What are ACA Adjustments?

When we talk about ACA related Adjustments, we are talking about your benefit adjustments for employee and employer contributions. When an employee accepts or opts in to a benefit package, you will need to set up the adjustments to track the employee and employer paid contributions for those benefits.

*Note* Before you can apply and adjustments to an employee's pay setup to be deducted from their checks, you must first set up the general adjustment settings in Administration. If you are an admin, check out ACA Admin: Setting Up ACA Adjustments in Administration for more information.

This article includes:

- ACA Adjustment Overview

- Adding ACA Adjustments to the Employee Record

- How ACA Adjustments Appear on Check Stubs

ACA Adjustment Overview

You may have multiple adjustments related to your benefit package options available to you. Always work with your team to make sure it is clear when which adjustment should be used. This section will review the basic three kinds of adjustments related to ACA but remember that naming conventions and benefit packages available may be different for you company.

Employer Paid Adjustments

An employer paid adjustment is added to the employee's record to track what, you, as the employer, are paying for this employee's adjustment. It is there to help track the employer paid portion of any benefit package. Keep in mind that there may be more than one option available if there are multiple packages.

Employer paid adjustments will not deduct or add any money to the employee's pay check.

Employee Paid Adjustments

Employee paid adjustments are meant to reflect the amount the employee is meant to pay for the benefits package. There may be more than one employee paid adjustment if there are multiple packages available so make sure you are selecting the correct one based on the employee's paperwork.

Employee paid adjustments will deduct an amount from each paycheck for that employee based on the benefits package.

Dependent/Family Benefit Adjustments

If employee's have opted for insurance benefits that also cover their dependents or spouse, there may be additional adjustments required depending on how your Admin team has set up the adjustment package options. It's important to familiarize yourself with the options available to ensure you are selecting the correct adjustments for those employee's opting in for additional coverage.

Typically, dependent or family benefit adjustments will deduct an amount from each paycheck for that employee based on the additional costs for those packages. Work with your team and benefits provider to determine costs and if their is an additional employer paid option for these adjustments as well.

Adding ACA Adjustments to the Employee Record

There are multiple ways to add ACA or benefit related adjustments to the employee record.

Adding ACA Adjustments on the Employee Record

All of the adjustment types listed in the ACA Adjustment Overview section above can be added to the employee record in the same way.

*Note* Employer paid portions of benefits are linked to the employee paid portions. After you have added the employee paid portion on their record, the linked employer paid adjustment will automatically be added as payroll is run the first time for this adjustment.

- Navigate to the employee record you wish to add adjustments to

- Navigate to the Pay Setup > Adjustments section on the left

- Select the + in the upper right to add a new adjustment

- Select the adjustment type from the drop down

- Check with your admin if you are unsure which option to choose

- Optionally, enter a start date for when this benefit should start deducting from the employee's check or calculating the employer paid amount

