Version ∞2017.12.1

Enterprise

New:

- Added the ability to include Branch Burden percentages in the Gross Profits Calculators. This is done by navigating to All Options > Administration > Branch and filling out the burden rate field for each branch. Then when in the GP calculator, check the “Use Branch” checkbox.

- When accessing the GP Calculator from the Customer form, the branch burden from the customer’s branch will be used.

- When accessing the GP Calculator from the Order form, the branch burden from the order’s branch will be used.

- When accessing the GP Calculator from the Assignment form, the branch burden from the assignment’s branch will be used.

- When accessing the GP Calculator from the Rate Sheet dialog, the branch burden from that specific rate sheet’s branch will be used. If there is no branch setup on a rate sheet, the branch burden will be 0.

- Added a sum line to Money Network Funding Wizard. In Pay/Bill > Payroll > Manage Unfunded Paycards, there is now a sum total field below the datagrid that will reflect the total net of all selected paycards.

- Created an 'IgnoreAccrueError' config to control if the below error displays during payroll calculation.

- “Employee has an active accrual but no accrual was calculated on the check. Please ensure that this is correct or update the accrual tier or effective date and recalculate.”

- Made the following changes to the Manage Web User area:

- Added back the ability to view the Password Report that was removed in a previous release. Users will need to check the “Display New Password Report” checkbox in the reset password window for the report to appear again.

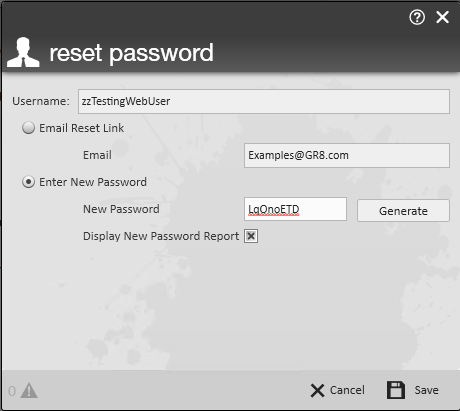

- A new window will now open when resetting a password. This window will look like the below image and will open up after a user clicks on the “Reset Password” button.

- Selecting the Email Reset Link option will email a password reset link to the employees email address that's on file.

- Note that the email address must be setup under contact methods in order for it to show here.

- Selecting the Enter New Password option will allow you to enter in a password by either the generate button or by using a custom one of your own choosing.

- Checking the Display New Password Report checkbox will make the Password report pop up which will contain the user’s username and new password.

Improvements:

- Improved the handling of ratio (bill method = ratio) benefit adjustments in the PEO Adj fee calculation. This is setup in Customer > Invoice Setup > PEO Setup > Adj Fees area. Now, when billing customers for a benefit fee type adjustment, the correct amount is added to the adjustments area of the invoice.

- Changed the WOTC Eligible Icon in the Employee Header to be brighter.

- Improved logging on the ConfigRoot table to now log config records that have been deleted. This previously only log any updates made or new configs being created. The logging will also log all changes that were made in a batch, rather than just the first one in said batch.

- Modified the Payroll Summary Report to check secondary direct deposits against their related EINC.

- When adding a new hotlist for a customer, the “Description” field is required and no longer says optional.

Fixes:

- E-Verify cases with a status of Employment Authorized will get a ClosedDate in SQL moving forward. This will cause the E-Verify icon in the employee header to turn green. Refreshing existing cases with an Employment Authorized status will also update the E-Verify icon.

- Modified error checking on Ctxns triggers to prevent false positive errors from occurring when modifying bill amounts on timecard adjustments for timecards that had been processed through payroll.

- Altered the procedure “EOY_1099Print” to correct a no data exists for the year error when reprinting a 1099 from previous year where a contractorID was less than 9 characters.

- Fixed an error that could occur when using Apps and attempting to load available assessments for Assess on Cloud. There were unknown cultures being sent, these are now excluded from the list.

- Corrected an issue on the Gross Profit summary report where grouping by “ASG Service Rep” could display the incorrect service reps. Now the report will show the correct service reps when grouping by “ASG Service Rep”

- Modified the Nationality/Veteran Status fields to expand and shrink with the Enterprise window size. These fields are found in the bottom right of Employee > Details. This will prevent the E-Verified checkbox or Citizen Status field from being pushed out of the Enterprise window when at the smallest window size.

WebCenter

Fixes:

- Previously, when a timeclock timecard was marked as failed, the processing engine would never pick up that timecard again and try to reprocess it. Now, it will pick up timecards with a failed status and try to process them again.

- Previously, when a punch was being placed on a timeclock timecard, the existing timecard might not be found and a new one would be created. This would result in 2 or 3 timecards for the same weekend date, assignment and aident. This has been fixed.

- Previously, the timeclock timecard submit procedure (wc_TimeClock_DownloadTimecardsToCtxns) was not calculating the correct number of failed timecards. Now it will display the correct number of failed timeclock timecards submitted. Also, additional error logging has been added to track failed timeclock timecard submissions; a failed event will be recorded in the wc_Timeclock_ActionLog table. This will help TempWorks Support troubleshoot timeclock timecard issues in the future.

- The Manage W-2s link on the employee homepage will now be hidden when the Pay History tab is hidden.

Taxes

Rate Changes:

- Final State FUTA Credit Reduction rate update and recalculation effective 12/1/2017.

- California is increasing from 1.8% to 2.1%.

- Virgin Islands is increasing from 1.8% to 2.1%.

- Knox County, Ohio, sales tax rate is increasing to 7% effective 1/1/2018.

- Warren County, Ohio, sales tax rate is increasing to 7.25% effective 1/1/2018.