What is the Look Back Method?

The look back method for measuring employee eligibility for insurance and full time status is a bit more complex than the monthly measurement option. This option allows you to track employee hours from their hire date for a longer period of time to determine if they meet full or part time status requirements and should be offered insurance. This method will consist of longer cycles where employees will go through a measurement, administration, and stability period.

Monthly Measurement vs. Look Back Method

When the monthly measurement method is used to confirm an employee as full-time, an offer of coverage would have to be made the first day after the next two full months from the month for which eligibility was determined.

If you use look back measurement, you will enter your employer settings in administration and cycles will be generated for each employee. Look back periods allow employees to have a longer measurement period before offering insurance but they also lock in an eligibility status for a longer time.

Monthly measurement means they evaluate an employee's full time status every month. If the monthly measurement option is used, you will not need to enter information in the employer settings and will not have cycles generated. Instead, the employee hours reports will be used to determine who hit the hours threshold each month.

*Note* We strongly suggest monthly measurements for clients who go live on new software midyear. This means you measure who is full time and offer them insurance for the month that they were full time. This is something we can track in the system off new and past employees (past employees so long as they have a txns conversion).

Setting Up the ACA Cycles for the Look Back Method

If you are going to utilize the Look Back Method, there will be some additional setup requirements for your administrators before you begin entering ACA dates, etc.

*Note* Before you set up your ACA Cycle information in Enterprise, make sure you have your benefit information with you to make it easy for you enter the correct information the first time. Keep in mind that ACA information is typically different for each EINC or Employer so you may need to walk through the setup for multiple hierarchies depending on your company.

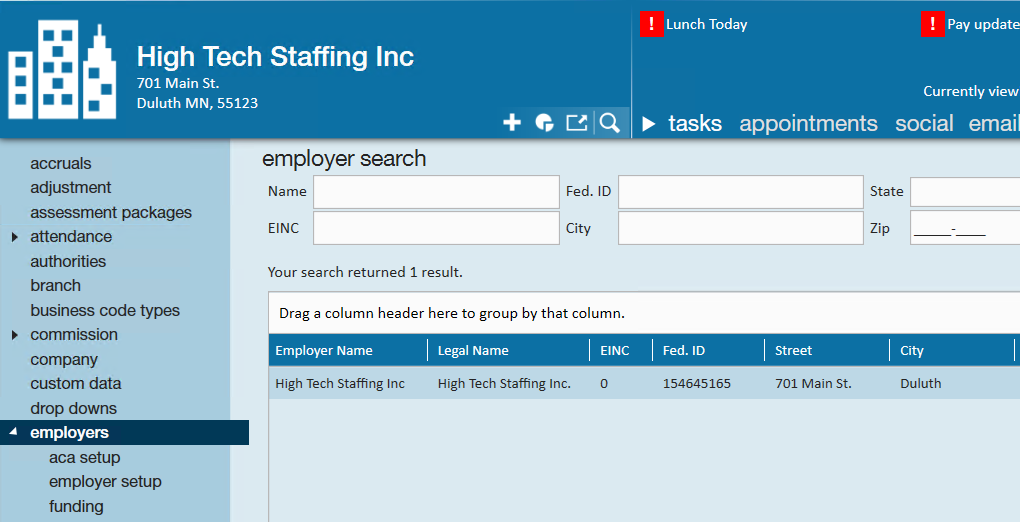

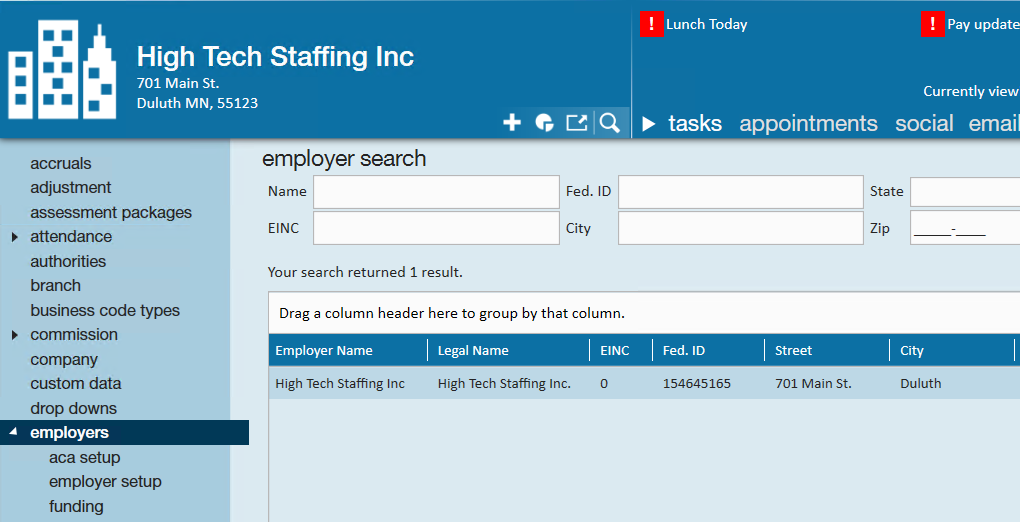

To Find ACA Cycle Admin Settings:

- In Enterprise, navigate to All Options > Administration

- Select Employers

- Double click on the employer on the list you want to set up ACA Cycle information for

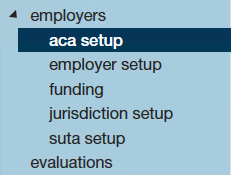

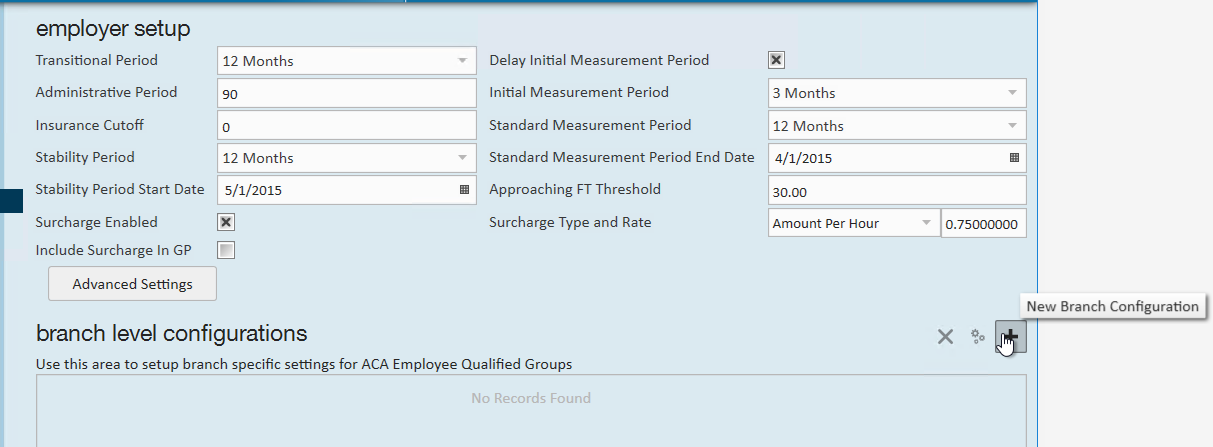

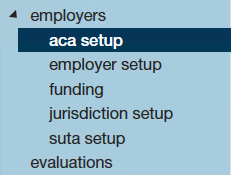

- Select ACA Setup on the left

Entering Applicable ACA Cycle Information

When you first start using the look back method, you will need to set up your cycle settings in administration:

*Note* Always work with your benefits provider or a legal advisor if you are unsure of any of the following ACA Cycle settings.

