Overview of Subcontractor Payroll in Enterprise

Subcontractor Vendors are 3rd party staffing agencies or other providers that are sending their employees to fill some of your orders. Because these employee's do not belong to your staffing agency, the payroll for these people will be consolidated into a payment to the agency. The agency is then responsible for paying and preparing tax documents for their employees.

Running payroll for subcontractors has never been easier! The payroll process follows the same pay/bill road map. This article will walk through the process with tips and tricks to make it easy for your payroll processors.

This article covers:

- Time Entry & Proofing

- Sub Push Payroll Runs

- Creating a Consolidated Check (SubPayCons)

- Correcting Subcontractor Checks

Time Entry & Proofing

The basic time entry and proofing process is the same for subcontracted employees as it is for regular employees. Since each subcontracted employee will have an assignment in Enterprise, their timecards will appear in time entry the same as any other employee.

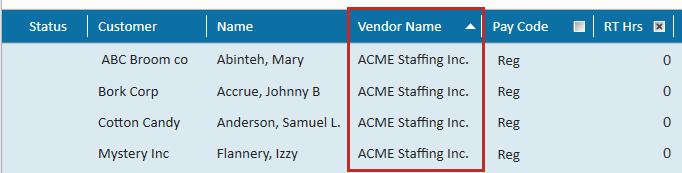

To Identify Subcontracted Vendor Timecards:

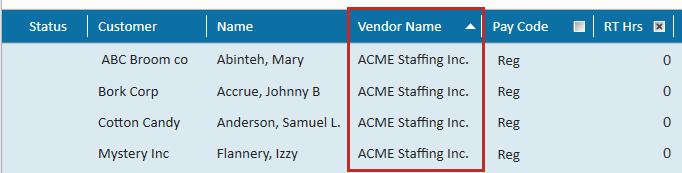

- Add the Vendor Name column to your Time Entry:

- Right click on the column headers to add a column.

- Enter hours for these timecards the same as any other timecard

*Note* Remember that assignment pay and bill rates for Vendor timecards will be different than other timecards:

- Bill Rate: When working with subcontractors the bill rate will still be what is invoiced to the client the employee works for.

- Pay Rate: When working with subcontractors the pay rate will now be what is paid to the subcontractor.

Consider the following process questions:

| Question | Answer |

|---|---|

| Will you receive subcontracted employees' time from the customer or the vendor? | |

| Will you need to verify the hours with the Vendor before completing payroll? | |

| How will your pay and bill rates be different for Vendor timecards vs. regular employees? |

Proofing Notes:

- Subcontracted employees will probably not have a valid SSN, I-9 on file, ACA hire date, etc. because these employees are not owned by your company. It is ok in these situations to approve the proofing errors that may come up. Always work with your manager for full expectations.

- Vendor timecards can be proofed with regular timecards

Completing a Sub Push Run

Once the Subcontracted Vendor timecards have been run through Time Entry & Proofing, Payroll will need to be completed in two steps. The first step, the sub push run, will push the employee timecards through payroll while the second step will consolidate the amounts onto one check for the Subcontractor Vendor.

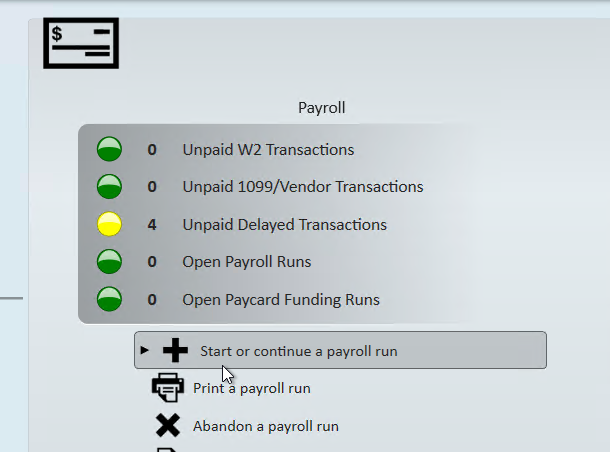

How Do I Know If I Need to Do a Sub Push Run?

