substantially-similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury.

Under the FFCRA, an employee qualifies for expanded family leave if the employee is caring for a child whose school or place of care is closed (or child care provider is unavailable) for reasons related to COVID-19.

Learn more about duration, amount of leave, and additional restrictions on FFCRA's website.

Searching By Message Action Code

You can search for employees who have requested sick leave related to the Coronavirus

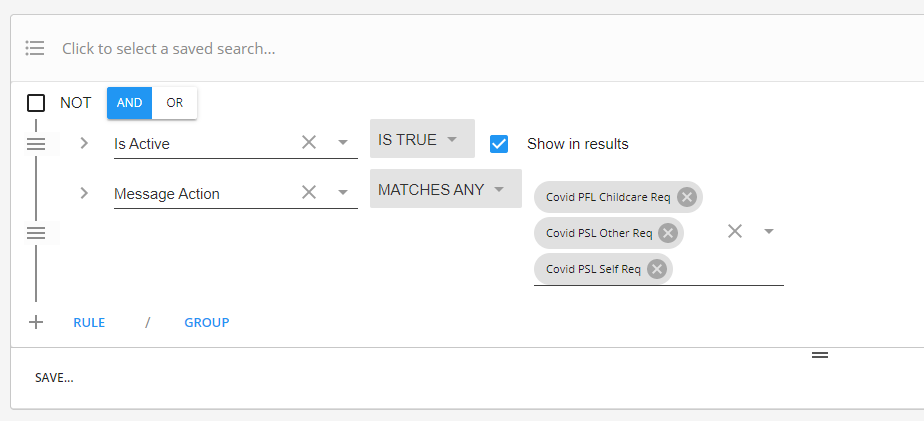

In Enterprise

Search under Profile for Message Action and add all codes you want to search by (make sure to keep match any):

To search for requests that do not have approval documented:

- Choose message action like [ex. Covid PSL Self Req]

- Select the Add option

- Choose Not Like message action [ex. Covid PSL Self Appved]

- Select Match All

Check out Enterprise - Searching for more information.

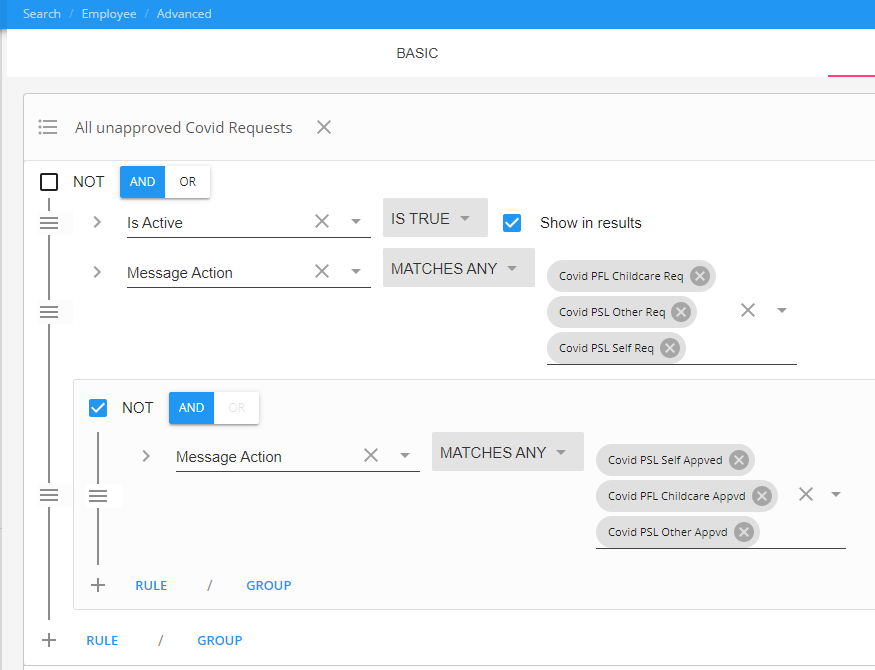

In Beyond

Search for message action matches any [include any COVID message action codes]

To find only employees who have a request logged but not an approval logged:

- Message action matches any [include all req COVID message action codes]

- Create a group

- Add a rule in the group where message action matches any [ include all appved COVID message action codes]

- Check the box at the top of the group where it says NOT - this will exclude all employees who have approval message

Check out Beyond - Advanced Searching for more information.

Document Types

New document types have been created to help you save & search for Coronavirus related documents. In order to maintain your company's eligibility for tax credits, you may need to retain written documentation on COVID-19 related leave requests and approvals. We recommend saving this on the employee's record in Enterprise or Beyond to easily keep track of it.

For more information on qualifying documentation, check out questions 44-46 on the IRS Q&A.

*Note* Document types can have security placed around them. In Enterprise, you will need to have the Staffing Specialist Sec Role or related permission for document types. In Beyond, each user will need to be part of a security group with the document type read/write/edit options (the default All Access security group will have these permissions).

New Document Types Created:

- Covid-19 Paid Sick Leave

- Covid-19 Child Care Leave

There are proofing errors that will appear when a COVID-19 paycode is used and no documentation is found on their record (see below).