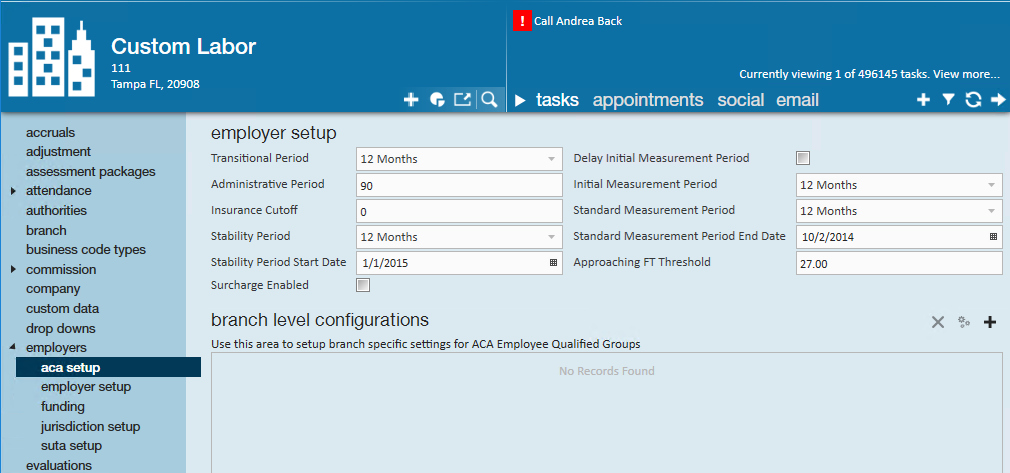

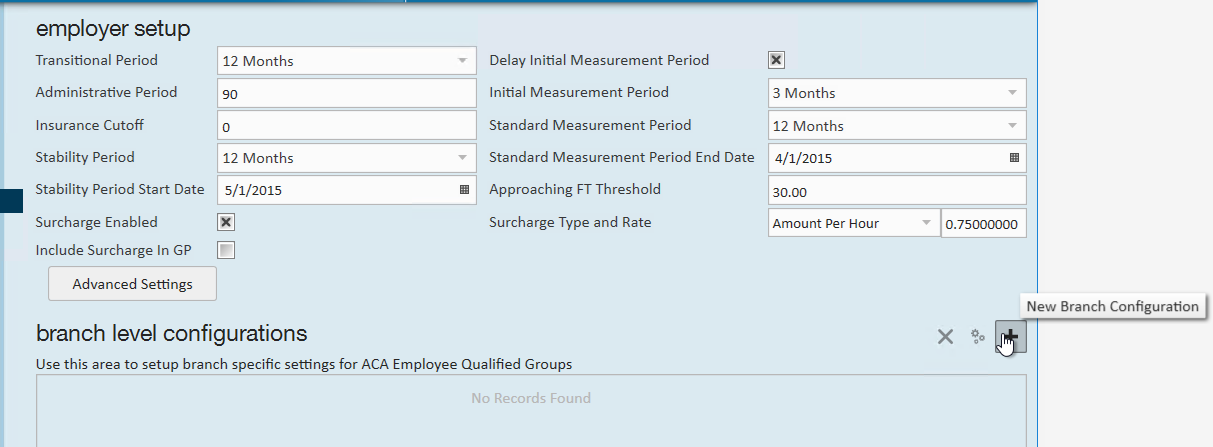

Employer ACA Look Back Setup

The following table walks through the different fields you will need to fill out in order to set up your look back method

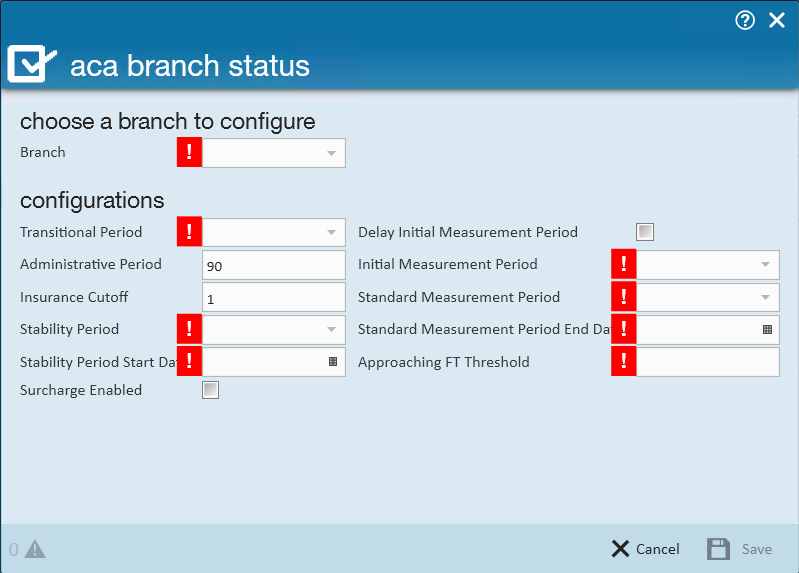

| Field Name | Description |

|---|---|

| Transitional Period | This drop down was used for those transitioning to ACA look back method back when ACA was first starting out. |

| Administrative Period | Enter the number of days that employees have to accept or decline their insurance option.

*Note* Employees who are not being offered coverage will still be reflected in the administrative period. |

| Delay Initial Measurement Period | Click to put an X in the box if you would like the insurance coverage start date delayed to the first day of the following month after enrollment.

|

| Initial Measurement Period | Select a length in months in the drop down field

|

| Insurance Cutoff | Enter a day of the month that employees need to be enrolled by if you are doing monthly enrollments |

| Standard Measurement Period | Select a length in months from the drop down field.

|

| Standard Measurement Period End Date | Enter the date your standard measurement period ends here.

|

| Stability Period | Select a length in months for your stability period.

|

| Stability Period Start Date | Enter the first date following open enrollment period.

|

| Approaching FT Threshold | Enter in a number of weekly hours in this field. This number is used in system calculations for any employees not coded with an ACA status of fulltime.

|

Looking for information on settings up surcharges? Check out ACA Admin: Setting Up ACA Surcharges for Customers.