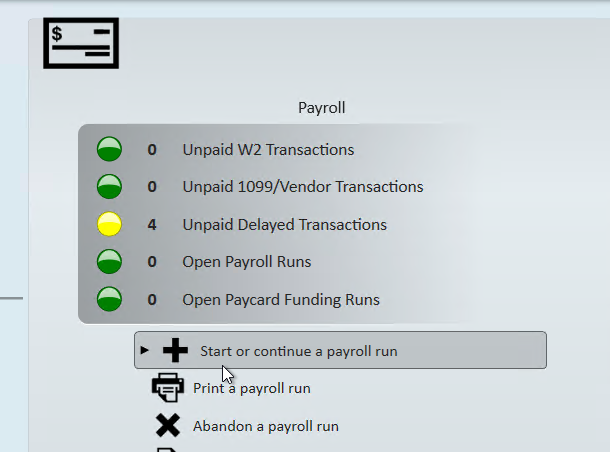

All Subcontractor Vendor timecards will need to be pushed through payroll via a sub push run. Timecards that are ready to be pulled into a sub push run will show as "Unpaid Delayed Transactions" under the payroll section in pay/bill.

Create a Sub Push Run

- Navigate to the Payroll section of pay/bill road map

- Select Start or continue a payroll run

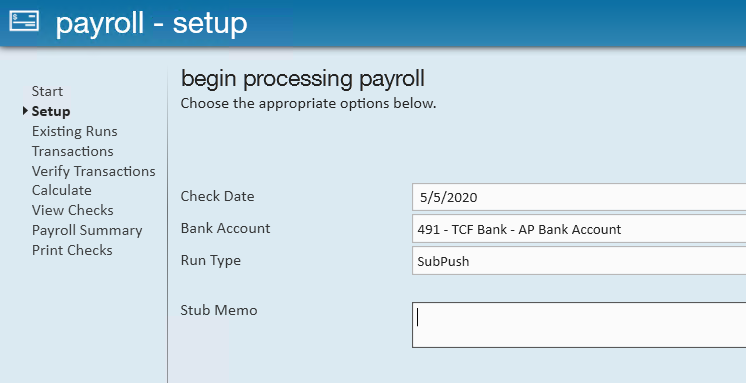

- Choose "Create a New Payroll Run"

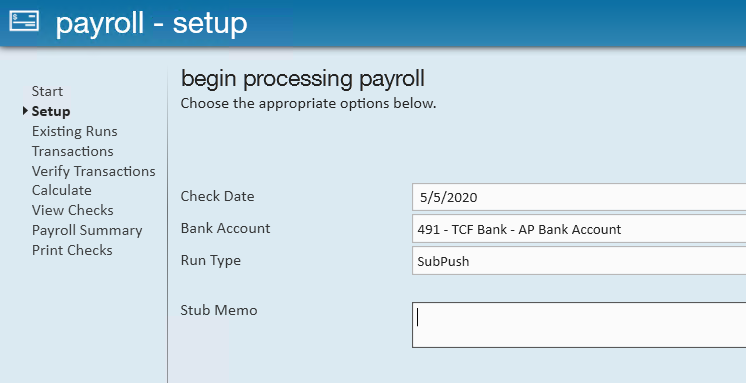

- Select the Run Type of SubPush

- Select Next

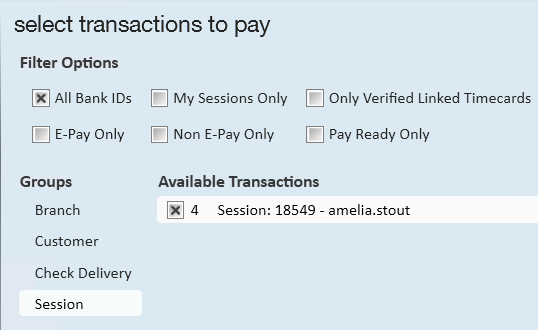

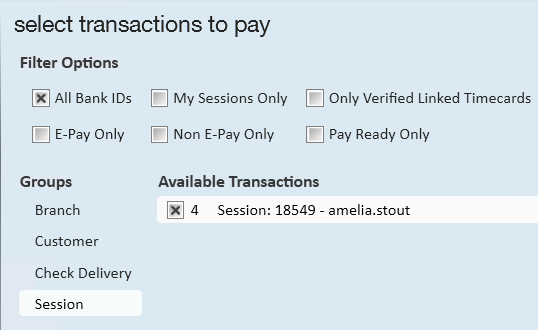

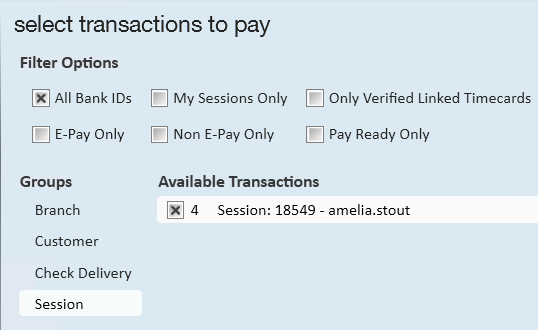

- Select the transactions you want to pull into this run like usual

- Select Next

- Verify your transactions (like any other payroll run) and select next to continue

- Review any payroll errors if applicable and either resolve them or approve them before selecting next

- Check out Enterprise - Payroll Errors, Their Meanings, and How To Fix for more information.