Learn more about uploading documents: Enterprise - Managing Employee Documents & Beyond - Documents

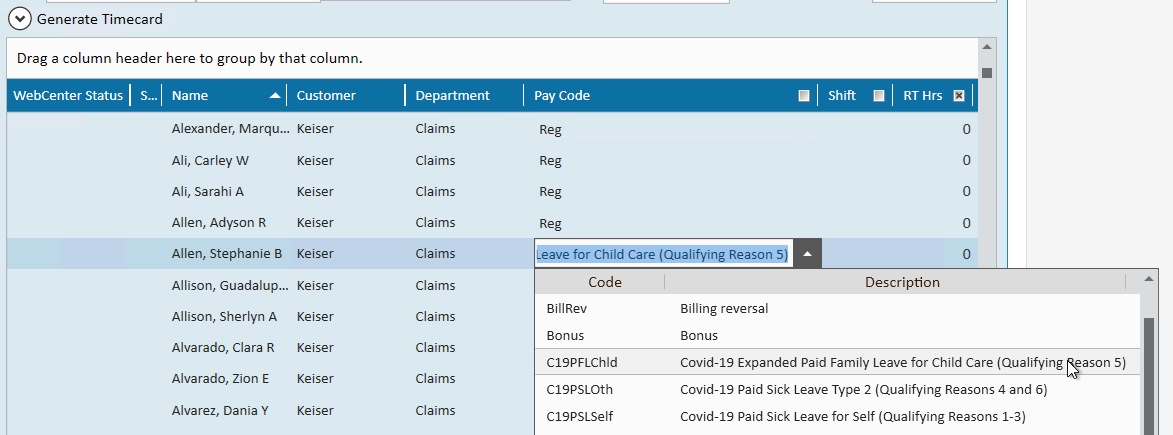

Using Coronavirus Related Pay Codes

In order to help your team properly track and pay Coronavirus FFCRA related leave, TempWorks has added the following pay codes:

- C19PSLSelf - Covid-19 Paid Sick Leave for Self (Qualifying Reasons 1 - 3)

- C19PSLOth - Covid-19 Paid Sick Leave Type 2 (Qualifying Reasons 4 - 6)

- C19PFLChld - Covid-19 Expanded Paid Family Leave for Child Care (Used for up to 10 weeks after the two weeks of C19PSLOth is used up for Qualifying Reason 5)

For more information on qualifying reasons, amounts, and other pay information, check out FFCRA and IRS Q&A.

Each of these new pay codes will be exempt from the employer portion of Social Security Tax (cfica) and will count as 0 hours worked so you can utilize units or RT hours to track.

*Note* By default these new pay codes will not be exempt from any adjustments. If you would like these pay codes to be exempt from adjustments, contact the TempWorks Support Team. For more information on paying adjustments, check out question 54 on the IRS Q&A.

*Note* If you are utilizing the default COVID pay codes provided, the system will automatically pay these on a separate check from any other regular pay. This box is required and if it is not checked, it can cause inaccuracies in your 941 reporting:

For more information, check out Enterprise - One-Time Adjustments and Overrides.

Coronavirus Related Proofing & Payroll Errors

With new pay codes and new requirements related to FFCRA, we've added new proofing and payroll errors specifically related to using the new pay codes specified above.

Use this guide and work with your management team to decide what action needs to be taken when you receive these proofing errors.

Proofing Errors

| Proofing Error | Meaning |

|---|---|

[COVID Pay Code] requires XX Appvd Message | In order to help your payroll team know what sick leave has been approved, your team will need to be logging the approval messages on the employee's record. If the message is not logged with the correct message action on the employee's record, this proofing error will alert your payroll team.

Review the employee's record to see if a different type of leave has been approved than what was entered in payroll. If no approval is present, work with your management team to ensure approval has been made and documented before continuing. |

[COVID Pay Code] requires XX doc type | In order to help your payroll team know if the proper documentation has been filled out, approved and saved, the proper documents need to be saved on the employee's record with the proper documentation type.

Review the employee's record to see if a different type of leave has been approved than what was was entered in payroll. If no document is present related to COVID-19, ask your management before proceeding. |

To learn more about proofing, check out Enterprise - Proofing Time Entry Sessions & Enterprise - Proofing Errors, Their Meanings, and How To Fix.

Payroll Errors

*Note* Please familiarize yourself with the necessary qualifications and limitations related to the FFCRA. We are tracking the maximum hours and dollar amounts but your employees may not qualify for the maximums.

Maximum hours and dollar amounts are tracked in 2 separate time periods: 4/1/2020-3/21/2021 & 4/1/2021- 9/30/2021 in accordance with the updated American Rescue Protection Act(ARPA).

| Payroll Error | Meaning |

|---|---|

The employee has a reached the max of XX hours with Paycode [XX] | In accordance with the FFCRA, there are limitations to the number of paid hours an employee can take. We are tracking this per aident (employee id). Here are the limits:

Maximums may be lower depending on employee's eligibility. Adjust the time entered in payroll to meet the limit. Work with your payroll manager to determine if the remainder time will be left as unpaid or if PTO/Sick/Vacation time accrued can be used. |

The employee has reached a max gross of $XX with Paycode [XX] | In accordance with the FFCRA, there is a total dollar amount limit to the amount of paid leave that can be covered under this act. We are tracking the max amounts per aident (employee id).

Maximums may be lower depending on employee's eligibility. Review the time entered and adjust the transaction in time entry to meet the limit described above. Work with your payroll manager for any further details on how to proceed. |

To learn more about payroll errors, check out Enterprise - Payroll Errors, Their Meanings, and How To Fix.