What is the Staged Check Report?

The staged check report is a user's first opportunity to view in detail how the net pay amount has been determined for an employee. By reviewing the staged check report, users can determine if corrections are needed before a check/transaction is posted thus negating the need for a formal check correction (void or reversal).

How to pull the staged check report:

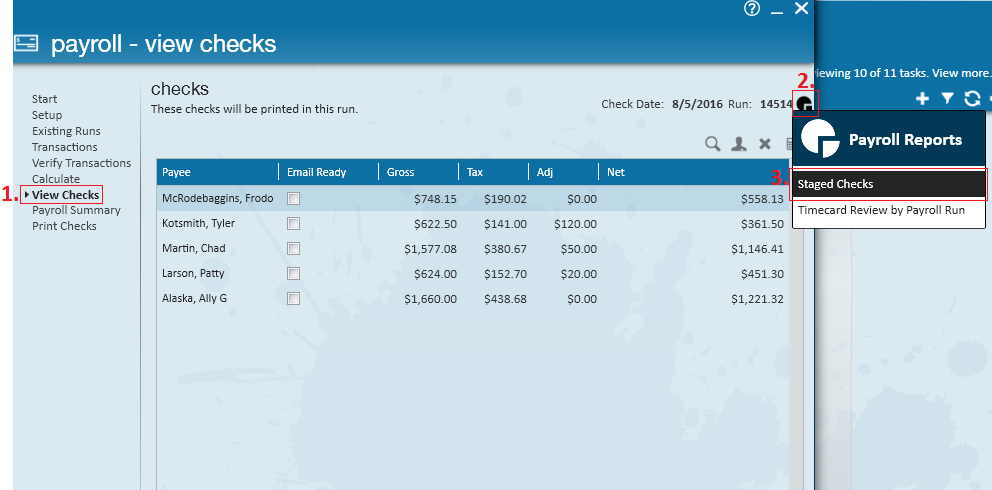

Step 1: From the (1.) view checks page of the payroll wizard, hover over the (2.) reports icon and select to view the (3.) staged checks report.

This will open the report, allowing users to see a preview of how the check came to its net amount. Recommended items to review:

- Adjustments:

- Wage Garnishments

- Child Support

- Insurance

- Benefits

- Taxes:

- Federal

- State

- Local

- Accruals

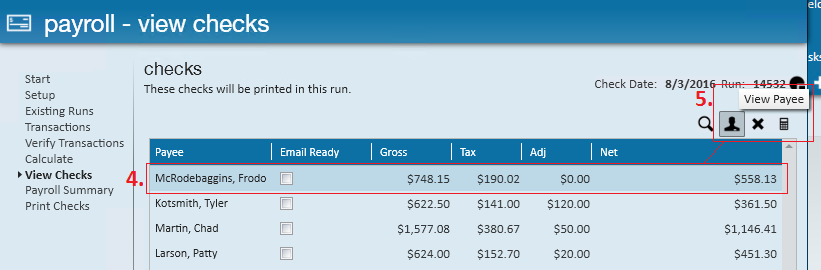

Step 2: If a recurring adjustment, tax,or accrual appears to be calculating incorrectly, (4.) click to highlight the affected employee and select the (5.) employee icon to view the payee (this will navigate you directly to the employee's record).

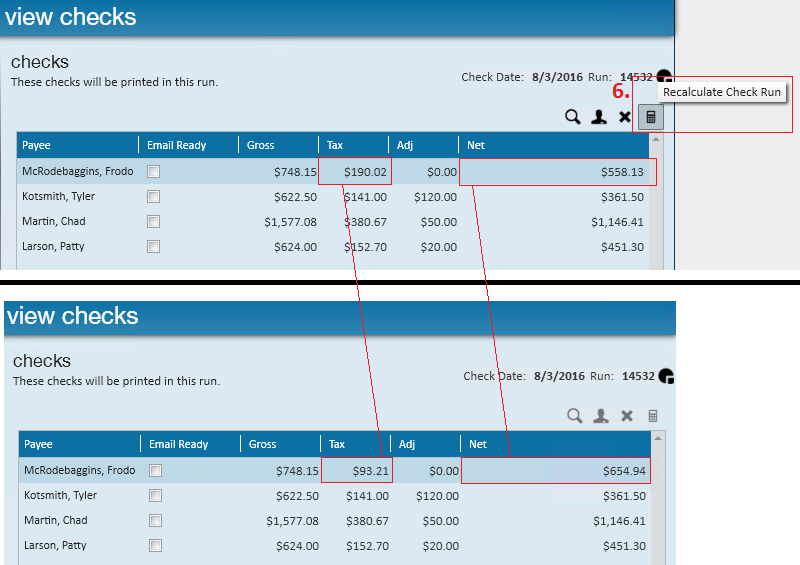

Step 3: If any changes are made to an employee's adjustments, taxes, or accrual select to (6.) recalculate the check run. This will take any new changes into account and a new net amount will display. In the example below, changes were made to an employee's allowances and thus a new net amount displays:

*Note* Updates to accruals will not impact the net amount of the check. Please review the staged check report to verify changes have taken place.

Step 4: After reviewing the staged check report and confirming that check(s) are calculating as you would anticipate, continue to process payroll through the wizard as normal.