- View the "Checks"

- Subcontractor vendor check totals will be consolidated onto a single check to the vendor when you conduct the SubPayCons payroll run (see below)

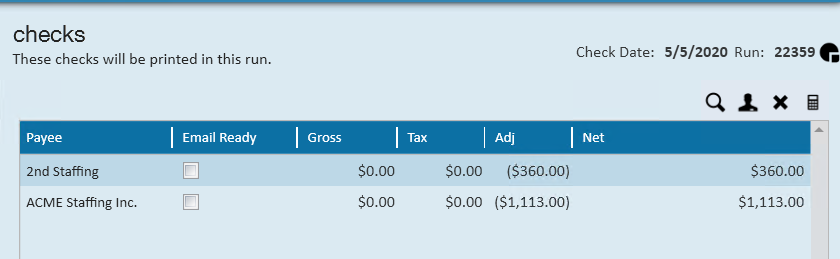

- Notice that the net amounts for all these checks is totaling to $0 - we are not paying the individual employees so no checks will be printed in this run. The adjustment amounts will be what is pushed to the consolidated check.

- Notice that there is no tax amounts on these checks. This is because we are not responsible for calculating tax for the employees since the employees are owned by the 3rd party subcontractor.

- Select Next

- No checks will be printed in this run, select next

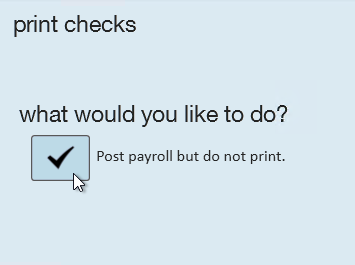

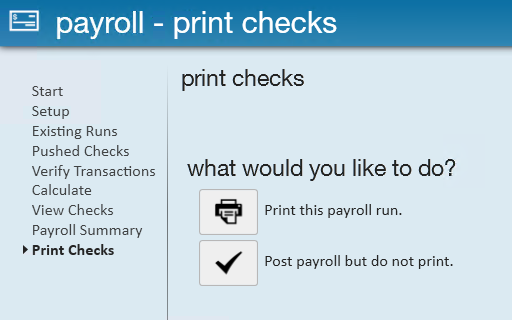

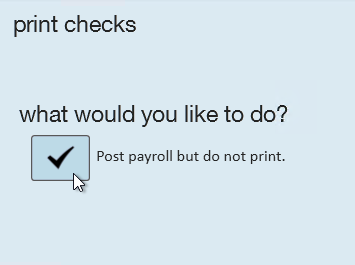

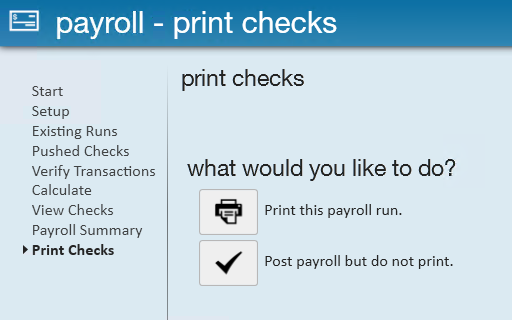

- Select "Post payroll but do not print"

What About Invoicing?

Subcontractor Vendor transactions are processed with all other transactions during invoicing. Remember that the bill rates on the vendor timecards will be the rate billed back to the customer so there should be no reason to change your billing processes.

Invoicing will need to be completed before you can pull the transactions into a consolidated check for the Vendor.

Creating a Consolidated Check for the Vendor (SubPayCons)

After your subcontractor vendor transactions have been pushed through a SubPush run, the week can technically be closed. So it's extremely important to set up processes around when you need to pay your vendors. A consolidated check can be created via a SubPayCons payroll run at any time.

Work with your team to review your contracts with vendors and decide when you need to pull the consolidated checks to pay your vendors.