- Select Next

- Review or enter an amount

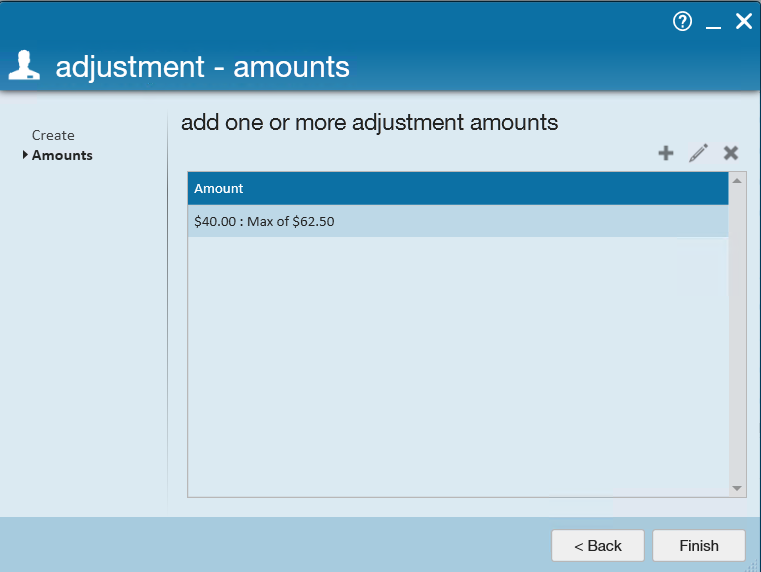

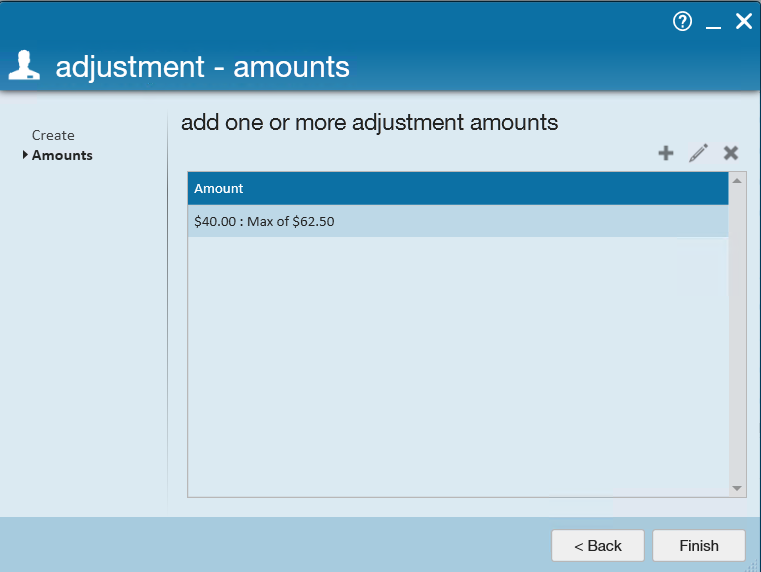

Example with Amount Added

Example with Amount Added

- Depending on how the adjustment was set up, there may already be a rule for how money is deducted or calculated for this adjustment

- If the adjustment amount is already set, simply review it before hitting finish

- If there is no adjustment amount, select the + to add a new rule

- If the adjustment amount needs to be changed, select the pencil to edit the existing amount

- Select Finish

Once the adjustment is added, it will appear on the list for the employee:

Adding an ACA Adjustment When Updating the Insurance Status

If you are also manually updating the insurance status for the employee, you can add the employee ACA adjustment at the same time. Check out Setting ACA Hire Dates for Employees for more information on insurance statuses.

Under the pay setup section of the Employee's record, you will see insurance status located under the Affordable Care Act section. When you choose the Accepted Status and enter the effective date, you will be prompted to add the employee insurance adjustment upon saving.

This adjustment will appear on the employee's record under pay setup > adjustments.

How ACA Adjustments Appear on Paycheck Stubs

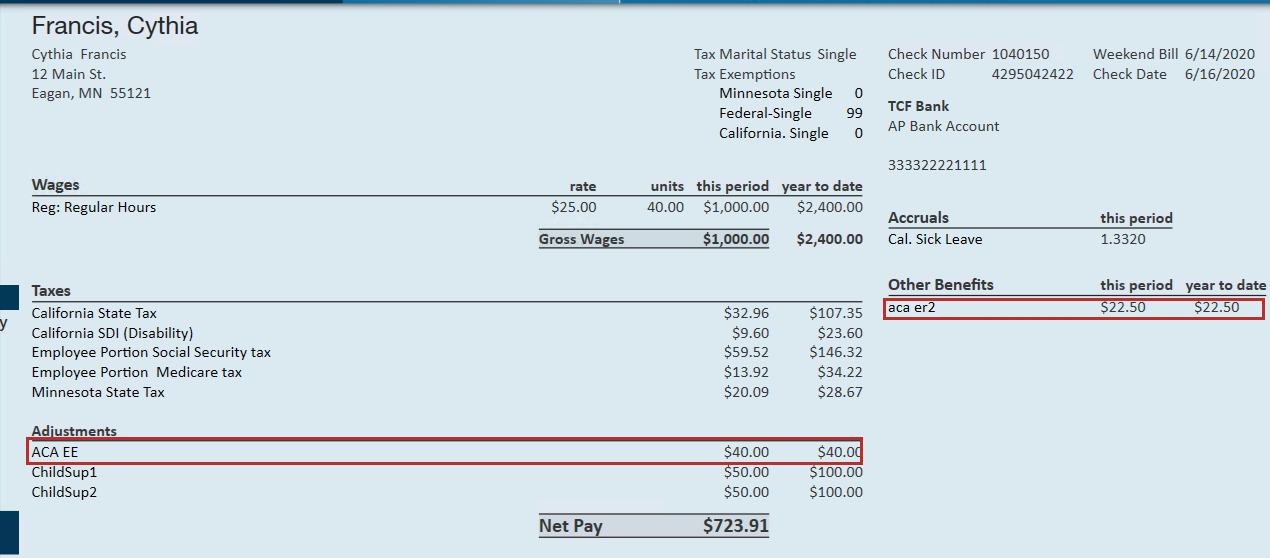

When you look at the details of an employee's check register, you will see the employee's portion of the benefits located under adjustments adn the employer portion located under other benefits:

Depending on your check stub style, the ACA adjustments may appear under the taxes/adjustments section: