Daily Webinar - Customer Adjustments and Invoice Processing from TempWorks Software on Vimeo.

Your organization may charge fees, apply discounts, or charge percentages to the invoice depending upon agreements made with a client.

Quick Steps

- Navigate to the Invoice Section of the Customer Record

- Select Adjustments

- Select the + icon to the right of the the invoice adjustments header

- Select Adjustment Type

- Select TierId (if no tierID select "Not TierID")

- Enter a positive numerical amount (depending on adjustment type it will be % or $)

- Invoice Text - how you want this adjustment to appear on the customer invoice.

- Select Save

- Now that the adjustment has been added, create an invoice and the adjustments will automatically calculate.

Complete and Detailed Steps

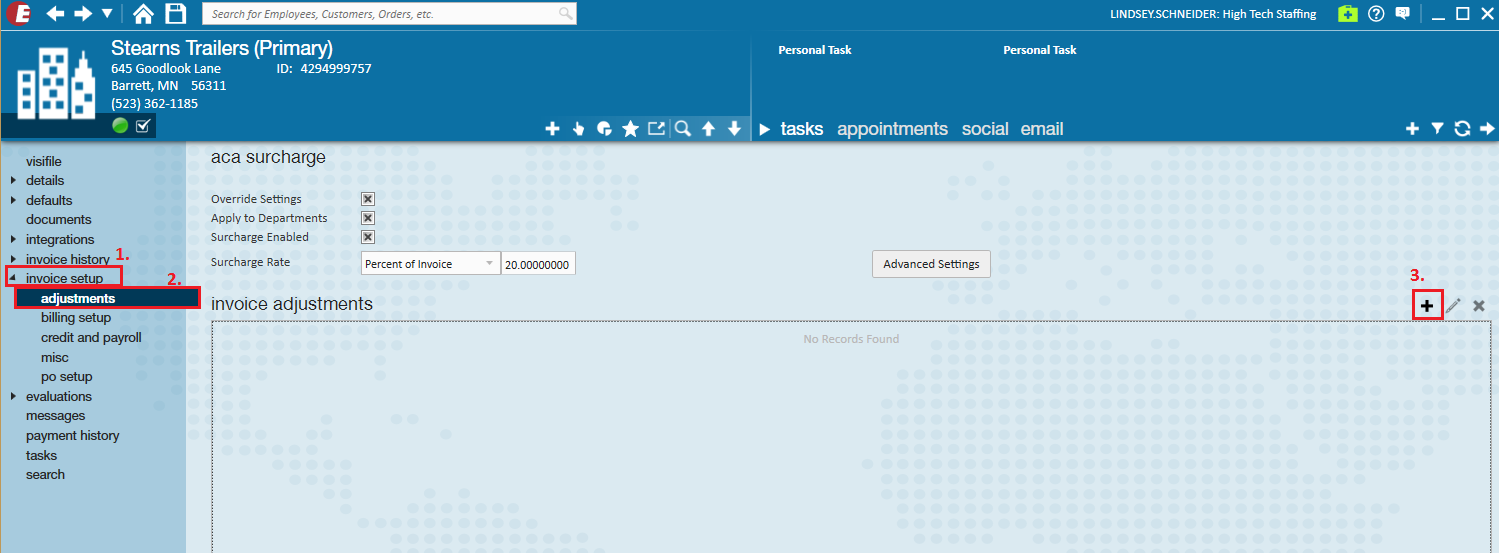

Navigate to the Customer record you wish to apply the adjustment or discount to. Expand the Invoice setup section (1.), select adjustments (2.), + icon (3.) to open the add adjustment window.

*Note* If a discount or adjustment is added to the Customer record, it will be applied to every invoice processed for that client. These adjustments are applied during the invoice run. A separate adjustment would need to be applied at the department to take effect in the same manner.

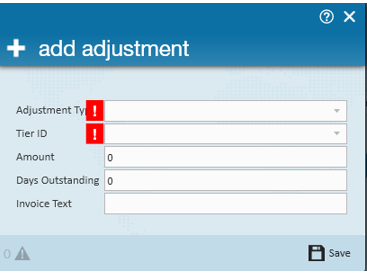

Within the add adjustment window you may modify the following:

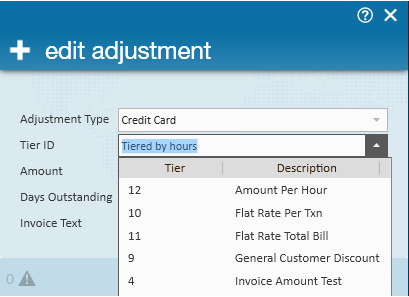

Adjustment Type: Select whether you are going to apply a credit card fee, a discount, or rebate

.*Note* Credit Card and Rebate adjustment types are included in the payroll costs on the Gross Profit reports.