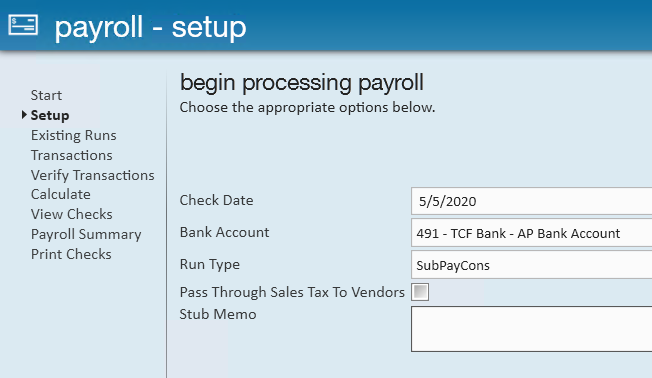

Creating a SubPayCons Payroll Run

- Navigate to the Payroll section of pay/bill road map

- Select Start or continue a payroll run

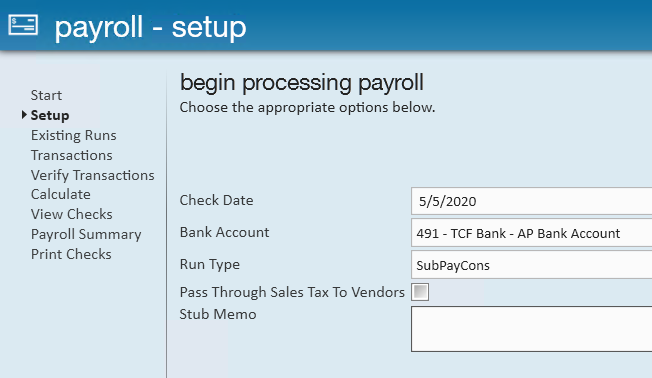

- Select the Run Type of SubPayCons

- Optionally, check the box to pass sales tax to the vendor: If this box is checked, sales tax charged to the customer will be paid to the Vendor which is calculated based on the payroll cost. When creating the check for the Vendor, you will see a second adjustment with the sales tax amount being paid to them.

- Select Next

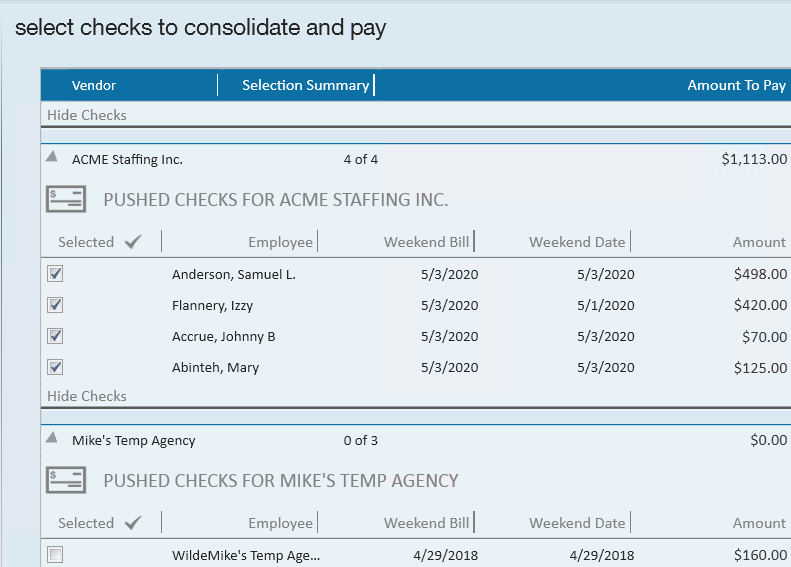

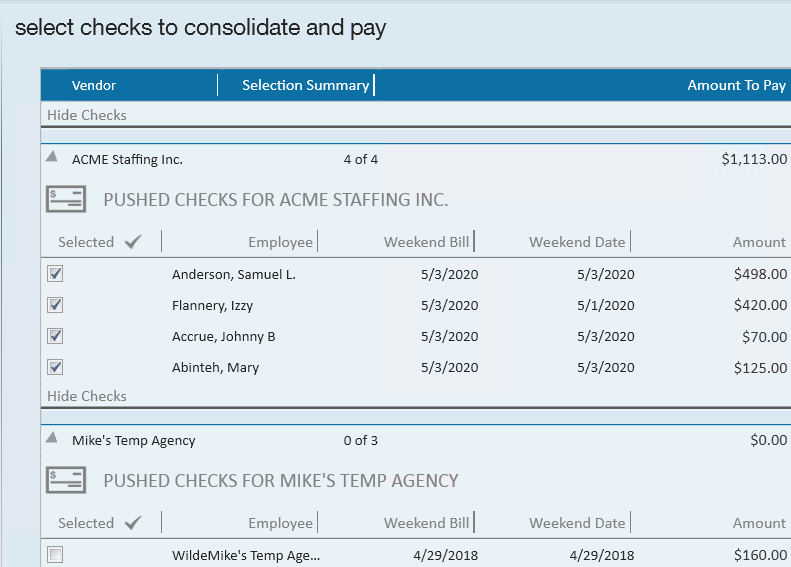

- Select checks to consolidate and pay

- Here all vendors with transactions available to be paid will be displayed. Transactions must be fully run through payroll and invoicing before they will display here.

