Overview

Beginning in the 2023 tax year, TempWorks Tax Services will no longer include the following taxes:

- Nevada Modified Business Tax

- New York Metro Commuter Transit tax

- Wyoming Worker Comp

This article outlines reports that can be used to gather the above tax information.

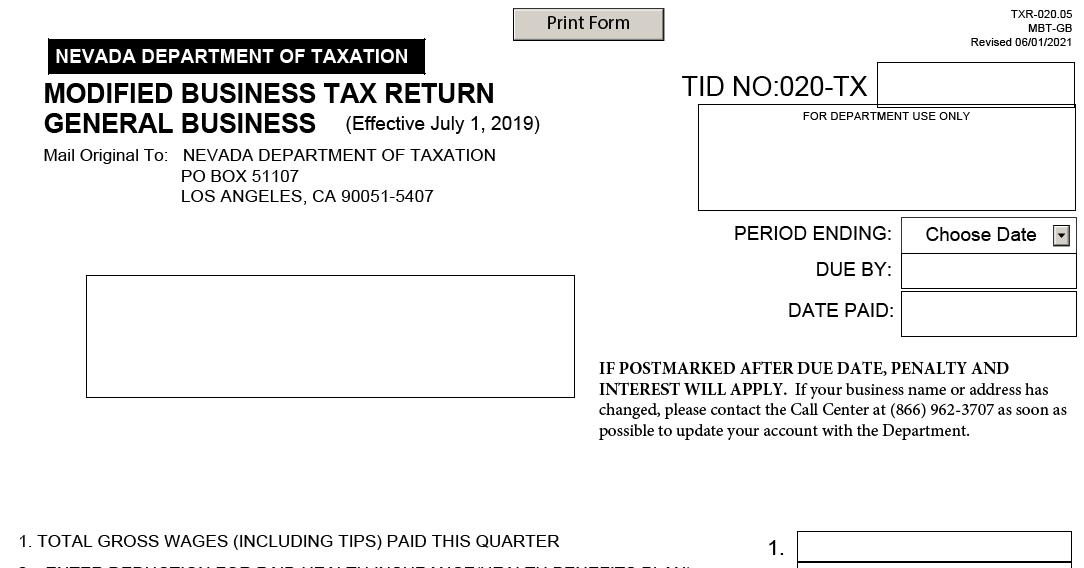

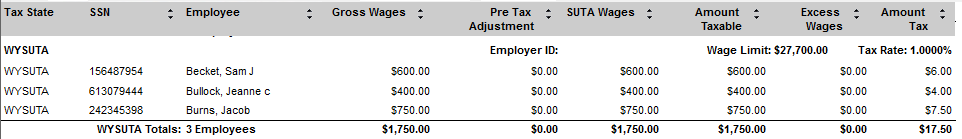

Nevada Modified Business Tax (NV MBT)

- Run the Unemployment Summary Report with the following parameters:

- Start Date = First day of the quarter for which you are filing

- End Date = Last day of the quarter for which you are filing

- Date Filter = Check Date

- Branch = All branches under the EINC for which you are filing

- Make sure you are at hierarchy level where you can see all branches for the EINC for which you are filing.

- Unemployment Type = State

- Use the "SUTA Wages" column for the NV SUTA line on the report as your “Total gross wages paid this quarter” on line 1 of the MBT-GB form.

- Complete the remainder of the form according to the instructions from Nevada:

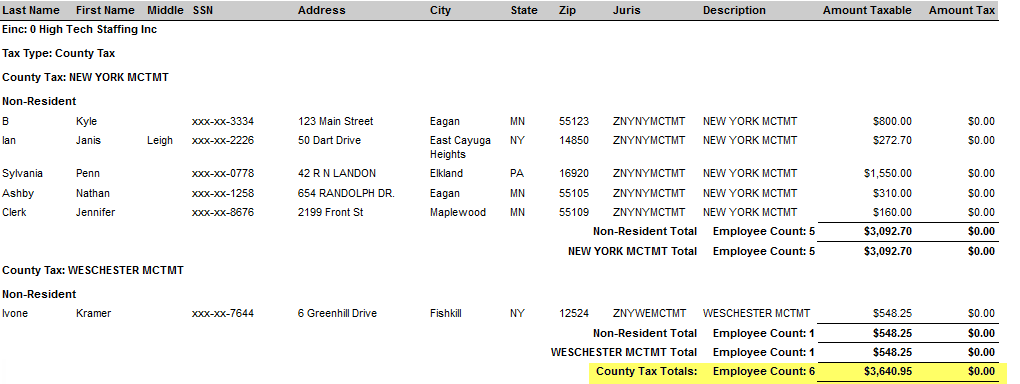

New York Metro Commuter Transit Tax (NY MCTMT)

- Run the Local Tax Detail Report with the following parameters*:

- Tax Type = County Tax

- Tax State = New York

- Start Date = First day of the quarter for which you are filing

- End Date = Last day of the quarter for which you are filing

- Date Filter = Check Date

- *Make sure you are at hierarchy level where you can see all branches for the EINC for which you are filing.

- Use the "County Tax Totals Amount Taxable" value as the “Payroll expense subject to the MCTMT” on the MTS-305.

- Helpful link (subject to change as the state makes updates): Metropolitan commuter transportation mobility tax (MCTMT) forms (current period)

- Follow the form instructions to complete the remainder of the form.

*Note* If New York ever adds additional county taxes, this method will change. Instead, you would need to sum up the juris totals for each juris on the report containing “MCTMT” in the juris name.

Wyoming Worker Comp (WY WC)

*Note* You will need to request a paper form from the state.

Helpful link (this may be subject to change as the state makes updates):

- Forms & Documents: WC Summary Report (Workers’ Compensation only) – If you need a replacement copy of this form, please contact the Division at (307) 777-6763 or email DWS-wcemployerservices@wyo.gov. Click here for instructions for correctly filling out this form.

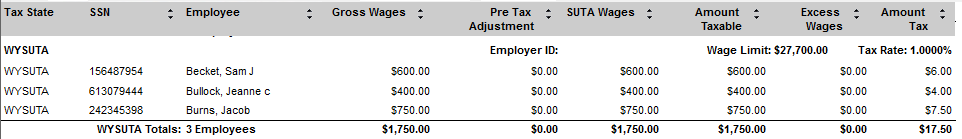

- Run the Unemployment Wage Detail Report with the following parameters:

- Start Date = First day of the quarter for which you are filing

- End Date = Last day of the quarter for which you are filing

- Date Filter = Check Date

- Branch = All branches under the EINC for which you are filing

- Make sure you are at hierarchy level where you can see all branches for the EINC for which you are filing.

- Unemployment Type = State

- Use the "SUTA Wages" column for the WY SUTA line on the report as your total gross wages for WY Worker Comp:

Related Articles

- None