Tier ID: You may setup tier amounts that can be flat amounts or percentages and can be based upon total hours, Year To Date hours, life time sales etc. I.E. If the Customer hits $150,000 in sales, or 5,000 hours, they receive a discount.

*Note* Depending upon the circumstances of how you wish to apply tiers to your invoices, initial setup will be done by Tempworks.

Amount- Enter a positive numerical amount, the system will automatically recognize how to handle the amount based upon the Adjustment type selected. For example, if it’s a $40.00 discount the system will deduct accordingly.

Invoice Text- Additional information can be added to reflect what the adjustment is for, and displayed accordingly on the invoice.

Example 1: You want to charge the Customer a 2% processing fee because they pay you consistently with a credit card.

Example 2: You want to apply a regular discount to the Customer based upon contract agreements.

Once the adjustments have been added and invoicing processed, you may now preview the details of the invoice.

In this example, the balance of $812.00 (1.) followed the 2% credit card adjustment (2.) to get the total of $828.24 (3.).

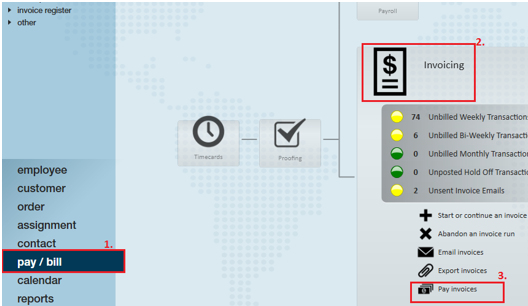

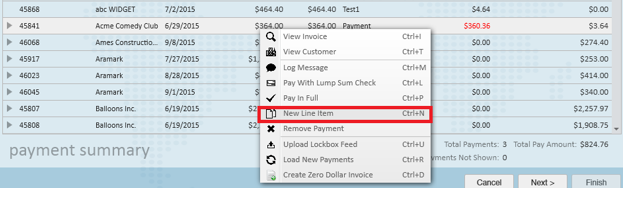

If you haven’t edited an invoice and wish to apply a one-time discount, navigate to Pay/Bill (1.), Invoices (2.), Pay Invoices (3.).

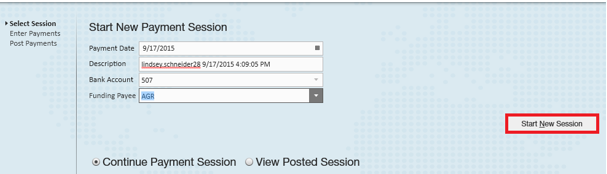

Within the Pay Invoices section verify the payment session information is correct and select Start New Session.

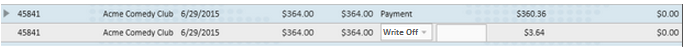

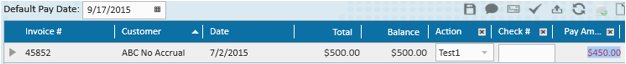

Select the invoice you wish to apply the discount to and select the action of Write-Off. In this example Test 1 is in place of “Write Off”.

*Note* To add additional action items to the drop down please contact Tempworks.

Once you have applied the discount you may run the Invoice Payment Report to verify discounts posted properly.

Example: The invoice is due Net 30 days, if they pay within 10 days they get a 1% discount. You may setup additional Term options within the Credit and Payroll section of the Customer record.

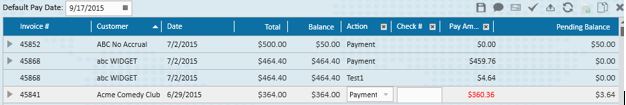

*Note* To add additional term options please contact Tempworks. These terms can be applied to show discounts on the invoice as custom invoice styles can be created for the specified terms. Within the Pay Invoices section you may apply the discount amount, with a pending balance left.

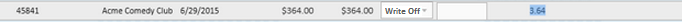

To fully take care of the pending balance create a new line item.

Select the action of Write Off, and enter the pending balance amount.

Once this is set to zero you have successfully entered the discount information.