- Transactions under each vendor name will be automatically checked if they are ready to be paid according to the "Pay Delay in Days" setting on the Vendor Record. You can choose to pay transactions early by checking the box next to them.

- Once you have reviewed the transactions being pulled, hit Next to continue

- If applicable, review any payroll errors and click next

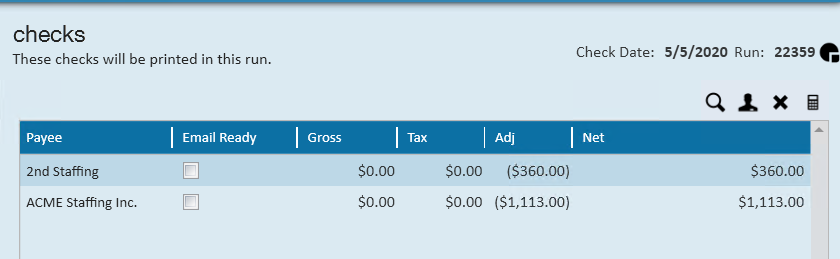

- Review the check totals

- Not ready to pay one vendor? You can remove the check from this run by selecting it and choosing the X in the upper right. It will be available to be pulled into a future run

- Use the magnifying glass in the upper right to view more check details

- When ready, select Next

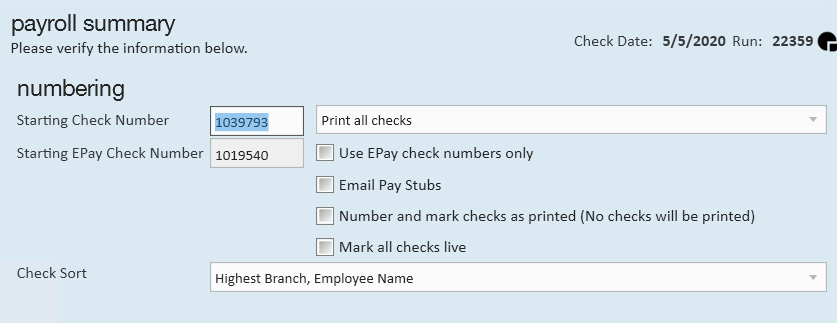

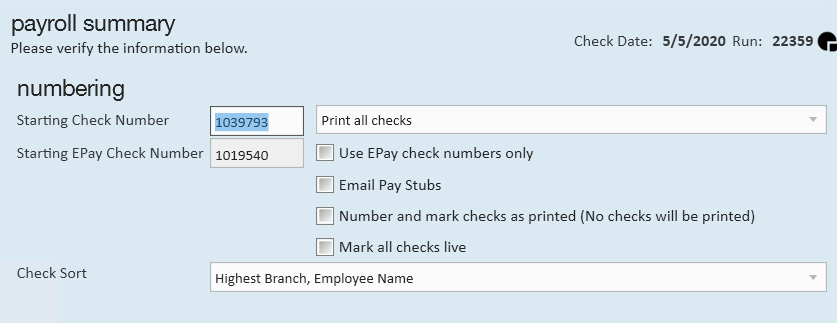

- Select your check printing settings and choose next

- Select "Print this payroll run" to print the checks

- Select Finish when printing is complete

Now your vendor checks will be printed and ready to be sent to your vendor.

Subcontractor Checks and Corrections

When correcting sub contractor checks there are two basic correction routes you might take depending on a single question.

How to Find the Subcontractor Checks:

- Subcontractor checks (from a SubPayCons run) can be found under the check register in Pay/Bill (ex. ACME Staffing Inc. check below)

- SubPush checks will also be shown here as well as on the employee's record (ex. Mary Abinteh check below)

Was the consolidated check processed?

| Yes, it has been processed | No, it has not been processed |

| Void/reverse the Subcontractors check. | Void the Employees "Pushed" net zero check |

| Void the employees Pushed net zero check. | Reprocess the "pushed" net zero check |

| Reprocess the employee's "pushed" net zero check | Reprocess the Sub contractors check. *Make sure the pushed checks have posted* |

| Reprocess the Sub contractors check. *Make sure the pushed checks have posted* |

For more information on check corrections, take a look at How to Void and/or Reverse Checks.