This article outlines ways to troubleshooting potential issues with Federal Tax Withholding.

*Note* For additional assistance, please contact TempWorks Support.

Pay Setup

- Check the Employee Change Log report to see if there have been recent changes to the employee tax setup.

- Check if allowances are set to "99". This will result in taxable wages being tracked but no tax being withheld.

- Check if the employee has been marked as exempt. This will result in no taxable wages and no tax being withheld.

- Check if the employee has an "Additional Withholding" or "Percentage" entered within their Pay Setup.

- Verify the information on the Pay Setup screen reflects what the employee has entered on the W-4.

*Note* For more information on entering employee tax information, please see the following article titled Enterprise - How to Manage Employee Taxes.

Orders

- Check the "Pay Periods" on the order.

- Check the Order Change Log report to see if the Pay Periods have been changed recently.

*Note* For more information on the Pay Periods of an Order, please see the following article titled Enterprise - Order Types and Pay Periods.

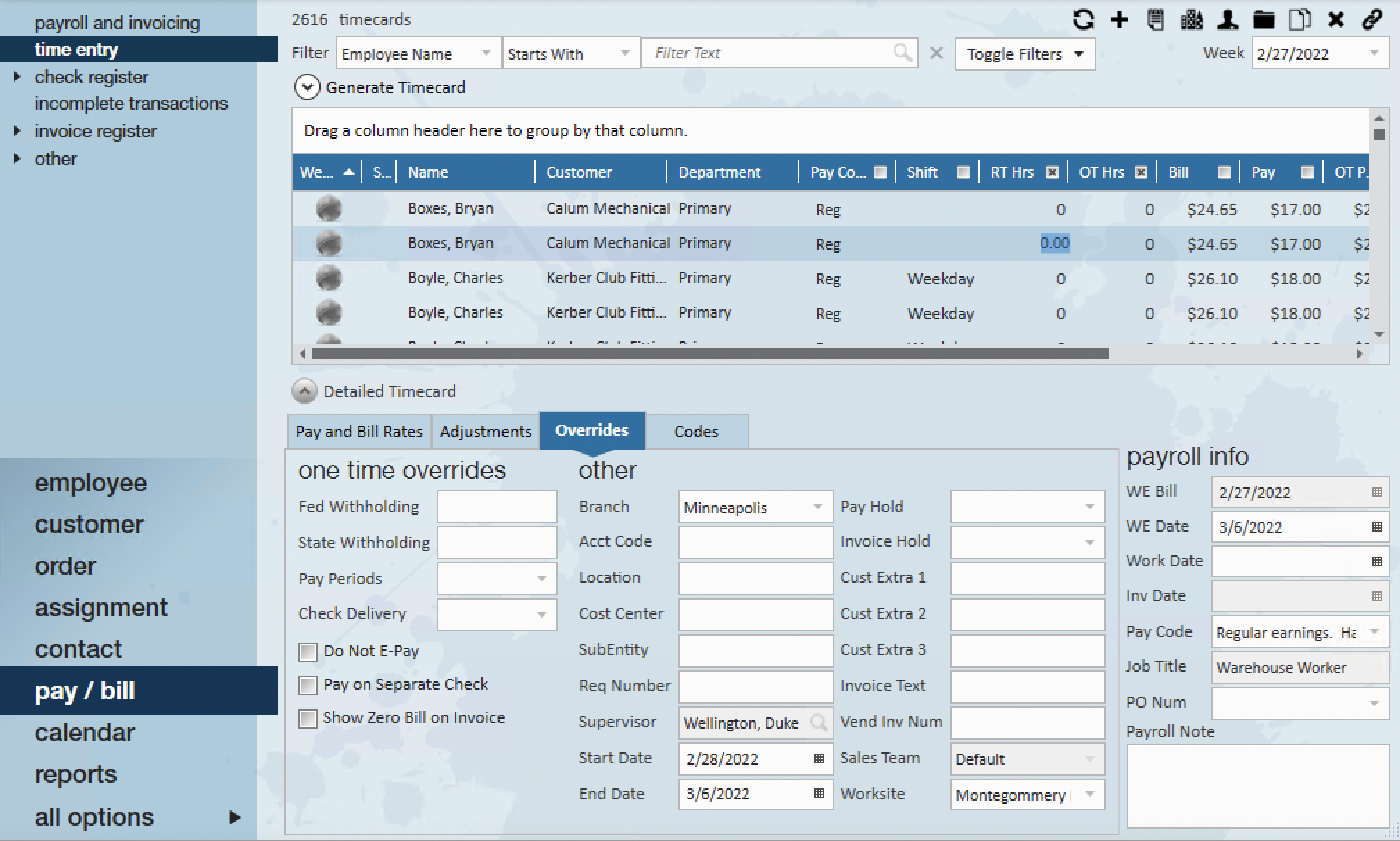

Timecards

- Check the employees timecard for values in "Fed Withholding", "State Withholding", and "Pay Periods" on the "Overrides" tab.

- Check the Paycode of the transaction:

- The Paycode may be set up to withhold at the supplemental tax rate.

