What is the PPP Loan Forgiveness Estimator

This report is meant to be a helpful tool that will gather data related to the CARES Act Paycheck Protect Program(PPP) Loan Forgiveness including a estimated total forgiveness amount. Keep in mind that this report is only to be used to help gather important data and is not a guarantee of your loan forgiveness.

Please review the report disclaimer before using this report and if you are ever unsure, be sure to work with a legal professional.

*Note* Looking for other COVID-19 Reports? Check out the COVID Reports Manual.

This article includes:

Where to Find This Report

You can run this report in Enterprise by navigating to All Options > Reports and selecting the Time & Pay category on the left.

Select the magnifying glass to run the report.

*Note* Keep in mind your hierarchy will change what report information is available. We recommend running this report at the highest hierarchy level you have available. (ex. System, Subsystem, etc.). Check out Hierarchy Training for more information.

You will need permission to view Time & Pay reports in order to run this report. Check out Enterprise - Security Roles for more information on Enterprise security.

Parameters

In order to run the report, you will need to review and enter information under the parameters section at the top. Let's breakdown what each of those parameters are:

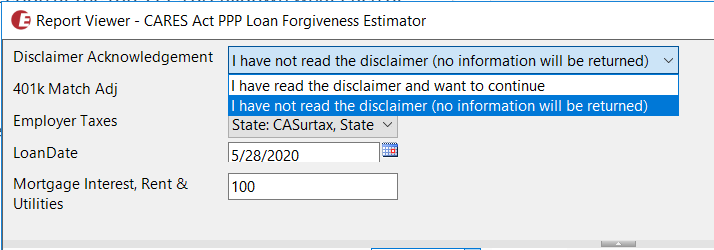

Disclaimer

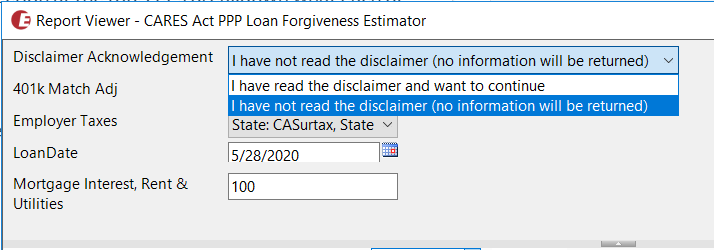

In order to see any of the report, you will first need to read and agree to the disclaimer. If you select View Report, you will be shown the full disclaimer and the disclaimer will be saved with the report should it be exported.

Change the Disclaimer Acknowledgement to "I have read the disclaimer and want to continue" and select view report again in order to view the full report.

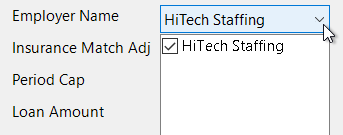

Employer Name

Select which EINC or Employer name you want to include in this report. If you have multiple EINCs or company entities, you may want to run the report separately for each. Always consult your legal advisors, if you are unsure.

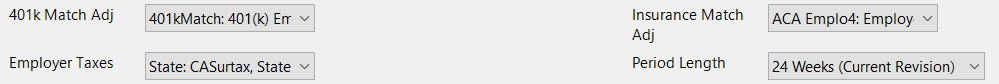

Adjustments & Taxes

There are a number of drop down parameters that allow you to select one or more options related to adjustments and taxes that will be included on this report. Always consult your legal advisors if you are unsure of which options to include.

| Parameter | Definition |

|---|---|

| 401K Match Adj | In this drop down, select any adjustment types that are related to 401K match amounts that are paid by employers. This is used in calculations on this report. |

| Insurance Match Adj | In this drop down, select any adjustment types that are related to employer paid insurance or insurance match. This is used in calculations on this report. |

| Employer Taxes | In this drop down, select which Employer paid taxes should be included in calculations on this report. By default, this includes state taxes. |

