What is WebCenter?

The employee portal of WebCenter gives you, the temp employee, access to important information including paycheck stubs, assignment info, and important documents.

*Note* Each staffing company has a unique URL link to WebCenter and will need to provide you with log in credentials. These same credentials are used to log into HRCenter.

Check out (Legacy) Employee Portal - Welcome to WebCenter for more information.

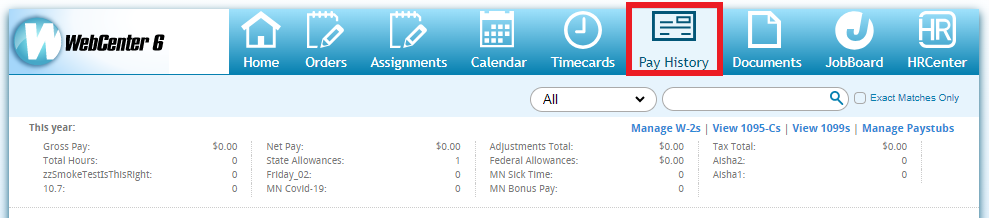

The Pay History Tab

The "Pay History" tab can be used by your employer to offer you the ability to access and view your pay checks in WebCenter. Within this article, we will teach you how to find and print those pay stubs.

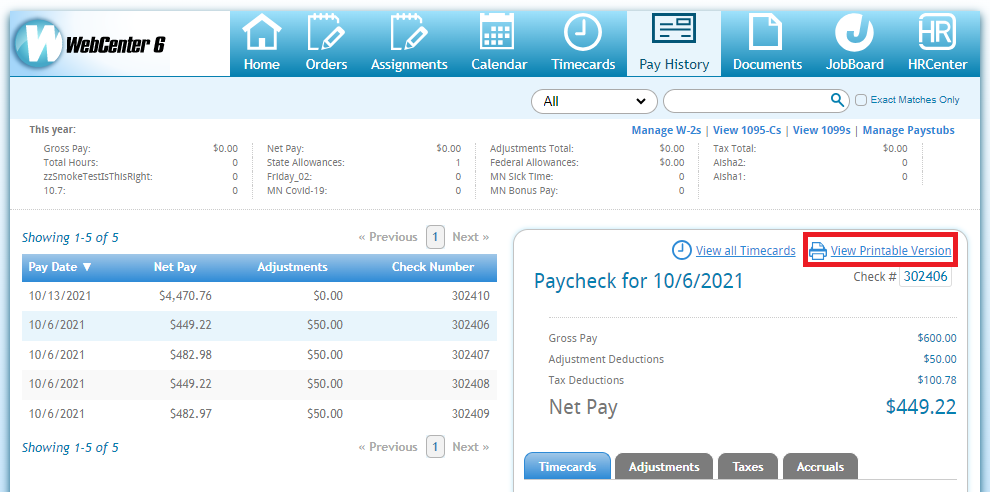

You can easily locate your paychecks by interacting with the "Pay History" tab:

There are three distinct sections here to review:

Manage W-2s

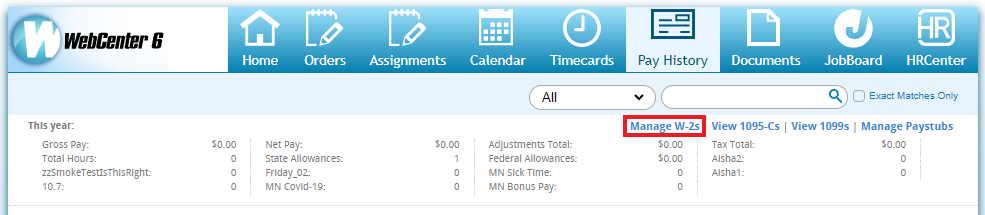

The top section contains working year-to-date information about your pay information including gross pay, net pay, and tax info derivative from your W-4. Here, you may also view W-2s from past years by selecting "Manage W-2's":

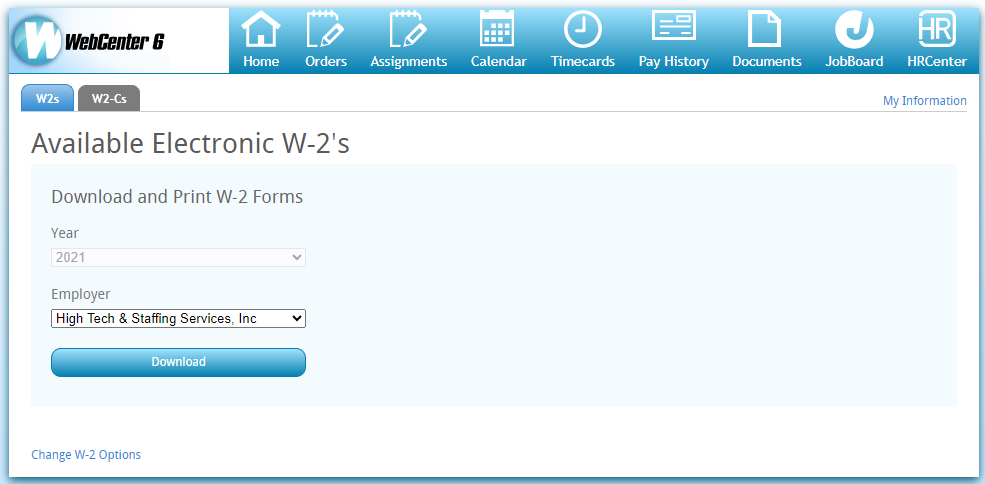

Once you have selected "Manage W-2s", you will be taken to a page displaying available W-2s and/or W2-Cs for print/review:

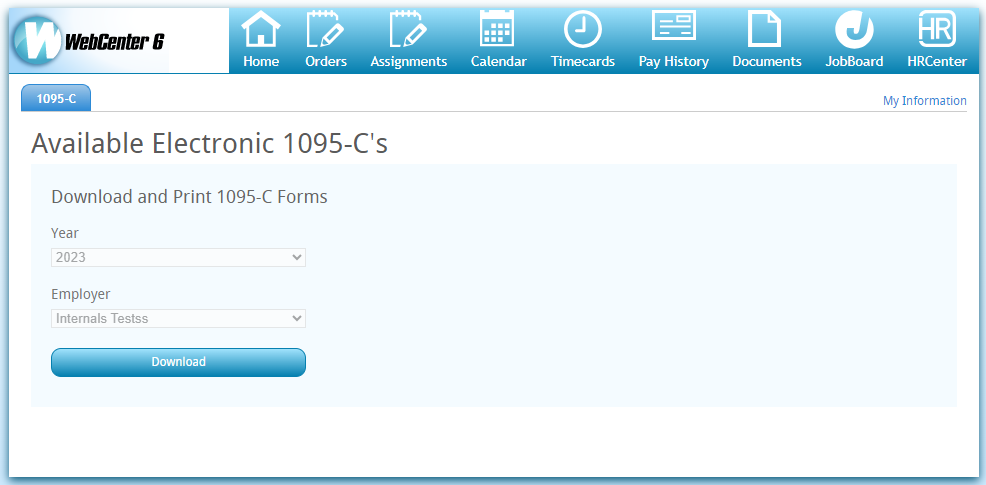

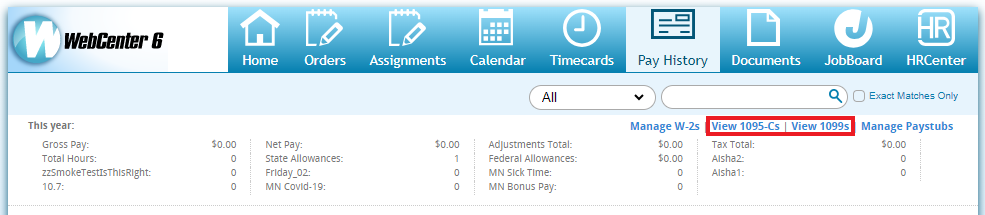

Manage 1095-Cs and 1099s

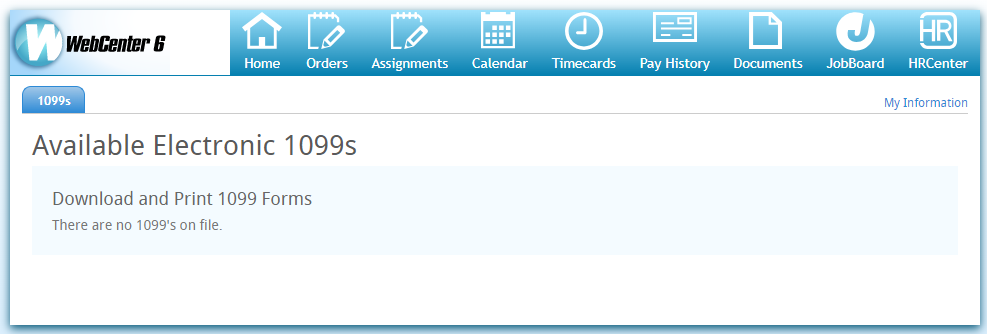

Selecting the "View 1095-Cs" or "View 1099s" option will navigate you to a page that displays the 1095-Cs or 1099s that you have available to download.

*Note* 2023 and future years 1095-Cs and 1099s are available to access and download from WebCenter.

In the event you do not have any forms to download, you will receive the following message upon selecting one of the options:

Check Info

In the lower portion on the left side, past paychecks will be displayed.

To view a paycheck, select the check line item. The highlighted paycheck will display on the right side.

If you would like to print the stub, select "View printable version":

The printable version of this paycheck will open in a separate tab and can be exported (or downloaded) as a PDF by selecting the export icon.

Additionally, the details of your paycheck stub can reveal useful information by selecting the desired tab:

- Timecards - The timecards that compose this paycheck.

- Adjustments - All deductions and reimbursements that effect this check.

- Taxes - All taxes withheld for this check.

- Accruals - If your employer offers any PTO, or "sick time", the amount accrued by this check.