Branch Level Configurations

If you have a specific branch that may need different ACA look back settings, you can create branch specific configurations.

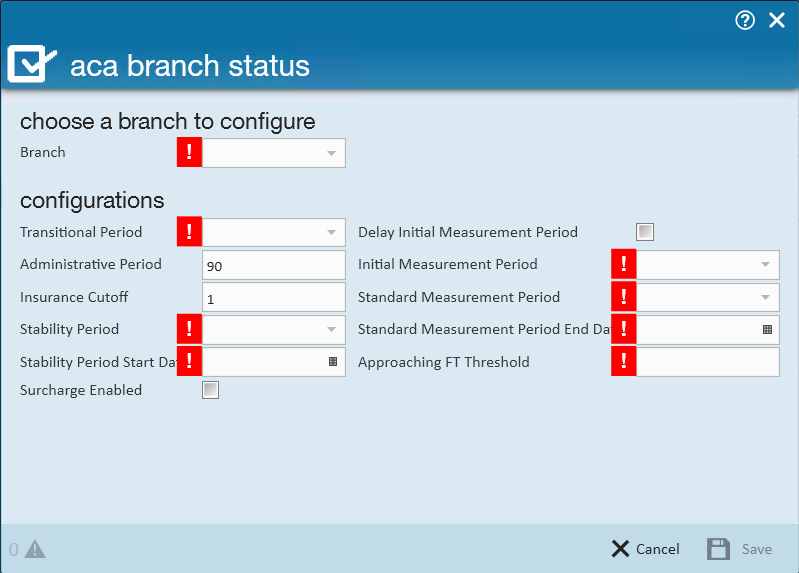

- Under the Branch Level Configurations section select the + to add a new branch specific setting.

- Select which branch you want to set up specific settings for:

- Set the Look Back configurations (same as the list above)

- Select save

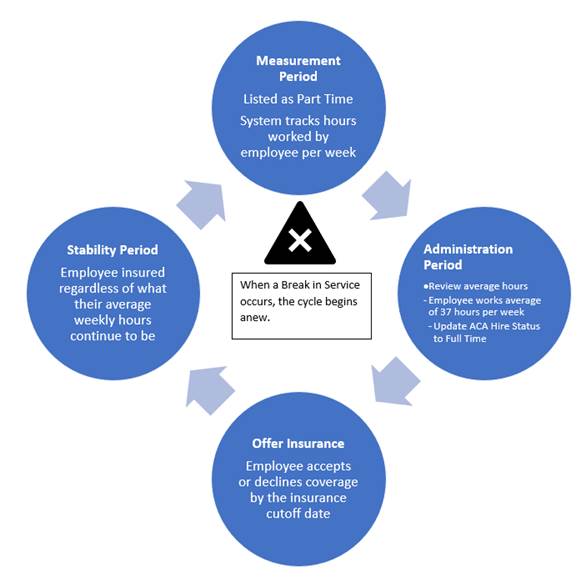

ACA Cycle Overview

How our system tracks ACA Look Back Cycles:

Setting Hire Dates

Your recruiters or team members will set the ACA hire date for the employees under the pay setup section of the employee's record.

The system will check daily to update the employee's cycle status

Current Cycle

Employees will start with a measurement period where the employee's status and hours worked will be evaluated to see if they qualify for insurance.

After the measurement period, the employee will go into the administration period where you will review their average hours, update their ACA status if necessary, and potentially offer them insurance.

Employees will either accept or decline insurance options given and then the employees will be put into a stability period.

During the stability period, they will continue to be covered by insurance even if their hours change each week. The system will continue to count the days of the stability period.

Employees who continue to be employed by you will enter a new measurement period in order to review if they will continue to qualify for insurance after the next open enrollment session. This new measurement period may overlap with their first stability period depending on when they were hired vs. when your yearly open enrollment session is.

Break In Service

A break in service is detected in the system when an employee that is currently on an ACA cycle has not worked for a 13 week period or more, or the employee has not worked for 4 weeks or more, where that 4 week break is greater than the preceding work period (e.g. 3 week assignment followed by a 4 week break).

Next Steps

Now that your look back settings are in place, here are the next recommended steps:

For Admins:

- Give your team access to add ACA Hire dates: ACA Admin: ACA Permissions & Security

- Create Benefit Adjustments: ACA Admin: Setting Up ACA Adjustments in Administration

- Consider ACA Surcharges: ACA Admin: Setting Up ACA Surcharges for Customers

For General Users:

- Set Hire Dates for Employees: Setting ACA Hire Dates for Employees

- Adding ACA Adjustments to Employees: Managing ACA Adjustments for Employees