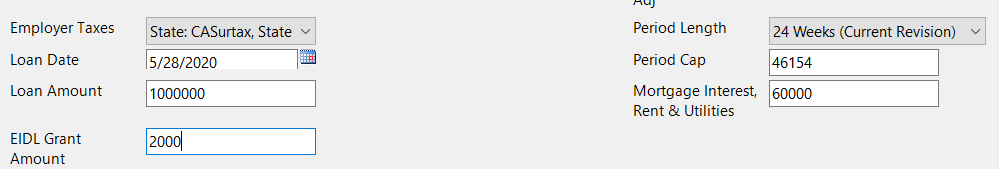

Loan Date & Amounts

The last few fields will need to filled out in order to run the calculations for the report. If any of the amounts are not applicable to you, you can enter 0.

| Parameter | Definition |

|---|---|

| Period Length | Select the number of weeks you want to review in this report (default is set to 24 weeks) |

| Period Cap | The maximum dollar amount of forgivable wages in the covered period |

| Loan Date | This should be the same data as your PPP Loan Disbursement Date and marks the first day of the covered (8 week) period. |

| Loan Amount | Enter the total amount of your loan |

| Mortgage Interest, Rent, & Utilities | Enter the total costs from applicable mortgage interest, rent, and utilities for your company that you want to include in this report's calculations |

| EIDL Grant Amount | Enter any Economic Injury Disaster Loan (EIDL) Grant amount you have received, if applicable. |

Report Breakdown

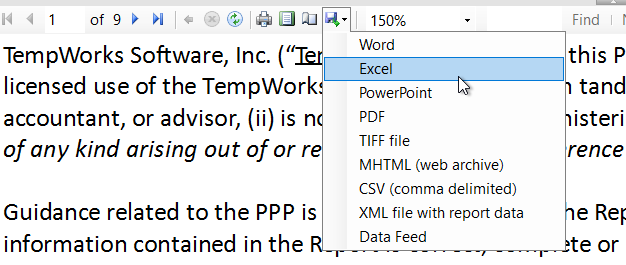

Once you have accepted the disclaimer and entered all necessary parameters, you will be able to view the full report. If you are going to be using this report for reference later, you can export it by selecting the export option. We recommend exporting this report to Excel as there are a few different tabs of information included.

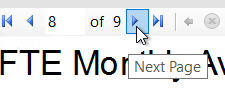

The following sections break down what information is included in the different pages of this report. Remember that you can navigate through these pages in the upper left:

Disclaimer Page

The first page of the report contains the full disclaimer that should be read through before viewing the rest of the report.

If the Disclaimer Acknowledgement parameter at the top of the report is set to "I have not read the disclaimer" there will be no additional pages to view in this report.