*Note* This information can be found within Enterprise > Pay/Bill > Time Entry > Timecard > Detailed Timecard > "Overrides" Tab:

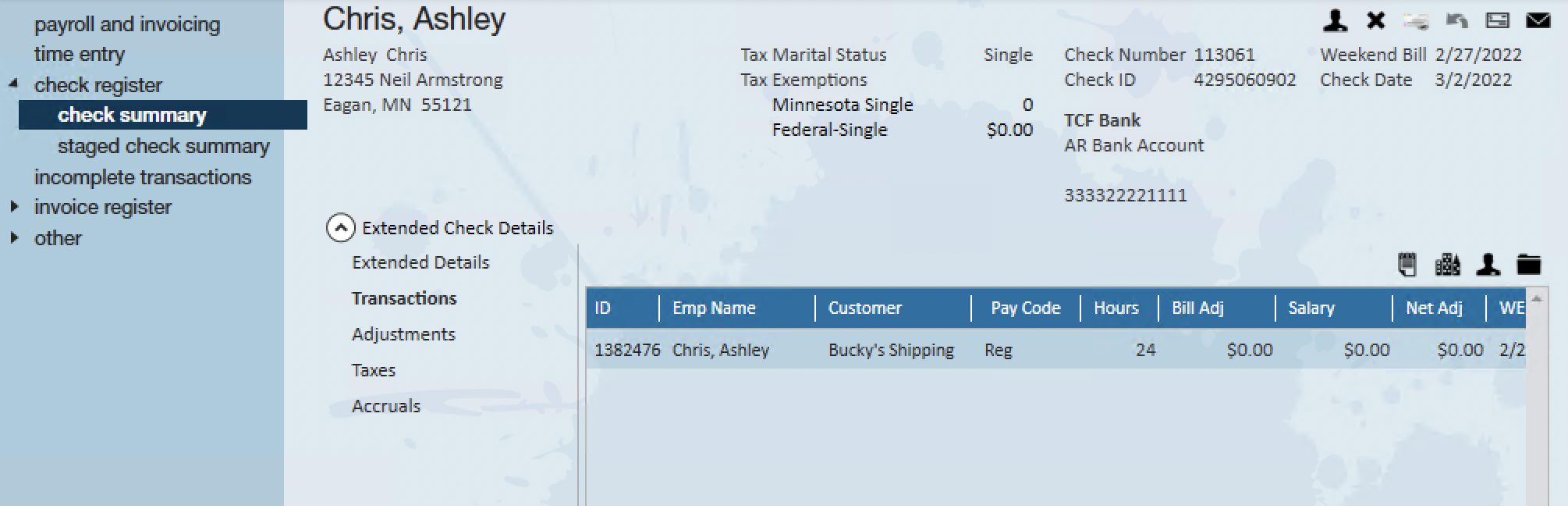

Check Register

- Check to see if the employee check in question had multiple transactions from different weekend dates:

- If the pay periods on the Order(s) is 52 but there are multiple weekend dates on the check, the system will adjust the pay periods when annualizing the wages for tax calculation purposes.

*Note* This information can be found within Enterprise > Pay/Bill (or Employee) > Check Register > Check Summary > Extended Check Details > Transactions

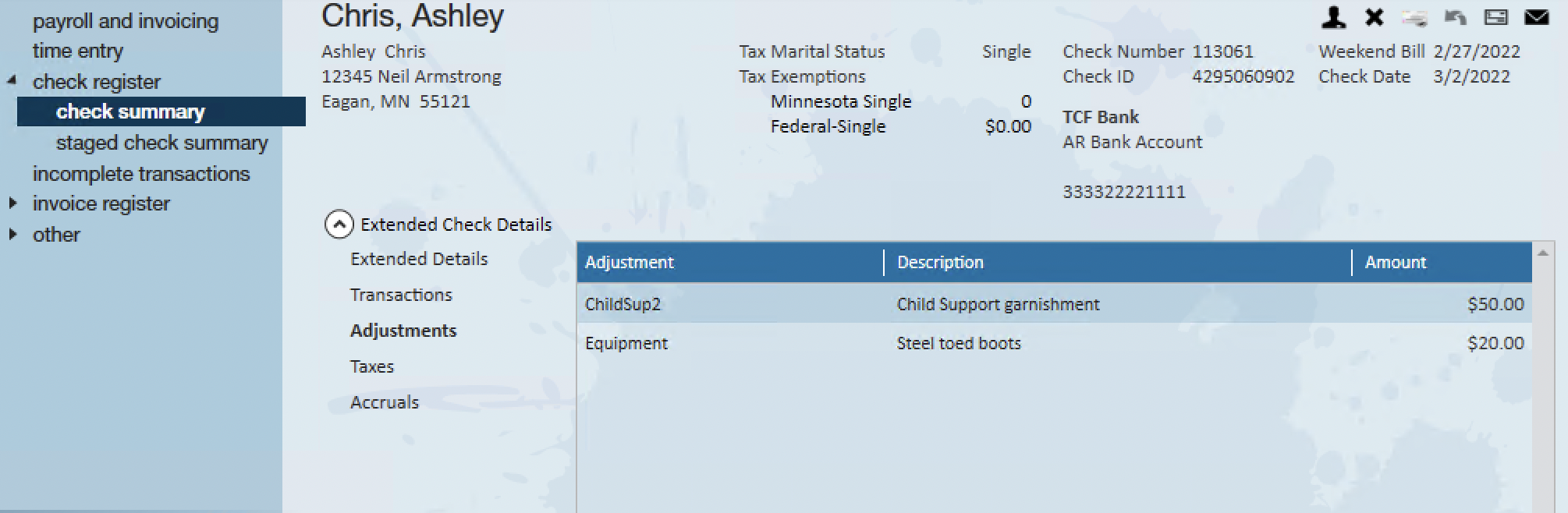

- Check to see if there were any pre-tax deductions on the check.

*Note* This information can be found within Enterprise > Pay/Bill (or Employee) > Check Register > Check Summary > Extended Check Details > Adjustments

Additional Resources

- Refer to the following publication for additional information:

- Publication 15-T - Specifically pages 8-10