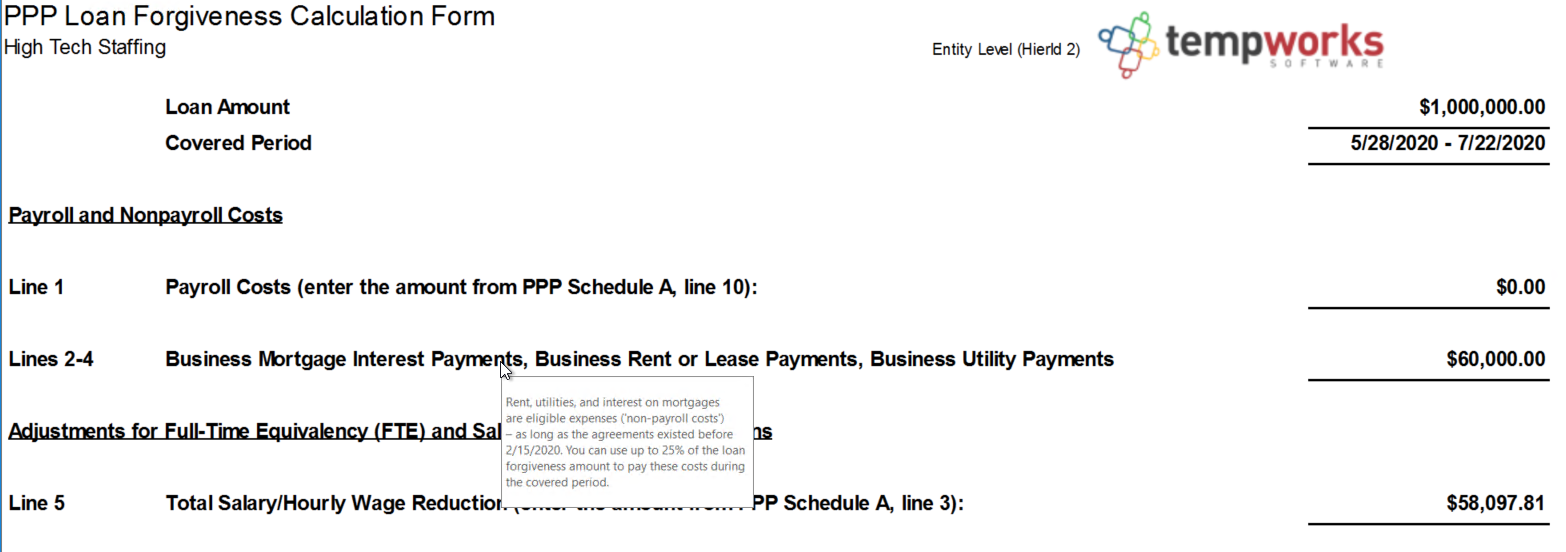

PPP Loan Forgiveness Calculation Form

This page will display all calculation amounts for the PPP Loan Forgiveness. Hover over any line description or amount for a full definition as to what is considered when calculating these amounts.

This is meant to mirror the PPP Loan Forgiveness Application but keep in mind that as the requirements, regulations, and forms change, this data may no longer be accurate. Always consult with a tax professional or legal advisor before using the calculations here.

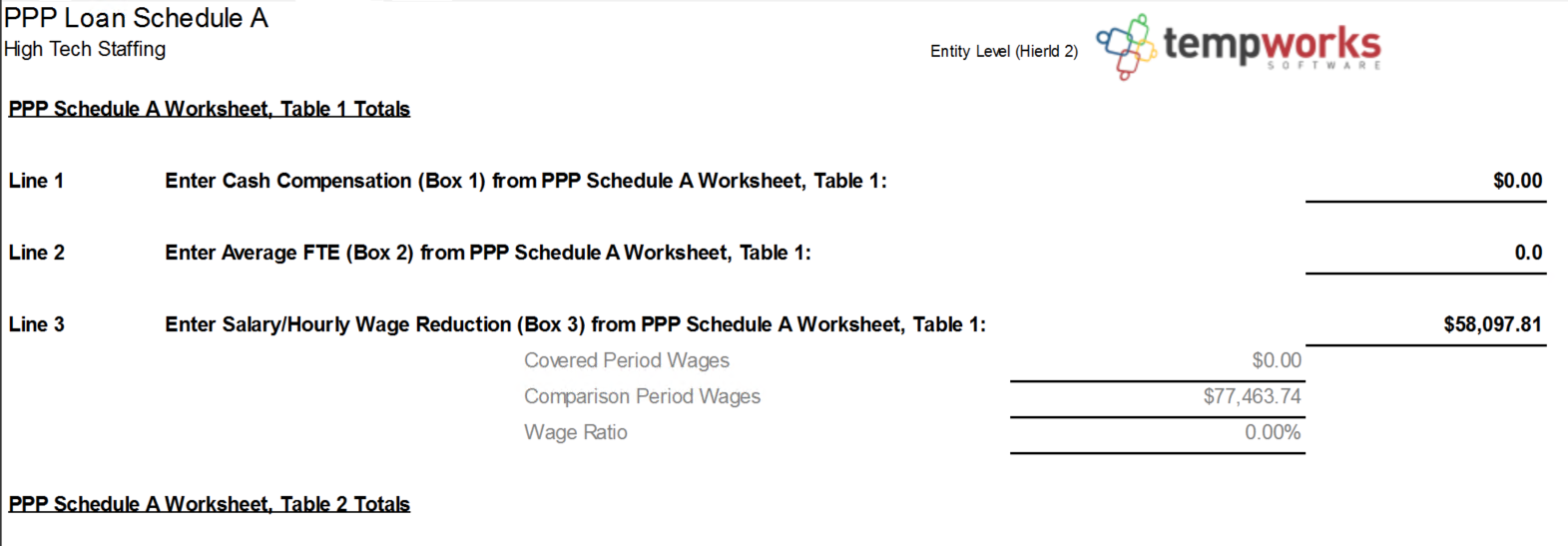

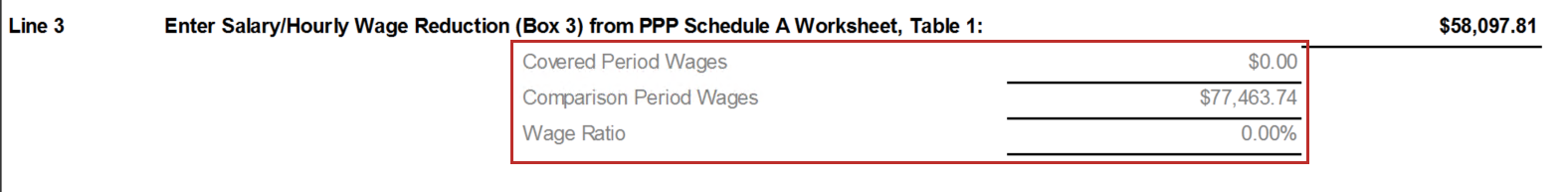

PPP Loan Schedule A

This page will display the PPP Loan Schedule A form with any calculations made.

Items in grey are not on the regular Schedule A form but show the amounts calculated and used to calculate the related line amounts:

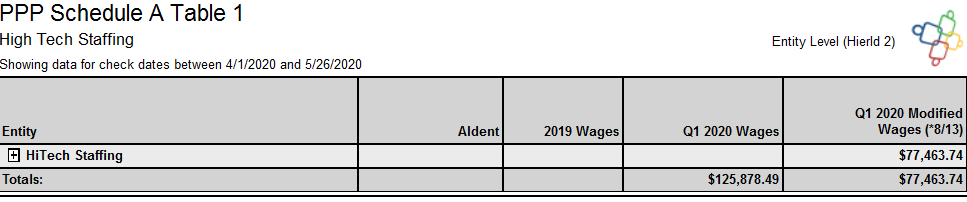

PPP Schedule A Table 1

This section of the report will show all data included for the Schedule A Table 1 calculations for the PPP Forgiveness Application. This list should include employees who were employed by the borrower at any point during the covered period and did not make more than $100,000 in 2019 from the borrower.

Use the + button next to the entity name to expand the details

Below, we break down what each column of this table includes:

| Column Name | Definition |

|---|---|

| AIdent | This is the employee ID number in TempWorks |

| 2019 Wages | This column is for reference to help you determine which section of schedule A the employee falls into (whether they made more than 100,000) |

| Q1 2020 Wages | This column includes the total wages for the first quarter of 2020 between 1/1/2020 and 3/31/2020 with a cap of $25K per employee |

| Q1 2020 Modified Wages | The modified wages take the Q1 wages amount taken from the 13 week period and prorates the amount to the 8 week time frame for the loan calculation purposes. (Q1wages divided by 13 and then multiplied by 8 to get the 8 week average) |

| Cash Compensation (Box 1) | This is the sum of the employee's applicable gross salary, wages, tips, commission, paid leave, and allowance for dismissal or separation paid or incurred during the loan "covered" period. |

| Average FTE Count (Box 2) | This column indicates the average time the employee was considered a "Full Time Equivalent" employee. This is calculated by finding the average number of hours paid per week, divided by 40, and rounded to the nearest tenth. The maximum for each employee is 1. |

| Wage Variation | Difference between the modified wages and the cash compensation columns. |

| Salary/Hourly Wage Reduction (Box 3) | The wage reduction amount used for Box 3 in this table. Keep in mind that there are additional qualifications that should be considered before entering this value on a PPP Loan Application. Always consult a legal professional if you are unsure and review the PPP Loan Schedule A table information. |

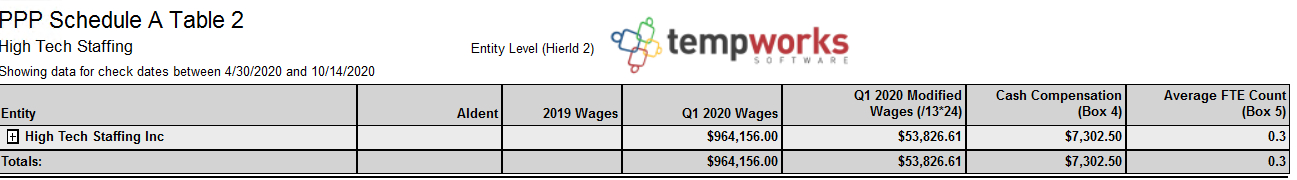

PPP Schedule A Table 2

This section is similar to the first table but will include employees who were employed during the covered period and received more than $100,000 in 2019 from the borrower. This table will only show AIdent, 2019 Wages, Cash Compensation, and Average FTE Count (box 5) which can be explained above.

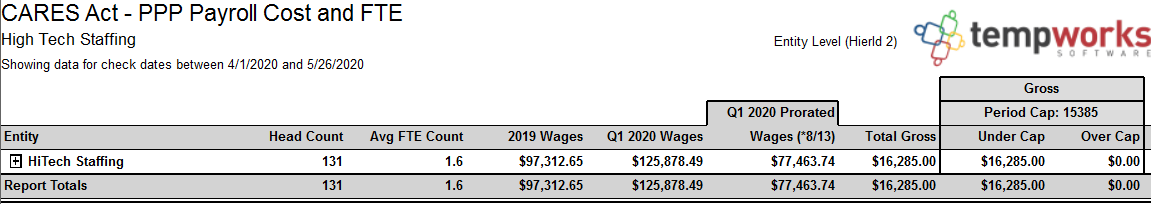

CARES Act - PPP Payroll Cost and FTE

This page displays the same information as the CARES Act PPP Loan Application Report. Check out COVID Reports Manual for more details.

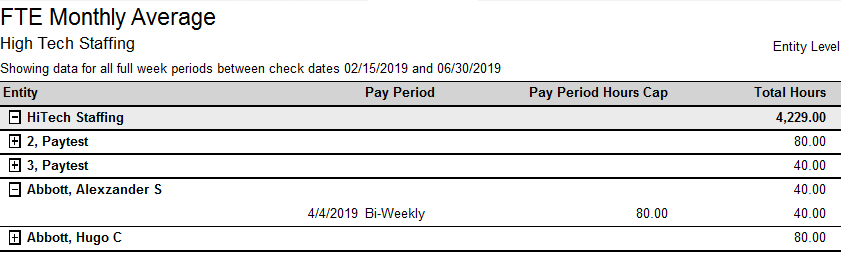

FTE Monthly Average

This section displays FTE calculations for each employee during the covered loan period.

| Column Name | Definition |

|---|---|

| Pay Period | Displays which pay period(s) they were paid for and whether they are paid daily, weekly, or biweekly. |

| Pay Period Hours Cap | Displays the total number of hours that could be used to consider full time (weekly = 40 vs. biweekly = 80) |

| Total hours | Total hours paid during the pay period |

| Eligible FTE Hours | Total hours or pay period hours cap whichever is lower |

| Weekly FTE Count | Eligible FTE Hours divided by Pay Period Hours Cap and rounded to the nearest 10th |

| # of Weeks | Number of weeks for the loan coverage |

| Avg FTE Count | Add all Weekly FTE Counts for an employee and divide by # of Weeks |